Market Overview

The Singapore Fixed Wing Turbine Aircraft market has seen significant growth, driven by increasing demand for private and business aviation. The market’s size is bolstered by the expanding aviation infrastructure, governmental initiatives to support the aerospace sector, and rising demand for high-performance, fuel-efficient aircraft. In 2023, the market was valued at approximately USD ~ billion, with projections for 2024 to reach USD ~ billion. This growth is attributed to the rising disposable income, improving business travel trends, and advancements in turbine engine technology, which provide better fuel economy and performance.

The market is dominated by key players in regions like Singapore and neighboring Southeast Asian nations, with the city-state’s strategic position and robust aviation infrastructure driving demand. Singapore, known for its world-class Changi Airport, has a leading role in business aviation, serving as a hub for corporate and charter flights. Additionally, the government’s strong support for the aerospace sector, including incentives and regulations that promote aviation technology, enhances the attractiveness of Singapore as a central player in the region’s aviation industry.

Market Segmentation

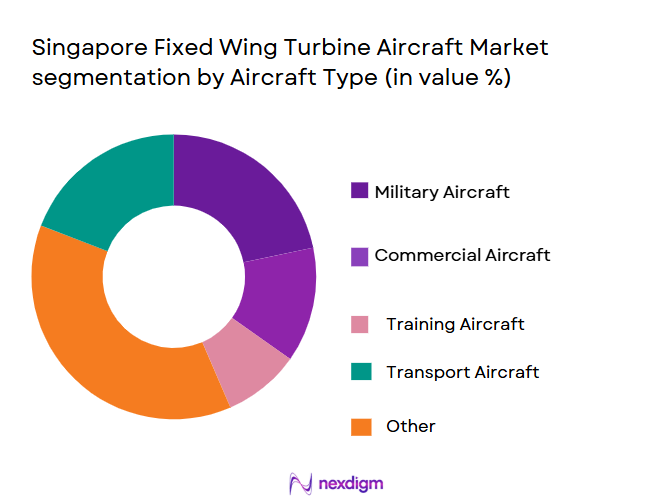

By Aircraft Type

The Singapore Fixed Wing Turbine Aircraft market is segmented by system type into turboprop aircraft, jet engine aircraft, single-engine aircraft, multi-engine aircraft, and light aircraft. Among these, turboprop aircraft dominate the market share, especially for shorter regional flights. Their efficient fuel consumption, lower operational costs, and ability to operate from smaller airports make them ideal for the Southeast Asian market, where frequent short-haul flights are common. Moreover, turboprops offer excellent performance in hot and high environments, further enhancing their demand in Singapore’s tropical climate.

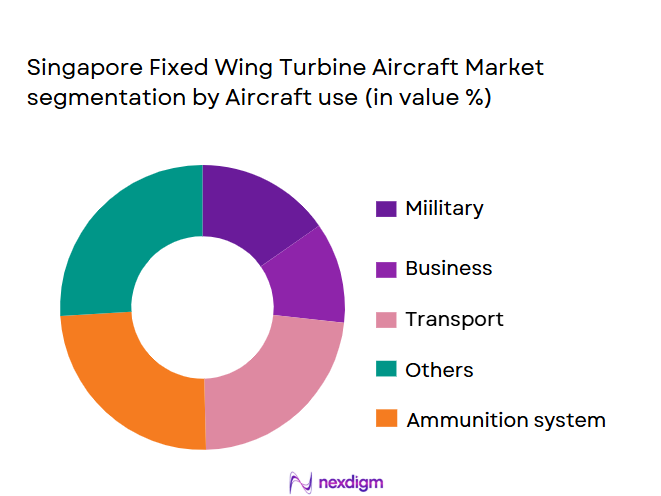

By Aircraft Use

The market is also segmented by platform type into business aircraft, private aircraft, government aircraft, commercial aircraft, and military aircraft. Business aircraft dominate the market due to the high demand for corporate travel in the region. With a growing number of executives and businesses opting for private and chartered flights, business aircraft offer efficiency and convenience. Furthermore, these aircraft are favored by businesses for rapid travel between Southeast Asia’s major commercial hubs, contributing to the sector’s leading position in market share.

