Market Overview

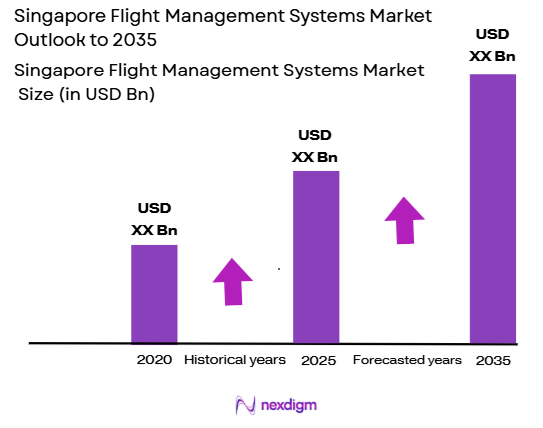

The Singapore Flight Management Systems market is valued at USD ~billion, with a robust growth trajectory backed by technological advancements and increasing demand for automated solutions within the aviation industry. This market is primarily driven by the growing need for efficient air traffic management and navigation solutions. As airlines and governments invest in modernizing aviation infrastructure, the demand for flight management systems that enhance safety, efficiency, and operational effectiveness continues to grow, ensuring the market remains strong and dynamic.

The market is dominated by countries such as Singapore, the United States, and several European nations. Singapore, in particular, stands out due to its strategic location as an international aviation hub and its strong regulatory framework that encourages innovation in the aviation sector. The country’s investment in smart technologies, digital transformation in aviation, and government support for industry growth further solidify its dominance in this space. These factors position Singapore as a leader in the global flight management systems market.

Market Segmentation

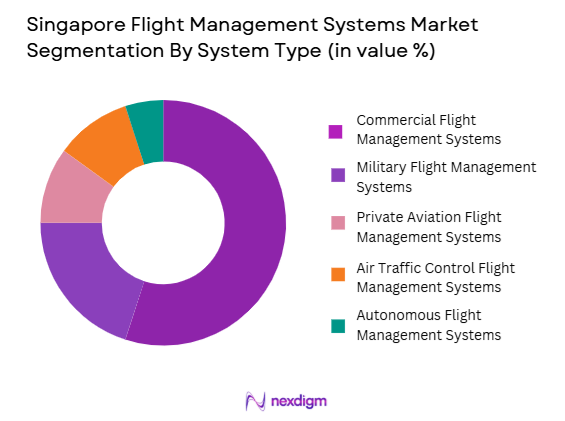

By System Type

The Singapore Flight Management Systems market is segmented into commercial, military, private aviation, and air traffic control systems. Among these, the commercial flight management systems segment holds the largest market share due to the expanding commercial aviation sector, which continuously demands upgraded navigation and management systems for operational efficiency. This segment is especially strong due to the increasing number of flights globally and the rising focus on enhancing safety and reducing operational costs in the commercial airline industry. The growth of low-cost carriers and the need for next-generation flight systems further amplify the dominance of this segment.

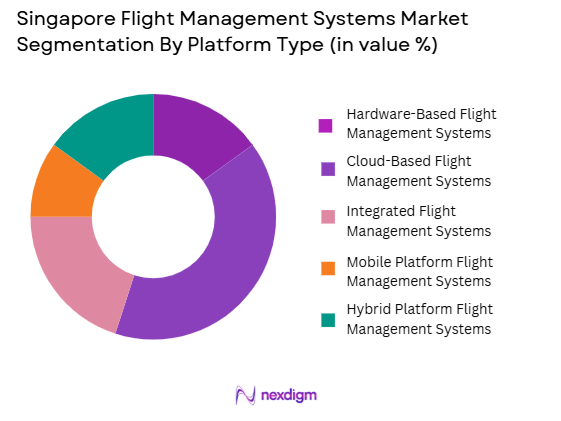

By Platform Type

The market is also segmented based on platform type into hardware-based systems, cloud-based systems, integrated systems, mobile platforms, and hybrid platforms. Cloud-based flight management systems dominate the market due to the growing adoption of cloud computing technologies across the aviation industry. Airlines are increasingly seeking scalable and cost-effective solutions that can handle large amounts of data efficiently, and cloud platforms offer flexibility, reduced maintenance costs, and the ability to integrate with other aviation systems. These advantages make cloud-based platforms particularly attractive, driving their market leadership.

