Market Overview

The Singapore Crew Oxygen Systems market is driven by the increasing demand for reliable oxygen systems in aviation and space industries. Based on a recent historical assessment, the market size is expected to surpass USD ~ billion. Growth is fueled by the advancement of technology in oxygen systems, increasing aircraft fleet, and rising investments in commercial and defense aviation. The implementation of safety regulations in the aviation and aerospace sectors has also contributed to the demand for advanced crew oxygen systems. These systems are critical for ensuring crew safety, particularly in high-altitude conditions where supplemental oxygen is essential for optimal performance.

Singapore, being a leading aerospace hub, dominates the market due to its strategic location and advanced infrastructure. The city’s prominent role in the aviation and aerospace sectors, combined with government initiatives supporting technological advancements and regulatory compliance, has fostered growth in the market. Additionally, Singapore’s well-developed aerospace ecosystem, including R&D facilities and manufacturing capabilities, strengthens its competitive advantage. The country’s collaboration with global aerospace players further consolidates its position in the crew oxygen systems market.

Market Segmentation

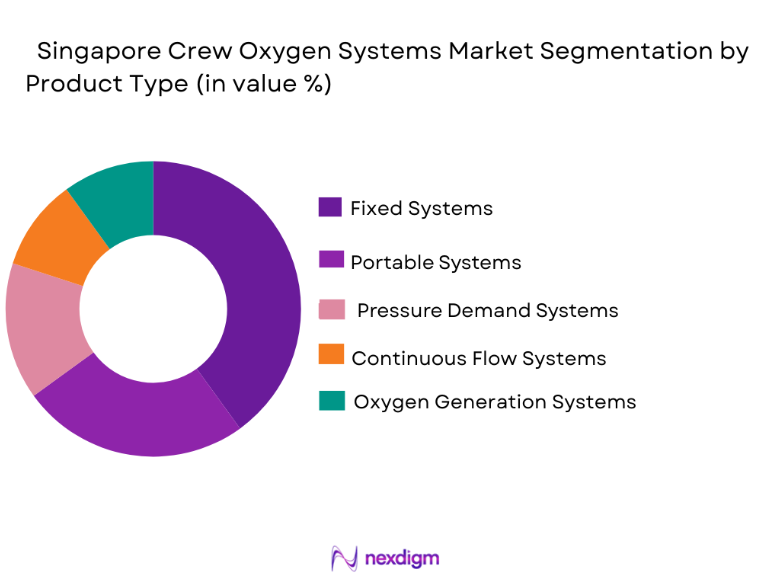

By Product Type

The Singapore Crew Oxygen Systems market is segmented by product type into fixed systems, portable systems, pressure demand systems, continuous flow systems, and oxygen generation systems. Recently, fixed systems have dominated the market share due to their integration in commercial and military aircraft. These systems provide continuous oxygen supply, ensuring safety at high altitudes. Airlines and defense sectors favor fixed systems for their reliability, low maintenance, and ease of integration. Moreover, they meet stringent safety and regulatory standards, making them the preferred choice for both new aircraft and retrofit installations.

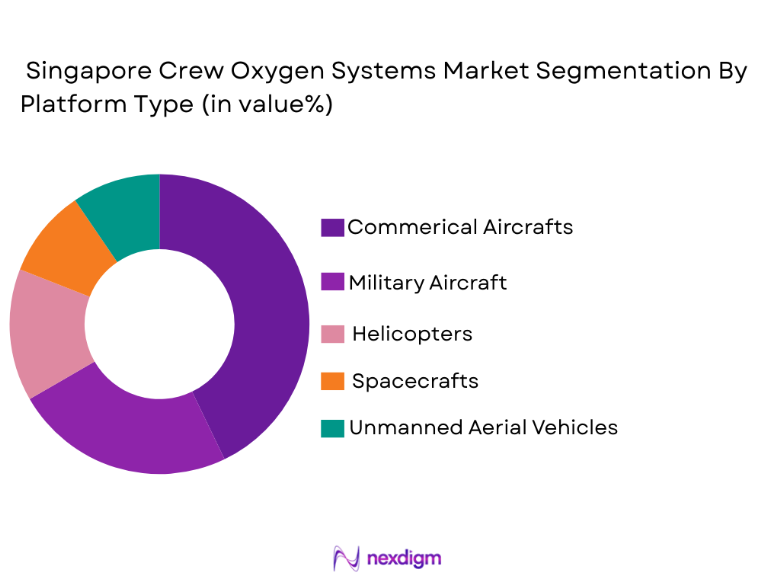

By Platform Type

The market is also segmented by platform type into commercial aircraft, military aircraft, helicopters, spacecrafts, and unmanned aerial vehicles (UAVs). Recently, commercial aircraft have had a dominant market share due to the rising air travel demand in the Asia-Pacific region. With increased air traffic, airlines are focused on enhancing safety, which includes upgrading their oxygen systems. Additionally, military aircraft and helicopters are also key contributors to the market, driven by defense spending and the need for advanced safety systems in high-risk flight operations.

