Market Overview

The Singapore Flight Inspection market has seen steady growth, with a market size valued at USD ~ million. This expansion is largely attributed to the increasing demand for enhanced aviation safety standards, the rise in air traffic, and growing government investments in the aviation sector. The aviation industry’s modernization initiatives, including the adoption of cutting-edge flight inspection systems, further contribute to the market’s development. The ongoing technological advancements in automation and the need for stringent compliance with regulatory standards are driving substantial market growth.

Singapore has positioned itself as a dominant player in the Southeast Asian flight inspection market due to its strategic location as a global aviation hub. The country’s regulatory authorities, such as the Civil Aviation Authority of Singapore (CAAS), are leading the way in developing stringent flight inspection standards. Moreover, the country’s advanced airport infrastructure and the consistent rise in air traffic make it a key market for flight inspection technologies. Neighboring countries, like Malaysia and Indonesia, are also contributing to regional growth, leveraging Singapore’s technological expertise and training facilities.

Market Segmentation

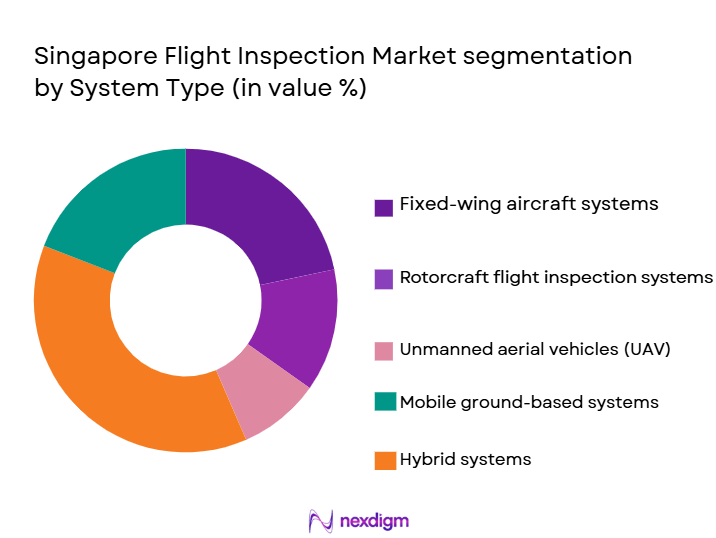

By System Type

The Singapore Flight Inspection market is segmented by system type into aircraft-mounted inspection systems, ground-based inspection systems, portable flight inspection equipment, hybrid flight inspection systems, and unmanned aerial systems (UAS) for inspection. Among these, the aircraft-mounted inspection systems dominate the market, accounting for the largest share. This dominance is driven by their long-established use in the industry for ensuring the safety and accuracy of flight operations. These systems are highly effective in capturing real-time data and performing inspections across various flight parameters, making them essential for the civil aviation authorities and large-scale airport operations. Additionally, their ability to integrate with other aircraft systems and provide a comprehensive view of airspace safety has contributed to their ongoing preference in the market.

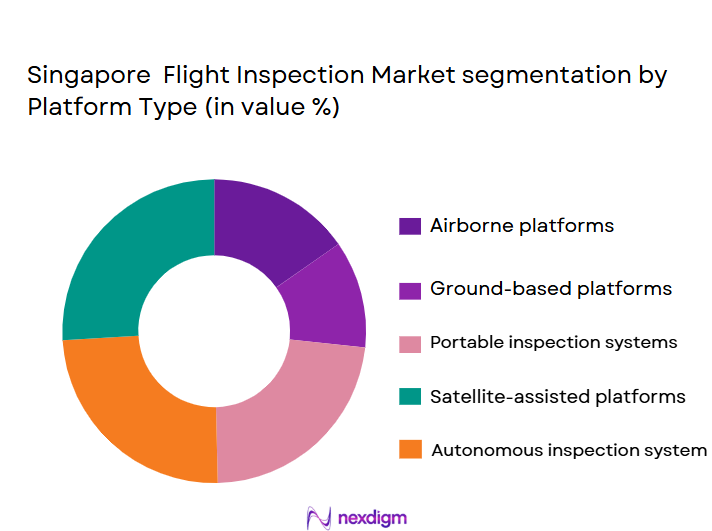

By Platform Type

The Singapore Flight Inspection market is further segmented by platform type into fixed-wing aircraft, rotary-wing aircraft, unmanned aerial vehicles (UAVs), ground control stations, and mobile inspection units. Fixed-wing aircraft currently holds a dominant position in the market, capturing the largest share due to their higher efficiency in long-range flight inspections and their ability to carry more complex inspection systems. They are typically used for inspecting large airports, airways, and routes with high air traffic. The versatility and endurance of fixed-wing aircraft, combined with regulatory requirements for flight safety, make them the preferred platform for flight inspections, particularly in a region with dense aviation activity like Singapore.

