Market Overview

The Singapore helicopter blades market is valued at approximately USD ~million, driven by both the growing defense sector and the expanding civil aviation industry. The market’s growth is primarily supported by the nation’s strategic military initiatives, which require modern and efficient rotorcraft, as well as the burgeoning demand for civilian helicopter services. Technological advancements in blade materials, such as composites, are also contributing to market growth, enhancing performance and fuel efficiency in both military and civilian helicopters. The market is further bolstered by the government’s investment in aviation infrastructure and defense modernization programs, which continue to fuel demand for high-quality helicopter components.

Singapore, as a key aviation hub in Southeast Asia, plays a central role in the demand for helicopter blades. The country’s significant defense budget and growing use of helicopters in various sectors such as search and rescue, tourism, and emergency services make it a dominant player in the market. The strategic location of Singapore, its advanced infrastructure, and its role as a regional transport and military hub ensure a steady demand for advanced rotorcraft and their components. The government’s commitment to modernizing its military and civil aviation fleets further drives the demand for high-performance helicopter blades.

Market Segmentation

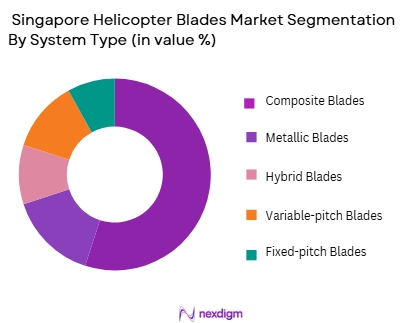

By System Type

The Singapore helicopter blades market is segmented by system type into composite blades, metallic blades, hybrid blades, variable-pitch blades, and fixed-pitch blades. Among these, composite blades have the largest market share, due to their lightweight nature, improved fuel efficiency, and resistance to corrosion. Composite blades are increasingly favored in both military and civilian applications, as they reduce operating costs and increase the overall lifespan of the helicopter. Their advanced material composition, including carbon fiber and fiberglass, also allows for better performance under extreme conditions, which is essential for both military missions and emergency services.

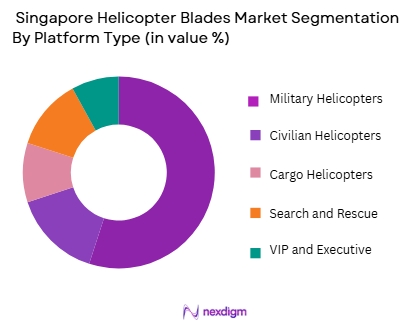

By Platform Type

The platform type segment includes military helicopters, civilian helicopters, cargo helicopters, search and rescue helicopters, and VIP/executive helicopters. The military helicopter segment holds the dominant share, driven by Singapore’s commitment to defense modernization. With increasing geopolitical concerns in Southeast Asia, the demand for advanced military rotorcraft is high, especially for strategic operations requiring specialized blades. The growing need for rotorcraft in defense operations, as well as the government’s focus on enhancing military capabilities, ensures that military helicopters will remain the leading platform type in the market.

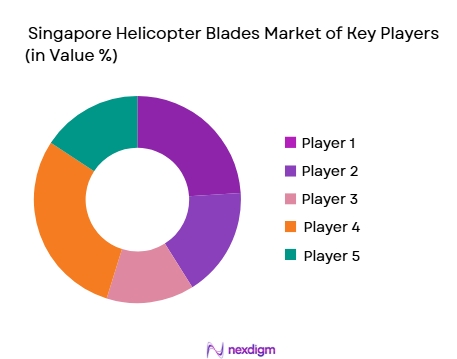

Competitive Landscape

The Singapore helicopter blades market is competitive, with key players from both local and global industries. Companies in this market are engaged in continuous research and development to offer lightweight, fuel-efficient, and durable helicopter blades. The market is primarily driven by the demand from defense sectors and commercial helicopter operators. While a few dominant global players lead the market, local manufacturers also have a significant presence, offering tailored solutions to meet the specific needs of the region’s aviation infrastructure.

