Market Overview

Based on a recent historical assessment, the Singapore digital MRO market size is valued at USD ~ billion. This growth is driven by the increased adoption of digital technologies such as predictive maintenance, AI-powered diagnostics, and cloud-based solutions within the aviation sector. The demand for cost-effective, real-time, and efficient maintenance services is expanding as airlines and MRO providers prioritize digital transformation to improve operational efficiency and reduce downtime. The shift towards more integrated and automated maintenance solutions continues to drive this growth.

Singapore remains the dominant player in the digital MRO market, owing to its strategic location as a major aviation hub in Asia-Pacific. The city-state’s world-class infrastructure, advanced technological landscape, and government support for innovation in aerospace technology contribute significantly to its leadership. Furthermore, Singapore’s focus on digitalization in aviation, through initiatives and partnerships, strengthens its position as the leading market for digital MRO solutions in the region.

Market Segmentation

By Product Type

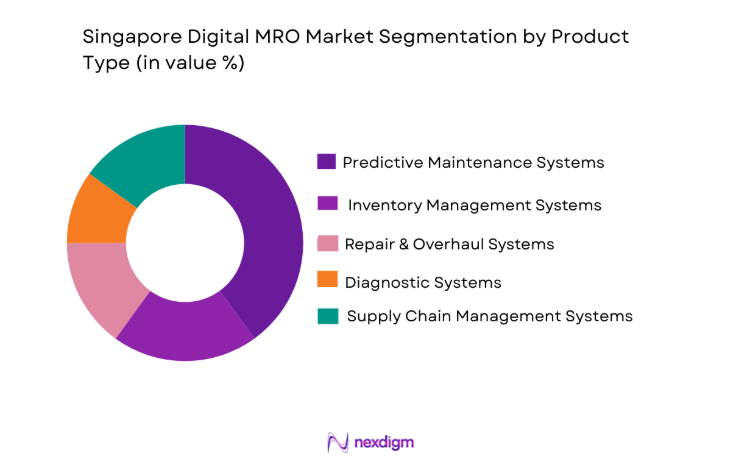

The Singapore digital MRO market is segmented by product type into predictive maintenance systems, inventory management systems, repair & overhaul systems, diagnostic systems, and supply chain management systems. Recently, predictive maintenance systems had a dominant market share due to their ability to reduce downtime and improve efficiency. Factors such as demand for real-time monitoring, cost-saving capabilities, and the growing use of AI-powered tools have contributed to the widespread adoption of these systems in aviation maintenance operations.

By Platform Type

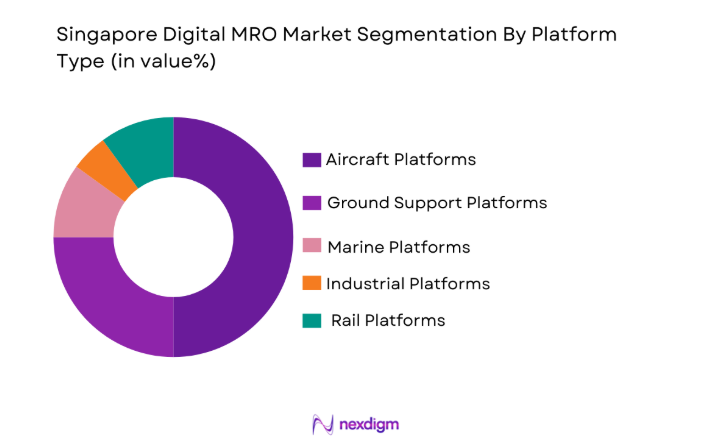

The market is segmented by platform type into aircraft platforms, ground support platforms, marine platforms, industrial platforms, and rail platforms. Recently, aircraft platforms have dominated the market share due to the significant demand for MRO services in commercial and military aviation. The need for efficient and cost-effective maintenance solutions for aircraft has driven the adoption of digital MRO technologies in this sector, with airlines and defense organizations prioritizing predictive maintenance for reducing aircraft downtime.

Competitive Landscape

The competitive landscape of the Singapore digital MRO market reflects significant consolidation among major players, driven by advancements in predictive maintenance and cloud-based solutions. Leading companies such as Rolls-Royce, Lufthansa Technik, and Honeywell Aerospace dominate the sector, leveraging their technological expertise and global reach to expand their influence in the market. Strategic partnerships and acquisitions have intensified competition, and new players are emerging with innovative digital solutions aimed at enhancing operational efficiency and reducing costs.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue |

| Rolls-Royce | 1904 | London, UK | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | Morris Plains, USA | ~ | ~ | ~ | ~ |

