Market Overview

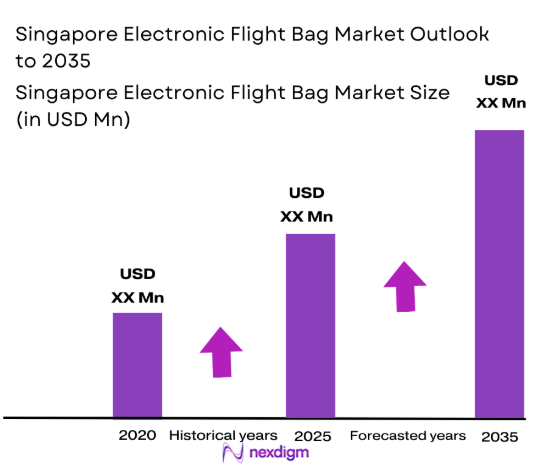

The Singapore Electronic Flight Bag market is valued at approximately USD ~ million, driven by the adoption of paperless cockpit operations across airlines and regulatory support for digital transformation in aviation. Technological advancements in the development of electronic flight bags (EFBs), which streamline flight operations, improve flight crew efficiency, and reduce operational costs, are significantly contributing to market growth. Additionally, the shift toward modern, data-driven aviation systems has led to increased demand for EFB solutions in both commercial and military aviation sectors.

Singapore remains a dominant player in the Electronic Flight Bag market due to its strategic location as a global aviation hub, strong infrastructure, and technological advancements in aviation. The country’s favorable regulatory environment and government support for smart aviation solutions, including digitalization, have further bolstered the growth of the EFB market. Airlines operating in Singapore, including regional carriers and international airports, are increasingly adopting EFB solutions to enhance operational efficiency and meet stringent aviation standards.

Market Segmentation

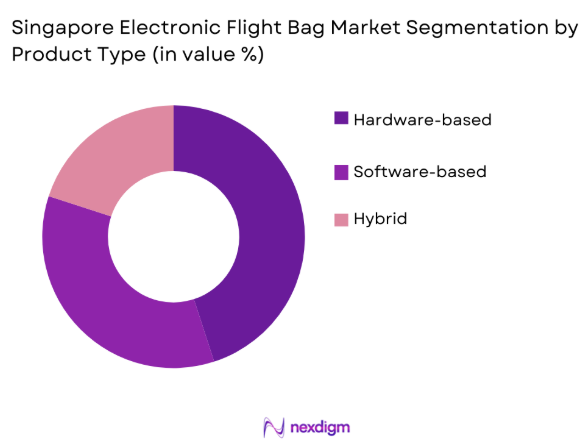

By Product Type:

The Singapore Electronic Flight Bag market is segmented by product type into hardware-based EFBs, software-based EFBs, and hybrid EFBs. Recently, software-based EFBs have seen the highest market share due to their ease of integration, cost-effectiveness, and flexibility. The rise in demand for cloud-based solutions that allow real-time access to flight data has contributed to the growth of this segment. Furthermore, software EFBs offer airlines enhanced scalability and greater functionality, which has attracted significant investments from major airlines and tech providers.

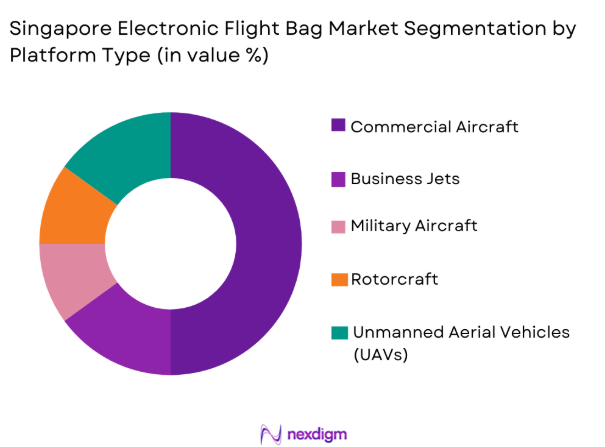

By Platform Type:

The market is segmented into commercial aircraft, military aircraft, business jets, rotorcraft, and UAVs. The commercial aircraft segment has the largest share due to the large number of passenger flights and the increasing emphasis on fuel efficiency, safety, and operational cost reduction. Airlines globally are adopting EFB systems to ensure better management of flight operations, while government regulations push for paperless cockpit solutions. As a result, this segment continues to lead the market in terms of EFB adoption and demand growth.

