Market Overview

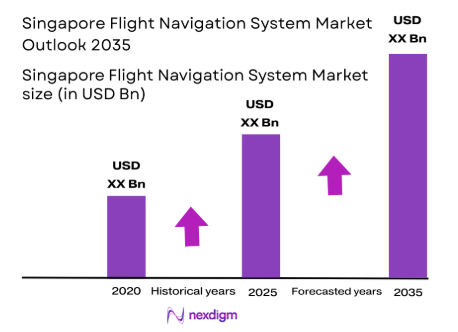

The Singapore Flight Navigation System market is valued at approximately USD ~ billion in 2025, as per recent market reports. This market growth is primarily driven by the modernization of air traffic management systems, increased air traffic in the Asia-Pacific region, and the push for higher airspace efficiency and safety. Government investments in upgrading airport infrastructure and adopting advanced satellite-based navigation technologies have further catalysed growth. Additionally, the rise in commercial air travel, coupled with the proliferation of UAVs (unmanned aerial vehicles), continues to expand demand for more robust flight navigation systems in the region.

Singapore remains the dominant force in the market due to its strategic location as a global aviation hub and its robust regulatory environment fostering technological advancements in air traffic control and navigation systems. Neighboring countries like Malaysia, Indonesia, and Thailand also influence the market due to their growing aviation sectors and expansion of air traffic networks. These nations benefit from collaborations with Singapore’s technological advancements, driving regional growth in flight navigation systems. Singapore’s role as a leader in aviation technology, combined with its strong governmental support, positions it at the forefront of this market.

Market Segmentation

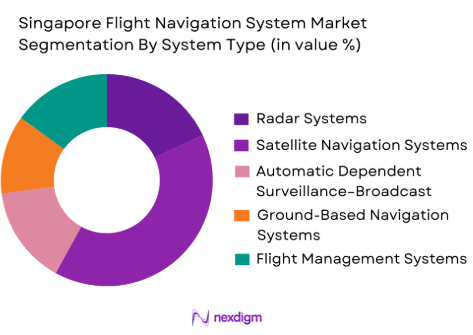

By System Type

The Singapore Flight Navigation System market is segmented into several system types, including radar systems, satellite navigation systems, automatic dependent surveillance–broadcast (ADS-B), ground-based navigation systems, and flight management systems. Satellite navigation systems currently dominate the market due to their accuracy, cost-effectiveness, and scalability, playing a pivotal role in global air traffic management. The demand for these systems has surged in recent years, fueled by advancements in GPS and GNSS technologies, offering high precision and reliability. Additionally, satellite systems allow for seamless integration with existing infrastructures, providing added value to both commercial and military aviation sectors.

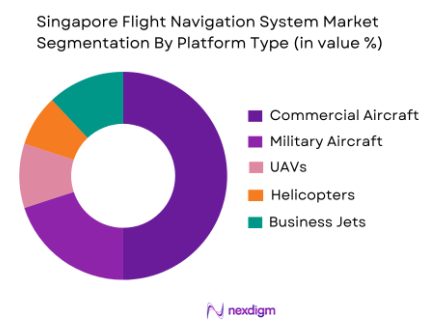

By Platform Type

The market is further segmented based on platform types into commercial aircraft, military aircraft, UAVs (unmanned aerial vehicles), helicopters, and business jets. The commercial aircraft segment commands the largest share, driven by the rapid growth of the aviation industry and an increase in international flights. Moreover, Singapore’s strong position as a major aviation hub contributes to the high demand for flight navigation systems in commercial aircraft. The military aircraft segment is also a significant contributor, driven by government investments in defense and the need for advanced navigation technologies to support national security operations.

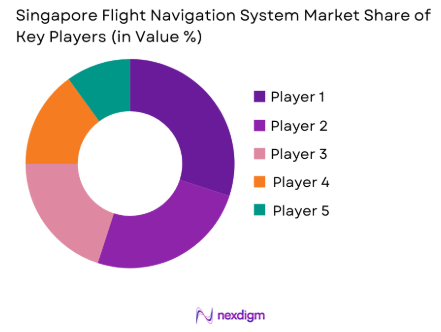

Competitive Landscape

The Singapore Flight Navigation System market is characterized by a competitive landscape dominated by both local and global players. Key players include companies such as Thales Group, Honeywell International, Rockwell Collins, Collins Aerospace, and Garmin Ltd. These firms contribute to the market through technological innovation, strategic partnerships, and strong service offerings. The collaboration between these key players with government agencies and aviation authorities is a significant driver of growth. The consolidation in the market reflects the influence of these companies in providing comprehensive air navigation solutions.

