Market Overview

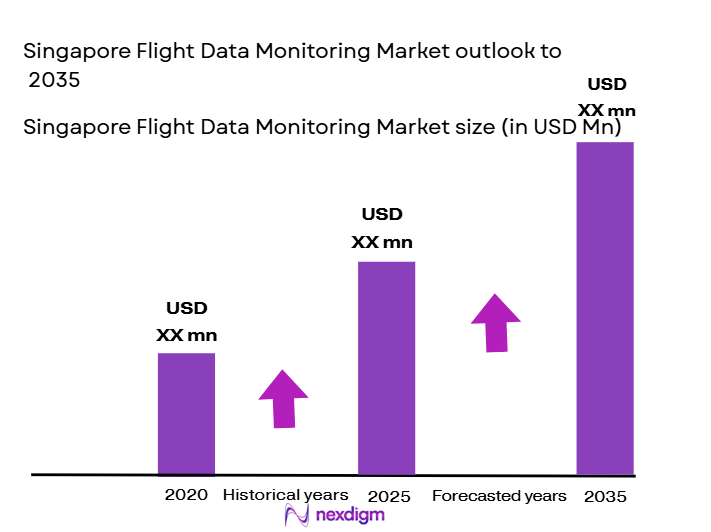

The Singapore Flight Data Monitoring market is valued at approximately USD ~ billion in 2024. This market is driven by the increasing demand for aviation safety systems and real-time data monitoring solutions. The continuous growth of air travel and stricter regulatory standards for safety and compliance contribute to the increasing market demand. Furthermore, the integration of advanced technologies, such as artificial intelligence and machine learning, into flight data monitoring systems has boosted the market’s growth. These technologies provide predictive maintenance capabilities and enhance the overall operational efficiency of aviation businesses. The market’s growth is supported by increased spending on aviation infrastructure and a robust regulatory environment aimed at improving flight safety.

Singapore, along with other aviation hubs like the United States, the United Kingdom, and China, dominates the Flight Data Monitoring market due to their well-established aviation industries and stringent safety regulations. Singapore, specifically, serves as a key aviation hub in Asia, with its Changi Airport being one of the busiest international airports globally. The country’s focus on technological advancement and its strategic position in the Asia-Pacific region, which is witnessing increasing air traffic, further enhances its role in the flight data monitoring industry. The government’s commitment to improving aviation safety and technology adoption has positioned Singapore as a leader in flight data monitoring systems.

Market Segmentation

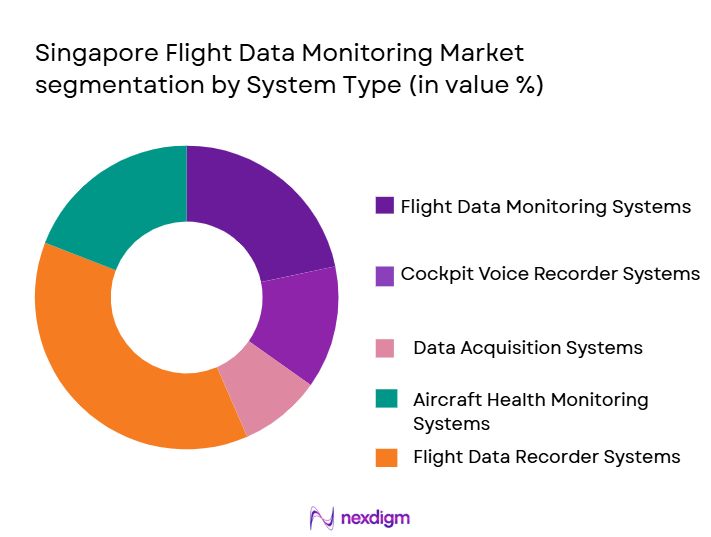

By System Type

The Singapore Flight Data Monitoring market is segmented by system type into Flight Data Monitoring Systems, Flight Data Acquisition Units, Data Recording Units, Data Playback Systems, and Flight Data Monitoring Software. Among these, Flight Data Monitoring Systems have the dominant market share in 2024. This dominance is primarily due to the growing need for comprehensive systems that enable continuous monitoring of flight operations in real-time. Airlines and aviation companies prefer these integrated systems as they offer valuable insights into the performance of aircraft, allowing for proactive maintenance and improved operational safety. As flight operations become more complex, the demand for these systems is expected to continue growing, particularly as airlines strive for greater efficiency and regulatory compliance.