Competitive Landscape

The Singapore Flight Inspection market is dominated by several major global and regional players who specialize in aviation safety technologies. These key players include companies such as Honeywell International, Thales Group, and Rockwell Collins, which are pioneers in the flight inspection systems sector. These companies have established a significant presence through continuous innovation, technological advancements, and strong partnerships with local regulatory bodies and airport authorities. The competition is further fueled by local firms that adapt global technologies to cater to the specific needs of Southeast Asia’s aviation industry.

| Company | Establishment Year | Headquarters | Technological Innovation | Market Presence | Regulatory Compliance | Partnerships | Product Portfolio | Sustainability Initiatives | Service Offerings |

| Honeywell International | 1906 | Morris Plains, NJ, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1973 | Cedar Rapids, IA, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Indra Sistemas | 1993 | Madrid, Spain | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| L3 Technologies | 2002 | New York, NY, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore flight inspection Market Dynamics

Growth Drivers

Increased Demand for Enhanced Safety and Performance

The aviation industry’s emphasis on improving flight safety and operational efficiency is driving the demand for advanced aircraft sensors in Singapore. With rising air traffic and stringent safety regulations, aircraft sensors play a pivotal role in monitoring and ensuring the optimal performance of aircraft systems. The growing need for real-time data on engine performance, navigation, and system health has led to an uptick in the adoption of sensors that provide precise and reliable information, thus enhancing the overall safety of aviation operations.

Technological Advancements in Sensor Capabilities

Recent innovations in sensor technologies, such as more precise pressure sensors, temperature sensors, and navigation sensors, are significantly contributing to the growth of the Singapore aircraft sensors market. The integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies into sensors has led to more accurate data collection, predictive maintenance, and better fuel efficiency. As the aviation sector continues to embrace smart technology, the demand for advanced sensors is expected to grow, improving aircraft system capabilities and operational efficiencies.

Market Challenges

High Installation and Maintenance Costs

One of the significant challenges in the Singapore aircraft sensors market is the high installation and maintenance costs associated with advanced sensor technologies. Aircraft sensors require specialized installation processes and regular calibration, which can be costly for airlines and operators. This financial barrier is especially challenging for smaller carriers and regional airlines, limiting the widespread adoption of cutting-edge sensor systems despite their potential to improve safety and efficiency.

Complex Regulatory and Certification Processes

Aircraft sensors in Singapore must adhere to stringent regulations set by authorities such as the Civil Aviation Authority of Singapore (CAAS). The certification process for new sensor technologies can be time-consuming and complex, requiring comprehensive testing and validation to ensure they meet safety and performance standards. This regulatory framework can delay the introduction of innovative sensor technologies into the market, as manufacturers need to navigate through rigorous approval processes before their products are approved for use in commercial aircraft.

Opportunities

Rise in Aircraft Fleet Modernization

The modernization of aircraft fleets is creating substantial opportunities for the aircraft sensors market. Airlines and aircraft operators in Singapore are increasingly investing in the latest aircraft models that come equipped with advanced sensors for better monitoring and control of their systems. As older aircraft are retired and replaced with newer, sensor-equipped models, the demand for high-performance sensors in both new and retrofitted aircraft will grow, providing a continuous market for sensor manufacturers.

Expansion of Autonomous and Electric Aircraft

The rise of autonomous and electric aircraft presents new opportunities for the aircraft sensors market in Singapore. These new-generation aircraft are highly dependent on advanced sensors for navigation, flight control, and system monitoring. As the Singapore aviation industry looks towards the future of electric and unmanned aircraft, the need for sophisticated sensors to enable autonomous flight operations is expected to increase. This shift towards more sustainable and innovative aircraft technologies will open new avenues for growth in the aircraft sensor market.

Future Outlook

Over the next decade, the Singapore Flight Inspection market is expected to experience significant growth driven by continuous technological advancements in automated flight inspection systems, increasing air traffic, and ongoing government initiatives to enhance aviation safety and infrastructure. The need for more precise, cost-effective, and efficient flight inspection technologies will further propel the market. As regulatory bodies continue to implement stricter safety guidelines, the adoption of advanced flight inspection technologies will continue to expand. Moreover, with the integration of unmanned aerial systems (UAS) and AI-driven tools, the market is set to evolve, offering more autonomous and automated solutions for the aviation sector.

