Market Overview

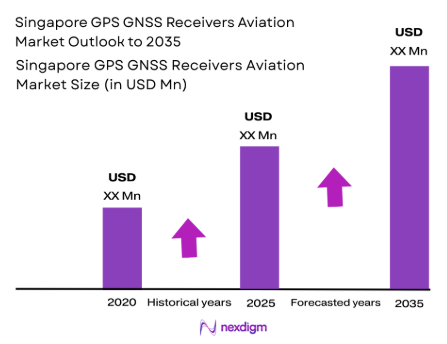

The Singapore GPS GNSS Receivers Aviation market is valued at approximately USD ~million in 2025, and it is expected to grow at a steady rate driven by significant advancements in GNSS technology and the increasing demand for more precise and reliable positioning systems in aviation. The growth is propelled by both the government’s regulatory push for higher aviation safety standards and the expanding demand from both commercial and military aviation sectors. Innovations in multi-frequency GNSS receivers and the rise of UAVs (Unmanned Aerial Vehicles) also contribute to the market’s expansion.

Singapore, as a leading aviation hub in Asia, plays a central role in dominating the GPS GNSS receivers aviation market due to its strategic geographical position and strong regulatory framework. Additionally, key countries in Southeast Asia, including Malaysia and Thailand, also contribute to the growth as their aviation sectors continue to modernize. The demand in these regions is primarily driven by the need for more advanced navigation systems and the ongoing development of both commercial and military aviation infrastructure. Singapore’s status as a global aviation leader, combined with its active participation in aviation safety standards, further cements its dominance in the market.

Market Segmentation

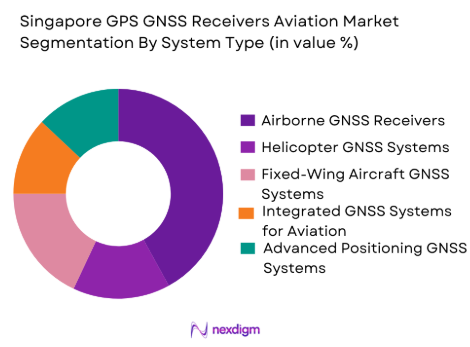

By System Type

The Singapore GPS GNSS Receivers Aviation market is segmented by system type into Airborne GNSS Receivers, Helicopter GNSS Systems, Fixed-Wing Aircraft GNSS Systems, Integrated GNSS Systems for Aviation, and Advanced Positioning GNSS Systems. Among these, Airborne GNSS Receivers hold the largest market share due to their critical role in enhancing aircraft navigation accuracy. With the growing reliance on air travel and aviation safety requirements, the demand for precise positioning systems in commercial aircraft has increased. These systems ensure improved flight management, safety, and efficiency, which makes them the dominant choice for both civil and military aviation sectors.

By Platform Type

The market is also segmented by platform type, including Commercial Aircraft, Private Aircraft, Military Aircraft, Helicopters, and UAVs. Commercial Aircraft dominate this segment, accounting for the largest market share. This dominance can be attributed to the growing demand for air travel across Asia, particularly in Southeast Asia, where commercial air traffic continues to increase. Furthermore, regulatory mandates requiring precise positioning and navigation systems in commercial aircraft further boost the adoption of GPS GNSS systems. The trend of modernizing fleet capabilities and the rise in international travel further solidify the commercial aviation sector’s dominance in the market.

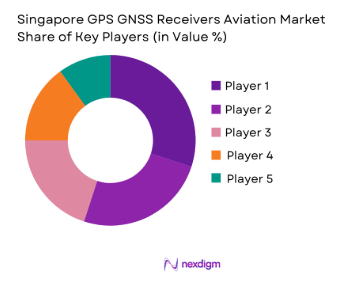

Competitive Landscape

The Singapore GPS GNSS Receivers Aviation market is dominated by a few key players who offer cutting-edge technology and robust solutions for both commercial and military aviation. The competitive landscape features a mix of global aviation technology companies and specialized regional players. Companies such as Garmin and Honeywell International, along with other established brands like Rockwell Collins, are prominent in the market due to their strong presence, technological expertise, and expansive product portfolios. The consolidation of these players reflects the need for highly reliable and accurate navigation systems in aviation.

| Company | Establishment Year | Headquarters | Product Portfolio | Innovation | Market Presence | R&D Investment | Regulatory Compliance | Customer Support |

| Garmin Ltd. | 1989 | USA | GPS Systems, Aviation Receivers | High | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | USA | Avionics, GNSS Solutions | Very High | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | USA | GPS/Avionics, Navigation Systems | High | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | GNSS Solutions, Positioning Systems | Very High | ~ | ~ | ~ | ~ |

| L3 Technologies | 2002 | USA | GPS/GNSS Systems, Surveillance | Moderate | ~ | ~ | ~ | ~ |