Competitive Landscape

The competitive landscape of the Singapore Fixed Wing Turbine Aircraft market is dominated by a mix of global aviation giants and specialized regional manufacturers. Companies like Embraer and Textron Aviation hold significant positions due to their comprehensive portfolios of turboprop and light aircraft. Singapore’s strategic location as a major aviation hub has made it an attractive market for both established international companies and local players. The landscape is characterized by intense competition for service contracts and infrastructure development, with key players constantly innovating to enhance aircraft performance and fuel efficiency.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Market Focus | Technology Focus | Customer Base | Strategic Initiatives |

| Textron Aviation | 1923 | USA | ~ | ~ | ~ | ~ | ~ |

| Embraer | 1969 | Brazil | ~ | ~ | ~ | ~ | ~ |

| Bombardier Aerospace | 1942 | Canada | ~ | ~ | ~ | ~ | ~ |

| General Electric Aviation | 1892 | USA | ~ | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | USA | ~ | ~ | ~ | ~ |

Singapore fixed wing turbine aircraft Market Analysis

Growth Drivers

Singapore Fixed Wing Turbine

Increasing demand for fuel-efficient aircraft has been a key growth driver for the Singapore Fixed Wing Turbine Aircraft market. As the aviation sector continues to focus on reducing its carbon footprint, the demand for fuel-efficient turbine engines has grown significantly. With global commitments to reduce carbon emissions, including Singapore’s targets for sustainable aviation, aircraft manufacturers are increasingly focused on producing engines that provide better fuel economy. This is leading to greater adoption of turbine aircraft that offer improved performance, reduced operational costs, and lower environmental impact.

Another significant growth driver

is the expanding private and business aviation market in Singapore. As one of the financial hubs in Asia, Singapore has seen a continuous rise in business aviation, driven by the increasing number of high-net-worth individuals and corporations seeking efficient, time-saving air travel. The demand for private jets and business aircraft is growing, fueled by an increasing number of regional and international businesses looking for faster travel options. With the country’s strong economic growth and strategic geographical location, this demand is expected to continue rising, supporting further growth in the fixed-wing turbine aircraft market.

Market Challenges

High Cost

The high costof acquiring and maintaining aircraft presents a significant challenge to the Singapore Fixed Wing Turbine Aircraft market. Aircraft ownership is a costly venture, especially when factoring in the purchase price and ongoing maintenance costs. Turbine engines, while highly efficient, require regular maintenance and replacement of parts, contributing to significant operational expenses. For smaller operators, these costs can be a barrier to entry, limiting market participation and slowing overall growth. This financial burden can hinder the adoption of newer, more fuel-efficient models, especially among smaller businesses and private owners.

Stringent regulatory requirements

also pose a challenge in the Singapore aviation market. The Civil Aviation Authority of Singapore (CAAS) enforces strict safety, operational, and environmental standards for aircraft operators, which can increase the complexity of operations. Compliance with international aviation regulations, such as those set by the International Civil Aviation Organization (ICAO), requires continuous investments in both technology and human resources. These regulations are designed to enhance safety and sustainability but can also result in delays and added costs for aircraft owners and operators. The need to meet these stringent standards can deter potential buyers and add to the operational burden for existing operators.

Opportunities

Small Turboprop Aircraft

The growing demand for small turboprop aircraft presents a notable opportunity for the Singapore Fixed Wing Turbine Aircraft market. Turboprops are ideal for short regional flights, which are common in Southeast Asia. The demand for regional connectivity is on the rise, as businesses and governments alike look for faster, more cost-effective ways to travel between cities. The Singapore government’s push for enhanced regional connectivity through improved aviation infrastructure supports the growth of this segment. As the aviation ecosystem continues to expand, turboprop aircraft, known for their efficiency and ability to operate from shorter runways, will see increasing demand in Singapore and across the Southeast Asian region.

Government investments

in aviation infrastructure also provide significant growth opportunities for the fixed-wing turbine aircraft market. With ongoing projects like the expansion of Seletar Aerospace Park and improvements to Changi Airport’s infrastructure, Singapore continues to strengthen its position as a key global aviation hub. These developments not only enhance the country’s air connectivity but also create a more favorable environment for aircraft operations. As a result, the increased availability of airport facilities, particularly for private aviation, creates opportunities for the acquisition and operation of fixed-wing turbine aircraft. Additionally, continued support from the government for sustainable aviation technologies is expected to accelerate the market’s growth.