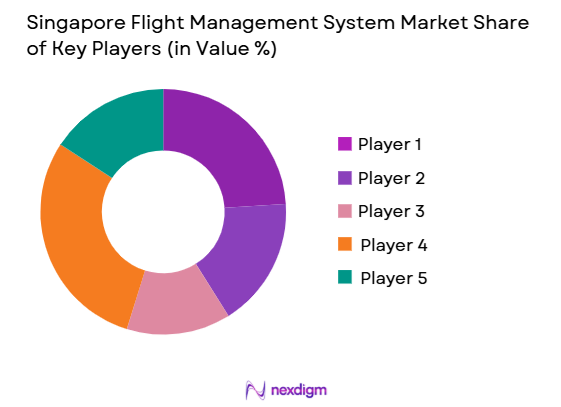

Competitive Landscape

The Singapore Flight Management Systems market is dominated by several major players, including both global leaders and regional innovators. Companies such as Thales Group, Honeywell Aerospace, and Rockwell Collins are leading the market with advanced, integrated solutions that cater to commercial and military aviation sectors. Additionally, regional players like SITA and Navtech have established themselves by providing tailored solutions for air traffic control and local aviation needs, further consolidating the competitive landscape.

| Company | Establishment Year | Headquarters | Product Focus | Market Reach | Key Clients | Innovations/Tech |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1995 | USA | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1999 | USA | ~ | ~ | ~ | ~ |

| SITA | 1999 | Switzerland | ~ | ~ | ~ | ~ |

| Navtech | 1994 | USA | ~ | ~ | ~ | ~ |

Singapore Flight Management Systems Market Analysis

Growth Drivers

Increasing Air Traffic and Aviation Infrastructure Development

The rapid expansion of global air traffic, particularly in the Asia-Pacific region, is a key growth driver for the Singapore Flight Management Systems market. The rising number of air passengers and freight transportation necessitates the upgrading of flight management systems to ensure efficiency and safety in increasingly crowded skies. Singapore, with its position as a major air transport hub, has been at the forefront of infrastructure development. This growth is supported by government initiatives to modernize airports, optimize airspace management, and integrate advanced technologies such as 5G for better communication and navigation. Airlines and aviation companies are investing heavily in modernizing their fleets, which has accelerated the adoption of next-generation flight management systems. These systems help airlines improve fuel efficiency, reduce operational costs, and enhance safety protocols, driving demand for such technologies. Additionally, with the increasing need for sustainability in the aviation industry, flight management systems are playing a pivotal role in optimizing flight routes and minimizing carbon emissions, further fostering market growth.

Technological Advancements in Avionics

Technological advancements in avionics are significantly contributing to the growth of the Singapore Flight Management Systems market. The continuous development of flight management systems, such as integration with artificial intelligence, predictive maintenance, and real-time data analytics, has opened new avenues for innovation in flight operations. These advancements allow for more precise navigation, flight planning, and better decision-making capabilities in real-time. Flight management systems now include sophisticated features such as automatic flight planning, weather updates, and air traffic control integration, which have become critical for both commercial and military applications. Singapore, as a technology-driven nation, supports the adoption of these systems through strong regulatory frameworks and technological infrastructure. The ongoing research and development investments in the aviation sector are further accelerating the adoption of cutting-edge systems that offer enhanced safety, fuel efficiency, and operational optimization. These advancements position the Singapore Flight Management Systems market to continue its strong growth trajectory, providing key players with opportunities to introduce innovative products and solutions.

