Market Overview

The Singapore Fighter Aircraft IRST market is valued at approximately USD ~ million, driven by the Republic of Singapore Air Force (RSAF) modernization and the increasing reliance on advanced infrared search and track (IRST) technologies for enhancing situational awareness and targeting accuracy. The market’s growth is fueled by RSAF’s continued investments in next-generation fighter platforms, including the F-35 and the F-16 upgrade program, both of which are expected to integrate cutting-edge IRST systems. As Singapore’s defense spending has consistently increased, with a focus on air superiority and multi-role capabilities, the demand for IRST systems is expected to see sustained growth in the coming years. Government initiatives to strengthen regional security, along with the increasing need for stealth and advanced sensor systems, further accelerate this market’s expansion.

Singapore is the dominant force in the Southeast Asian Fighter Aircraft IRST market due to its highly advanced military technology, strong defense budget, and strategic location. The Republic of Singapore Air Force (RSAF) is one of the most technologically advanced air forces in Asia, having heavily invested in modern aircraft such as the F-35, which integrates IRST systems. Additionally, the ongoing regional security concerns in the Asia-Pacific, coupled with the Singaporean government’s commitment to defense modernization, positions the country as a market leader. Furthermore, Singapore serves as a key partner in defense collaborations with global powers, amplifying its role in the IRST market.

Market Segmentation

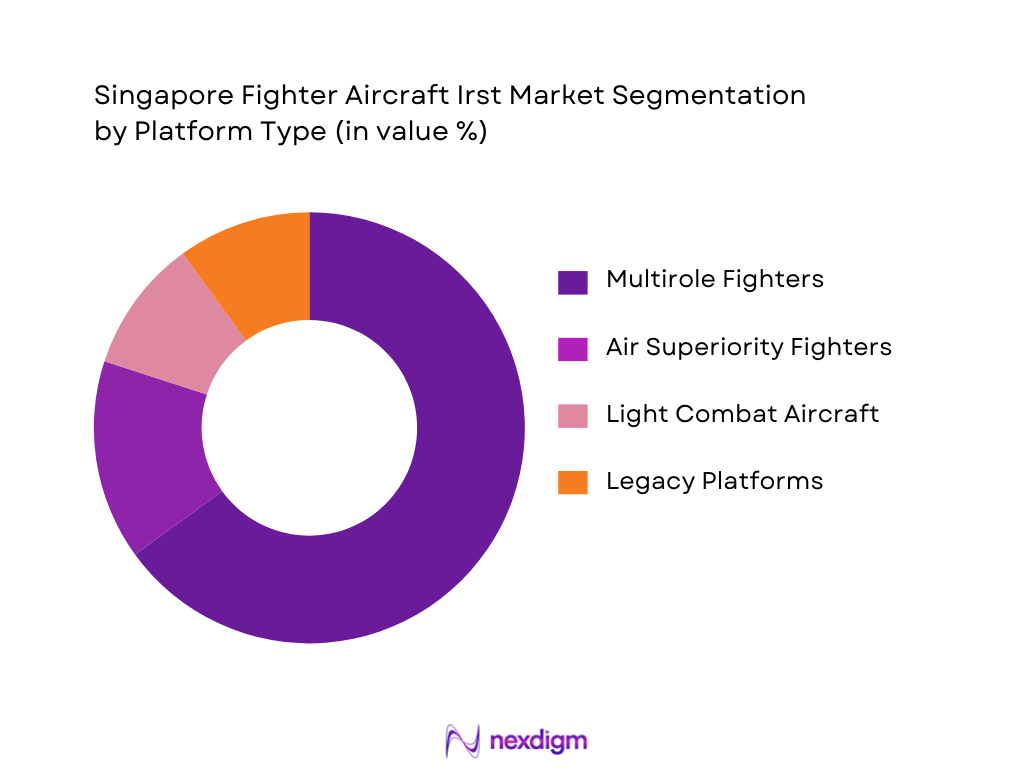

By Platform Type

The Singapore Fighter Aircraft IRST market is segmented into various fighter aircraft categories, with a dominant presence of multirole fighters. Multirole fighters, such as the F-35, continue to dominate due to their adaptability across a wide range of missions, including air-to-air combat, ground attack, and intelligence, surveillance, and reconnaissance (ISR). The F-35’s integration of advanced IRST technology makes it a key driver of this segment, bolstered by its increasing adoption in the RSAF. Other segments like air superiority fighters and light combat aircraft also contribute but to a lesser extent, with RSAF focusing more on platforms that provide comprehensive multi-domain operations and sensor fusion.