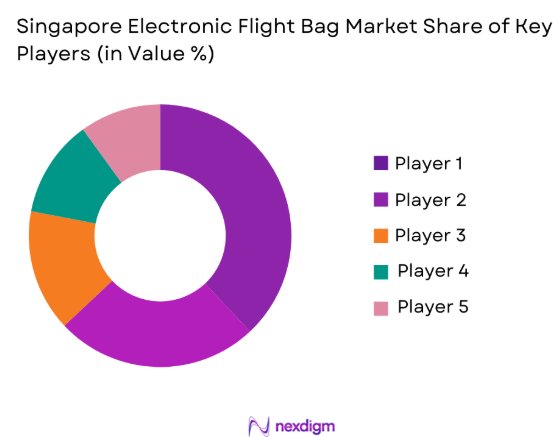

Competitive Landscape

The Singapore Electronic Flight Bag market features a competitive landscape with key players pushing the boundaries of technology to deliver innovative EFB solutions. Industry consolidation is evident as leading companies collaborate to enhance the functionalities of EFB systems. Major players are focused on developing software solutions that integrate seamlessly with aircraft operations. These players influence the market through strong brand recognition, technological advancements, and large-scale deployments across commercial and military platforms.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Garmin | 1989 | USA | ~

|

~

|

~

|

~

|

~

|

| Honeywell | 1906 | USA | ~ | ~

|

~

|

~

|

~

|

| Rockwell Collins | 1933 | USA | ~ | ~

|

~

|

~

|

~

|

| Jeppesen | 1934 | USA | ~ | ~

|

~

|

~

|

~

|

| Thales Group | 2000 | France | ~ | ~

|

~

|

~

|

~

|

Singapore Electronic Flight Bag Market Analysis

Growth Drivers

Government Support for Digital Transformation:

The Singapore Electronic Flight Bag market is being significantly driven by the government’s emphasis on digital transformation in the aviation industry. Singapore’s strategic focus on technological innovation and efficient aviation operations has resulted in the implementation of regulations that encourage the use of digital tools. Electronic flight bags, which reduce paper usage and streamline flight operations, are a direct response to these regulatory changes. The government has introduced various programs to facilitate the integration of advanced technologies in aviation, providing incentives for airlines to adopt EFB systems. These initiatives align with Singapore’s vision to enhance its status as a global aviation hub and ensure safety, efficiency, and sustainability within the sector. Additionally, the global aviation industry’s trend towards digitalization further complements Singapore’s domestic policies, creating a conducive environment for EFB systems to flourish and improve operational efficiency across airlines and other aviation operators.

Technological Advancements in EFB Solutions:

Another key driver of the Singapore Electronic Flight Bag market is the continuous technological advancements in the development of EFB systems. Innovations in cloud computing, mobile devices, and artificial intelligence (AI) are transforming the way electronic flight bags are designed and implemented. Modern EFB systems offer greater flexibility and scalability, allowing airlines to adopt cloud-based platforms that facilitate real-time data access. The integration of AI-driven analytics within EFB systems enables predictive maintenance, real-time route optimization, and enhanced decision-making capabilities for flight crews. Additionally, advancements in the user interface (UI) and user experience (UX) design have made EFB systems more intuitive and easier to use, further increasing their adoption. The increasing integration of EFBs with other aircraft systems, such as flight management and navigation, ensures seamless operations, which is essential for improving safety, reducing operational costs, and enhancing overall flight efficiency.

Market Challenges

High Initial Investment Costs:

One of the primary challenges faced by the Singapore Electronic Flight Bag market is the high initial investment required to implement and integrate these systems into existing airline operations. While EFB solutions are known to offer significant long-term savings through operational efficiencies, the upfront costs involved in purchasing and deploying the necessary hardware, software, and infrastructure can be substantial. Smaller airlines, in particular, may find it difficult to justify these expenses, especially if they are not immediately able to realize the cost savings from operational improvements. Furthermore, the integration of EFB systems with existing flight management and cockpit systems can require additional investments in training, software updates, and infrastructure upgrades. This high initial cost, coupled with the complexity of integrating the technology into existing airline systems, may limit the willingness of certain airlines to fully commit to EFB adoption, especially during economic downturns or periods of financial strain in the aviation sector.

Cybersecurity and Data Privacy Concerns:

As electronic flight bag systems increasingly rely on cloud-based platforms and data-sharing networks, cybersecurity and data privacy concerns have emerged as major challenges for the market. The sensitive nature of flight operations and passenger data transmitted through EFB systems makes them vulnerable to cyber threats, including data breaches, hacking, and other malicious activities. With the growing reliance on digital systems for critical flight information, the risk of cyberattacks has become more pronounced. Airlines and aviation authorities must ensure that the systems used for managing flight operations are secure and comply with rigorous data protection regulations to prevent unauthorized access to sensitive information. As the aviation industry becomes more interconnected through digital solutions, the challenge of safeguarding data and ensuring privacy continues to grow. Therefore, addressing these cybersecurity challenges and ensuring that EFB solutions are secure and compliant with international standards is essential for the continued growth of the market.

Opportunities

Expansion of Digitalization in Aviation:

One of the key opportunities for the Singapore Electronic Flight Bag market is the continued expansion of digitalization in aviation. As airlines around the world focus on improving operational efficiency, reducing environmental impact, and enhancing passenger experience, the demand for digital solutions like EFBs is expected to rise. Digitalization is transforming flight operations, enabling airlines to move towards paperless cockpits and optimize flight management systems. EFB systems provide real-time access to flight data, route optimization, and weather information, improving decision-making and enhancing safety. As airlines increasingly seek to modernize their operations and align with international sustainability and regulatory standards, the adoption of EFB systems is expected to become more widespread. Furthermore, the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) into EFB systems will drive greater innovation and offer new growth prospects for companies in the sector, allowing them to expand into new market segments and regions.

