Market Overview

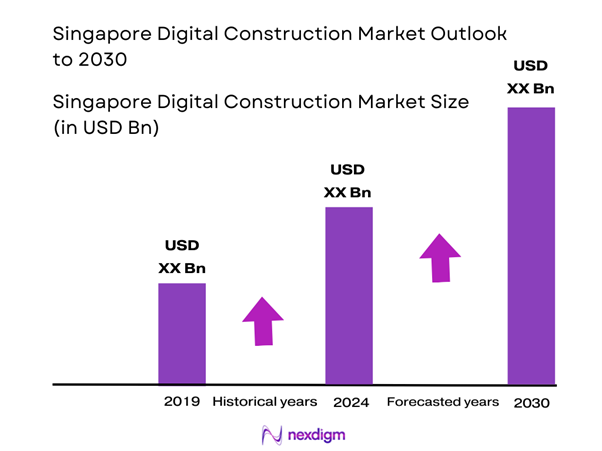

The Singapore Digital Construction Market is valued at USD 3000 million in 2024 with an approximated compound annual growth rate (CAGR) of 8.6% from 2024-2030, based on a five-year historical analysis. This market is driven by the country’s strong emphasis on smart city initiatives, significant investments in infrastructure, and the adoption of advanced technologies like Building Information Modeling (BIM) and Internet of Things (IoT).

Singapore stands out as a dominant player in the Digital Construction Market, primarily due to its strategic geographical location, robust economy, and rigorous regulatory framework promoting innovation. Major cities such as Singapore are leading in digital construction practices, thanks to extensive urban planning and development. The government’s proactive role in embracing technology and sustainability further cements Singapore’s status as a leader, attracting international firms and fostering a competitive landscape in the digital construction ecosystem.

The Singapore government has elaborated various initiatives to bolster the digital construction market, aiming to enhance productivity within the building industry. As part of the Smart Nation initiative, the government has announced investments of SGD 2.4 billion to improve construction practices and promote the training of digital skills. In 2023, the Minister for National Development reiterated that the government commits to support infrastructure development through the Singapore Green Building Masterplan, which outlines plans for improving building energy performance by 30% in the next five years.

Market Segmentation

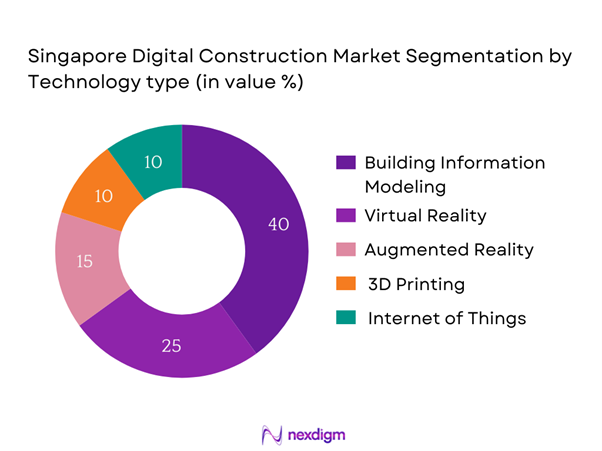

By Technology Type

The Singapore Digital Construction Market is segmented by technology type into Building Information Modeling (BIM), Virtual Reality (VR), Augmented Reality (AR), 3D Printing, and Internet of Things (IoT). The BIM segment holds a dominant market share, driven by its ability to improve accuracy in project planning and execution while reducing costs and enhancing collaboration among stakeholders. As the foundation for digital construction, BIM facilitates better decision-making through visualization and real-time data sharing, making it essential for large-scale projects in Singapore.

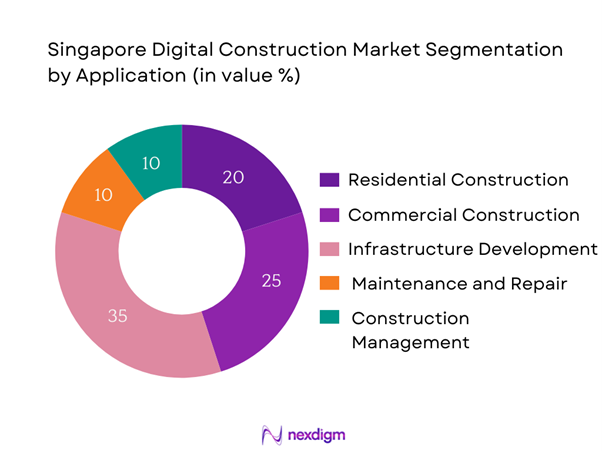

By Application

The market is also segmented by application into Residential Construction, Commercial Construction, Infrastructure Development, Maintenance and Repair, and Construction Management. Infrastructure Development is leading this market segment, fueled by ongoing government investment in public infrastructure projects. The emphasis on improving transport networks and urban utilities is pushing this sub-segment forward, especially as Singapore aims to support its growing population and economy through more efficient infrastructure solutions.