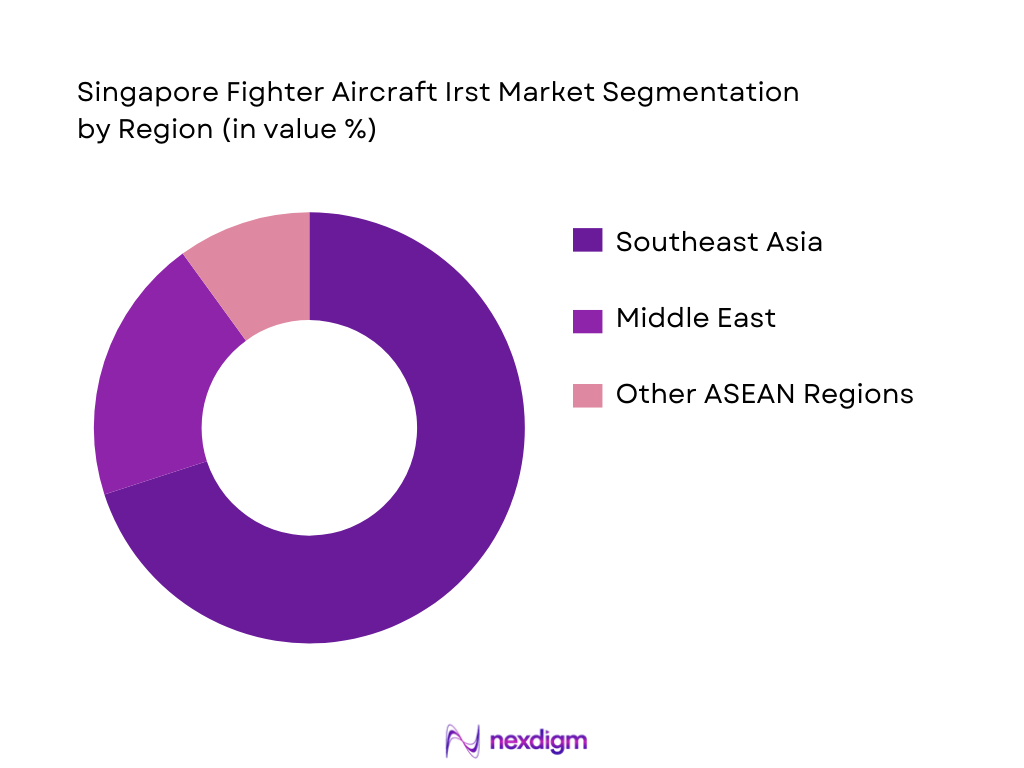

By Region

Regionally, Singapore stands as the dominant force in the market due to its substantial investments in defense technology, particularly in air power and advanced sensors like IRST. The market share is mainly driven by Southeast Asia, where Singapore is strategically located and serves as a hub for defense technology development and collaboration. Neighboring countries such as Malaysia and Indonesia are gradually adopting IRST systems, primarily through joint ventures and defense procurements, but Singapore’s market share remains unrivaled due to its strong defense policies and partnerships with Western defense manufacturers.

Competitive Landscape

The Singapore Fighter Aircraft IRST market is characterized by a high degree of competition, with several key players dominating the technology integration and system manufacturing landscape. Major players include Lockheed Martin, Raytheon Technologies, and Thales Group, all of which supply integrated IRST systems for advanced fighter platforms such as the F-35, F-16, and F-15. The market also benefits from robust partnerships between global primes and local integrators, reflecting Singapore’s active involvement in the global defense supply chain. The strong relationship between government procurement and defense contractors ensures a competitive and dynamic market landscape.

| Company | Establishment Year | Headquarters | Key Focus Area | IRST Integration | Market Share | Recent Developments |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ |

| Leonardo S.p.A. | 1948 | Rome, Italy | ~ | ~ | ~ | ~ |

Singapore Fighter Aircraft Irst Market Analysis

Growth Drivers

RSAF Modernization & F‑35 Integration Roadmap (Strategic Air Superiority Push)

The Republic of Singapore Air Force (RSAF) is undergoing a significant modernization effort, with the integration of the F-35 fighter jet at the forefront of its strategic air superiority plans. The F-35, equipped with advanced IRST technology, enhances the RSAF’s capability in stealth operations and precision targeting. This initiative is crucial for ensuring that Singapore maintains air dominance in the region, enabling the RSAF to effectively address evolving threats. The focus on F-35 integration is expected to drive demand for IRST systems as part of the broader modernization of the air force.

Network Centric Warfare (Sensor Fusion Imperative)

As part of the transition to network-centric warfare, the RSAF is placing a high emphasis on sensor fusion, where data from various platforms and sensors, including IRST systems, are seamlessly integrated to provide a comprehensive operational picture. This approach enhances decision-making, situational awareness, and target acquisition capabilities. The shift towards a more interconnected and data-driven defense strategy makes the need for sophisticated IRST systems even more critical, as they contribute to the overall network by providing real-time infrared data and enabling advanced combat operations.

