Market Overview

The Singapore helicopter engines market is valued at approximately USD ~million in 2024. The market growth is primarily driven by the country’s expanding defense sector and increasing demand for civilian helicopter services. The significant investments in military helicopter fleets, as part of defense modernization, and the growing use of helicopters in commercial sectors like tourism, emergency medical services, and offshore support, contribute to the demand for advanced helicopter engines. Furthermore, technological advancements in engine efficiency and fuel-saving technologies continue to bolster the market.

Singapore is a dominant player in the Southeast Asian helicopter engines market due to its strong defense capabilities and strategic geographical location. The country’s capital, Singapore, plays a vital role as the central hub for both military and civilian helicopter operations. Singapore’s investments in military modernization, particularly in air defense systems and emergency services, drive the demand for advanced helicopter engines. Additionally, the city’s status as an aviation and maritime hub further strengthens the market’s growth prospects, making it a key driver in the region.

Market Segmentation

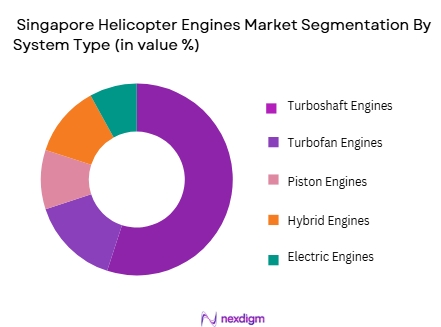

By System Type

The Singapore helicopter engines market is segmented by system type into turboshaft engines, turbofan engines, piston engines, hybrid engines, and electric engines. Turboshaft engines have the largest market share, primarily due to their widespread use in both military and commercial helicopters. These engines are known for their high power-to-weight ratio, making them ideal for helicopters that require reliable and efficient performance in demanding conditions. The continued growth of Singapore’s defense sector, combined with the expansion of helicopter services for offshore energy and tourism sectors, drives the sustained demand for turboshaft engines.

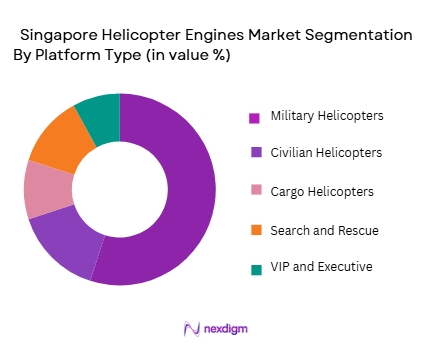

By Platform Type

The platform type segment includes military helicopters, civilian helicopters, cargo helicopters, search and rescue helicopters, and VIP/executive helicopters. Military helicopters dominate the market, driven by Singapore’s robust defense spending and ongoing modernization of its military helicopter fleet. The demand for these helicopters is primarily for surveillance, transport, and combat operations. As part of its strategic defense initiatives, the country continues to expand its fleet, which requires high-performance helicopter engines to meet demanding military operational requirements.

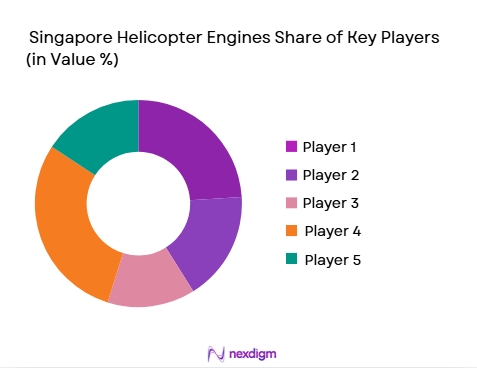

Competitive Landscape

The Singapore helicopter engines market is dominated by a few major international players, including renowned aerospace and defense companies. These players have established strong market positions by providing advanced and efficient engine technologies tailored for both military and civilian helicopters. The competitive landscape is characterized by high R&D investments in engine technology, efficiency improvements, and compliance with aviation safety and regulatory standards. These leading companies continue to innovate to meet the growing demand for next-generation helicopter engines.

Major Players

| Company | Establishment Year | Headquarters | Products | R&D Investment | Manufacturing Capacity | Market Focus |

| GE Aviation | 1917 | USA | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | UK | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | USA | ~ | ~ | ||

| Safran Helicopter Engines | 2005 | France | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1942 | USA | ~ | ~ | ~ | ~ |

Singapore Helicopter Engines Market Analysis

Growth Drivers

Strategic MRO & Aerospace Hub Expansion

Singapore’s aerospace sector is rapidly expanding as a regional Maintenance, Repair, and Overhaul (MRO) hub, serving both civil and defense rotorcraft engines. The government and industry investments into aerospace infrastructure support engine servicing, component repair, and overhaul capabilities, which drives demand for helicopter engines and related services. Singapore’s strategic location and world‑class aviation ecosystem attract global OEMs, airlines, and defense forces seeking reliable, certified engine maintenance and replacement services. This regional MRO emphasis bolsters engine demand not just for new installations, but also ongoing lifecycle support, contributing to market growth through 2035.