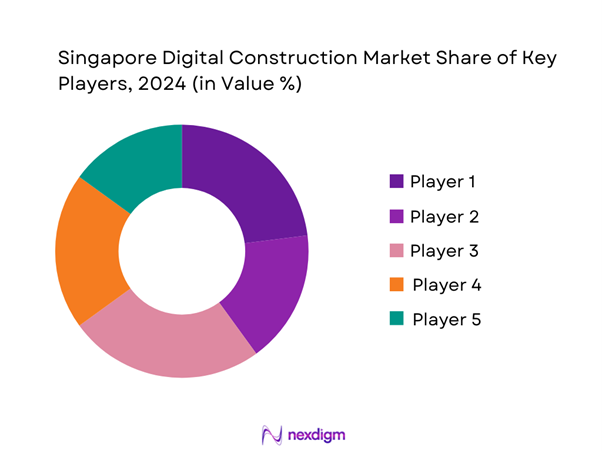

Competitive Landscape

The Singapore Digital Construction Market is dominated by a few major players, including both local and international companies. This consolidation highlights the significant influence of these key firms on market innovations and the overall competitive terrain. Leading companies leverage technological advancements and strong investments in research and development to maintain their market position.

| Company | Establishment Year | Headquarters | Market Share | Number of Products | R&D Investment | Partnerships | Geographical Reach | Employee Strength |

| Trimble Inc. | 1978 | California, USA | – | – | – | – | – | – |

| Autodesk, Inc. | 1982 | California, USA | – | – | – | – | – | – |

| Procore Technologies, Inc. | 2002 | California, USA | – | – | – | – | – | – |

| Bentley Systems, Inc. | 1984 | Pennsylvania, USA | – | – | – | – | – | – |

| Kreo | 2016 | Paris, France | – | – | – | – | – | – |

Singapore Digital Construction Market Analysis

Growth Drivers

Increasing Urbanization

Singapore is undergoing significant urbanization, with over 5.7 million residents concentrated in a land area of just 728.6 square kilometers, reflecting an urbanization rate of about 100%. According to the World Bank, the urban population of Singapore has grown steadily, which drives the demand for innovative construction solutions to meet housing and infrastructure needs. The country aims to accommodate an estimated population increase to 6.9 million by 2030. This rapid urbanization fosters a greater need for digital construction technologies that enhance efficiency and sustainability in response to housing and infrastructure challenges.

Rising Adoption of Advanced Technologies

Singapore’s construction sector is increasingly adopting advanced technologies, including Building Information Modeling (BIM), and IoT, essential for modernizing construction processes. As per the Building and Construction Authority of Singapore (BCA), BIM usage among projects has surged to about 97% in 2023, a significant rise from only 50% in 2010. This adaptation is aimed at improving efficiency and project delivery timelines. Moreover, the BCA’s strategic plan aims to integrate IoT technologies across construction sites, thereby enhancing automation and predictive maintenance. This widespread adoption marks a transformative shift within the industry.

Market Challenges

High Initial Costs

One of the major hurdles faced by the digital construction market in Singapore is the high initial costs associated with integrating advanced construction technologies. Reports indicate that many companies invest approximately SGD 500,000 to SGD 1 million on average for technology implementation per project, which can deter smaller firms from adopting digital practices. This challenge is compounded by the requirement to train existing workforce members in employing these new technologies. The high upfront costs can result in a slower transition to digital construction practices, impacting overall market growth.

Data Security Concerns

As construction firms increasingly rely on digital technologies, data security becomes a prominent concern. Cybersecurity threats have escalated in recent years, leading firms to invest more significantly in protective measures. According to Singapore’s Cyber Security Agency, the cost of cybercrime in the construction industry is forecasted to reach SGD 1.5 billion annually by end of 2025. These concerns regarding data breaches and potential vulnerabilities can slow the pace at which companies embrace digital solutions, restraining innovation in the sector.

Opportunities

Sustainable Building Practices

There is an increasing opportunity in sustainable building practices, driven by both consumer demand and regulatory pressures in Singapore. In 2023, the government reported that approximately 70% of new buildings are designed to meet green building standards, showcasing a commitment to environmental sustainability. The Singapore Green Building Council also highlighted that the adoption of green building methods can reduce carbon emissions by 24.3 million tons annually. This presents a unique opportunity for the digital construction sector to integrate sustainability-focused technologies into their projects, positioning for significant growth.

Integration of AI and Machine Learning

The ongoing integration of AI and machine learning into digital construction processes presents transformative opportunities for efficiency and accuracy. As reported by the Infocomm Media Development Authority, AI usage in Singapore’s construction sector is estimated to increase by 25% annually from 2023 onwards. Machine learning algorithms can optimize resource allocation and project management, improving timelines and cost efficiency significantly. This growing landscape indicates a burgeoning market ripe for innovation and expansion within the digital construction sector, creating pathways for future advancements.