Major Players

- Honeywell International

- Thales Group

- Rockwell Collins

- Indra Sistemas

- L3 Technologies

- Aviation Safety Networks

- Airbus

- GE Aviation

- Saab

- Northrop Grumman

- AgustaWestland

- Curtiss-Wright

- Sensus

- Inmarsat

- Boeing

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Civil Aviation Authority of Singapore, ICAO)

- Airport Authorities

- Aviation Maintenance Companies

- Aircraft Manufacturers

- Airline Operators

- Aviation System Integrators

- Airport Infrastructure Developers

Research Methodology

Step 1: Identification of Key Variables

The first step involves constructing an ecosystem map to identify all key stakeholders in the Singapore Flight Inspection Market. This is achieved by conducting extensive desk research, analyzing secondary sources such as industry reports and government data, and utilizing proprietary databases to gather relevant market information. The goal is to identify and define the critical factors influencing market dynamics, such as regulatory trends, technological innovations, and key market players.

Step 2: Market Analysis and Construction

During this phase, we analyze historical data from credible sources to understand market penetration, the role of different stakeholders, and the revenue generation dynamics in the Singapore Flight Inspection Market. We examine market data concerning installed units, average system prices, and customer demands across various regions, with a specific focus on the effectiveness of existing flight inspection systems.

Step 3: Hypothesis Validation and Expert Consultation

We validate market hypotheses through consultations with industry experts via computer-assisted telephone interviews (CATIs). This step includes engaging professionals across the aviation ecosystem, including manufacturers, aviation regulators, and flight inspection system providers. These expert insights help refine and verify the conclusions drawn from the market data and ensure a precise understanding of the market dynamics.

Step 4: Research Synthesis and Final Output

In this final phase, we engage with key players such as aircraft manufacturers and system integrators to validate and supplement data. The collected insights are synthesized to refine product segmentations, forecast future growth, and assess evolving market trends. The final report provides a comprehensive analysis based on both primary and secondary data sources, ensuring accuracy and market relevance.

- Executive Summary

- Singapore Flight Inspection Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Demand for Air Travel and Aviation Safety

Technological Advancements in Inspection Equipment

Government Investments in Aviation Infrastructure - Market Challenges

High Initial Investment Costs for Advanced Systems

Regulatory and Certification Hurdles

Complexity in Integrating New Technologies with Existing Systems - Market Opportunities

Emerging Demand for UAS in Flight Inspections

Expansion of Smart Airport Infrastructure

Rising Focus on Sustainability in Aviation Inspections - Trends

Increased Adoption of UAVs for Flight Inspections

Integration of AI and Machine Learning in Flight Inspection Systems

Shift Towards Autonomous Flight Inspection Systems

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Aircraft-mounted Inspection Systems

Ground-based Inspection Systems

Portable Flight Inspection Equipment

Hybrid Flight Inspection Systems

Unmanned Aerial Systems (UAS) for Inspection - By Platform Type (In Value%)

Fixed-Wing Aircraft

Rotary-Wing Aircraft

Unmanned Aerial Vehicles (UAVs)

Ground Control Stations

Mobile Inspection Units - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Fleet Retrofit

System Upgrades

Part Replacement - By EndUser Segment (In Value%)

Civil Aviation Authorities

Airports and Air Traffic Control Towers

Military Aviation

Private Operators

Aviation Maintenance Organizations - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Third-Party Resellers

Government Procurement Contracts

Airport Procurement Offices

Online Procurement Platforms

- Market Share Analysis

- Cross Comparison Parameters

(Market Value, Technological Advancements, Regulatory Compliance, Customer Satisfaction, Market Share Growth Market Penetration, Technology Integration, R&D Investment, Operational Efficiency, Customer Retention, Regulatory Compliance, Product Portfolio Diversity) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Honeywell International

Thales Group

Rockwell Collins

Indra Sistemas

L3 Technologies

Aviation Safety Networks

Airbus

GE Aviation

Saab

Northrop Grumman

AgustaWestland

Curtiss-Wright

Sensus

Inmarsat

Boeing

- Increasing Demand for Automated Flight Inspection Systems

- Growing Focus on Precision and Accuracy in Inspections

- Increase in Airport Modernization Projects

- Rising Pressure to Enhance Air Safety Standards

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035