Competitive Landscape

The competitive landscape of the Singapore Crew Oxygen Systems market is influenced by both global and regional players. Major manufacturers are continuously improving their product offerings to enhance system efficiency, safety, and cost-effectiveness. Additionally, key players have focused on consolidating their positions by forming strategic partnerships with airlines and defense forces. Technological advancements and innovations have increased market competitiveness, especially in the field of oxygen generation systems.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Honeywell Aerospace | 1906 | Morris Plains, USA | ~ | ~

|

~ | ~ | ~ |

| Collins Aerospace | 1999 | Charlotte, USA | ~ | ~ | ~ | ~ | ~ |

| Air Liquide | 1902 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Linde Group | 1879 | Munich, Germany | ~ | ~ | ~ | ~ | ~ |

| AmSafe Bridport | 1954 | Phoenix, USA | ~ | ~ | ~ | ~ | ~ |

Singapore Crew Oxygen Systems Market Analysis

Growth Drivers

Increasing aircraft fleet size in Asia Pacific

The rapid expansion of the aviation sector in the Asia Pacific region is significantly boosting demand for crew oxygen systems. As the region sees an increase in both commercial airlines and military aircraft fleets, the need for reliable and advanced oxygen systems is growing. Airlines are investing heavily in newer fleets, which require modern and efficient oxygen solutions, particularly for long-haul flights where crew safety is critical. Additionally, the rising middle class in countries like China, India, and Southeast Asia is driving air travel demand, further accelerating fleet expansion. As regional aviation hubs grow and military air forces modernize, the demand for advanced oxygen systems in both commercial and defense sectors continues to rise, making this growth driver a key factor in the market’s expansion.

Technological advancements in oxygen generation systems

Continuous improvements in oxygen generation technology are another significant growth driver for the Singapore Crew Oxygen Systems market. Advances in oxygen concentrators, generation systems, and storage technologies are increasing the efficiency and reliability of oxygen systems on board. Innovations such as the development of compact, lightweight, and energy-efficient oxygen systems are making it easier for airlines and military forces to adopt these solutions. The integration of artificial intelligence and IoT technologies to monitor and maintain oxygen systems is further enhancing system performance, ensuring greater safety and reliability during operations. These technological advances not only improve the user experience but also lower operational costs, making modern oxygen systems more attractive to airlines and defense contractors.

Market Challenges

High costs of advanced oxygen systems

A key challenge in the Singapore Crew Oxygen Systems market is the high cost associated with advanced oxygen systems, particularly for commercial airlines and defense sectors. The development of sophisticated oxygen generation and delivery systems, while improving system reliability and efficiency, comes at a high price. The need for regular maintenance, replacement parts, and technological upgrades further increases costs. Smaller airlines and defense contractors with limited budgets may struggle to afford the latest, most advanced systems, leading them to opt for cheaper alternatives that may not meet the highest safety standards. This financial barrier can delay the adoption of modern systems and restrict market growth, especially in emerging markets where budget constraints are more pronounced.

Regulatory compliance complexities

As the aviation and defense industries become more regulated, staying compliant with international safety standards is an ongoing challenge for oxygen system manufacturers. Different regions impose varying regulations on crew oxygen systems, which adds complexity for companies operating globally. This requires manufacturers to continually update their systems to meet evolving standards, leading to increased development costs and extended certification timelines. Moreover, stricter regulations can make it difficult for smaller players to remain competitive, as compliance requires significant investment in research, development, and testing. Navigating these regulatory complexities can result in delays in bringing products to market and hinder overall market growth.

Opportunities

Growing demand for crew oxygen systems in emerging markets

Emerging markets, particularly in Asia Pacific, offer significant opportunities for the growth of crew oxygen systems. As economies in these regions continue to develop, there is an increasing demand for modern aviation infrastructure, including the latest safety technologies. The rise in disposable income among middle-class populations in countries such as China, India, and Southeast Asia is contributing to the growth of the aviation industry. Airlines are now investing in newer fleets, many of which require advanced oxygen systems. This trend is expected to expand as regional aviation hubs continue to thrive, prompting a growing need for advanced safety systems that include reliable crew oxygen solutions. Furthermore, the expansion of military forces in these regions is also driving demand for oxygen systems in defense aircraft, contributing to market growth. This growth is poised to continue as more airlines enter the market and as governments prioritize defense modernization programs.