| Lufthansa Technik | 1951 | Frankfurt, Germany | ~ | ~ | ~ | ~ |

| General Electric Aviation | 1892 | Boston, USA | ~ | ~ | ~ | ~ |

| SIA Engineering Company | 1982 | Singapore | ~ | ~ | ~ | ~ |

Singapore Digital MRO Market Analysis

Growth Drivers

Increased Investment in Digital Transformation

The rise of digital transformation in aviation has significantly impacted the digital MRO market in Singapore. Airlines, maintenance service providers, and OEMs have increasingly turned to digital solutions, including predictive maintenance, IoT, and AI-based systems, to optimize operations. This transition is expected to accelerate in the coming years, driven by the need for operational efficiency, cost reduction, and improved asset reliability. Governments and aerospace companies have invested heavily in this transition, recognizing the substantial long-term cost savings and operational improvements that these technologies offer. Singapore, with its advanced infrastructure and progressive policies, has been at the forefront of this digital transformation, positioning itself as a leader in the market. The increasing importance of data-driven decision-making, combined with improved sensor technologies, will continue to drive the adoption of digital MRO solutions in the region. Enhanced demand for digital solutions also supports the market, driven by the growing importance of faster and more efficient maintenance processes in both the commercial and military sectors. The increasing reliance on air travel post-pandemic further boosts the demand for efficient MRO services, providing significant growth prospects for the market.

Technological Advancements in Predictive Maintenance

Predictive maintenance technologies are rapidly advancing, fueling the growth of the digital MRO market in Singapore. The application of AI, machine learning, and big data analytics allows for monitoring aircraft systems in real-time, predicting failures before they occur. This technology helps companies to proactively address maintenance issues, avoiding costly repairs, and unplanned downtime. Singapore’s leading MRO providers have embraced these technologies, integrating them into their operations to enhance service offerings and improve fleet management efficiency. Predictive maintenance offers the potential for lower maintenance costs, reduced operational downtime, and increased asset reliability, which are key benefits that drive its adoption. Additionally, the integration of IoT technology in aircraft systems allows real-time data monitoring, giving MRO providers crucial insights into aircraft conditions. The increasing use of these digital technologies not only optimizes MRO operations but also extends the service life of equipment, helping businesses achieve significant cost savings. Technological advancements in predictive maintenance solutions are expected to continue influencing the market as more players adopt and integrate these technologies to stay competitive.

Market Challenges

High Initial Investment in Digital MRO Solutions

The adoption of digital MRO technologies comes with a high initial investment, which poses a challenge for many companies. While the long-term benefits of digital solutions, such as predictive maintenance and cloud-based platforms, are significant, the upfront costs involved in upgrading existing systems and integrating new technologies can be prohibitive. Many MRO providers and airlines, especially smaller players, face challenges in justifying the return on investment (ROI) for these digital systems, which require substantial capital expenditure. Furthermore, the cost of training personnel to effectively use these advanced systems adds an additional layer of expense. As a result, some companies may delay their adoption of digital MRO solutions, especially in regions where the infrastructure for digital transformation is still being developed. While the Singapore government provides incentives for digitalization in the aerospace sector, smaller and medium-sized companies still struggle with the initial costs, which limits the pace of adoption. The challenge remains that the industry needs to make a strong business case for the technology in order to overcome these financial hurdles and accelerate the move towards digital MRO.

Data Privacy and Security Concerns

With the increasing reliance on digital solutions, the issue of data privacy and security has become a significant challenge for the digital MRO market. The collection and transmission of sensitive data, such as aircraft system diagnostics and performance metrics, raise concerns about potential cybersecurity threats. These systems, which rely on interconnected devices and cloud-based platforms, are vulnerable to data breaches, hacking, and cyber-attacks. Airlines, MRO providers, and other stakeholders must ensure that the data transmitted is encrypted, and that strict cybersecurity measures are in place to protect it from unauthorized access. Furthermore, the regulatory landscape surrounding data privacy is becoming more stringent, with regulations such as the General Data Protection Regulation (GDPR) in Europe and local data protection laws in Singapore. This complicates the implementation of digital MRO solutions, especially for companies operating in multiple regions. Ensuring that digital systems comply with these regulations adds complexity to the adoption process, as MRO providers must invest in advanced cybersecurity infrastructure and continuously monitor emerging threats. Data privacy and security concerns represent a significant barrier to the widespread adoption of digital MRO technologies.

Opportunities

Expansion of Cloud-Based MRO Solutions

One of the key opportunities in the Singapore digital MRO market is the expansion of cloud-based MRO solutions. Cloud technology offers several advantages over traditional on-premises systems, including scalability, cost-effectiveness, and accessibility. MRO providers can benefit from cloud solutions by storing large amounts of data, such as maintenance records, diagnostics, and repair schedules, without the need for significant physical infrastructure investment. This makes it easier for companies to implement digital MRO technologies, especially small and medium-sized enterprises (SMEs), which may not have the resources to invest in costly on-premises solutions. Cloud-based platforms also allow for real-time data sharing between MRO providers, OEMs, and airlines, enhancing collaboration and improving the overall maintenance process. Moreover, cloud solutions offer enhanced flexibility, enabling users to access data and systems remotely, which is crucial for global operations. As companies in the aviation sector increasingly turn to cloud-based solutions for their MRO needs, this market segment is expected to see rapid growth in the coming years. This trend is further supported by advancements in cloud security technologies, which help mitigate concerns about data privacy and security. With the increasing demand for cost-effective and efficient MRO services, the expansion of cloud-based solutions offers a significant opportunity for growth in the market.

