Market Overview

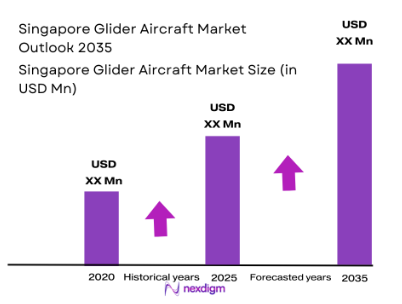

The Singapore Glider Aircraft market is valued at USD ~ million in 2025, driven by an increasing interest in recreational aviation and government initiatives supporting sustainable air mobility. The glider aircraft market is also seeing growth through technological advancements in aircraft design and propulsion systems, particularly the shift towards electric and hybrid models, which offer reduced operating costs and environmental benefits. Singapore’s strategic location and proximity to countries with growing interest in aviation sports further contribute to this market’s growth.

Singapore, being a regional hub for aviation and aerospace industries, plays a central role in the glider aircraft market, with major cities like Singapore city and surrounding areas leading the demand. The dominance of these regions is attributed to the presence of aviation enthusiasts, flying clubs, and numerous training schools. Moreover, Singapore’s status as a global aviation and tourism hub has spurred interest in glider tourism and leisure activities. This growth is bolstered by supportive government policies and infrastructure investments focused on sustainable aviation.

Market Segmentation

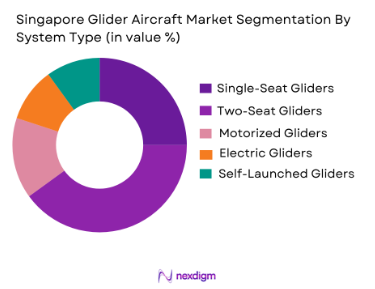

By System Type

The Singapore Glider Aircraft market is segmented by system type into single-seat gliders, two-seat gliders, motorized gliders, electric gliders, and self-launched gliders. The two-seat gliders dominate the market due to their use in training, recreational flying, and gliding events. These gliders are popular for beginners and intermediate pilots, offering a balance of affordability, performance, and safety. The two-seat glider segment benefits from strong demand from both private users and aviation schools, ensuring its leading position in the market.

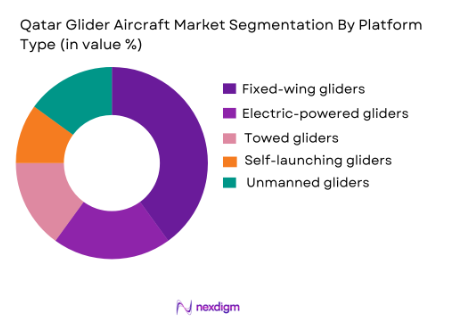

By Platform Type

The market is segmented by platform type into aerobatic gliders, touring gliders, training gliders, competition gliders, and cross-country gliders. Training gliders lead the market share due to their demand from flight schools and training institutes. These gliders are specifically designed to offer controlled and safe flying experiences, making them ideal for novice pilots. The affordability and versatility of training gliders further contribute to their dominance, as they are widely adopted in gliding academies and by new pilots.

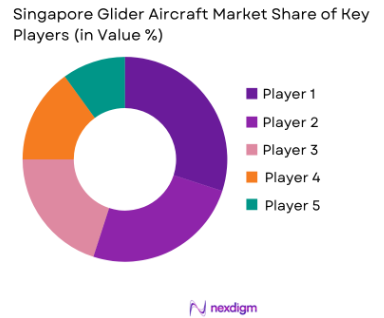

Competitive Landscape

The Singapore Glider Aircraft market is dominated by a mix of local and international players, with global manufacturers like Schempp-Hirth Flugzeugbau, Grob Aerospace, and DG Flugzeugbau holding significant positions in the market. These companies are leading through innovation, providing advanced designs and better technology integration into their gliders. The local players focus on tailored glider solutions and specialized services for training schools, maintaining a competitive edge in a niche segment of the market.

| Company | Establishment Year | Headquarters | Market Share (%) | Product Portfolio | Innovation Focus | Regional Reach | Partnerships | Certifications | Price Range | Technological Expertise |

| Schempp-Hirth Flugzeugbau | 1981 | Germany | High | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Grob Aerospace | 1980 | Germany | Medium | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| DG Flugzeugbau | 1973 | Germany | High | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Quicksilver Aircraft | 1965 | USA | Medium | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Piper Aircraft | 1937 | USA | Medium | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore Glider Aircraft Market Analysis

Growth Drivers

Technological Advancements in Glider Design

The continuous evolution of glider technology, including advancements in materials, lightweight structures, and electric propulsion systems, is driving the market. These innovations offer improved performance, safety, and fuel efficiency, which attracts both recreational pilots and aviation training institutions in Singapore. The shift towards electric and hybrid gliders also supports sustainability efforts and reduces operating costs, making gliders more appealing to a broader consumer base.

Government Support and Policy Initiatives

Singapore’s government has been promoting sustainable aviation technologies, including green aviation initiatives that support electric and hybrid gliders. Additionally, investments in aviation infrastructure and support for air sports through local flying clubs and recreational programs are further fuelling market growth. This favorable regulatory environment ensures that glider aircraft can thrive as part of the country’s broader push towards sustainable and eco-friendly aviation solutions.

