Market Overview

The Singapore Freighter Aircraft Market is valued at USD~ billion in 2025, primarily driven by the expansion of e-commerce, global trade, and the increasing demand for efficient and fast air cargo transport solutions. As a key transportation hub in Southeast Asia, Singapore’s strategic location supports the growth of air freight activities. The aviation sector’s investments in modern freighter aircraft, along with the regulatory support provided by local authorities, further accelerate the market’s growth.

Singapore, along with neighboring countries like Malaysia and China, dominates the Freighter Aircraft market in Asia due to its well-established air cargo infrastructure, strategic location, and integration with global logistics networks. The Changi Airport in Singapore is one of the busiest airports globally, handling a significant volume of air freight. The country’s strong regulatory framework, coupled with its capacity to support efficient logistics, solidifies its position as a dominant player in the market.

Market Segmentation

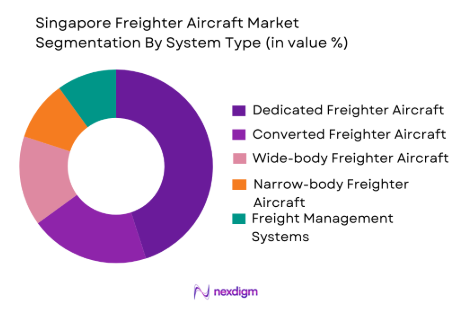

By System Type

The Singapore Freighter Aircraft market is segmented by system type into dedicated freighter aircraft, converted freighter aircraft, wide-body freighter aircraft, narrow-body freighter aircraft, and freight management systems. Among these, dedicated freighter aircraft dominate the market due to their superior cargo capacity, efficiency, and specialized design for freight transport. As e-commerce continues to boom, dedicated freighters offer the most effective and cost-efficient means of transporting goods across long distances. These aircraft are increasingly favored by cargo airlines that require specialized systems to meet high demand for freight logistics.

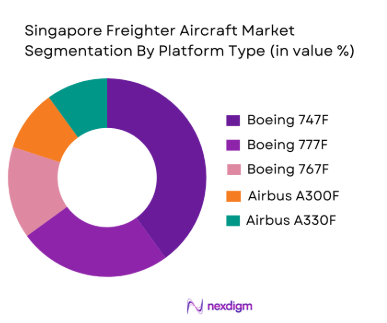

By Platform Type

The market is also segmented by platform type, including aircraft models such as the Airbus A300F, Boeing 747F, Airbus A330F, Boeing 777F, and Boeing 767F. The Boeing 747F remains the dominant platform in the market. Its extensive range, large cargo capacity, and long operational history make it the preferred choice among cargo airlines. The versatility and proven performance of the Boeing 747F in global logistics networks have solidified its leadership in the segment. Moreover, its large hold capacity aligns well with the growing demand for air cargo, further cementing its market dominance.

Competitive Landscape

The Singapore Freighter Aircraft market is dominated by a few key players, with both regional and international companies leading the market. Key players include Singapore Airlines Cargo, DHL Express, and FedEx Express. These companies have established strong brand presence and distribution networks across the region, benefiting from strategic partnerships with aircraft manufacturers and leveraging their extensive logistics networks. These players continue to expand their fleets of dedicated freighters and converted aircraft to meet growing demand in the region.

| Company Name | Establishment Year | Headquarters | Fleet Size | Global Reach | Technology Adoption | Customer Base | Revenue (2024) |

| Singapore Airlines Cargo | 1972 | Singapore | 130+ | ~ | ~ | ~ | ~ |

| DHL Express | 1969 | Germany | 200+ | ~ | ~ | ~ | ~ |

| FedEx Express | 1971 | USA | 160+ | ~ | ~ | ~ | ~ |

| Emirates SkyCargo | 1985 | UAE | 130+ | ~ | ~ | ~ | ~ |

| Cargolux Airlines International | 1970 | Luxembourg | 80+ | ~ | ~ | ~ | ~ |

Singapore Freighter Aircraft Market Analysis

Growth Drivers

Boom in E-commerce and Online Retail

The rapid growth of e-commerce and online retail, particularly in Southeast Asia, is a primary driver for the Singapore Freighter Aircraft market. With consumers increasingly demanding fast and efficient delivery of goods, e-commerce companies are relying on air freight solutions to ensure quicker shipping times. Singapore, with its advanced logistics infrastructure and strategic geographic location, acts as a critical hub for air cargo. This creates a sustained demand for freighter aircraft to facilitate the smooth movement of goods across the globe, especially as cross-border e-commerce transactions continue to grow. The country’s well-established air freight capabilities make it a preferred destination for international cargo carriers, supporting continued demand for both dedicated freighters and converted aircraft to handle e-commerce shipments.

