Market Overview

The Singapore heavy lift helicopter market is valued at USD ~billion, driven by the increasing demand for advanced transportation solutions in industries such as defense, construction, and oil and gas. Government investments in defense and infrastructure projects, coupled with the need for lifting heavy loads in challenging environments, have significantly contributed to the market’s growth. The market’s growth is further fueled by innovations in helicopter technology, offering enhanced performance and cost-efficiency.

Singapore, along with key players in the broader Asia-Pacific region such as the UAE and China, dominates the heavy lift helicopter market. The country’s strategic positioning and robust defense spending, combined with its thriving offshore oil industry, create a significant demand for heavy lift helicopters. Singapore’s focus on modernizing its military and expanding its offshore infrastructure in the oil and gas sector, along with its well-established aerospace and defense sectors, positions it as a leader in the region.

Market Segmentation

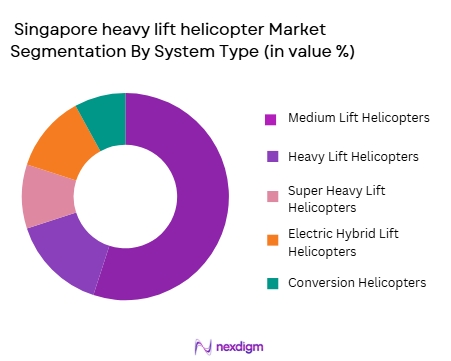

By System Type:

The Singapore heavy lift helicopter market is segmented by system type into medium lift helicopters, heavy lift helicopters, super heavy lift helicopters, electric hybrid lift helicopters, and conversion helicopters. Among these, the heavy lift helicopters segment holds a dominant share due to their extensive use in critical sectors like defense and infrastructure. These helicopters are essential for lifting and transporting heavy equipment, machinery, and personnel to remote areas. The growing construction projects and defense activities in the region, combined with technological advancements in helicopter designs, further boost the demand for heavy lift helicopters, making them the preferred choice for various industries.

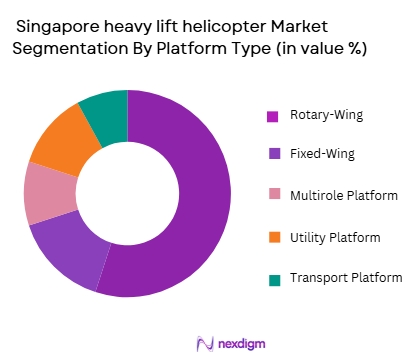

By Platform Type:

The market is segmented by platform type into rotary-wing, fixed-wing, multirole platform, utility platform, and transport platform. Rotary-wing helicopters dominate the platform type segment due to their ability to perform vertical takeoffs and landings, making them highly versatile in a variety of environments. The need for flexibility in construction sites, defense operations, and offshore oil platforms contributes to the market dominance of rotary-wing helicopters. Their ability to access difficult terrain and operate in diverse conditions ensures their prevalence in the heavy lift helicopter market.

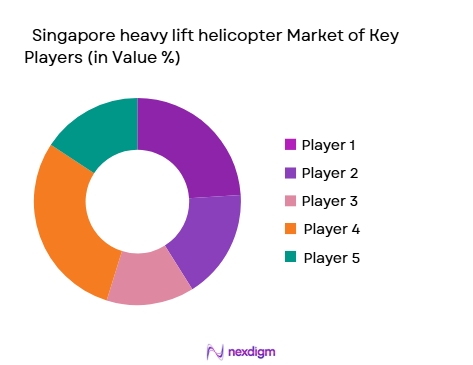

Competitive Landscape

The Singapore heavy lift helicopter market is characterized by strong competition among a few major players, including both global manufacturers and regional specialists. Companies like Airbus Helicopters, Sikorsky Aircraft, and Boeing dominate the market, owing to their established brand presence, technological expertise, and global operational reach. These companies continuously innovate to meet the growing demands of the defense, oil, and construction industries, which drives their market leadership.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Market-Specific Parameter |

| Airbus Helicopters | 1965 | Marignane, France | ~ | ~ | ~ | ~ | ~ |

| Sikorsky Aircraft | 1923 | Stratford, USA | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Rome, Italy | ~ | ~ | ~ | ~ | ~ |