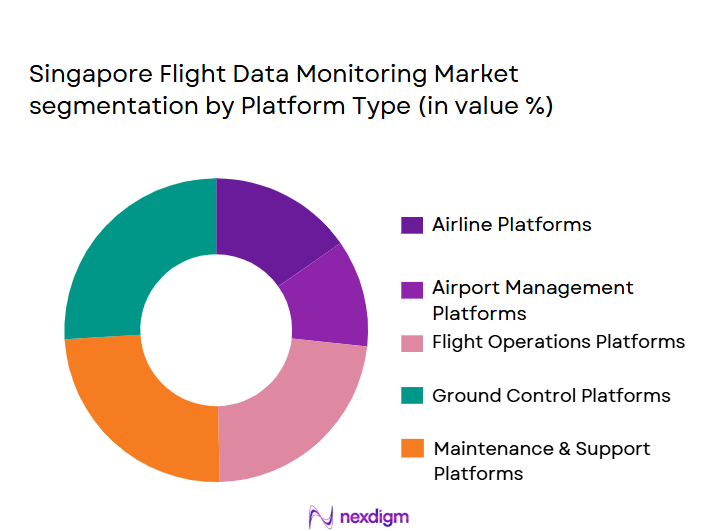

By Platform Type

The market is also segmented by platform type into Fixed Wing Aircraft, Rotorcraft, Unmanned Aerial Vehicles (UAVs), Commercial Airliners, and Military Aircraft. Among these, Commercial Airliners hold the largest share in 2024. This is due to the large-scale adoption of flight data monitoring systems by major airlines globally, which use these systems to improve safety, optimize maintenance schedules, and comply with stringent regulations. Commercial airlines have a significant focus on reducing operational costs while enhancing passenger safety, making the integration of advanced flight data monitoring systems a priority. With the growth of the airline industry and increasing air traffic, the demand for flight data monitoring systems for commercial airliners will continue to rise.

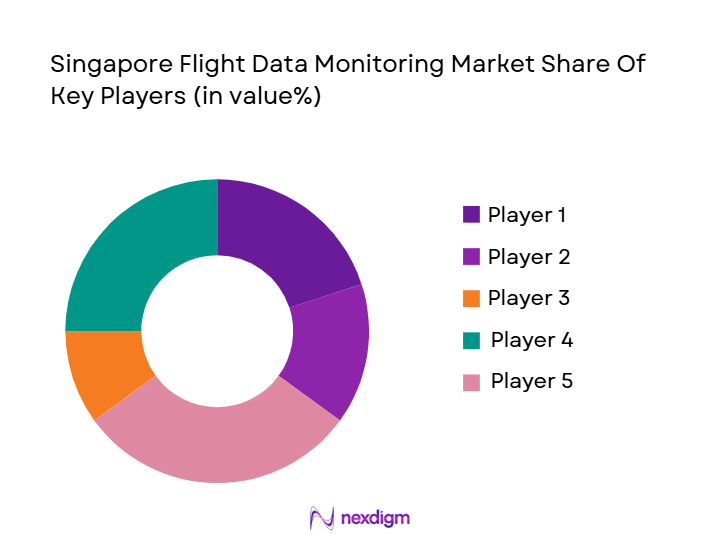

Competitive Landscape

The Singapore Flight Data Monitoring market is dominated by a mix of global players and regional companies, each contributing to innovations in flight data analytics and safety solutions. Major players in the market include Honeywell Aerospace, Rockwell Collins, and Teledyne Controls. These companies lead the market due to their robust product offerings, strong customer base, and extensive research and development capabilities. The dominance of these players highlights the high competition and the technological advancements driving the market. Their ongoing investments in artificial intelligence and data analytics ensure that they remain at the forefront of the flight data monitoring industry.