Market Challenges

High Initial Investment and Maintenance Costs

The relatively high cost of purchasing glider aircraft, especially advanced models with electric or hybrid propulsion systems, remains a barrier for potential buyers. This is compounded by the significant maintenance and operational costs, which can limit accessibility for private consumers and small-scale operators, thus hindering broader market adoption.

Limited Training and Maintenance Infrastructure

While Singapore has a growing number of aviation enthusiasts, there is a lack of specialized facilities for training and maintenance of glider aircraft. The scarcity of qualified instructors and maintenance personnel capable of handling advanced glider systems (including electric models) poses a challenge for scaling up the glider industry. This limitation affects both domestic users and international customers seeking specialized services.

Opportunities

Expansion of Glider Tourism and Recreational Aviation

The growing popularity of recreational flying and glider tourism offers significant growth potential for the market. Singapore’s strategic location as a global aviation hub makes it an attractive destination for tourists looking to experience gliding. Developing glider tourism packages could boost demand for both training and leisure gliders, driving market expansion.

Increasing Adoption of Electric and Hybrid Gliders

As the global aviation industry shifts towards greener technologies, there is a strong opportunity for growth in the electric and hybrid glider segments. Singapore, with its focus on sustainable technology and innovation, is well-positioned to lead the adoption of electric gliders. These eco-friendly alternatives appeal to consumers and organizations focused on reducing carbon footprints, presenting new market opportunities for manufacturers and service providers.

Future Outlook

Over the next 5 years, the Singapore Glider Aircraft market is expected to witness significant growth, driven by continuous innovation in glider design, increasing consumer interest in sustainable aviation solutions, and expanding gliding communities. The rise of electric propulsion systems and green aviation initiatives is set to play a key role in transforming the market, offering lower operating costs and attracting new users. Additionally, the government’s emphasis on aviation sports and tourism will further boost market expansion.

Key Players

- Schempp-Hirth Flugzeugbau

- Grob Aerospace

- DG Flugzeugbau

- Quicksilver Aircraft

- Piper Aircraft

- Hirth Engines

- Rolls-Royce Aviation

- Harman International

- Lange Aviation

- L-3 Communications

- Sailplane Services

- Schreder Aviation

- Meyer Aircraft

- Aviators

- Aviation Technologies

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aviation Enthusiasts and Private Consumers

- Aircraft Manufacturers and OEMs

- Flying Clubs and Recreational Aviation Groups

- Glider Training Institutes

- Aerospace and Defense Organizations

- Commercial Aviation Operators

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying and defining the primary variables that drive market dynamics in the Singapore Glider Aircraft market. The variables include product types, platform types, market growth drivers, and regulatory considerations. The phase is initiated by gathering data from secondary sources, including industry reports, journals, and government publications.

Step 2: Market Analysis and Construction

Historical data for the Singapore Glider Aircraft market is gathered and analysed, including past growth rates, product adoption, and service demand. Market penetration and service availability are also considered. Revenue generation is projected by assessing industry trends and sales volumes across key segments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through consultations with industry experts, manufacturers, and key stakeholders. Computer-assisted telephone interviews (CATI) will provide deep insights into operational practices, technological advancements, and market expectations.

Step 4: Research Synthesis and Final Output

A comprehensive synthesis of the collected data will be conducted, combining primary insights with secondary data. This will be followed by validation through direct engagement with market participants, such as glider manufacturers and training schools, ensuring that the market analysis is robust, accurate, and reliable.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising interest in recreational aviation

Technological advancements in glider design

Increasing demand for environmentally friendly aviation options - Market Challenges

High initial investment for glider ownership

Limited availability of maintenance facilities

Stringent regulatory requirements for airworthiness certification - Market Opportunities

Growing popularity of sustainable aviation

Rising adoption of electric propulsion systems

Expanding markets for commercial air tourism and gliding events - Trends

Increased development of hybrid and electric propulsion in gliders

Integration of smart technology for enhanced navigation and safety

Growing participation in gliding competitions and sports

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Single-Seat Gliders

Two-Seat Gliders

Motorized Gliders

Electric Gliders

Self-Launched Gliders - By Platform Type (In Value%)

Aerobatic Gliders

Touring Gliders

Training Gliders

Competition Gliders

Cross-Country Gliders - By Fitment Type (In Value%)

Retrofit Gliders

New Gliders

Gliders with Hybrid Propulsion

Gliders with Advanced Navigation Systems

Gliders with Enhanced Safety Features - By End User Segment (In Value%)

Private Users

Aviation Training Institutes

Aerospace & Defense Organizations

Commercial Air Operators

Air Sports Enthusiasts - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Third-Party Resellers

Online Platforms

Government Procurement

Lease/Rentals

- Market Share Analysis

- Cross Comparison Parameters (Product Innovation, Market Penetration, Distribution Network, Cost Leadership, Brand Loyalty)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Schreder Aviation

Schempp-Hirth Flugzeugbau

Meyer Aircraft

Piper Aircraft

Grob Aerospace

DG Flugzeugbau

Quicksilver Aircraft

Sailplane and Gliding

Hirth Engines

Harman International

Rolls-Royce Aviation

Aviation Technologies

Lange Aviation

L-3 Communications

Sailplane Services

- Increasing demand from private and recreational pilots

- Training institutes expanding their glider fleets

- Aerospace and defense sectors adopting gliders for research and development

- Rising popularity of air sports leading to higher consumer demand

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035