Restraints

Budgetary Prioritization & Program Deferral Risks

One of the key constraints in the Singapore Fighter Aircraft IRST market is the potential for budgetary prioritization and program deferral. Singapore’s defense budget is finite, and resources must be allocated across various defense initiatives. As a result, large-scale programs, such as the integration of advanced IRST systems into fighter aircraft, may face delays or reductions in funding, depending on shifting national security priorities or unforeseen fiscal challenges. This could slow the pace at which new technologies are integrated into the RSAF’s aircraft fleet.

Technical Integration Complexities with Legacy Platforms

Integrating modern IRST systems into legacy platforms, such as the RSAF’s older F-16 fighters, presents a significant technical challenge. These platforms were not originally designed to accommodate advanced IRST technologies, requiring complex retrofitting and system upgrades. Compatibility issues, along with the high cost of these upgrades, can lead to delays in fully modernizing the fleet. Additionally, retrofitting existing aircraft with new IRST systems may introduce operational risks during the integration phase, further complicating the process and potentially impacting the timeline for achieving full operational readiness.

Opportunities

AI-Enabled IRST Analytics & Predictive Detection

AI-enabled IRST systems are poised to revolutionize the market by offering enhanced target detection and tracking capabilities. Machine learning algorithms can be integrated into IRST systems to analyze vast amounts of sensor data, enabling predictive detection and more accurate threat identification. This technology allows for better decision-making and faster response times in combat situations. As AI technology continues to advance, its incorporation into IRST systems will make them more efficient and capable of handling increasingly complex combat scenarios, driving demand for these systems across modern air forces.

Regional Export Demand from ASEAN & Indo-Pacific Allies

As regional defense capabilities evolve, there is increasing demand for advanced IRST technologies from ASEAN countries and Indo-Pacific allies. These nations are modernizing their air forces to address emerging security threats and are looking to integrate state-of-the-art systems, such as IRST, into their fighter fleets. Singapore, with its advanced technological capabilities and strong defense sector, is well-positioned to meet this demand. The RSAF’s experience with cutting-edge IRST solutions positions Singapore as a key exporter, with opportunities to support defense programs across Southeast Asia and the wider Indo-Pacific region.

Future Outlook

Over the next 5 years, the Singapore Fighter Aircraft IRST market is expected to experience significant growth, driven by the RSAF’s modernization programs, particularly with the F-35 acquisition, and increasing regional security concerns. The integration of IRST technologies with next-generation fighter aircraft will continue to be a focal point, with advancements in sensor fusion and stealth capabilities enhancing the demand. Government support for defense innovations and increased regional defense collaborations will further propel the market, as neighboring ASEAN countries gradually expand their IRST capabilities through partnerships and procurements.

Major Players

- Lockheed Martin

- Raytheon Technologies

- Thales Group

- Northrop Grumman

- Leonardo S.p.A.

- BAE Systems

- Saab AB

- Leonardo DRS

- L3Harris Technologies

- BAE Systems

- Elbit Systems

- Rheinmetall Defence

- FLIR Systems

- Kongsberg Defence & Aerospace

- Curtiss-Wright Defense Solutions

Key Target Audience

- Government and Regulatory Bodies (Republic of Singapore Ministry of Defence)

- Investments and Venture Capitalist Firms

- Defence Primes and Integrators (OEMs)

- Military and Aerospace Manufacturers

- Regional Armed Forces (RSAF, Malaysian Air Force)

- Research & Development Divisions (Defense Companies)

- Regional and International Defence Contractors

- Defence Procurement & Acquisition Agencies

Research Methodology

Step 1: Identification of Key Variables

This phase involves defining all key variables affecting the Singapore Fighter Aircraft IRST market, including technological trends, market growth drivers, and competitive dynamics. Desk research will be conducted using secondary and proprietary databases, and key stakeholders will be mapped out for further consultation.

Step 2: Market Analysis and Construction

Historical data will be compiled to assess the growth of the IRST technology in the Singaporean defense sector. This phase includes evaluating the current penetration of IRST systems in RSAF platforms and understanding technology integration across different aircraft models.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market growth and trends will be validated through in-depth interviews with experts from global defense primes, regional procurement officials, and military analysts. These consultations will help verify assumptions and ensure accurate market projections.