Market Challenges

Cybersecurity Threats and Data Privacy Concerns

As flight management systems become more connected and integrated with various aviation technologies, the risk of cybersecurity breaches has emerged as a significant challenge. With increasing reliance on digital systems for navigation, flight control, and communication, aviation companies are vulnerable to cyberattacks that can compromise the safety and security of air travel. Protecting sensitive flight data and ensuring the integrity of aviation networks are paramount. The challenge lies in developing robust cybersecurity measures to counter emerging threats while maintaining operational efficiency. Singapore, being a global leader in aviation technology, must adhere to stringent cybersecurity protocols and collaborate with international bodies to mitigate risks. However, the constantly evolving nature of cyber threats makes it difficult to stay ahead, and ensuring that flight management systems remain secure against potential breaches is an ongoing challenge for both technology providers and aviation companies.

High Implementation and Maintenance Costs

The cost associated with implementing and maintaining flight management systems is another challenge for the Singapore market. Advanced flight management systems require significant upfront investments, which can be prohibitive for smaller airlines or operators with limited budgets. These costs extend beyond the initial purchase and installation, as system maintenance, updates, and integration with other technologies also require substantial financial commitments. Additionally, flight management systems must comply with evolving regulatory requirements, which may necessitate further system upgrades or replacements over time. While larger airlines and defense contractors can afford these costs, smaller players may face difficulties in adopting the latest systems, potentially hindering market growth. This cost barrier has led to a trend of long-term contracts and partnerships between system integrators and aviation companies, wherein the costs are shared, but it remains a challenge for many smaller operators in the market.

Opportunities

Emerging Markets and Regional Expansion

As air travel continues to grow in emerging markets, particularly in Southeast Asia and the broader Asia-Pacific region, there is a significant opportunity for the Singapore Flight Management Systems market to expand. Countries in these regions are investing heavily in their aviation infrastructure to accommodate the surge in air traffic. Singapore, being strategically positioned as a regional aviation hub, can capitalize on this growth by providing advanced flight management solutions to both new and existing airports, airlines, and aircraft operators. The expansion of regional carriers, as well as the increasing demand for aircraft in these emerging markets, offers opportunities for Singapore-based companies to lead in providing state-of-the-art flight management systems. Additionally, partnerships with regional players to integrate Singapore’s advanced technology into their infrastructure could further accelerate growth.

Government Initiatives for Aviation Modernization

Government-backed initiatives and funding to modernize aviation infrastructure present an opportunity for growth in the Singapore Flight Management Systems market. Singapore’s government has made substantial investments in upgrading its airports, airspace management systems, and introducing new regulations that promote innovation and safety within the aviation sector. The government’s push for a “smart airport” initiative, coupled with its commitment to adopting the latest technological advancements, provides a favorable environment for flight management system providers. These developments support the demand for advanced navigation, safety, and communication systems, presenting opportunities for companies offering flight management solutions to engage in long-term government contracts. Such initiatives ensure a stable demand for high-performance systems and create a positive market outlook.

Future Outlook

Over the next decade, the Singapore Flight Management Systems market is expected to experience substantial growth driven by advancements in AI, cloud technologies, and growing global air traffic. As airlines and governments continue to prioritize modernization, the demand for enhanced safety, operational efficiency, and data-driven decision-making systems will fuel the market’s expansion. Moreover, the increasing adoption of autonomous aircraft will further drive innovation and demand for next-gen flight management systems.

Major Players in the Market

- Thales Group

- Honeywell Aerospace

- Rockwell Collins

- SITA

- Navtech

- L3 Technologies

- Collins Aerospace

- GE Aviation

- FlightSafety International

- Garmin

- Northrop Grumman

- Airbus

- Boeing

- UTC Aerospace Systems

- FLYHT Aerospace Solutions

Key Target Audience

- Airlines and Commercial Aviation Operators

- Military and Defense Agencies

- Airports and Air Traffic Control Authorities

- Aviation Equipment Manufacturers

- Aircraft OEMs

- Government and Regulatory Bodies

- Investment and Venture Capitalist Firms

- System Integrators and Technology Providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying key market variables through desk research. This includes the exploration of secondary and proprietary databases, focusing on variables that influence the Singapore Flight Management Systems market. These variables range from technological advancements to regulatory factors impacting system adoption and infrastructure upgrades in the aviation sector.