Future Outlook

Over the next decade, the Singapore Fixed Wing Turbine Aircraft market is expected to experience robust growth. This growth will be driven by continuous advancements in aircraft engine technologies, increased demand for corporate and private aviation, and government support for the aviation industry. The market is also likely to see an expansion of infrastructure, including the development of new airports and private airfields, which will cater to both regional and international travel. The increasing adoption of sustainable aviation practices will further enhance market dynamics, positioning Singapore as a key player in the global aviation landscape.

Major Players

- Textron Aviation

- Embraer

- Bombardier Aerospace

- General Electric Aviation

- Pratt & Whitney

- Honeywell Aerospace

- Safran

- Airbus

- Gulfstream Aerospace

- Lockheed Martin

- Boeing

- Hawker Beechcraft

- Pilatus Aircraft

- Dassault Aviation

- Aero Vodochody

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Civil Aviation Authority of Singapore)

- Aircraft Manufacturers

- Aerospace Component Suppliers

- Aviation Service Providers

- Airlines and Operators

- Airport Authorities

- Aerospace Research Institutions

Research Methodology

Step 1: Identification of Key Variables

The initial phase of research focuses on identifying key variables that affect the Singapore Fixed Wing Turbine Aircraft market. This involves mapping out stakeholders such as aircraft manufacturers, government bodies, and service providers. Desk research and secondary databases will be leveraged to collect data regarding market growth drivers and key challenges, establishing a comprehensive understanding of the market dynamics.

Step 2: Market Analysis and Construction

Historical market data, including aircraft sales and service data, will be compiled and analyzed. The focus will be on understanding how market penetration, regional demand, and aircraft types influence overall market growth. This will involve assessing both primary and secondary data sources, ensuring a robust foundation for market forecasting.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses, such as the effect of government support on aircraft sales, will be validated through expert consultations. Computer-assisted telephone interviews (CATIs) with industry experts, including aircraft manufacturers and aviation service providers, will provide insights into product performance, consumer preferences, and financial dynamics.

Step 4: Research Synthesis and Final Output

The final phase will involve synthesizing findings from primary and secondary research. Detailed insights will be gathered from interviews with manufacturers and end-users to validate conclusions. The research methodology will ensure an accurate representation of the Singapore Fixed Wing Turbine Aircraft market, factoring in all critical elements affecting its growth.

- Executive Summary

- Singapore Fixed Wing Turbine Aircraft Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for efficient fuel consumption in aviation

Expanding private and business aviation market in Singapore

Government initiatives promoting local aerospace industry - Market Challenges

High cost of acquiring and maintaining aircraft

Stringent regulatory requirements

Competition from alternative propulsion technologies - Market Opportunities

Emerging demand for small turboprop aircraft

Government investments in aviation infrastructure

Technological advancements in turbine engine efficiency - Trends

Growth in air charter and private aviation services

Shift towards environmentally friendly aircraft systems

Rise in demand for advanced navigation and avionics systems

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Turboprop Aircraft

Jet Engine Aircraft

Single-Engine Aircraft

Multi-Engine Aircraft

Light Aircraft - By Platform Type (In Value%)

Business Aircraft

Private Aircraft

Government Aircraft

Commercial Aircraft

Military Aircraft - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

MRO (Maintenance, Repair, and Overhaul)

Retrofit

Upgrade Kits - By EndUser Segment (In Value%)

Government & Military

Private Individuals & Corporations

Airlines & Operators

Charter Services

Search & Rescue Operations - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Third-Party Dealers

Leasing & Financing

Government Contracts

OEM Partnerships

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, Product Offering, Price, Market Penetration, Technology Integration, R&D Investment, Operational Efficiency, Customer Retention, Regulatory Compliance, Product Portfolio Diversity Distribution Channels, Customer Support) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Textron Aviation

Embraer

Bombardier Aerospace

General Electric Aviation

Pratt & Whitney

Rolls-Royce

Honeywell Aerospace

Safran

Airbus

Gulfstream Aerospace

Lockheed Martin

Boeing

Hawker Beechcraft

Pilatus Aircraft

Dassault Aviation

- Growing preference for private jet ownership in Southeast Asia

- Increasing use of fixed wing turbine aircraft in corporate travel

- Rising demand for aerial surveillance and monitoring services

- Expansion of military fleets and modernized government aviation assets

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035