Step 4: Research Synthesis and Final Output

Data collected through primary and secondary research will be synthesized to create the final report. This will involve cross-referencing information with manufacturers, integrators, and key defense agencies to finalize market estimates and future forecasts.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Defence Acquisition Lifecycle Mapping, Primary Procurement Data Sources and Military Stakeholder Interviews, Multi‑Phase Tender Assessment Framework, Value Stream & Cost Curve Modelling, Constraints & Data Limitations)

- Definition and Scope (IRST in Fighter Avionics, Airborne Sensor Suite Integration)

- Market Genesis & Historical Deployment in RSAF Fighter Platforms

- RSAF Fighter Inventory & IRST Adoption Roadmap

- Defense Procurement Process & Strategic Capability Alignment

- Supply Chain and Value Chain

- Growth Drivers

RSAF Modernization & F‑35 Integration Roadmap (Strategic Air Superiority Push)

Network Centric Warfare (Sensor Fusion Imperative)

Regional Air Threat Dynamics & ISR Requirements

Cost Optimisation Through Shared Avionics Commonality - Market Constraints

Budgetary Prioritisation & Programme Deferral Risks

Technical Integration Complexities with Legacy Platforms

Export Control & Technology Transfer Restrictions

Supply Chain Inflation & Component Scarcity - Opportunities

AI‑Enabled IRST Analytics & Predictive Detection

Regional Export Demand from ASEAN & Indo‑Pacific Allies

Modular Open Architecture Sensor Systems

Dual‑Use (Training & Simulation, UAV IRST Adaptation) - Market Trends

Shift to AESA / IRST Fusion Systems

Software Defined Sensor Capabilities

Collaborative Sensor Networks (UAV + ISR Platforms) - Regulatory & Compliance Environment

MINDEF Procurement Policy Framework (Analytic Hierarchy Process)

Export Control Implications

Standards (NATO STANAG / MIL‑STD Interoperability) - SWOT & Strategic Framework

Strengths (Local Integration Capabilities)

Weaknesses (Scale Limitations)

Opportunities (ASEAN Exports)

Threats (Regional Competition) - Porter’s Five Forces (Fighter IRST Segment)

- Ecosystem Mapping (OEMs, Sub‑Tier Suppliers, System Integrators, End Users)

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Platform Type (In Value %)

Multirole Fighters (e.g., F‑35A/B)

Air Superiority Fighters

Light Combat Aircraft

Upgrade Kits for Legacy Platforms (e.g., F‑16 Block Upgrade)

Export/Regional Partner Integrations - By IRST Technology Type (In Value %)

Passive IRST (Scanning Array)

Electro‑Optical Targeting IRST

Distributed Aperture Systems (DAS)

Hybrid IRST + AESA Fusion

High‑Altitude Optimised IRST - By Capability Tier (In Value %)

Baseline Detection

Tracking & Targeting Accuracy

Long‑Range Engagement Support

Sensor Fusion & AI‑Assisted Targeting

All‑Weather Performance - By End User (In Value %)

Republic of Singapore Air Force (RSAF)

Defence Primes & Local Integrators

Regional Export Customers (ASEAN Partners)

MRO and Refurbishment Houses

Flight Test & Evaluation Agencies - By Procurement Type (In Value %)

New Build Fighter IRST Installs

Retrofit / Mid‑Life Upgrade Contracts

Support, Maintenance & Aftermarket Spares

Software/Algorithm Refresh Contracts

Training & Simulation Kits

- Market Share by Value/Install Base (IRST Suppliers in Singapore/Region)

- Cross‑Comparison Parameters (Company Overview, IRST Technology Portfolio, Integration Experience, Sensor Performance Metrics, Compliance & Certification, Delivery Capability, Aftermarket Support, Warranty/Obsolescence Strategy)

- Detailed Profiles of Major Players in Fighter IRST & Avionics Market

Lockheed Martin Corporation (IRST/IFF Integration, F‑35 Sensor Fusion)

Raytheon Technologies (IRST Systems & EW Suites)

Northrop Grumman (Distributed IRST Solutions)

BAE Systems (IRST for Eurofighter/Jaguar Platforms)

Saab AB (IRST Electro‑Optical Systems)

Thales Group (IRST + Targeting Sensors)

Leonardo S.p.A. (EO/IR Search & Track Systems)

Elbit Systems (IRST & Defensive Aids Suites)

Kongsberg Defence & Aerospace (Sensor Fusion Modules)

Honeywell Aerospace (Avionics & Sensor Interfaces)

L3Harris Technologies (IRST & Tactical EW)

Textron Systems (Flight‑Ready IRST Packages)

Curtiss‑Wright Defense Solutions (High‑Performance Sensors)

FLIR Systems (Thermal Imaging IRST Submodules)

Rheinmetall Defence (Sensor Integration Platforms)

- Capability Requirement Profiles

- Budget Allocation Logic

- Technology Evaluation Criteria

- Lifecycle Cost Impact Analysis

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035