Growth in Autonomous Aviation Systems:

The rise of autonomous aviation systems presents a significant opportunity for the Singapore Electronic Flight Bag market. As the aviation industry begins to adopt autonomous aircraft and unmanned aerial vehicles (UAVs), there is a growing need for electronic flight management systems that support these technologies. EFB solutions are well-positioned to integrate with autonomous systems, providing flight crews or operators with real-time data and control over flight operations. The development of autonomous aviation systems, including pilotless commercial aircraft, is expected to create new opportunities for EFB providers to enhance flight safety, improve operational efficiency, and manage complex flight data. As airlines and aviation companies continue to invest in autonomous technologies, the demand for EFB solutions designed to interface with these systems will increase. Additionally, the growing interest in urban air mobility (UAM) and drone-based operations will further contribute to the expansion of the EFB market, creating a diverse range of new opportunities for EFB providers.

Future Outlook

The future of the Singapore Electronic Flight Bag market is optimistic, with substantial growth expected over the next five years. Technological developments, such as the continued integration of AI and cloud-based systems, will drive further innovation in EFB solutions, enhancing the operational capabilities of airlines. Additionally, regulatory support for digitalization in aviation and the demand for paperless cockpits will contribute to the continued adoption of EFB systems across both commercial and military aviation sectors. Moreover, the growth of autonomous aviation systems and the increasing use of UAVs will open up new market segments, presenting fresh opportunities for EFB providers to cater to these emerging needs. As the aviation industry continues to evolve, the role of EFB solutions in streamlining flight operations, enhancing safety, and improving efficiency will become more pronounced, ensuring the long-term growth and relevance of the EFB market.

Major Players

- Garmin

- Honeywell

- Rockwell Collins

- Jeppesen

- Thales Group

- Avidyne Corporation

- Sita

- Universal Avionics

- Panasonic Avionics

- Navtech

- Boeing

- Embraer

- Airbus

- Rockwell Automation

- L3 Technologies

Key Target Audience

- Airlines

- Aircraft Manufacturers

- Military Aviation Operators

- Aircraft Leasing Companies

- Aviation MRO Providers

- Aviation Regulatory Bodies

- Airlines Technology Procurement Teams

- Investment and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

In this step, key market variables such as technological developments, regulations, market size, and growth drivers are identified through secondary research and expert consultations.

Step 2: Market Analysis and Construction

The market is analyzed based on historical data, current trends, and forecasts. A comprehensive construction of the market’s segmentation, dynamics, and competitive landscape follows.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses generated from market analysis are validated through consultation with industry experts, key stakeholders, and decision-makers in the aviation and technology sectors.

Step 4: Research Synthesis and Final Output

After validation, the collected data and insights are synthesized to form the final market report, offering a clear and detailed understanding of the Singapore Electronic Flight Bag market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological Advancements in Aviation

Rising Adoption of EFB Solutions by Airlines

Regulatory Push for Paperless Operations - Market Challenges

High Initial Cost of Implementation

Integration with Legacy Systems

Cybersecurity and Data Privacy Concerns - Market Opportunities

Expansion of Digitalization in Aviation

Growth of Autonomous Aircraft

Collaborations Between Airlines and Technology Providers - Trends

Increased Use of Cloud-based EFB Systems

Integration of AI and Big Data in Flight Operations

Shift Towards Sustainable Aviation Technologies - Government Regulations

Aviation Safety Regulations

Digitalization and Automation Standards

Data Privacy and Cybersecurity Regulations

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command & Control Systems

Navigation Systems

Flight Management Systems

Communication Systems

Data Storage Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

Rotorcraft

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

On-board Solutions

Portable Solutions

Hybrid Solutions

Integrated Solutions

Cloud-based Solutions - By EndUser Segment (In Value%)

Airlines

Aircraft Manufacturers

Maintenance, Repair, and Overhaul (MRO) Providers

Military Aviation

Charter & Private Jet Operators - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Distributors

Government Contracts

Online Bidding Platforms

Private Sector Procurement

- Market Share Analysis

CrossComparison Parameters (System Type, Platform Type, End-user Segment, Procurement Channel, Material/Technology) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Garmin

Honeywell

Lufthansa Systems

Rockwell Collins

Jeppesen

Thales Group

Universal Avionics

Avidyne Corporation

Sita

Panasonic Avionics

Navtech

Boeing

Embraer

Airbus

Rockwell Automation

- Airlines’ Adoption of EFB Solutions for Efficiency

- Aircraft Manufacturers’ Role in EFB Integration

- Military Operators’ Growing Interest in Digital Systems

- MRO Providers’ Contribution to EFB Maintenance

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035