| Company Name | Establishment Year | Headquarters | Market Expertise | Research & Development | System Type Specialization | Customer Base |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | United States | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1973 | United States | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ |

| Garmin Ltd. | 1989 | United States | ~ | ~ | ~ | ~ |

Singapore Flight Navigation System Market Analysis

Growth Drivers

Rising Air Traffic in the Asia-Pacific Region

One of the major drivers of growth in the Singapore Flight Navigation System market is the continuous increase in air traffic, particularly in the Asia-Pacific region. As one of the world’s busiest regions for air travel, Singapore plays a critical role as a hub for connecting global flights. With growing consumer demand for air travel, airlines are investing in advanced flight navigation systems to manage increased flight volumes, ensure safety, and maintain operational efficiency. This surge in demand for more precise and reliable navigation systems is prompting governments and private sector players to invest in the modernization of airspace management and navigation infrastructure. Such developments not only cater to commercial aviation but also bolster regional security by upgrading military and defense air navigation systems. As a result, the market for flight navigation systems is expanding rapidly to accommodate the needs of both airlines and military aviation.

Government Initiatives and Infrastructure Development

The Singapore government’s commitment to enhancing its aviation infrastructure through regulatory support and technology investments is a significant growth driver for the flight navigation system market. In alignment with global trends toward digital transformation and smart airports, Singapore has introduced several initiatives to modernize its air traffic management systems. The Civil Aviation Authority of Singapore (CAAS) has been at the forefront of these efforts, implementing advanced technologies such as satellite-based navigation and communication systems to improve air traffic flow and safety. These government-driven initiatives are expected to continue to support market growth, as Singapore aims to remain a global leader in air transport by enhancing its air navigation capabilities. Furthermore, public-private partnerships in this sector are encouraging innovation and creating new opportunities for both local and international players in the aviation industry.

Market Challenges

High Costs of Advanced Navigation Systems

The primary challenge facing the Singapore Flight Navigation System market is the high cost associated with implementing advanced navigation systems. High upfront investments in infrastructure, software, hardware, and training programs are required to integrate these systems into existing air traffic management structures. Many airports and air navigation service providers face financial constraints, which limit their ability to adopt cutting-edge technologies. The integration of new systems, such as satellite-based navigation and advanced radar systems, can be a significant financial burden. Additionally, maintaining and upgrading these systems over time requires continuous investment, which may strain the budgets of smaller or less developed regions within the country. This challenge often delays the full-scale adoption of new technologies, limiting the growth potential of the market. As such, the high cost of advanced flight navigation systems remains a critical barrier to growth, particularly in the face of global economic pressures.

Complexity of Regulatory Compliance

The regulatory landscape surrounding the flight navigation system market in Singapore is complex and evolving. New standards and compliance requirements, particularly around safety, cybersecurity, and data privacy, can create hurdles for market participants. The introduction of new airspace management regulations, along with the need to meet international aviation safety standards, requires ongoing investments in system upgrades, certifications, and compliance checks. The complexity and cost of navigating these regulatory frameworks can be a significant obstacle for both new entrants and existing players looking to scale operations in Singapore. Additionally, regulatory changes can introduce uncertainty in the market, leading to delays in system deployment and adoption. This ever-evolving regulatory environment requires market players to stay ahead of changes and continuously adjust their offerings to ensure compliance, adding an extra layer of complexity and cost to business operations in the market.

Opportunities

Expansion of Unmanned Aerial Vehicles (UAV) Market

The increasing use of unmanned aerial vehicles (UAVs) for both commercial and military applications presents a significant opportunity for the Singapore Flight Navigation System market. As UAV technology evolves, there is a growing need for sophisticated navigation systems that can handle the unique challenges associated with UAV operations, including autonomous flight, airspace integration, and communication with other aircraft. Singapore is already positioning itself as a leader in UAV technology, with initiatives aimed at expanding the use of UAVs for logistics, surveillance, and environmental monitoring. This trend creates an opportunity for the flight navigation system market to provide tailored solutions that support the safe and efficient operation of UAVs in both urban and non-urban airspace. As UAVs become more prevalent in the region, demand for specialized flight navigation systems will rise, creating new avenues for innovation and market growth.

