Market Overview

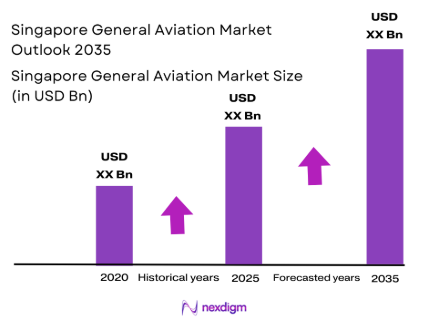

The Singapore general aviation market is a vital component of the country’s aviation industry. Driven by economic growth, infrastructure development, and an increasing demand for business aviation, the market size has expanded significantly. According to a report from the Civil Aviation Authority of Singapore (CAAS), the general aviation market in Singapore is valued at USD ~billion, with a steady rise in private aviation services. The market size reflects the economic dynamism of the region, with the city-state being a prominent hub for aviation activities in Southeast Asia, and continued investments in infrastructure contributing to the market’s growth.

Dominant countries such as Singapore, Malaysia, and Indonesia dominate the Southeast Asian general aviation market due to their strategic locations, robust economic development, and government support. Singapore, with its strong aviation infrastructure and being a global financial centre, leads the region. Additionally, Singapore’s position as a transport hub, supported by its world-class airport and airspace accessibility, makes it a key player in the regional market. Neighbouring countries also benefit from increasing business aviation and leisure demand, making them important contributors to the market’s growth in the region.

Market Segmentation

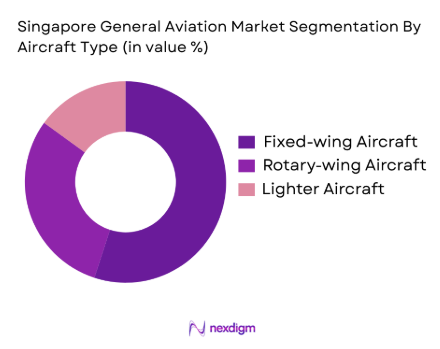

By Aircraft Type

The Singapore general aviation market is segmented by aircraft type into fixed-wing aircraft, rotary-wing aircraft, and lighter aircraft. Among these, fixed-wing aircraft dominate the market due to their suitability for both private and business aviation. Their larger range, speed, and capacity make them ideal for frequent business travel and long-distance flights, which are highly demanded in Singapore’s corporate landscape. These aircraft are commonly used by multinational corporations and high-net-worth individuals, further cementing their dominance in the market. The demand for private jets, such as the Gulfstream and Bombardier models, has continued to grow due to increasing affluence and the need for time-efficient travel.

By Service Type

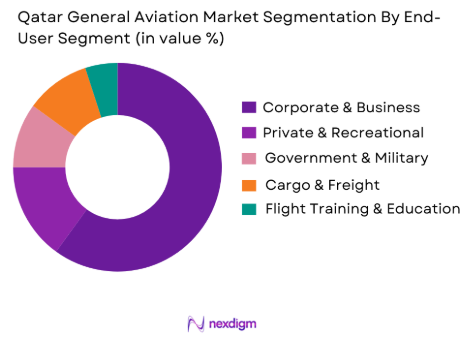

The general aviation market is segmented by service type into charter services, maintenance and repair services, and pilot training services. Charter services, particularly for business jets, lead the market in Singapore. The demand for on-demand flight services by corporate executives and wealthy individuals is on the rise, as chartered flights offer flexibility, privacy, and convenience. Charter services are highly sought after due to Singapore’s position as a major business hub in Southeast Asia, where executives need to travel quickly to various regional destinations without the constraints of commercial airline schedules. Additionally, the availability of luxury travel packages on private jets has driven the demand for charter services.

