Market Overview

The Singapore General Aviation Engines market is valued at approximately USD ~ billion, based on the 2025 analysis. Growth in this market is primarily driven by increasing demand for private and business aviation in the Asia-Pacific region, which has seen significant expansion over recent years. The market’s growth is also supported by government policies promoting air mobility and general aviation infrastructure. The demand for more fuel-efficient and eco-friendly engine solutions further contributes to market expansion, along with technological advancements and rising disposable incomes among the region’s affluent population.

Singapore is the dominant hub for general aviation engines in Southeast Asia, driven by its strategic location as a global aviation and financial hub. The country’s robust aviation infrastructure, world-class airport facilities, and pro-business policies have fostered a strong aviation ecosystem. Other notable countries include Malaysia, Thailand, and Indonesia, which also contribute significantly due to increasing wealth and regional economic growth. These countries are seeing growth in private and corporate air travel, further boosting demand for general aviation engines in the region.

Market Segmentation

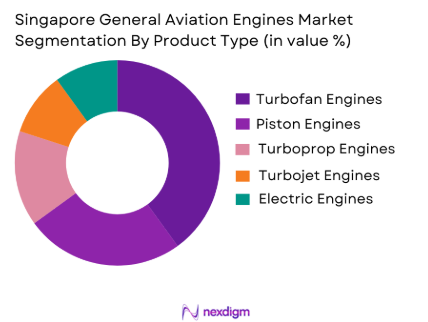

By Product Type

The Singapore General Aviation Engines market is segmented by product type into turbofan engines, piston engines, turboprop engines, turbojet engines, and electric engines. Among these, turbofan engines dominate the market due to their widespread use in business and private jets. The efficiency, reliability, and performance of turbofan engines make them a preferred choice for high-end private aircraft. Companies like Rolls-Royce and Pratt & Whitney are key suppliers, driving the demand for these engines. The growing preference for business jets, along with advancements in engine technology that enhance fuel efficiency and reduce emissions, further contributes to the dominance of turbofan engines.

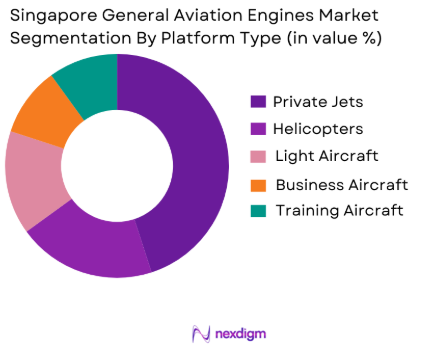

By Platform Type

The market is also segmented by platform type into private jets, helicopters, light aircraft, business aircraft, and training aircraft. Private jets hold the largest market share in Singapore’s general aviation sector due to the increasing demand for luxury travel and business aviation. Private jets are preferred for their convenience, speed, and ability to access smaller airports, saving time for business leaders and affluent individuals. With the growing emphasis on personalized services and the increasing number of high-net-worth individuals in Singapore, private jets are expected to continue dominating this segment.

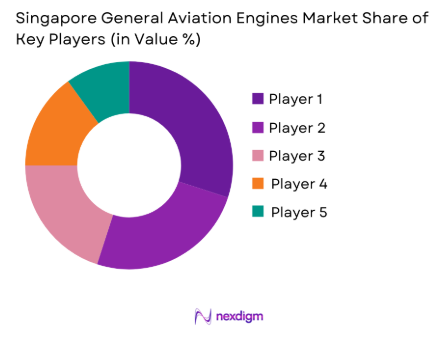

Competitive Landscape

The Singapore General Aviation Engines market is characterized by a few key players, with global manufacturers dominating the industry. Companies such as Rolls-Royce, Pratt & Whitney, and General Electric are market leaders, with a significant presence in the region. These companies are highly competitive, leveraging technological advancements, strong customer relationships, and a wide distribution network. The market is also witnessing the entry of smaller, specialized firms focusing on electric and hybrid engines, catering to the growing demand for eco-friendly solutions.