Major Players

| Company | Establishment Year | Headquarters | Products | R&D Investment | Manufacturing Capacity | Market Focus |

| Airbus Helicopters | 1997 | France | ~ | ~ | ~ | ~ |

| Bell Helicopter | 1935 | USA | ~ | ~ | ~ | ~ |

| Leonardo Helicopters | 2000 | Italy | ~ | ~ | ~ | ~ |

| Safran Helicopter Engines | 2005 | France | ~ | ~ | ~ | ~ |

| Kaman Aerospace | 1945 | USA | ~ | ~ | ~ | ~ |

Singapore Helicopter Blades Market Analysis

Growth Drivers

Expansion of Aerospace Services & Helicopter Fleet Activity

Singapore’s strategic focus on aerospace services and maintenance positions it as a regional hub for aviation components, including helicopter blades. The country supports a growing helicopter fleet across military, commercial, emergency medical services, and offshore logistics, with bases such as Sembawang supporting numerous rotorcraft operations. Demand for replacement blades and upgraded rotor technology is driven by routine maintenance, fleet modernization, and safety requirements. As Singapore’s aerospace and defense market expands with government investment, the helicopter blades segment benefits from increased civil and military rotorcraft utilization in the Asia‑Pacific region, stimulating steady growth through 2035.

Adoption of Advanced Composite Materials & Blade Technology

Industry trends show a significant shift toward composite helicopter blades that offer higher performance, reduced weight, and greater fuel efficiency. Singapore’s sophisticated aerospace sector — supported by hubs like Seletar Aerospace Park — facilitates the adoption of next‑generation materials and designs. Composite blades enhance aerodynamics, extend service life, and improve vibration and noise performance. As operators demand lighter, more efficient helicopters for both civil and defense use, advanced blade technologies will drive market demand. Collaborations between local and global OEMs and MRO providers further accelerate innovation and application of these high‑performance blades into regional fleets.

️Market Challenges

Limited Domestic Manufacturing Base & Small Market Scale

Singapore’s helicopter blades market remains relatively niche due to its small overall aerospace manufacturing footprint compared with larger global hubs. Local production of highly specialized helicopter components like blades is limited, leading many operators to rely on imports or overseas suppliers. This reliance raises costs and can lengthen lead times, particularly for sophisticated composite blades requiring advanced fabrication capabilities. The limited size of the domestic market also reduces economies of scale for manufacturers considering local investment. These constraints may slow market expansion and make Singapore less competitive unless targeted strategies support domestic component manufacturing growth.

Stringent Regulatory & Certification Requirements

Helicopter blades are critical safety components, subject to stringent aviation regulations and certification standards enforced by the Civil Aviation Authority of Singapore (CAAS) and aligned with global norms like EASA and FAA. Meeting these rigorous airworthiness and performance criteria requires significant testing, documentation, and compliance efforts from suppliers and MRO providers. These regulatory demands can increase development and operational costs while lengthening time to market for new blade technologies. Maintaining consistent quality control and meeting evolving environmental, noise, and performance standards further complicates product introduction and service delivery in the Singapore context.

Opportunities

Growth of MRO and Aftermarket Services

Singapore’s role as a key aviation services hub in Asia‑Pacific creates opportunities for expansion of maintenance, repair, and overhaul (MRO) activities for helicopter blades. Operators increasingly seek localized MRO capabilities to reduce downtime and costs, making Singapore an attractive base for specialized rotorcraft component services. Establishing advanced inspection and refurbishment facilities — potentially in partnership with global OEMs and MRO leaders — can capture aftermarket demand from regional operators. Offering lifecycle services such as predictive maintenance, blade refurbishment, and performance upgrades enhances value propositions and bolsters Singapore’s aerospace services ecosystem through 2035.

Regional Export & Collaboration Potential

As a major aviation hub with strong government support for aerospace growth, Singapore can leverage its strategic position to export helicopter blade technologies and services across Southeast Asia. Collaborations with international OEMs, defense contractors, and regional helicopter operators can open new markets for both blade supply and aftermarket services. Investments in R&D and technology partnerships can drive innovation in lightweight composites and performance‑enhancing designs tailored to diverse operational needs. By aligning with regional fleet growth — particularly in tourism, offshore services, and defense modernization — Singapore’s helicopter blades segment can expand its market reach beyond domestic demand.