| Company Name | Year Established | Headquarters | Product Offering | Technology Focus | Market Reach |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ |

| Rockwell Collins | 1973 | United States | ~ | ~ | ~ |

| Teledyne Controls | 1960 | United States | ~ | ~ | ~ |

| Avidyne Corporation | 1994 | United States | ~ | ~ | ~ |

| Zodiac Aerospace | 1896 | France | ~ | ~ | ~ |

Singapore Aircraft Sensors Market Analysis

Growth Drivers

Increased demand for aviation safety and performance optimization

As air travel continues to expand globally, there is an increasing emphasis on ensuring the safety and efficiency of aircraft operations. Aircraft sensors play a critical role in providing real-time data for monitoring flight parameters, detecting system anomalies, and ensuring maintenance is performed before potential failures. With aviation safety becoming a top priority, airlines, especially those in high-traffic hubs like Singapore, are integrating more advanced sensor technologies to improve operational reliability and enhance safety protocols. The growing number of passengers and flights, especially in the Asia-Pacific region, is driving the demand for sophisticated aircraft sensors that monitor critical systems like engines, hydraulics, and avionics.

Technological advancements in sensor integration and IoT

The rise of Internet of Things (IoT) technology in aviation has significantly influenced the aircraft sensors market. These sensors are now being integrated with IoT to provide real-time data analytics, predictive maintenance, and enhanced operational efficiencies. In 2024, the adoption of IoT-enabled sensors is expected to increase due to their ability to monitor a wider range of aircraft systems and improve decision-making capabilities. Additionally, advances in sensor miniaturization and the development of high-performance materials for sensors have further enhanced their reliability and operational lifespan. These advancements are enabling airlines and operators in Singapore to enhance their fleet management and maintenance strategies, contributing to the market’s growth.

Market Challenges

High cost of sensor technology integration

Despite the growing demand for advanced aircraft sensors, the high cost of integration remains a significant barrier to widespread adoption, particularly for smaller airlines and operators. In 2024, the cost of installing a full suite of advanced sensors on an aircraft, including those for engine performance, fuel management, and cockpit monitoring, can exceed several hundred thousand dollars. For smaller operators, this investment can be challenging, especially when weighed against the return on investment in terms of safety and operational efficiencies. Additionally, the integration of new sensor systems with existing legacy systems in older aircraft further complicates the cost and implementation process.

Regulatory and certification hurdles

Aircraft sensor technology must adhere to stringent regulatory standards to ensure the safety and reliability of flight operations. These regulations are established by agencies such as the Singapore Civil Aviation Authority (CAAS) and international bodies like the International Civil Aviation Organization (ICAO). In 2024, complying with these regulatory requirements is challenging due to the continuous evolution of sensor technologies and the lengthy certification process for new sensor types. Any delay in the certification or regulatory approval process can hinder the pace at which new sensors are introduced to the market, creating a bottleneck for airlines looking to adopt the latest sensor technologies.

Opportunities

Expansion of the Asia-Pacific aviation market

The rapid growth of the Asia-Pacific region as a major hub for air travel presents significant opportunities for the aircraft sensors market. With Singapore being a key player in the region, the country’s strategic position as a major aviation hub drives investments in modernizing fleets with advanced sensor technologies. In 2024, passenger traffic in Asia-Pacific is expected to grow steadily, making it one of the fastest-growing regions for aircraft sensor adoption. This expansion provides manufacturers of aircraft sensors with ample opportunities to capture new business from airlines and operators seeking to enhance safety, performance, and efficiency within the region.

Adoption of autonomous and electric aircraft technologies

The increasing focus on autonomous and electric aircraft technologies is opening up new opportunities for the aircraft sensors market. As the aviation industry explores sustainable aviation solutions, electric and hybrid-electric aircraft are becoming more prominent, requiring a new generation of sensors for energy management, battery performance, and autonomous flight systems. These technologies are expected to significantly reshape the aircraft sensors landscape by 2025. Singapore’s involvement in these innovative aerospace developments further accelerates the need for advanced sensors to meet the specific requirements of electric and autonomous aircraft systems.