| MD Helicopters | 1966 | Mesa, USA | ~ | ~ | ~ | ~ | ~ |

Singapore heavy lift helicopter Market Analysis

Growth Drivers

Expanding Regional Infrastructure and Emergency Response Needs

Singapore’s strategic role as a regional hub for aviation and logistics supports demand for heavy lift helicopters that can transport large cargo, heavy equipment, and supplies in and out of the city‑state, especially for offshore infrastructure, remote construction, and disaster resilience operations. Across Asia‑Pacific, heavy lift helicopter deployments are increasing for offshore energy support, humanitarian missions and urban infrastructure work — trends that spill over to Singapore’s requirements due to regional cooperation in disaster relief, offshore support, and high‑value logistics missions. As nations in the region invest in capacity for rapid response to environmental and infrastructure challenges, Singapore’s operators benefit from broader fleet demand and shared missions that include heavy lift helicopters.

Defense Modernization and Multi‑Role Utility Expansion

The Asia‑Pacific heavy lift helicopter segment is being driven by defense modernization programs in many countries, where moves toward advanced rotorcraft capable of troop transport, logistics support, and rapid deployment are underway. Heavy lift helicopters provide indispensable utility for military and peace‑time missions due to their ability to carry heavy payloads over long distances and into challenging environments. Singapore’s defense forces — given the strategic importance of rapid mobilization and logistics in regional cooperation settings — can derive value from such platforms. Integration of these helicopters into defense and national security inventories fuels procurement and lifecycle support demand through 2035, aligning with broader Asia‑Pacific defense trajectories.

Market Challenges

High Acquisition & Operational Costs

Heavy lift helicopters are among the most expensive classes of rotorcraft, with high upfront acquisition costs and significant operational expenses tied to fuel, specialized maintenance, and crew training. This premium cost structure can strain public and private budgets in Singapore, especially if heavy lift needs are episodic rather than continuous. The cost barrier is a persistent challenge across the Asia‑Pacific heavy‑lift helicopter market, where operators must balance capability requirements with total cost of ownership and justify investment against alternative transport options or outsourced services. Ensuring sustainable utilization and cost‑efficient operations is essential to overcome fiscal constraints in fleet growth planning.

Skilled Workforce and Infrastructure Requirements

Operating and maintaining heavy lift helicopters demands highly specialized engineering, pilot training, and payload logistics support infrastructure — resources that are limited and often require international expertise. Singapore, despite its strong aerospace services base, may face challenges expanding the skilled workforce specific to heavy lift rotorcraft operations, particularly if demand rises sharply. Without localized advanced training facilities, Singaporean operators might rely on external MRO facilities and certified training programs, increasing dependency on international partners and elevating turnaround times. Developing domestic capabilities in heavy lift maintenance and highly trained flight crews over the next decade will be critical to sustain a competitive edge.

Opportunities

Regional Hub for Heavy Lift Helicopter Operations & Services

Singapore’s established aerospace infrastructure, including Seletar Aerospace Park, positions it uniquely to become a regional operations and support hub for heavy lift helicopters. By investing in specialized Maintenance, Repair, and Overhaul (MRO) facilities tailored for heavy rotorcraft and creating incentives for OEM service centers to establish bases, Singapore can attract business from Southeast Asia and the broader Asia‑Pacific — especially from countries without localized heavy lift support capabilities. A dedicated heavy lift services cluster could offer overhaul services, parts distribution, pilot training, and logistics planning, creating a robust ecosystem that captures aftermarket and operational revenue beyond direct procurement.

Multi‑Sector Applications & Technology Adoption

Emerging applications — from offshore wind and large infrastructure project support to humanitarian disaster response — present opportunities for heavy lift helicopters in Singapore’s market outlook. As renewable energy projects expand offshore around regional waters and large construction initiatives increase, heavy lift helicopter demand rises for transporting heavy modules and equipment. Additionally, advances in rotorcraft technology (fuel‑efficiency improvements, hybrid powerplants, and advanced avionics) can make heavy lift operations more efficient and economically viable over time. Singapore’s progressive tech adoption environment and strong regulatory framework can encourage operators to integrate next‑generation heavy lift platforms that capture emerging mission profiles through 2035.