Global Supply Chain Integration

The integration of global supply chains, especially in sectors like automotive, pharmaceuticals, and high-value electronics, is another significant growth driver for the Singapore Freighter Aircraft market. As multinational companies expand their operations across borders, the need for efficient, fast, and reliable transportation of goods becomes critical. Singapore’s strategic positioning as a leading port and aviation hub further amplifies its importance in the global supply chain network. The need for freighter aircraft to move raw materials, finished products, and spare parts in just-in-time delivery models has created a growing demand for air cargo services. With advancements in technology and logistics management, this trend is expected to continue, with more companies opting for air freight to meet the time-sensitive nature of modern supply chains.

Market Challenges

High Operational Costs and Maintenance

One of the key challenges faced by the Singapore Freighter Aircraft market is the high operational costs, especially related to fuel, maintenance, and airport fees. Freighter aircraft require frequent maintenance, especially when operating at high intensity, which significantly adds to the cost of ownership. This is compounded by the volatility of fuel prices, which affects the overall cost structure for airlines and freight operators. For freighter aircraft operators, these rising costs can be difficult to manage, leading to pressure on profit margins. While new technologies and fuel-efficient aircraft models are emerging, they still come with high capital costs, making it a challenge for smaller players to stay competitive in the market.

Regulatory and Certification Hurdles

Regulatory barriers, including compliance with aviation safety standards, certification requirements for aircraft, and environmental regulations, pose another challenge to the growth of the Singapore Freighter Aircraft market. Airlines and freight operators must navigate complex international regulations, including those set by the Civil Aviation Authority of Singapore (CAAS) and the International Civil Aviation Organization (ICAO). The process of certifying new freighter aircraft, especially converted models, can be lengthy and costly. Delays in obtaining approvals or compliance with new environmental regulations, such as those focused on reducing carbon emissions from aircraft, can hinder fleet expansion plans. These regulatory challenges increase operational costs and may delay the introduction of more fuel-efficient or eco-friendly freighter models into the market.

Opportunities

Sustainability and Eco-Friendly Aircraft Solutions

As environmental concerns continue to rise globally, there is an increasing demand for eco-friendly and fuel-efficient freighter aircraft. Airlines are under pressure to reduce their carbon footprints, and the aviation industry is investing in alternative fuels, such as sustainable aviation fuel (SAF), as well as more fuel-efficient aircraft. There is a significant opportunity in the Singapore Freighter Aircraft market for the adoption of these sustainable practices. Aircraft manufacturers and airlines that focus on creating and deploying more sustainable freighter aircraft will not only contribute to environmental goals but will also meet the growing demand for green logistics. Moreover, sustainability initiatives could attract more business from environmentally conscious customers and stakeholders, thus driving growth in the long term.

Emerging Markets and Regional Expansion

There is a considerable opportunity for the Singapore Freighter Aircraft market to expand into emerging markets across Asia-Pacific, including countries like India, Indonesia, and Vietnam, which are experiencing rapid industrial growth and rising demand for air cargo. As these markets develop, the demand for air freight services, including dedicated and converted freighter aircraft, is likely to increase. Singapore’s strategic geographic position as a logistics hub in Southeast Asia gives it a competitive advantage in capitalizing on these emerging opportunities. By expanding its fleet and offering flexible, scalable solutions, the Singapore Freighter Aircraft market can tap into new regional markets and support the growing logistics needs of these rapidly developing economies.

Future Outlook

Over the next decade, the Singapore Freighter Aircraft market is expected to experience significant growth driven by the continuing rise in global trade, e-commerce, and advancements in aircraft technology. Key factors contributing to this growth include the need for faster delivery times, an increase in demand for sustainable and fuel-efficient air cargo solutions, and the growing need for logistics solutions in emerging markets. As the market evolves, companies will increasingly adopt state-of-the-art aircraft, such as the Boeing 777F and Airbus A330F, to meet the rising demand for freight transport.