Singapore GPS GNSS Receivers Aviation Market Analysis

Growth Driver

Increasing Air Navigation & Fleet Modernization Demand

One of the key drivers shaping the Singapore GPS GNSS receivers aviation market is the rapid expansion and modernization of aviation fleets across commercial and military segments. Singapore’s strategic position as an aviation hub in Asia means that airlines, cargo carriers, and defense units consistently prioritize upgrading avionics systems — especially navigation and positioning technologies that are integral to safe and efficient flight operations. As the global GPS and GNSS receivers aviation market grows, this growth is driven by rising air traffic demand, post‑pandemic aviation recovery, and the introduction of newer aircraft requiring advanced integrated navigation solutions. Accurate GNSS systems support enhanced situational awareness, smoother autopilot integration, and reduced pilot workload in instrument flight rules (IFR) environments — making them indispensable for airlines and OEMs alike. Singapore’s focus on smart airport systems and air traffic management modernization further boosts demand, as regulators and operators adopt GNSS‑based navigation for greater operational efficiency, improved arrival/departure precision, and reduced fuel consumption.

Asia‑Pacific Market Escalation and Tech Adoption

Another major growth driver is the broader Asia‑Pacific aviation ecosystem’s expansion, of which Singapore is a pivotal part. The Asia‑Pacific region is forecast to showcase significant growth in aviation demand, driven by increasing passenger volumes, trade logistics, and regional defense investments. Countries such as China and India are expanding their commercial fleets and upgrading military aircraft, pushing the need for state‑of‑the‑art GNSS receivers capable of multi‑constellation support . For Singapore, this translates into enhanced regional demand, both for installed avionics systems and aftermarket upgrades — particularly as airspace complexity and efficiency requirements rise. Moreover, Singapore’s investments in aviation R&D, digital transformation, and integration of advanced navigation aids like GNSS augmentation systems position the market to benefit from technology convergence that improves accuracy and resilience. The higher precision offered by multi‑constellation GNSS improves safety margins during all flight phases, promoting wider adoption across carriers and maintenance, repair, and overhaul (MRO) service providers. This Asia‑Pacific emphasis on advanced GNSS technology accelerates innovation diffusion into Singapore’s aviation market, emphasizing reliability in navigation and timing solutions.

Market Challenges

Vulnerabilities to GNSS Interference

GNSS receivers depend on weak satellite signals that can be easily overwhelmed by intentional or unintentional radio frequency noise. In recent years, aviation authorities and industry studies have highlighted a sharp rise in GPS jamming and spoofing incidents over conflict zones and dense airspace environments. These signal disruptions can compromise aircraft positioning, timing, and navigation accuracy — posing risks to flight safety and operational continuity. Singapore’s aviation ecosystem, heavily reliant on precision navigation, must grapple with developing technical countermeasures and ensuring robust certification pathways for such technologies. The need for enhanced resilience against interference complicates product design, adds to costs, and demands collaboration between manufacturers, regulators, and air navigation service providers to update standards and testing protocols. Additionally, ensuring that GNSS receivers meet stringent reliability and safety requirements can create barriers to rapid deployment of new technologies, slowing market adoption.

Integration and Regulatory Hurdles

Aviation systems — especially in commercial and military aircraft — are subject to rigorous certification standards that ensure reliability, safety, and interoperability with legacy avionics. This integration challenge is compounded by Singapore’s high regulatory standards and its position as a global aviation hub, where interoperability with systems used by international carriers and air traffic authorities is essential. New GNSS receiver technologies often require substantial testing, validation, and certification to meet both civil aviation safety standards and defense specifications, which can delay time‑to‑market and increase development costs. Furthermore, avionics suppliers and aircraft OEMs must ensure that receiver upgrades do not disrupt avionics harmonization or require extensive retraining of maintenance personnel. Combined with evolving cybersecurity and data protection regulations, these factors create barriers to seamless adoption, forcing manufacturers and aviation stakeholders to invest in extensive compliance frameworks, increase validation cycles, and maintain high documentation standards before deployment.

Opportunities

Advanced GNSS Technologies & Multi‑Constellation Solutions

One of the most promising opportunities in the Singapore GPS GNSS aviation market lies in the adoption and development of advanced GNSS technologies — particularly multi‑constellation and multi‑frequency receivers. Traditional GPS receivers reliant on a single satellite constellation are increasingly being supplemented or replaced with multi‑constellation systems that offer superior accuracy, reliability, and redundancy. These capabilities are especially valuable in dense airspace environments, urban canyons, and during critical flight phases such as precision approaches and automatic landings. Singapore’s aviation stakeholders can leverage this technological shift to introduce higher‑precision navigation solutions, support next‑generation air traffic management systems, and meet stringent safety and efficiency requirements. The integration of GNSS augmentation technologiespresents an opportunity for suppliers to differentiate offerings with enhanced positioning accuracy and integrity monitoring. As aviation moves toward more autonomous and data‑driven operations, GNSS receivers capable of delivering robust, real‑time positioning data will find strong demand both within Singapore’s carriers and in the broader Asia‑Pacific market.

