Market Overview

The Singapore electronics manufacturing market is valued at USD 15 billion, drawing strength from a robust ecosystem that includes favorably positioned governmental policies and a skilled workforce. With continuous investments in industry innovation and the integration of smart technology, the market has leveraged its strong infrastructure and market access to Asia-Pacific regions. The growth trajectory is further amplified by the demand for consumer electronics and communication equipment.

Singapore, as a financial hub and technological center, dominates the electronics manufacturing landscape. Cities like Singapore offer superior logistics connectivity and a business-friendly environment, attracting multinational corporations to establish manufacturing facilities. Its strategic location within Southeast Asia also enhances accessibility to regional markets, enabling faster distribution and innovation collaboration among industry players. The fusion of foreign investment and local expertise continues to fuel the market’s expansion.

The Singaporean government is committed to enhancing the electronics sector through various initiatives and investments. In 2022, the government allocated USD 16.8 billion to support the development of advanced manufacturing sectors, aiming to develop a skilled workforce and improve the overall business environment. Initiatives such as the Industry Transformation Map for Electronics aim to double the sector’s productivity by enhancing technology adoption and workforce skills by end of 2025.

Market Segmentation

By Product Type

The Singapore electronics manufacturing market is segmented by product type into consumer electronics, industrial electronics, communication equipment, computer hardware, and semiconductors. Consumer electronics is currently the dominant segment due to consistently high consumer demand driven by advancements in technology and lifestyle changes. Major brands leverage innovative designs and enhanced functionality to capture consumer interest, resulting in strong market performance. Devices such as smartphones, wearables, and smart home appliances account for a significant share as they become integral components of everyday life.

By Application

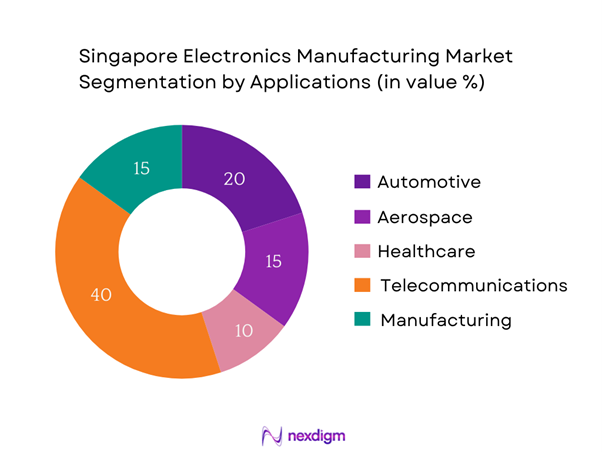

The market is further segmented by application, including automotive, aerospace, healthcare, telecommunications, and manufacturing. The telecommunications segment holds a dominant position, primarily due to the increasing demand for faster and more reliable communication networks. The rapid expansion of 5G technology and smart devices has heightened the need for advanced electronic components in this sector. Companies are continuously innovating to meet consumer requirements, driving sustained growth in telecommunications applications.

Competitive Landscape

The Singapore electronics manufacturing market is characterized by a competitive landscape dominated by a group of key players. These companies, such as Flex Ltd. and STMicroelectronics, leverage advanced technology and operational efficiencies to maintain their positions. The consolidation of a few major players indicates the significant influence they hold in shaping market trends and innovations.