Strategic Partnerships with Technology Providers

Another major opportunity in the Singapore digital MRO market lies in forming strategic partnerships with technology providers. Collaboration between MRO service providers and technology companies can lead to the development of innovative solutions that address the specific needs of the aviation industry. These partnerships can help accelerate the digital transformation of MRO services by providing access to cutting-edge technologies such as artificial intelligence, big data analytics, and blockchain. By working with technology providers, MRO companies can integrate advanced predictive maintenance tools, streamline operations, and improve the efficiency of their services. Additionally, these partnerships enable knowledge sharing and help MRO providers stay ahead of the competition by incorporating the latest technological advancements into their offerings. As technology continues to evolve, strategic partnerships with software developers, IoT solution providers, and cybersecurity firms will be essential for MRO companies to enhance their service capabilities and maintain competitiveness in the market. As such, forging strong partnerships with technology providers presents a major opportunity for companies in the digital MRO space to expand their reach and capabilities.

Future Outlook

The Singapore digital MRO market is poised for growth in the next five years, driven by continuous advancements in digital technologies and an increased focus on efficiency in aviation maintenance operations. With regulatory support for digital transformation in the aerospace sector, MRO providers are increasingly adopting cloud-based and predictive maintenance solutions. Technological innovations such as AI, machine learning, and IoT are expected to revolutionize the way maintenance services are provided, enhancing operational efficiency and reducing downtime. The increasing demand for cost-effective and reliable aircraft maintenance services, combined with the push for greater sustainability, will continue to fuel market expansion.

Major Players

- Rolls-Royce

- Honeywell Aerospace

- General Electric Aviation

- Lufthansa Technik

- SIA Engineering Company

- Boeing

- Thales Group

- Safran

- Airbus

- Jet Maintenance Solutions

- AAR Corporation

- MTU Aero Engines

- Wheels Up

- Collins Aerospace

- Turkish Technic

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- MRO providers

- Original equipment manufacturers (OEMs)

- Third-party logistics providers

- Aviation sector technology companies

- Aerospace industry contractors

Research Methodology

Step 1: Identification of Key Variables

This step involves defining the scope of the market and identifying the key variables that drive demand, market size, and growth patterns in the Singapore digital MRO market.

Step 2: Market Analysis and Construction

Analysis of historical market data and construction of the market model based on primary and secondary research sources to assess market value, size, and trends.

Step 3: Hypothesis Validation and Expert Consultation

Validating market assumptions with industry experts and through qualitative and quantitative analysis to ensure accuracy and relevance in projections.

Step 4: Research Synthesis and Final Output

Consolidating the research findings into a comprehensive market report that includes forecasts, insights, and strategic recommendations for stakeholders in the market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in National Security

Technological Advancements in AI and IoT

Rising Geopolitical Tensions in Asia-Pacific

Growing Demand for Predictive Maintenance

Expansion of Aerospace and Automotive Industries - Market Challenges

High Capital Expenditure in Digital MRO Solutions

Cybersecurity Concerns with Digital MRO Systems

Regulatory Compliance and Data Privacy Issues

Technological Integration and Interoperability Challenges

Resistance to Change in Traditional MRO Practices - Market Opportunities

Partnerships with Aerospace and Automotive Manufacturers

Growth of Electric Vehicles Driving MRO Demand

Emerging Markets for Industrial and Energy Maintenance Solutions - Trends

Increase in Use of Autonomous and Unmanned Systems

Integration of AI and Machine Learning in MRO Operations

Surge in Cybersecurity Investments for Defense Systems

Rise in Demand for Digital Twin Technologies

Greater Focus on Sustainability in MRO Processes - Government Regulations & Defense Policy

Export Control and Compliance Policies

Data Protection and Privacy Regulations

Government Funding and Grants for Defense Technologies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Aerospace Maintenance Systems

Automotive MRO Systems

Industrial Equipment Maintenance Systems

Energy Maintenance Systems

Maritime Maintenance Systems - By Platform Type (In Value%)

Aerospace Platforms

Automotive Platforms

Industrial Platforms

Energy Platforms

Maritime Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Aerospace Operators

Automotive Manufacturers

Industrial Manufacturers

Energy Operators

Maritime Operators - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

IoT-based Technologies

AI and Machine Learning Solutions

Blockchain Solutions

Augmented Reality Solutions

3D Printing Technologies

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (System Type, Platform Type, End-user Segment, Procurement Channel, Material/Technology)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Honeywell

GE Aviation

Rolls-Royce

Collins Aerospace

Lufthansa Technik

Safran

UTC Aerospace Systems

Rockwell Collins

Thales Group

Boeing

Air France Industries

AAR Corporation

MTU Aero Engines

Bombardier

Meggitt

- Aerospace Operators Seeking Advanced MRO Solutions

- Automotive Manufacturers Adopting Predictive Maintenance

- Industrial Manufacturers Enhancing Equipment Reliability

- Energy Operators Focusing on Cost-effective MRO Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035