Market Overview

The Singapore-France aviation market is valued at USD ~ billion, reflecting strong bilateral trade and tourism ties. This market’s growth is primarily driven by the expanding demand for air travel between Asia and Europe, especially given Singapore’s role as a regional air travel hub and France’s importance in the European aviation industry. The strong growth in both passenger traffic and freight transport plays a vital role in sustaining the market’s upward trajectory. Additionally, the rise of low-cost carriers and premium travel services has further propelled demand.

Key cities that dominate this market include Singapore and Paris, due to their strategic geographical locations and economic significance. Singapore serves as a pivotal aviation hub in Southeast Asia, with its Changi Airport being a major gateway to global routes. On the other hand, Paris, particularly Charles de Gaulle Airport, holds a central position in connecting Europe with international destinations, fostering strong air traffic between the two countries. These hubs continue to drive growth in the Singapore-France aviation market.

Market Segmentation

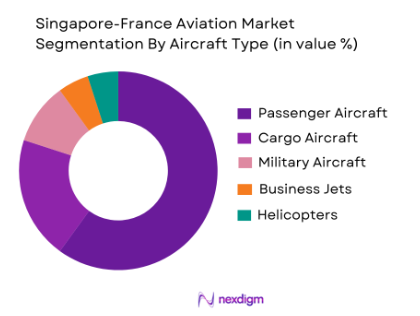

By Aircraft Type

The market is primarily segmented by aircraft type into passenger aircraft, cargo aircraft, military aircraft, business jets, and helicopters. Among these, passenger aircraft dominate the market. This is due to the sustained demand for international and regional flights connecting Singapore and France. Airlines in both regions continue to invest in larger, fuel-efficient planes such as the Airbus A350 and Boeing 787 to meet the rising passenger demand, with significant routes between Singapore Changi Airport and Paris Charles de Gaulle Airport.

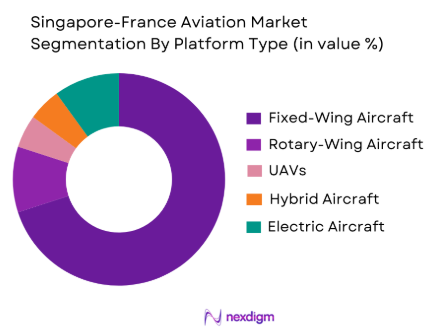

By Platform Type

In terms of platform type, the market is segmented into fixed-wing aircraft, rotary-wing aircraft, unmanned aerial vehicles (UAVs), hybrid aircraft, and electric aircraft. Fixed-wing aircraft dominate this segment, driven by the long-haul nature of most flights between Singapore and France. These aircraft, such as large commercial jets, are crucial for carrying both passengers and cargo across vast distances. With continued advancements in aviation technology, fixed-wing aircraft maintain their dominance due to their efficiency in long-haul routes.

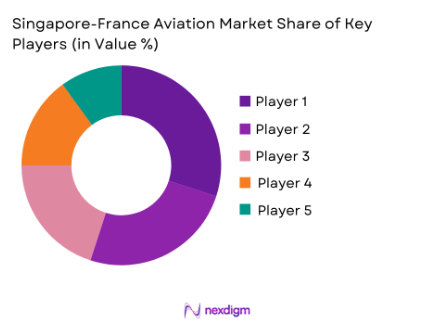

Competitive Landscape

The Singapore-France aviation market is dominated by several major players, both local and international. The market consolidation reflects the significant presence of key players, including Singapore Airlines, Air France, and Boeing. These companies play an instrumental role in shaping the market by offering competitive flight services, advanced aircraft technology, and strong international networks. Additionally, aircraft manufacturers such as Airbus and Boeing remain dominant in supplying the fleets of airlines operating between the two regions.

| Company Name | Year Established | Headquarters | Fleet Size | Revenue (USD Billion) | Market Presence | Key Partnerships |

| Singapore Airlines | 1947 | Singapore | ~ | ~ | ~ | ~ |

| Air France | 1933 | Paris, France | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | Derby, UK | ~ | ~ | ~ | ~ |

Singapore-France Aviation Market Analysis

Growth Drivers

Strong Bilateral Trade and Economic Ties

The Singapore-France aviation market benefits significantly from the robust economic relationship between the two nations. Both countries have long-established trade and investment connections, with Singapore serving as a crucial hub for European companies in Asia, and France playing a pivotal role in the European market for Singaporean businesses. The high volume of goods traded between Singapore and France, particularly in the aerospace, electronics, and pharmaceuticals sectors, drives demand for air cargo services. This has a direct positive impact on the aviation sector, particularly in terms of cargo aircraft operations. Furthermore, Singapore’s strategic location as a regional aviation hub facilitates the movement of people and goods, leading to consistent growth in both passenger traffic and freight between the two regions, which stimulates ongoing investments and infrastructure development.