| Company | Establishment Year | Headquarters | Market Share (%) | Product Type | Key Strengths | Innovations |

| Flex Ltd. | 1969 | Singapore | – | – | – | – |

| STMicroelectronics | 1987 | Geneva, Switzerland | – | – | – | – |

| HP Inc. | 1939 | Palo Alto, USA | – | – | – | – |

| Sony Electronics Singapore | 1967 | Tokyo, Japan | – | – | – | – |

| Singapore Technologies Electronics | 1967 | Singapore | – | – | – | – |

Singapore Electronics Manufacturing Market Analysis

Growth Drivers

Technological Advancements

Technological advancements are pivotal in driving the Singapore electronics manufacturing market. As of 2022, Singapore invested approximately USD 5.5 billion in research and development activities, ensuring companies adopt state-of-the-art technologies. The rise of Industry 4.0 emphasizes the incorporation of IoT, AI, and robotics into manufacturing processes. Additionally, the World Economic Forum reported that Singapore ranks 1st globally in manufacturing output per capita, showcasing its high-tech capabilities. This technological edge enables local manufacturers to deliver innovative products efficiently, meeting the increasing global demand.

Rising Demand for Smart Devices

The increasing global demand for smart devices significantly contributes to the growth of the Singapore electronics manufacturing market. In 2022, the total shipments of smart devices reached over 2.6 billion, a trend reflecting consumer preference for connectivity and advanced functionality. Singapore, as a tech hub, has witnessed a surge in the production of smart gadgets, resulting in a notable increase in exports. The expansion of 5G technology is further fueling this demand, driving manufacturers to innovate and adapt rapidly to meet consumer expectations.

Market Challenges

Supply Chain Disruptions

The electronics manufacturing sector is currently experiencing significant supply chain interruptions, exacerbated by geopolitical tensions and the lingering effects of the COVID-19 pandemic. According to the Singapore Economic Development Board, 2022 saw an increase in procurement costs, with some semiconductor manufacturers reporting delays affecting 68% of their projects due to component shortages. As a result, companies are focusing on diversifying their supplier base, but the challenge of maintaining operational efficiency persists amid these disruptions.

Rapid Technological Changes

The pace of technological evolution poses both opportunities and challenges to the market. Companies must constantly upgrade their technology to remain competitive. The investment in new machinery and software can be demanding, with reports indicating that 47% of firms in Southeast Asia acknowledged difficulties in adapting to rapid technological changes. The pressure to innovate may lead to substantial investment risks, particularly for smaller companies that may struggle to keep pace with larger players.

Opportunities

Growth in IoT Applications

The rapid growth in IoT applications offers substantial potential for the Singapore electronics manufacturing market. In 2022, the global IoT market valued USD 760 billion, with Singapore emerging as a valuable player due to its strong digital infrastructure and supportive policies. Currently, around 5 million IoT devices are in use in Singapore, primarily in sectors like healthcare, smart home technologies, and smart cities, indicating vast room for expansion. By fostering partnerships between tech companies and local startups, Singapore can leverage this trend to solidify its market leadership.

Expansion into Emerging Markets

Electronics manufacturers in Singapore have the potential to expand into emerging markets, which exhibit increasing demand for electronic goods. As of 2022, the ASEAN region’s GDP growth averaged 5% annually, prompting more investment in electronics production to satisfy demand. Countries like Vietnam and Indonesia have shown a rising middle class that facilitates higher disposable incomes, leading to increased purchases of consumer electronics. Singaporean firms can capitalize on this expansion by establishing manufacturing and service operations in these rapidly developing markets.

Future Outlook

The Singapore electronics manufacturing market is expected to exhibit sustained growth over the next several years, driven by continuous advancements in technology, increased investment from both domestic and international players, and evolving consumer preferences. The ongoing shift towards automation and smart manufacturing is anticipated to further catalyze the demand for electronic components, enhancing the market’s growth potential. As global competitiveness intensifies, innovations in research and development will play a crucial role in maintaining Singapore’s leading position in the electronics manufacturing domain.

Major Players

- Flex Ltd.

- STMicroelectronics

- HP Inc.

- Sony Electronics Singapore

- Singapore Technologies Electronics

- Broadcom Inc.

- NXP Semiconductors

- Denso Corporation

- Analog Devices, Inc.