Increasing adoption of advanced safety regulations

The global increase in aviation safety regulations presents another key opportunity for the crew oxygen systems market. Regulatory authorities such as the FAA and EASA are continuously introducing more stringent requirements for aircraft safety, including the provision of advanced oxygen systems for both crew and passengers. As safety standards evolve and governments around the world push for more comprehensive safety measures, airlines and defense contractors are increasingly investing in the latest oxygen technologies to comply with these regulations. Additionally, the introduction of new international safety standards will likely spur demand for upgraded and reliable oxygen systems, positioning the market for growth as airlines and military forces strive to meet evolving requirements. This trend is expected to drive the market toward greater adoption of high-quality, technologically advanced oxygen solutions.

Future Outlook

The future outlook for the Singapore Crew Oxygen Systems market indicates sustained growth driven by technological innovations, regulatory support, and increasing demand across commercial and military sectors. Advancements in oxygen generation technologies and the adoption of compact, lightweight systems will continue to improve system efficiency and lower operational costs. Additionally, government policies focused on enhancing air travel safety and defense capabilities will support market expansion. The demand for crew oxygen systems will also be fueled by growing aviation fleets, rising air travel demand, and increased defense spending in the region

Major Players

- Honeywell Aerospace

- Collins Aerospace

- Air Liquide

- Linde Group

- AmSafe Bridport

- Zodiac Aerospace

- B/E Aerospace

- Parker Hannifin

- GE Aviation

- L3 Technologies

- Orbital Systems

- Hamilton Sundstrand

- Oxygen Generating Systems International

- Dynair

- Safran

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- Airlines and aviation operators

- Aerospace defense contractors

- Commercial aviation service providers

- Military and defense agencies

- Aviation maintenance and repair organization

Research Methodology

Step 1: Identification of Key Variables

Identify and define the key variables that affect market trends, such as technological developments, economic conditions, and government regulations.

Step 2: Market Analysis and Construction

Conduct a thorough market analysis to understand the competitive landscape, customer demands, and industry trends.

Step 3: Hypothesis Validation and Expert Consultation

Validate market hypotheses with the help of industry experts, including engineers, technologists, and market analysts, to ensure accuracy.

Step 4: Research Synthesis and Final Output

Synthesize all gathered data and insights to create a comprehensive market report that provides clear and actionable recommendations for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing aircraft fleet size in Asia Pacific

Advancements in oxygen generation technologies

Growing demand for military and commercial aviation sectors

Rising investments in space exploration programs

Regulatory requirements for oxygen systems in aerospace - Market Challenges

High costs of advanced oxygen systems

Regulatory challenges across regions

Limited technology adoption in developing nations

Maintenance and support for legacy systems

Economic downturns affecting the aerospace sector - Market Opportunities

Growing demand for crew oxygen systems in emerging markets

Expansion of commercial space flight programs

Technological advancements in compact oxygen systems - Trends

Increased focus on environmental sustainability in aerospace

Integration of hybrid oxygen generation systems

Development of more compact and lightweight oxygen systems

Shift towards oxygen on-demand systems in commercial aviation

Technological convergence in aerospace and medical oxygen systems - Government Regulations & Defense Policy

Aviation safety standards tightening globally

Increasing government contracts for defense aerospace systems

Regulatory support for space exploration missions - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Fixed Systems

Portable Systems

Pressure Demand Systems

Continuous Flow Systems

Oxygen Generation Systems - By Platform Type (In Value%)

Commercial Aircrafts

Military Aircrafts

Helicopters

Spacecrafts

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment - By EndUser Segment (In Value%)

Aviation Operators

Defense Forces

Space Agencies

Private Aerospace Ventures

Emergency Services - By Procurement Channel (In Value%)

Direct Purchase

Third-Party Procurement

OEM Distribution

Aftermarket Channels

Government Procurement - By Material / Technology (in Value%)

Oxygen Generation Technology

Compressed Oxygen Systems

Chemical Oxygen Systems

Hybrid Oxygen Systems

Advanced Material Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, Material / Technology, Fitment Type, End User, Pricing Strategy, Regional Presence, Customer Base, R&D Investment)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

BAE Systems

Honeywell Aerospace

Collins Aerospace

Air Liquide

Linde Group

AmSafe Bridport

Hamilton Sundstrand

Zodiac Aerospace

L3 Technologies

Orbital Systems

GE Aviation

Parker Hannifin

Oxygen Generating Systems International

Dynair

B/E Aerospace

- Growing demand from commercial airlines for enhanced safety systems

- Expansion of military contracts in Asia-Pacific

- Demand for more efficient and cost-effective systems in commercial aviation

- Emerging space agencies and private aerospace companies increasing demand

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035