Aftermarket Upgrades & Aviation Digitalization Services

Another compelling opportunity arises from the aftermarket growth driven by aviation digitalization and integrated avionics services. As airlines and MRO providers seek cost‑effective ways to improve aircraft performance and comply with evolving navigation requirements, there is increasing demand for retrofitting and upgrading existing GNSS receivers with modern functionalities — such as enhanced signal processing, real‑time monitoring, and integration with flight management systems. Singapore’s status as a major MRO hub creates a strategic advantage for companies offering upgrade solutions and value‑added services. These aftermarket opportunities include tailor‑made GNSS solutions for aging fleets, predictive maintenance analytics leveraging GNSS data, and consulting services for compliance with updated regulatory frameworks. Additionally, partnerships between GNSS manufacturers, software providers, and aviation integrators can accelerate the delivery of customized solutions that address both operational pain points and regulatory compliance. As digital services become more prevalent in aviation ecosystems — including cloud‑based navigation data, real‑time updates, and IoT connectivity — GNSS receiver providers in Singapore and beyond can position themselves at the forefront of a value‑added services market that extends well beyond hardware sales

Future Outlook

Over the next decade, the Singapore GPS GNSS Receivers Aviation market is expected to grow significantly, fuelled by continuous advancements in GNSS technology and the increasing demand for more precise navigation systems. Additionally, government regulations in aviation safety, combined with the increasing deployment of unmanned aerial vehicles (UAVs) and the modernization of military aviation systems, will further drive market growth. The continued development of integrated GNSS solutions for aviation will also provide new opportunities for innovation and expansion in the market.

Major Players

- Garmin Ltd.

- Honeywell International

- Rockwell Collins

- Thales Group

- L3 Technologies

- Northrop Grumman

- Raytheon Technologies

- Universal Avionics Systems Corporation

- AeroNav GNSS

- Cobham Aerospace Communications

- NovAtel Inc.

- Sensonor AS

- Leica Geosystems

- TruTrak Flight Systems

- Altus Positioning Systems

Key Target Audience

- Airlines

- Helicopter Operators

- UAV Operators

- Military and Defense Agencies

- Aviation Authorities

- Aerospace Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The first phase involves mapping out the core variables influencing the Singapore GPS GNSS Receivers Aviation market, such as technological developments, regulatory changes, and market trends. This is accomplished through extensive desk research, tapping into both secondary and proprietary data sources to establish the key market determinants.

Step 2: Market Analysis and Construction

This phase includes collecting and analysing historical data on market performance and penetration of GNSS systems in aviation. The process will involve looking at industry-specific metrics such as adoption rates, sales performance, and technology trends that directly impact the Singapore market.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are then tested and refined through expert consultations, utilizing in-depth interviews with aviation industry experts. These consultations help verify and validate the initial hypotheses, ensuring that the data collected is comprehensive and accurate.

Step 4: Research Synthesis and Final Output

The final phase involves the synthesis of data gathered, combining both bottom-up and top-down research methods. This phase ensures the accuracy and validity of the market forecasts by cross-referencing the findings with input from aviation experts, leading to a well-rounded and thorough market analysis.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for accurate positioning systems in aviation

Advancements in GNSS technology enhancing system precision

Government regulations pushing for enhanced navigation safety standards - Market Challenges

High cost of advanced GNSS systems

Integration complexities with existing aviation infrastructure

Vulnerability to signal interference and jamming - Market Opportunities

Growth in unmanned aircraft systems (UAV) requiring advanced GNSS systems

Expanding commercial aviation sector in Asia Pacific

Technological advancements enabling more cost-effective GNSS solutions - Trends

Adoption of multi-frequency GNSS systems in aviation

Emerging applications for GNSS in urban air mobility (UAM)

Increasing focus on security in GNSS data transmission

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Airborne GNSS Receivers

Helicopter GNSS Systems

Fixed-Wing Aircraft GNSS Systems

Integrated GNSS Systems for Aviation

Advanced Positioning GNSS Systems - By Platform Type (In Value%)

Commercial Aircraft

Private Aircraft

Military Aircraft

Helicopters

UAVs (Unmanned Aerial Vehicles) - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Retrofit

Aftermarket

Upgrades

System Modifications - By End User Segment (In Value%)

Commercial Aviation

Private Aviation

Military Aviation

Helicopter Operators

UAV Operators - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Distributors and Resellers

Online Platforms

Government Contracts

Aftermarket Service Providers

- Market Share Analysis

- Cross Comparison Parameters (Price, Performance, Integration Capabilities, Customer Support, Innovation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Garmin Ltd.

Rockwell Collins

Honeywell International Inc.

Thales Group

L3 Technologies

Northrop Grumman

Raytheon Technologies

Universal Avionics Systems Corporation

AeroNav GNSS

Cobham Aerospace Communications

NovAtel Inc.

Sensonor AS

Leica Geosystems

TruTrak Flight Systems

Altus Positioning Systems

- Increased adoption of GNSS systems among private and commercial aircraft operators

- Growing interest from UAV operators in integrating GNSS technology for navigation

- Military sector investing in high-precision GNSS systems for tactical advantages

- Governments across Asia promoting GNSS technologies for aviation safety

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035