- GlobalFoundries

- ASML Holding

- Infineon Technologies

- Seagate Technology

- Western Digital

- Qualcomm

Key Target Audience

- OEMs (Original Equipment Manufacturers)

- Electronics Component Manufacturers

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Infocomm Media Development Authority)

- Supply Chain and Logistics Providers

- Distributors and Wholesalers

- Industry Associations and Trade Groups

- Technology Startups and Innovators

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we construct an ecosystem map that encompasses all major stakeholders within the Singapore electronics manufacturing market. This includes identifying manufacturers, suppliers, regulatory bodies, and end-users. Extensive desk research is conducted utilizing various secondary sources, including market reports, industry publications, and proprietary databases to gather comprehensive information, enabling the identification of key variables influencing market dynamics.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data relevant to the electronics manufacturing market. We assess market penetration, evaluate the ratio of product types to applications, and analyze revenue generation across different segments. Additionally, we scrutinize quality statistics to ensure precision and reliability in revenue estimates, which contribute to a validated market understanding.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and subsequently validated through interviews with industry experts representing a diverse array of companies within the sector. These consultations yield valuable operational insights and financial data, providing a deeper understanding of market trends and validating the statistics derived from the dataset.

Step 4: Research Synthesis and Final Output

In the final phase, we engage directly with multiple electronics manufacturers to gain details about sales performance, product segments, and customer preferences. This interaction not only verifies the data compiled in previous steps but also enriches our analysis, providing a comprehensive and accurate representation of the Singapore electronics manufacturing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Technological Advancements

Government Initiatives and Investments

Rising Demand for Smart Devices - Market Challenges

Supply Chain Disruptions

Rapid Technological Changes - Opportunities

Growth in IoT Applications

Expansion into Emerging Markets - Trends

Sustainability and Eco-Friendly Innovations

Increased Automation in Manufacturing - Government Regulation

Compliance Standards

Export and Import Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Consumer Electronics

– Smartphones

– Televisions and Display Panels

– Wearables

– Home Appliances

Industrial Electronics

– Automation Controllers

– Power Electronics

– Test and Measurement Instruments

– Robotics Components

Communication Equipment

– Routers and Modems

– Base Stations and Transceivers

– Optical Communication Devices

– IoT Communication Modules

Computer Hardware

– Laptops and Desktops

– Servers and Data Storage Devices

– Peripherals (e.g., monitors, keyboards)

– PCBs and Motherboards

Semiconductors

– Integrated Circuits (Analog, Digital, Mixed-signal)

– Memory Chips (DRAM, NAND, Flash)

– Sensors and Microcontrollers

– Power Semiconductors - By Application (In Value %)

Automotive

– ADAS Modules

– Infotainment Systems

– Battery Management Electronics for EVs

Aerospace

– Avionics Control Systems

– Sensor Modules

– Navigation Electronics

Healthcare

– Diagnostic Imaging Electronics

– Patient Monitoring Systems

– Medical Wearables and Implants

Telecommunications

– 5G Network Equipment

– Optical Fiber Transceivers

– Signal Processing Modules

Manufacturing

– PLCs and Motion Controllers

– Electronic Sensors and IoT Gateways

– Smart Factory Systems - By Distribution Channel (In Value %)

Direct Sales

Distributors/Wholesalers

Online Retail

Retail Outlets - By Region (In Value %)

Central Region

Eastern Region

Northern Region

Western Region - By Packaging Type (In Value %)

Bulk Packaging

– OEM and Industrial Shipments

– Wholesale Component Packaging

Consumer Packaging

– Retail-ready Packaging

– Eco-Friendly Packaging Formats

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Electronics Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Market Positioning, Innovations, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Flex Ltd.

STMicroelectronics

HP Inc.

Epson Singapore

Sony Electronics Singapore

Singapore Technologies Electronics

Broadcom Inc.

NXP Semiconductors

Denso Corporation

Analog Devices, Inc.

GlobalFoundries

ASML Holding

Infineon Technologies

Seagate Technology

Western Digital

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Points Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030