Increased Tourism and Business Travel

Tourism and business travel are two key drivers of growth in the Singapore-France aviation market. France has long been a popular destination for tourists from Asia, particularly from Singapore, where residents regularly travel to Europe for leisure and business purposes. In recent years, the rise of luxury tourism and corporate travel to destinations like Paris has driven demand for high-end flight services, such as business jets and premium cabins. Additionally, business travel between the two countries remains strong, with Singapore serving as an economic and financial hub for Southeast Asia and France’s strategic presence in the European Union. This consistent flow of passengers, especially business travelers seeking direct flights between Singapore and Paris, further bolsters the market’s growth, resulting in more route expansions and the introduction of more flight options by airlines operating between the two nations.

Market Challenges

High Operational Costs and Fuel Prices

One of the primary challenges facing the Singapore-France aviation market is the rising operational costs associated with fuel prices, maintenance, and labor. Fluctuating fuel prices are a critical factor influencing the profitability of airlines and their ability to maintain competitive ticket prices. Fuel represents a significant portion of an airline’s operational expenses, and any rise in global oil prices directly impacts costs. This challenge is exacerbated by increasing maintenance and regulatory compliance costs. The need for airlines to remain profitable while providing affordable travel options complicates the situation, particularly as demand for sustainable aviation practices grows, necessitating investments in fuel-efficient aircraft and greener technologies. These high operational costs hinder the ability of airlines to offer lower ticket prices, which could dampen passenger demand, particularly for long-haul flights like those between Singapore and France.

Regulatory and Certification Barriers

Regulatory complexities in both Singapore and France present another significant challenge to the aviation market. Both countries adhere to stringent aviation safety and environmental regulations, which may delay aircraft certifications, limit airspace access, or impose additional compliance costs. Furthermore, evolving environmental policies in the European Union, including the push for reduced carbon emissions in the aviation sector, can create challenges for airlines operating on long-haul routes, such as those between Singapore and France. Airlines must invest in the latest aircraft technologies to comply with these regulations, which can lead to substantial capital expenditures. Similarly, the differences in regulatory frameworks between countries and international aviation bodies can create barriers in terms of air traffic management, airport coordination, and operational flexibility, ultimately affecting the smooth flow of air traffic between these two regions.

Opportunities

Advancements in Sustainable Aviation Technologies

As the global aviation industry shifts toward sustainability, there are significant opportunities in the Singapore-France aviation market to adopt and integrate sustainable aviation technologies. This includes the development and deployment of fuel-efficient aircraft, sustainable aviation fuels (SAF), and hybrid-electric aircraft that could help mitigate environmental impacts while reducing operating costs. With both Singapore and France being at the forefront of technological innovation and environmental sustainability initiatives, there is ample scope for collaboration between the two nations to promote green aviation. In particular, the European Union’s strong commitment to decarbonizing the aviation sector presents an opportunity for French aircraft manufacturers like Airbus and international airlines operating between Singapore and France to lead the transition toward more eco-friendly air travel. This could result in long-term cost savings, increased market appeal, and a competitive advantage in attracting environmentally conscious passengers and investors.

Expansion of Urban Air Mobility (UAM) and Short-Haul Flights

Urban Air Mobility (UAM) and the growth of short-haul flights present significant opportunities in the Singapore-France aviation market, particularly as cities like Paris and Singapore pursue smarter, more sustainable transportation options. UAM encompasses innovations such as electric vertical takeoff and landing (eVTOL) aircraft, which are expected to revolutionize urban transport, reducing congestion and enhancing connectivity. In Singapore, the government has already announced plans for testing UAM technologies, and Paris is increasingly becoming a testing ground for eVTOL aircraft. This presents the aviation market with a unique opportunity to expand its services beyond traditional long-haul flights. Short-haul flights between nearby cities in Europe and Southeast Asia could benefit from this innovation, offering faster, cleaner alternatives for both passengers and cargo transport. Airlines, airports, and tech companies in both regions can capitalize on these new technologies to diversify and expand their market offerings.