| Company | Establishment Year | Headquarters | Technology Focus | Market Reach | Product Offerings | Key Differentiator |

| Rolls-Royce | 1906 | United Kingdom | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | United States | ~ | ~ | ~ | ~ |

| General Electric | 1892 | United States | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 2005 | France | ~ | ~ | ~ | ~ |

| Lycoming Engines | 1929 | United States | ~ | ~ | ~ | ~ |

Singapore General Aviation Engines Market Analysis

Growth Drivers

Expansion of Tourism and Private Aviation

Singapore has long been a hub for business and leisure travel, with its strategic location in Southeast Asia. The increasing demand for private aviation, especially among high-net-worth individuals and corporations, is driving the growth of the general aviation sector. As a result, the demand for aircraft engines is expected to grow. Additionally, the country’s push to enhance its tourism infrastructure and develop new aviation routes further boosts the need for general aviation services. This increase in demand for light aircraft and helicopters, both for tourism and business, creates a parallel demand for high-performance and efficient engines. The burgeoning private aviation market offers significant opportunities for engine manufacturers, repair service providers, and component suppliers in Singapore.

Technological Advancements and Innovation

The global aviation industry is embracing new technologies aimed at increasing fuel efficiency, reducing emissions, and enhancing overall performance. The same trend is evident in Singapore, where the government actively supports innovations in the aerospace sector. Technological advancements in engines, such as more efficient turbine engines, lightweight materials, and hybrid-electric propulsion, are key drivers of growth in the general aviation market. These innovations not only improve the operational cost-efficiency of aircraft but also help in meeting stringent environmental regulations, further encouraging the adoption of modern aircraft with cutting-edge engines. As these technological advancements continue, they will continue to drive the growth of Singapore’s general aviation engine market.

Market Challenges

High Operating Costs

One of the major challenges facing the general aviation engine market in Singapore is the high operational cost. This includes the cost of aircraft maintenance, fuel consumption, and, most importantly, the cost of engines and spare parts. The initial investment required to purchase and maintain general aviation aircraft with advanced engines is significant. Moreover, regular maintenance and overhauls of aviation engines can be expensive, especially for smaller operators with fewer resources. For private aviation owners and smaller airlines in Singapore, these high costs can limit the growth of the market. As a result, while demand is increasing, the financial burden placed on operators is a persistent challenge that limits market expansion.

Stringent Regulatory Compliance

The aviation industry is highly regulated, with stringent rules governing everything from aircraft maintenance to engine performance and environmental standards. In Singapore, the Civil Aviation Authority of Singapore (CAAS) enforces these regulations to ensure aviation safety. However, these regulations can create barriers for market participants, especially smaller operators or new entrants. Compliance with evolving standards related to engine emissions, noise reduction, and safety can be complex and costly. Engine manufacturers and operators must invest in technologies that meet these regulations, which can further increase operating costs and create challenges for growth. Stringent regulations may also slow the rate of adoption of new engine technologies, as they may require extended certification periods or costly modifications to existing aircraft.

Opportunities

Growth in Asia-Pacific Aviation Hub

Singapore has positioned itself as a key aviation hub within the Asia-Pacific region. Its role as a major transportation and logistics center, coupled with its advanced aviation infrastructure, presents significant opportunities for the general aviation engine market. With a growing number of international and regional flights, both commercial and private, the demand for efficient, reliable, and environmentally friendly aircraft engines is set to rise. The increasing interest in general aviation, especially for private jet ownership and business aviation, further fuels the growth of engine sales and maintenance services. For engine manufacturers, there are ample opportunities to expand into the Singapore market, providing advanced products and services to meet the evolving needs of the aviation sector.

Aerospace MRO (Maintenance, Repair, and Overhaul) Services

As the aviation industry in Singapore continues to grow, there is an increasing demand for aircraft maintenance, repair, and overhaul (MRO) services, particularly in the general aviation sector. Engine manufacturers and independent service providers have the opportunity to tap into this growing demand by offering specialized services, including engine repairs, overhauls, and spare parts. The government’s initiatives to develop aerospace MRO capabilities in Singapore further open up new growth avenues. As the general aviation fleet expands in the region, engine MRO services will play a critical role in ensuring the longevity and safety of aircraft. This segment presents an excellent opportunity for engine manufacturers and service providers to build long-term partnerships with aircraft owners and operators in Singapore.