Future Outlook

Over the next five years, the Singapore heavy lift helicopter market is expected to see sustained growth, driven by technological advancements in rotorcraft, government defense budgets, and an expanding oil and gas sector. Innovations in hybrid-electric propulsion and the increasing demand for helicopter leasing options are expected to create new opportunities. Additionally, ongoing infrastructure development in Southeast Asia will further boost demand for heavy lift helicopters, positioning the market for steady growth.

Major Players

- Bell Helicopter

- Sikorsky Aircraft

- Airbus Helicopters

- Lockheed Martin

- Boeing

- Leonardo

- Russian Helicopters

- MD Helicopters

- Guimbal Helicopters

- Kawasaki Heavy Industries

- China National Aviation Corporation

- Enstrom Helicopter Corporation

- NH Industries

- Aérospatiale

- Kawasaki Heavy Industries

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Helicopter service providers

- Defense contractors

- Construction and engineering firms

- Offshore oil and gas companies

- Helicopter leasing companies

- Aviation training institutions

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying critical variables affecting the Singapore heavy lift helicopter market, including technological advancements, regional defense needs, and oil and gas exploration trends. The data is gathered from authoritative industry reports, government sources, and expert opinions to identify the most impactful drivers and barriers in the market.

Step 2: Market Analysis and Construction

In this phase, we will analyze historical data to understand the current market structure and trends, focusing on market penetration, sector-specific demand, and the relationship between helicopter types and their respective applications in Singapore. Detailed financial data and market statistics will help construct the market model.

Step 3: Hypothesis Validation and Expert Consultation

We will develop hypotheses regarding the key market trends and validate them through consultations with industry experts, including manufacturers, operators, and regulatory bodies. These discussions will provide valuable qualitative insights and help refine our market forecasts.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all gathered data to ensure a comprehensive understanding of the market. This includes final consultations with manufacturers and operators, validating and refining the forecast, and ensuring accuracy before delivering the report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for military and defense operations in Singapore

Increasing infrastructure and construction projects requiring heavy lifting

Growing oil and gas exploration and development in the region - Market Challenges

High cost of procurement and maintenance of heavy lift helicopters

Shortage of skilled workforce for heavy lift helicopter operations

Regulatory hurdles in acquiring and certifying heavy lift helicopters - Market Opportunities

Government investments in defense and infrastructure boosting helicopter procurement

Increased use of helicopters for emergency services in remote areas

Development of electric hybrid helicopters for cost-effective and eco-friendly operations - Trends

Rising adoption of autonomous flight systems in heavy lift helicopters

Integration of advanced materials for weight reduction and increased payload capacity

Expansion of leasing models as an alternative to full ownership - Government Regulations

Strict safety and operational certifications for heavy lift helicopters

Emphasis on environmental regulations to reduce emissions

Government-driven initiatives for defense procurement and heavy lift projects - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Medium lift helicopters

Heavy lift helicopters

Super heavy lift helicopters

Electric hybrid lift helicopters

Conversion helicopters - By Platform Type (In Value%)

Rotary-wing

Fixed-wing

Multirole platform

Utility platform

Transport platform - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Custom-fit

Refurbished

Upgrade and retrofitting - By EndUser Segment (In Value%)

Defense & Military

Aerospace & Aviation

Construction & Heavy Machinery

Oil & Gas

Emergency Medical Services (EMS) - By Procurement Channel (In Value%)

Direct Purchase

Government Tenders

OEM Agreements

Leasing

Aftermarket Service Providers

- Cross Comparison Parameters (Market value, Installed units, System complexity tier, Procurement channels, Regional demand, Market Size & Growth Metrics, Fleet Composition & Demand Drivers, Cost & Economic Parameters)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Bell Helicopter

Sikorsky Aircraft

Airbus Helicopters

Lockheed Martin

Boeing

Leonardo

Russian Helicopters

MD Helicopters

Guimbal Helicopters

Kawasaki Heavy Industries

China National Aviation Corporation

Enstrom Helicopter Corporation

NH Industries

Aérospatiale

Kawasaki Heavy Industries

- Increased demand from defense and military end-users in Singapore

- Growing commercial applications for heavy lift helicopters in construction

- Focus on helicopter fleets for offshore oil and gas operations

- Emerging use of helicopters in disaster response and EMS

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035