Future Outlook

Over the next decade, the Singapore helicopter blades market is expected to witness significant growth. The continued expansion of both the military and civilian helicopter sectors, coupled with advancements in materials and technology, will fuel the demand for more advanced helicopter blades. The government’s investment in defense and infrastructure development will further enhance the need for high-performance rotorcraft and their components. Additionally, the increasing importance of sustainability and fuel efficiency in aviation will drive innovations in composite blades, opening new opportunities for the market.

Major Players

- Airbus Helicopters

- Bell Helicopter

- Leonardo Helicopters

- Safran Helicopter Engines

- Kaman Aerospace

- Sikorsky Aircraft

- MH Industries

- DART Aerospace

- Rotorcraft Support

- GE Aviation

- Honeywell Aerospace

- L-3 Communications

- Helicopter Services

- Aero Industries

- Lockheed Martin

Key Target Audience

- Military Agencies

- Civil Aviation Authorities

- Defense Contractors

- Aerospace Manufacturers

- Investments and Venture Capitalist Firms

- Aircraft Maintenance Providers

- Government and Regulatory Bodies

- Private Sector Helicopter Operators

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the critical variables influencing the Singapore Helicopter Blades market, such as defense spending, technological advancements in helicopter blade design, and regional demand for helicopter services. Extensive desk research, leveraging secondary and proprietary databases, will help gather industry-level data.

Step 2: Market Analysis and Construction

In this phase, historical data will be analyzed to assess market penetration, customer preferences, and revenue generation within the Singapore Helicopter Blades market. The analysis will focus on key performance indicators like market size, growth trends, and major drivers.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through expert consultations and interviews with industry professionals in aerospace, manufacturing, and defense sectors. Insights gained from these consultations will be used to refine the market data and assumptions.

Step 4: Research Synthesis and Final Output

The final phase will synthesize data from secondary sources and expert insights. Detailed findings will be presented to ensure the accuracy of market forecasts and strategies, providing a comprehensive view of the Singapore Helicopter Blades market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for military and defense helicopters in the region

Technological advancements in helicopter blade manufacturing

Expansion of civil aviation sector and tourism in Singapore - Market Challenges

High maintenance and operational costs of helicopter blades

Lack of skilled workforce for advanced manufacturing techniques

Volatility in raw material prices for blade manufacturing - Market Opportunities

Emerging demand for lightweight composite materials in helicopter blades

Growing market for retrofit and aftermarket blade solutions

Increase in government defense budgets boosting helicopter procurements - Trends

Shift towards environmentally friendly and energy-efficient helicopter blades

Automation and robotics integration in manufacturing processes

Custom blade solutions to meet specific helicopter requirements - Government regulations

Strict aviation safety regulations in Singapore

Certification standards for new composite materials

Compliance with environmental regulations for noise reduction - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Composite Blades

Metallic Blades

Hybrid Blades

Variable-pitch Blades

Fixed-pitch Blades - By Platform Type (In Value%)

Military Helicopters

Civilian Helicopters

Cargo Helicopters

Search and Rescue Helicopters

VIP and Executive Helicopters - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Refurbishment Fitment

Upgraded Fitment

Custom Fitment - By EndUser Segment (In Value%)

Military

Commercial Airlines

Private Sector

Search and Rescue Agencies

Government Agencies - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Through OEMs

Third-Party Distributors

Government Contracts

Aftermarket Suppliers

- Cross Comparison Parameters (Market Share, Competitive Pricing, Technological Innovation, Customer Service, Brand Reputation, Market Value, Fleet Size & Expansion, Technological Sophistication)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus Helicopters

Bell Helicopter

Leonardo Helicopters

Safran Helicopter Engines

Kaman Aerospace

Rotorcraft Support

GE Aviation

Honeywell Aerospace

L-3 Communications

Helicopter Services

Aero Industries

- Growing demand from Singapore’s military sector for advanced helicopter blades

- Increasing need for civilian helicopter blades in emergency services

- Singapore’s strategic location boosting demand for military-grade helicopters

- Rapid expansion of the tourism industry increasing civilian helicopter usage

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035