Future Outlook

Over the next decade, the Singapore General Aviation Engines market is expected to show steady growth, driven by rising consumer demand for private and business aviation. Key drivers will include technological advancements, increased demand for fuel-efficient engines, and government support for the aviation sector. With the growing shift towards eco-friendly solutions and electric propulsion systems, there is potential for significant innovation in engine technology. Moreover, the rise of urban air mobility and regional air transportation will further contribute to the growth of this market.

Major Players

- Rolls-Royce

- Pratt & Whitney

- General Electric

- Safran Aircraft Engines

- Lycoming Engines

- MTU Aero Engines

- Textron Aviation

- Honeywell Aerospace

- Continental Motors

- Williams International

- AeroVironment

- Daimler AG

- Rotax Aircraft Engines

- Turkish Aerospace Industries

- GE Aviation

Key Target Audience

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aircraft Manufacturers

- Aircraft Maintenance Providers

- General Aviation Operators

- Business Aviation Companies

- Aviation Technology Providers

- Engine Suppliers and Manufacturers

Research Methodology

Step 1: Identification of Key Variables

In this phase, key variables influencing the Singapore General Aviation Engines market are identified. Secondary research is conducted using various databases, industry reports, and public resources. The aim is to define variables such as demand drivers, market trends, and technological advancements, which directly impact the engine market.

Step 2: Market Analysis and Construction

This stage involves analysing historical data and market trends. The data collected helps assess market penetration, technology adoption, and regional demand. A comprehensive review of past performance is conducted to ensure accuracy in future projections and trend identification.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through expert interviews and surveys, engaging with industry professionals, engineers, and other stakeholders. This validation process ensures that the collected data is both accurate and aligned with market expectations.

Step 4: Research Synthesis and Final Output

The final phase involves integrating primary and secondary data from the previous steps. A comprehensive analysis is presented, covering trends, growth drivers, challenges, and market forecasts. Industry interactions and final data refinement ensure the reliability and validity of the output.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Grow

- Growth Drivers

Rising demand for private air travel in Southeast Asia

Technological advancements in engine efficiency and fuel economy

Government support for general aviation infrastructure and policy - Market Challenges

High capital expenditure for general aviation engine procurement

Regulatory complexities in engine certification

Limited availability of skilled maintenance professionals - Market Opportunities

Increasing popularity of sustainable and electric aviation technologies

Rising demand for aviation training programs and flight schools

Expansion of regional air mobility solutions - Trends

Development of hybrid and electric propulsion systems

Shift towards environmentally friendly aviation practices

Increasing investment in general aviation infrastructure

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Turbofan Engines

Piston Engines

Turbojet Engines

Turboprop Engines

Electric Engines - By Platform Type (In Value%)

Private Jets

Helicopters

Light Aircraft

Business Aircraft

Training Aircraft - By Fitment Type (In Value%)

OEM

Aftermarket

Retrofit

Upgrade

Replacement - By End User Segment (In Value%)

Private Owners

Flight Schools

Corporate Fleets

Air Ambulance Operators

Government & Military - By Procurement Channel (In Value%)

Direct Procurement

Distributors & Dealers

OEMs

Online Platforms

Third-party Resellers

- Market Share Analysis

- Cross Comparison Parameters (Market Share, Product Innovation, Regional Presence, Pricing Strategy, Customer Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Rolls-Royce

Pratt & Whitney

General Electric

Lycoming Engines

MTU Aero Engines

Textron Aviation

Honeywell Aerospace

Safran Aircraft Engines

GAMI

Continental Motors

Williams International

AeroVironment

Daimler AG

Rotax Aircraft Engines

Turkish Aerospace Industries

GE Aviation

- Increasing interest from private aircraft owners in efficient and eco-friendly engines

- Flight schools adapting to new training methodologies and aircraft technology

- Growing demand for business aircraft from corporate clients

- Government adoption of advanced aviation systems for defense and emergency us

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035