Advancements in Autonomous Flight Technology

Another significant opportunity in the Singapore Flight Navigation System market is the rise of autonomous flight technologies. As aviation technology continues to advance, there is increasing interest in developing fully autonomous aircraft, particularly in commercial and freight sectors. These developments are pushing the need for innovative flight navigation systems that can support the complexities of autonomous flight, including real-time navigation, decision-making algorithms, and airspace management. Singapore, being a hub for aviation innovation, is likely to play a key role in the adoption of autonomous flight systems. With the government’s support for technology-driven solutions in air travel, there are significant opportunities for companies to collaborate on developing and deploying autonomous flight navigation systems. As autonomous flight technology matures, the need for reliable, cutting-edge navigation systems will only increase, positioning the Singapore market as a key player in this transformation.

Future Outlook

Over the next 5 years, the Singapore Flight Navigation System market is expected to show substantial growth driven by continuous government support, advancements in satellite navigation technologies, and the increasing demand for more efficient air traffic management systems. Rising air traffic volumes in the Asia-Pacific region, coupled with the adoption of UAVs and autonomous flight systems, are expected to spur demand for state-of-the-art navigation solutions. The market will also benefit from continued investments in aviation infrastructure, particularly in urban and regional airports in Southeast Asia, further boosting technological advancements and integration of next-gen navigation systems.

Major Players

- Thales Group

- Honeywell International

- Rockwell Collins

- Collins Aerospace

- Garmin Ltd.

- Lockheed Martin

- L3 Technologies

- Leonardo S.p.A.

- Raytheon Technologies

- Collins Aerospace

- Northrop Grumman

- Saab AB

- Airbus

- Boeing

- AeroVironment

Key Target Audience

- Aviation Authorities

- Airlines operating in Southeast Asia

- Defense Contractors

- UAV Operators

- Air Traffic Management Providers

- Aviation System Integrators

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

In this step, we identify and map the critical factors that influence the Singapore Flight Navigation System market, including stakeholders, regulations, and technological advancements. Extensive secondary research is conducted to gather initial data from credible sources, such as government agencies, industry reports, and databases.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data and constructing a market model to estimate the future growth trajectory. This includes evaluating the adoption of various flight navigation technologies, market penetration, and service demand across multiple regions.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are tested and validated through expert interviews and consultations with stakeholders such as aviation authorities, airlines, and system manufacturers. Insights from industry experts help refine the data models and ensure a more accurate representation of market dynamics.

Step 4: Research Synthesis and Final Output

Finally, the research findings are synthesized and compiled into a detailed report. A bottom-up approach is used to validate data gathered from primary and secondary sources, while direct feedback from aviation manufacturers and service providers ensures the robustness and accuracy of the market projections.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased air traffic in the Asia-Pacific region

Technological advancements in satellite navigation systems

Government initiatives for airport and airspace modernization - Challenges

High cost of advanced navigation systems

Complexity of regulatory compliance

Cybersecurity concerns for navigation infrastructure - Opportunities

Growing demand for UAV navigation systems

Expansion of smart airports and modern air traffic control systems

Partnerships between commercial and defense sectors for system upgrades - Trends

Shift towards autonomous navigation systems for UAVs

Integration of AI and machine learning in flight navigation

Rise of private sector investments in airspace modernization

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Radar Systems

Satellite Navigation Systems

Automatic Dependent Surveillance

Ground-Based Navigation Systems

Flight Management Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

UAVs (Unmanned Aerial Vehicles)

Helicopters

Business Jets - By Fitment Type (In Value%)

Retrofit

Linefit

OEM Integration

Upgrades & Add-ons

System Replacement - By End User Segment (In Value%)

Aviation Authorities

Airlines

Defense Contractors

UAV Operators

Helicopter Operators - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Government Contracts

Third-Party Resellers

System Integrators

Online Platforms

- Market Share Analysis

- Cross Comparison Parameters (Revenue, Installed Units, Technology Adoption, Regulatory Compliance, Customer Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Thales Group

Honeywell International

Rockwell Collins

Garmin Ltd.

Lockheed Martin

L3 Technologies

Leonardo S.p.A.

Raytheon Technologies

Collins Aerospace

Northrop Grumman

Garmin

Saab AB

Airbus

Boeing

AeroVironment

- Aviation authorities seeking better air traffic control solutions

- Airlines focusing on improving safety and operational efficiency

- Defense contractors investing in secure and resilient navigation systems

- UAV operators enhancing system automation for remote areas

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035