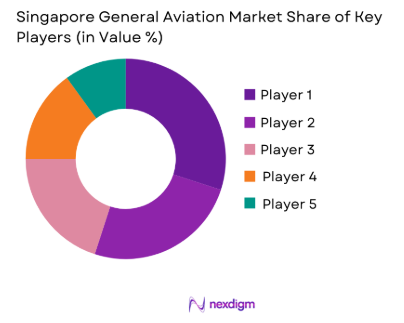

Competitive Landscape

The Singapore general aviation market is characterized by a competitive landscape that includes several global and regional players. The market is dominated by a few key players such as Textron Aviation, Embraer, and Gulfstream Aerospace, along with local entities providing support services like maintenance and flight operations. These major players have established strong brands, extensive service networks, and a high level of trust among corporate clients. Their dominance in the market reflects their ability to provide state-of-the-art aviation solutions, including aircraft leasing, charter services, and maintenance.

| Company | Year Established | Headquarters | Aircraft Type Coverage | Regional Presence | Market Specialization | Service Types Offered |

| Textron Aviation | 1923 | Wichita, Kansas, USA | ~ | ~ | ~ | ~ |

| Embraer | 1969 | São José dos Campos, Brazil | ~ | ~ | ~ | ~ |

| Gulfstream Aerospace | 1958 | Savannah, Georgia, USA | ~ | ~ | ~ | ~ |

| Bell Helicopter | 1935 | Fort Worth, Texas, USA | ~ | ~ | ~ | ~ |

| Airbus Helicopters | 1993 | Marignane, France | ~ | ~ | ~ | ~ |

Singapore General Aviation Market Analysis

Growth Drivers

Strategic Geographical Location

Singapore’s strategic location at the crossroads of major global aviation routes has played a pivotal role in driving the growth of its general aviation market. The country’s positioning within Southeast Asia makes it an attractive hub for international flights, cargo, and business travel. As global trade and business activities increase, Singapore continues to be a crucial entry and exit point for many regional and international travelers, boosting demand for private aviation services. The country’s well-developed infrastructure, including Changi Airport, renowned for its connectivity and efficiency, further strengthens its position as a key regional aviation hub. As a result, there is a rising demand for charter flights, private jet services, and cargo operations, contributing to the growth of the general aviation market in Singapore.

Government Support and Infrastructure Development

The Singaporean government has been proactive in fostering the growth of the aviation sector by providing strategic support through policies and infrastructure development. The Aviation Development Fund (ADF) and other government initiatives aim to boost the growth of aviation-related businesses, especially in the private aviation and leisure sectors. These efforts have included investment in advanced airport facilities, such as the Seletar Airport expansion, designed to cater specifically to general aviation. The government also provides various incentives, including tax benefits and regulatory frameworks conducive to private sector participation. This supportive environment has encouraged both local and international businesses to invest in aviation services, enhancing Singapore’s status as a hub for both business and leisure aviation.

Market Challenges

High Operating Costs and Regulatory Burdens

One of the primary challenges facing the general aviation market in Singapore is the high operating costs, which include fuel prices, airport fees, maintenance, and insurance. Singapore, being a highly regulated market, also has stringent safety, airspace management, and operational requirements that result in higher compliance costs. For operators, maintaining aircraft fleets and adhering to regulatory standards can be financially burdensome, particularly in an environment where profit margins are tight. Additionally, the high cost of aviation fuel further impacts the profitability of general aviation services. These factors make it challenging for smaller operators to enter the market and sustain their businesses in the face of rising expenses, thus limiting market competition and growth potential.

Limited Space and Airspace Congestion

Singapore, while being one of the world’s busiest aviation hubs, also faces challenges related to limited airspace and congestion. General aviation services, including private flights, are often restricted by airspace management, which prioritizes commercial airliners at major airports such as Changi. The increased demand for aviation services and the limited availability of airspace for general aviation flights can lead to delays, inefficiencies, and operational limitations. Furthermore, the small geographic area of Singapore means that there are limited airports available for general aviation operations. This creates logistical difficulties for flight operators, particularly those offering private or chartered services, who must navigate airspace constraints while maintaining punctuality and efficiency.

Opportunities

Expansion of Private Jet and Charter Services

The increasing demand for personalized and flexible air travel presents significant opportunities for private jet and charter services in Singapore. The rise of business executives, entrepreneurs, and high-net-worth individuals looking for time-efficient and secure travel options fuels the demand for private aviation. As the global business landscape becomes more interconnected, Singapore’s status as a business hub encourages professionals to seek private aviation solutions that can cater to tight schedules and specific needs. With limited commercial flight options for certain destinations and an increasing number of affluent travelers, the private jet and charter market is set to grow, presenting opportunities for new entrants and existing operators to expand their services.