Future Outlook

Over the next decade, the Singapore-France aviation market is expected to experience significant growth driven by increased global connectivity, the rise in travel demand, and technological advancements. The market is poised for a steady rise in air traffic, fuelled by the resumption of international travel post-pandemic and the ongoing expansion of both passenger and cargo aviation services. The growth of low-cost carriers and business aviation, coupled with advancements in electric aircraft technology, is likely to shape the future landscape of aviation between these two nations.

Major Players

- Singapore Airlines

- Air France

- Airbus

- Boeing

- Rolls-Royce

- Thales Group

- Safran

- Lufthansa

- Qatar Airways

- Emirates

- Cathay Pacific

- Etihad Airways

- China Southern Airlines

- United Airlines

- Delta Airlines

Key Target Audience

- Airline Operators

- Aircraft Manufacturers

- Airports and Airport Authorities

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aircraft Leasing Companies

- Cargo Operators

- Military and Defense Agencies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying all the key variables that affect the Singapore-France aviation market, such as passenger traffic, cargo volumes, and technological developments. Data will be gathered from both primary and secondary sources, ensuring a comprehensive understanding of the market.

Step 2: Market Analysis and Construction

In this phase, historical data will be analysed to evaluate the market penetration of airlines, aircraft manufacturers, and cargo operators. The goal is to understand the revenue potential for these segments and project future market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through interviews with industry experts in both Singapore and France, including representatives from airlines, airports, and regulatory bodies. These consultations will provide in-depth insights into operational challenges and opportunities.

Step 4: Research Synthesis and Final Output

The final research phase involves synthesizing all collected data and insights to produce a comprehensive market analysis. This will include detailed reports on market size, growth projections, and segmentation breakdowns, ensuring accurate forecasts and actionable recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased passenger travel between Singapore and France driving demand for new aircraft

Expansion of cargo transport between the two regions, creating need for more specialized cargo aircraft

Technological advancements in aviation, such as electric and hybrid aircraft, creating new market opportunities - Market Challenges

High operational costs due to fuel prices and infrastructure limitations

Regulatory and certification complexities between Singaporean and French aviation authorities

Supply chain disruptions and delays in aircraft deliveries - Market Opportunities

Growth in business aviation and private jet demand between Singapore and France

Emerging markets in Asia-Pacific creating new demand for aviation services

Potential for electric aircraft adoption in both commercial and private sectors - Trends

Increased adoption of sustainable aviation fuels (SAF) and carbon-neutral technologies

Growth in Urban Air Mobility (UAM) in major cities such as Singapore and Paris

Integration of AI and automation in aircraft operations and air traffic control systems

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Passenger Aircraft

Cargo Aircraft

Military Aircraft

Business Jets

Helicopters - By Platform Type (In Value%)

Fixed-Wing Aircraft

Rotary-Wing Aircraft

Unmanned Aerial Vehicles (UAVs)

Hybrid Aircraft

Electric Aircraft - By Fitment Type (In Value%)

Commercial Aviation

Private Aviation

Military Aviation

Cargo Aviation

Urban Air Mobility (UAM) - By End User Segment (In Value%)

Airlines

Cargo Operators

Government & Military

Business & Private Aviation

Urban Air Mobility Operators - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Third-Party Procurement

Leasing Companies

Government Procurement

Online Platforrms

- Market Share Analysis

- Cross Comparison Parameters (Revenue Growth, Product Innovation, Market Share, Geographic Reach, Customer Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Airbus

Singapore Airlines

Air France

Dassault Aviation

Boeing

Lufthansa Group

Emirates

Qatar Airways

Thales Group

Rolls-Royce

GE Aviation

Airbus Helicopters

Safran

ATR

Indigo Partners

- Airlines adopting more fuel-efficient fleets to cut costs and meet environmental targets

- Cargo operators investing in specialized aircraft for time-sensitive and high-value goods

- Government agencies in both regions focusing on strengthening defense and surveillance capabilities

- Private aviation users increasingly opting for more personalized and flexible flight services

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035