Future Outlook

The Singapore Digital Construction Market is expected to show significant growth driven by continuous government initiatives promoting smart city development, advancements in digital construction technologies, and increasing demand for sustainable building practices. The integration of innovative technologies, such as AI and machine learning, is anticipated to further enhance productivity and operational efficiencies, establishing Singapore as a global leader in the digital construction landscape.

Major Players

- Trimble Inc.

- Autodesk, Inc.

- Procore Technologies, Inc.

- Bentley Systems, Inc.

- Kreo

- Hexagon

- Esri

- RIB Software SE

- Aconex Ltd.

- Viewpoint, Inc.

- SmartBuild

- HOK

- DG Paul Company

- Skanska

- Hilti Corporation

Key Target Audience

- Construction firms and contractors

- Real estate developers

- Engineering and architecture firms

- Government and regulatory bodies (Building and Construction Authority, Urban Redevelopment Authority)

- Investments and venture capitalist firms

- Technology providers and software developers

- Urban planners and consultants

- Industry associations and organizations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Singapore Digital Construction Market. This step is underpinned by extensive desk research that utilizes a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Singapore Digital Construction Market. This includes assessing market penetration, the ratio of technology adoption to construction projects, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of firms within the market. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple construction technology providers and end-users to acquire detailed insights into technology segments, adoption rates, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Singapore Digital Construction Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Urbanization

Government Initiatives

Rising Adoption of Advanced Technologies - Market Challenges

High Initial Costs

Data Security Concerns - Opportunities

Sustainable Building Practices

Integration of AI and Machine Learning - Trends

Digital Twin Technology

Modular Construction - Government Regulation

Building Codes and Standards

Incentives for Digital Adoption - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Technology Type (In Value %)

Building Information Modeling (BIM)

– 3D BIM (Geometric Modeling)

– 4D BIM (Time & Scheduling Integration)

– 5D BIM (Cost Estimation Integration)

– BIM for Facility Management (6D/7D BIM)

Virtual Reality (VR)

– Virtual Walkthroughs for Design Review

– Immersive Safety Training Simulations

– VR in Client Presentation & Collaboration

Augmented Reality (AR)

– On-Site Visualization of Blueprints

– AR-Based Installation Guidance

– Smart Glasses Integration for Site Inspections

3D Printing

– On-Site Component Printing

– Modular Prefab Production

– Architectural Scale Models for Design Validation

Internet of Things (IoT)

– Smart Sensors for Structural Health Monitoring

– IoT for Energy Management in Buildings

– Real-Time Construction Site Monitoring (e.g., Asset Tracking) - By Application (In Value %)

Residential Construction

– Smart Housing Development (IoT-integrated Homes)

– BIM for Multi-Unit Residential Towers

– Digital Permit Approvals & Inspection Workflows

Commercial Construction

– Green Building Compliance using BIM

– AR/VR for Space Planning & Leasing

– Integrated Digital Twin Models for Facility Management

Infrastructure Development

– Digital Twin for MRT & Roadway Projects

– BIM for Underground Utilities & Tunneling

– IoT for Traffic & Environmental Impact Monitoring

Maintenance and Repair

– Predictive Maintenance Systems (via IoT)

– BIM-Integrated Facility Lifecycle Management

– AR-Based Remote Inspection and Repair Workflows

Construction Management

– Cloud-Based Project Tracking & Coordination

– AI-Powered Safety & Progress Monitoring

– Mobile Apps for On-Site Reporting & Scheduling - By Deployment Mode (In Value %)

Cloud-Based

– SaaS BIM Platforms

– Cloud IoT Dashboards for Real-Time Monitoring

– Collaborative VR Platforms for Remote Design Teams

On-Premises

– Enterprise BIM and Data Storage Infrastructure

– Secure On-Site 3D Printing Units

– Internal AR/VR Simulation Studios for Large Projects - By End-User Sector (In Value %)

Private Sector

– Real Estate Developers

– Design & Engineering Consultancies

– Technology-Driven Construction Firms

Public Sector

– Building and Construction Authority (BCA)

– Land Transport Authority (LTA)

– Housing & Development Board (HDB) Projects - By Region (In Value %)

Central Region

Northern Region

Southern Region

Eastern Region

Western Region

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Technology Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Technology Type, Number of Touchpoints, Distribution Channels, Number of Partnerships, Margins, Production Capacity, Unique Value Offering, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Trimble Inc.

Autodesk, Inc.

Procore Technologies, Inc.

Bentley Systems, Incorporated

Hexagon AB

Nemetschek AG

Aconex Ltd.

PlanGrid (part of Autodesk, Inc.)

SmartBuild

RIB Software SE

Viewpoint, Inc.

Esri

Kreo

Infotech Corporation

Hilti Corporation

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030