Aviation Tourism and Leisure Travel

With the resurgence of post-pandemic travel, the demand for luxury and bespoke travel experiences is on the rise, particularly in Singapore’s general aviation sector. Aviation tourism, including scenic flights, private tours, and air cruises, is gaining popularity among tourists seeking unique experiences. The growing interest in luxury travel among affluent individuals from both Singapore and abroad offers a promising opportunity for the general aviation market to diversify into leisure and recreational sectors. Singapore’s proximity to neighboring countries like Indonesia, Malaysia, and Thailand also presents an opportunity for cross-border private tourism flights, tapping into the region’s growing demand for luxury travel options. The expansion of aviation services targeting the leisure market could drive growth in this sector, enhancing the country’s position as a premium travel destination.

Future Outlook

Over the next decade, the Singapore general aviation market is poised for substantial growth, driven by increasing demand for business aviation, the expansion of infrastructure, and rising affluence in the region. Government policies supporting aviation and business growth, along with advancements in aircraft technology, are expected to foster the growth of the general aviation market. With a focus on sustainable aviation and the increasing interest in private air travel, the market outlook remains positive. The market is projected to experience an upward trajectory, with new entrants and improved services enhancing the sector’s competitiveness and growth potential.

Major Players

- Textron Aviation

- Embraer

- Gulfstream Aerospace

- Bell Helicopter

- Airbus Helicopters

- Dassault Aviation

- Honda Aircraft Company

- Piaggio Aerospace

- Sikorsky Aircraft

- Bombardier Aerospace

- Pilatus Aircraft

- Cessna Aircraft Company

- Beechcraft

- Piper Aircraft

- Diamond Aircraft Industries

Key Target Audience

- Aircraft Manufacturers

- Aviation Operators

- Private Jet Owners

- Investment and Venture Capitalist Firms

- Corporate Executives and High-net-worth Individuals

- Government Aviation Agencies

- Airline Companies

- Aviation Service Providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Singapore general aviation market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Singapore general aviation market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple general aviation manufacturers and service providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Singapore general aviation market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Business Aviation Demand

Government Support for Infrastructure Development

Rising Wealth and Disposable Income in Singapore - Market Challenges

High Operational Costs

Regulatory Restrictions on Airspace

High Initial Investment for Aircraft Acquisition - Market Opportunities

Growing Demand for Air Ambulance Services

Expanding Private Jet Ownership

Increased Interest in Sustainable Aviation Technologies - Trends

Technological Advancements in Aircraft Systems

Growth of UAV Integration in General Aviation

Shift Towards Electric Aircraft in General Aviation

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Fixed-wing Aircraft

Rotary-wing Aircraft

Light Aircraft

Business Jets

Helicopters - By Platform Type (In Value%)

Private Aircraft

Corporate Jets

Helicopter Platforms

Leisure Aircraft

Air Ambulance Platforms - By Fitment Type (In Value%)

Standard Fitment

Custom Fitment

Retrofit Solutions

OEM Fitment

Upgrade Fitment - By End User Segment (In Value%)

Private Operators

Business Aviation

Government & Military

Charter Services

Medical Emergency Services - By Procurement Channel (In Value%)

Direct Purchase

Leasing

Government Procurement

Brokered Sales

Auction & Secondary Market

- Market Share Analysis

- Cross Comparison Parameters (Market Penetration, Technological Innovations, Customer Loyalty, Pricing Strategy, Distribution Network)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Force’s

- Key Players

Textron Aviation

Embraer

Gulfstream Aerospace

Dassault Aviation

Honda Aircraft Company

Bell Helicopter

Airbus Helicopters

Sikorsky Aircraft

Beechcraft

Cessna Aircraft Company

Piaggio Aerospace

Pilatus Aircraft

Diamond Aircraft Industries

Jet Aviation

ExecuJet Aviation Group

- Private individuals seeking luxury travel experiences

- Corporations expanding executive aviation fleets

- Government agencies using aviation for surveillance and logistics

- Medical organizations investing in air ambulance services

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035