Major Players

- Singapore Airlines Cargo

- DHL Express

- FedEx Express

- Emirates SkyCargo

- Cargolux Airlines International

- China Airlines Cargo

- Qatar Airways Cargo

- Cathay Pacific Cargo

- China Eastern Airlines Cargo

- Kuehne + Nagel

- United Parcel Service (UPS)

- Lufthansa Cargo

- Air France-KLM Cargo

- Japan Airlines Cargo

- All Nippon Airways (ANA) Cargo

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Cargo Airlines

- E-commerce Logistics Providers

- Freight Forwarders

- Aviation Manufacturers

- Freight Brokers

- Airline Operators

Research Methodology

Step 1: Identification of Key Variables

The initial step involves identifying and analysing key stakeholders in the Singapore Freighter Aircraft market. This includes airlines, aircraft manufacturers, cargo logistics companies, and regulatory bodies. A mix of secondary research and proprietary data sources will be utilized to map out the ecosystem of the market, helping to identify key drivers, restraints, and growth opportunities.

Step 2: Market Analysis and Construction

This phase focuses on constructing a historical view of the market by evaluating trends in market size, installed units, and the competitive landscape. The data collected will help provide insights into the regional spread of freighter aircraft and assess overall growth, using a mix of industry reports, sales figures, and expert consultations.

Step 3: Hypothesis Validation and Expert Consultation

In this step, hypotheses regarding market trends and growth drivers will be validated through consultations with industry experts, such as cargo airline executives, aircraft manufacturers, and logistics professionals. These consultations will ensure the accuracy and reliability of data used in the final market projections.

Step 4: Research Synthesis and Final Output

In the final phase, primary data collected from consultations will be integrated with secondary research findings. The research will undergo a rigorous review process to ensure consistency and validate the market’s projections. This final output will provide an accurate and comprehensive analysis of the Singapore Freighter Aircraft market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

Market Definition and Scope

Value Chain & Stakeholder Ecosystem

Regulatory / Certification Landscape

Sector Dynamics Affecting Demand

Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in E-commerce and Online Retail Demand

Expansion of International Freight Networks

Growing Demand for Faster, More Efficient Air Cargo Transport - Market Challenges

High Initial Investment and Maintenance Costs

Regulatory Barriers and Certification Delays

Limited Availability of Converted Freighter Aircraft - Opportunities

Emerging Markets for Air Cargo in Asia-Pacific

Technological Advancements in Aircraft Conversion

Growing Demand for Environmentally Sustainable Freight Solutions - Trends

Adoption of Autonomous Cargo Handling Technologies

Increased Focus on Fuel Efficiency in Freighter Aircraft

Growth of Last-Mile Delivery Services

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Dedicated Freighter Aircraft

Converted Freighter Aircraft

Wide-body Freighter Aircraft

Narrow-body Freighter Aircraft

Freight Management Systems - By Platform Type (In Value%)

Airbus A300F

Boeing 747F

Airbus A330F

Boeing 777F

Boeing 767F - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer) Freighters

Converted Freighters

Hybrid Freighters

Freight Conversion Kits

Freight Management Systems - By End User Segment (In Value%)

Cargo Airlines

Express Delivery Services

E-commerce Logistics

Third-Party Freight Forwarders

Freight Brokers - By Procurement Channel (In Value%)

Direct Purchase from OEMs

Leasing from Financial Institutions

Freight Conversion Programs

Secondary Market Sales

Public Procurement Programs

- Market Share Analysis

- Cross Comparison Parameters (Market Penetration, Operational Efficiency, Fleet Size, Technological Adoption, Regional Expansion)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Singapore Airlines Cargo

SATS Cargo

DHL Express

Qatar Airways Cargo

Cargolux Airlines International

FedEx Express

Emirates SkyCargo

Cathay Pacific Cargo

China Airlines Cargo

Kuehne + Nagel

United Parcel Service (UPS)

China Eastern Airlines Cargo

Singapore Technologies Aerospace

Lufthansa Cargo

Air France-KLM Cargo

- Rising Demand for Air Cargo in Southeast Asia

- Increased Focus on E-commerce Logistics

- Growth of Global Supply Chain Networks

- Shift towards Hybrid Freight Solutions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035