Step 2: Market Analysis and Construction

In this phase, historical data regarding the market, including system adoption rates, trends in air traffic, and technological changes, will be analyzed. We will examine the penetration of advanced flight management systems across commercial and military aviation to estimate revenue generation patterns and predict future growth trajectories.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated by consulting industry experts through computer-assisted telephone interviews (CATI). These interviews will involve experts from key players in the aviation industry, government regulatory bodies, and system providers to gather operational insights, refine data, and validate market dynamics.

Step 4: Research Synthesis and Final Output

The final phase will involve collaboration with multiple stakeholders, including aviation companies and government agencies, to verify assumptions and obtain insights on product preferences, consumer demand, and technological requirements. These insights will help complete a comprehensive market analysis for the Singapore Flight Management Systems market.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Demand for Air Traffic Control Solutions

Increasing Adoption of Automation in Aviation

Advancements in Air Safety and Navigation Technologies - Market Challenges

High Initial Costs of Flight Management Systems

Complex Regulatory Requirements and Certification Processes

Cybersecurity Concerns in Aviation Systems - Trends

Shift Toward Cloud-Based Flight Management Solutions

Integration of AI in Flight Management Systems

Emergence of Multi-Modal Aviation Systems

- Market Opportunities

Growth in Air Cargo Management Systems

Rising Investment in Autonomous Aircraft Technologies

Expanding Air Traffic in Emerging Economies - Government regulations

ICAO Standards for Aviation Systems

Air Navigation Service Provider Regulations

Cybersecurity Regulations for Aviation Systems - SWOT analysis

Strong Demand for Advanced Flight Management Systems

Technological Advancements and Innovation

Cost and Regulatory Barriers for New Entrants - Porters 5 forces

High Bargaining Power of Suppliers

Threat of New Entrants with Technological Innovation

Moderate Threat of Substitutes from Alternative Solutions

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Commercial Flight Management Systems

Military Flight Management Systems

Private Aviation Flight Management Systems

Air Traffic Control Flight Management Systems

Autonomous Flight Management Systems - By Platform Type (In Value%)

Hardware-Based Flight Management Systems

Cloud-Based Flight Management Systems

Integrated Flight Management Systems

Mobile Platform Flight Management Systems

Hybrid Platform Flight Management Systems - By Fitment Type (In Value%)

Retrofit Flight Management Systems

OEM Flight Management Systems

Aftermarket Flight Management Systems

Integrated Fitment Flight Management Systems

Independent Fitment Flight Management Systems - By EndUser Segment (In Value%)

Commercial Airlines

Private Aviation

Military & Defense

Government Agencies & Regulators

Air Traffic Controllers - By Procurement Channel (In Value%)

Direct Sales

Third-Party Distributors

Online Platforms

Government Contracts

OEM Procurement Channels

- Market Share Analysis

- CrossComparison Parameters(Market Share, Product Differentiation, Technological Advancements, Pricing Strategies, Customer Satisfaction)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Thales Group

Honeywell Aerospace

Rockwell Collins

Garmin

L3 Technologies

Northrop Grumman

SITA

Collins Aerospace

FlightSafety International

GE Aviation

Boeing

Airbus

UTC Aerospace Systems

FLYHT Aerospace Solutions

Navtech

- Growing Need for Enhanced Safety in Commercial Airlines

- Increasing Adoption of Smart Technologies in Private Aviation

- Military Applications Driving Advanced Systems Development

- Government Initiatives Promoting Air Traffic Control Advancements

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035