Future Outlook

Over the next decade, the Singapore Flight Data Monitoring market is poised for significant growth. Driven by technological advancements, regulatory requirements for real-time monitoring, and the increasing volume of air traffic, the market will continue to evolve. The adoption of artificial intelligence and predictive analytics in flight data monitoring systems is expected to be a major growth driver. Airlines will increasingly rely on these technologies to enhance safety, reduce costs, and improve operational efficiency. Additionally, rising government regulations surrounding aviation safety standards will encourage further investment in flight data monitoring solutions.

Major Players in the Market

- Honeywell Aerospace

- Rockwell Collins

- Teledyne Controls

- Avidyne Corporation

- Zodiac Aerospace

- Curtiss-Wright

- Collins Aerospace

- Garmin International

- L3 Technologies

- Flight Data Systems Ltd

- Boeing

- Airbus

- Thales Group

- Universal Avionics Systems Corporation

- Siemens AG

Key Target Audience

- Investments and Venture Capitalist Firms

- Airlines and Aviation Operators

- Aerospace and Defense Manufacturers

- Government and Regulatory Bodies

- Air Traffic Control Providers

- Aviation Technology Providers

- Aircraft Manufacturers

- Aviation Maintenance and Repair Organizations (MROs)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Singapore Flight Data Monitoring Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Singapore Flight Data Monitoring Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple flight data monitoring system manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Singapore Flight Data Monitoring Market.

- Executive Summary

- Singapore Flight Data Monitoring Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for flight safety and data monitoring solutions

Advancements in flight data analytics and AI integration

Rising adoption of flight data monitoring by low-cost carriers - Market Challenges

High initial installation costs

Data security and privacy concerns

Lack of skilled professionals for data interpretation - Market Opportunities

Expansion in emerging aviation markets

Technological advancements in predictive maintenance

Collaborations between aircraft manufacturers and flight data monitoring providers - Trends

Integration of IoT and cloud computing in flight data monitoring

Growing emphasis on sustainability in aviation

Shift towards real-time flight data monitoring

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

By Market Value, 2020-2025

By Installed Units, 2020-2025

By Average System Price, 2020-2025

By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Flight Data Monitoring Systems

Flight Data Acquisition Units

Data Recording Units

Data Playback Systems

Flight Data Monitoring Software - By Platform Type (In Value%)

Fixed Wing Aircraft

Rotorcraft

Unmanned Aerial Vehicles

Commercial Airliners

Military Aircraft - By Fitment Type (In Value%)

Linefit

Retrofit

OEM

Aftermarket

Upgrades - By End-user Segment (In Value%)

Commercial Airlines

Military Aviation

Air Traffic Control

Aircraft Manufacturers

Government & Regulatory Bodies - By Procurement Channel (In Value%)

Direct Sales

Distributors

OEM Partnerships

Online Platforms

Third-Party Vendors

- Market Share Analysis

- Cross Comparison Parameters

(System Complexity, Price Tier, Technology Integration, Global Presence, Customer Base Market Penetration, Technology Integration, R&D Investment, Operational Efficiency, Customer Retention, Regulatory Compliance, Product Portfolio Diversity) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Honeywell Aerospace

Garmin International

Rockwell Collins

Teledyne Controls

L3 Technologies

Aerospace Technologies Group

Curtiss-Wright

Avidyne Corporation

Daimler AG

Flight Data Systems Ltd

Zodiac Aerospace

Thales Group

Universal Avionics Systems Corporation

Collins Aerospace

Boeing

Siemens AG

- Growing demand for real-time monitoring by commercial airlines

- Military aviation’s need for high-accuracy data tracking

- Increasing regulation and standards for air traffic control systems

- Rising use of flight data monitoring by governmental bodies for safety compliance

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035