Rising Helicopter Utilization Across Sectors

Helicopters in Singapore serve expanding civil sectors such as emergency medical services, offshore logistics, business travel, and aerial tourism, in addition to defense and homeland security operations. Globally, the helicopter engines market is projected to grow strongly, driven by higher aircraft production and upgrades to more efficient powerplants — a trend that extends into Asia Pacific markets like Singapore. Engine manufacturers continue to innovate toward fuel‑efficient turboshaft designs and digital control systems, further attracting operators focused on performance and lower operational costs. This cross‑sector helicopter utilization stimulates demand for robust engine solutions.

Market Challenges

Limited Domestic Manufacturing & Engine Production

Singapore’s aerospace ecosystem excels in MRO and services, but local production of helicopter engines is limited compared with major regional and global manufacturing hubs. This reliance on imports for advanced turboshaft engines — combined with the need for foreign supply chains — can lead to longer lead times and cost pressures for operators. Engine parts, precision components, and full powerplants often come from overseas manufacturers, exposing the market to global supply chain disruptions and geopolitical risks. Building a stronger domestic capabilities base for engine production remains a key challenge.

Regulatory Complexity & Certification Requirements

Helicopter engines are safety‑critical systems that must meet stringent airworthiness and environmental standards set by bodies like the Civil Aviation Authority of Singapore (CAAS) and international regulators. Navigating complex approval and certification processes for new engine technologies or imported parts can delay market entry and increase compliance costs for providers. Evolving regulations — especially around emissions, noise, and sustainability — place additional burdens on engine integration, testing, and aftermarket servicing. These regulatory and certification barriers pose ongoing challenges that could slow technology adoption and operational expansion.

Opportunities

Advanced Technology Adoption & Hybrid Propulsion

The global helicopter engines market is trending toward fuel‑efficient, digital control, and hybrid propulsion systems, offering Singapore operators opportunities to adopt next‑generation technologies. Innovations such as improved turboshaft designs, enhanced engine health monitoring, and early-stage hybrid‑electric systems can reduce fuel consumption and maintenance costs while meeting environmental goals. Singapore’s position as a tech‑savvy aviation hub — combined with industry partnerships — creates fertile ground for early adoption and demonstration of these advanced powerplants. Tailoring these solutions to meet civil, defense, and urban air mobility needs could unlock further engine market growth.

Regional Service & Export Growth Potential

Singapore can leverage its strong MRO infrastructure and regulatory standing to serve as a regional helicopter engines service hub for Southeast Asia and beyond. By expanding engine overhaul centers, test facilities, and skilled workforce training programs, Singaporean firms can attract business from neighboring countries that lack such capabilities. Strategic alliances with engine OEMs and defense partners — for example, linking with global engine manufacturers for authorized service support — could broaden revenue streams through exports of maintenance services, parts distribution, and engine upgrades. This export‑oriented growth presents a significant market opportunity by 2035.

Future Outlook

Over the next decade, the Singapore helicopter engines market is expected to experience continued growth, driven by the country’s defense spending, technological advancements in helicopter engine design, and increasing commercial applications for helicopters. The demand for high-performance and fuel-efficient engines is expected to rise, particularly in the military and offshore sectors. Furthermore, the potential adoption of hybrid and electric engines in the coming years may contribute to a shift in the market, offering new opportunities for innovation and expansion.

Major Players

- GE Aviation

- Rolls-Royce

- Pratt & Whitney

- Safran Helicopter Engines

- Honeywell Aerospace

- Turbomeca

- Kaman Aerospace

- MTU Aero Engines

- L-3 Communications

- Lockheed Martin

- Sikorsky Aircraft

- Airbus Helicopters

- Leonardo Helicopters

- UTC Aerospace Systems

- Turbomeca

Key Target Audience

- Military Agencies

- Civil Aviation Authorities

- Defense Contractors

- Aerospace Manufacturers

- Investments and Venture Capitalist Firms

- Aircraft Maintenance Providers

- Government and Regulatory Bodies

- Private Sector Helicopter Operators

Research Methodology

Step 1: Identification of Key Variables

The first step in the research methodology is identifying critical market variables such as defense spending, technological advancements, and growing civilian helicopter services. This involves extensive secondary research using industry reports, government publications, and aviation data to map out the key factors influencing the market.

Step 2: Market Analysis and Construction

In this phase, historical data on the Singapore helicopter engines market will be analyzed. This includes evaluating past growth patterns, market penetration, and technological advancements. Key metrics like market size and growth trends will be used to build a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through expert consultations with industry professionals in aerospace and defense sectors. This phase helps refine initial assumptions, gain insights into market developments, and validate trends identified during the previous phase.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the gathered data and expert insights to produce a comprehensive market analysis. This report will provide a detailed forecast of the Singapore helicopter engines market, offering actionable insights to industry stakeholders and decision-makers.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased military spending and modernization of defense capabilities

Expansion of civilian aviation sector and helicopter-based services

Technological advancements in engine technologies improving efficiency and reducing costs - Market Challenges

High maintenance and operational costs of advanced helicopter engines

Dependency on foreign suppliers for critical engine components

Regulatory challenges related to safety and certification standards - Market Opportunities

Rising demand for hybrid and electric engines in helicopters

Emerging markets in the Middle East and North Africa driving demand for helicopters

Opportunities in the aftermarket engine service sector due to increasing fleet age - Trends

Increased focus on fuel efficiency and low-emission engines

Technological advancements in engine noise reduction

Integration of artificial intelligence and digital monitoring systems in engines - Government regulations

Aviation safety standards and regulations for engine performance

Certification requirements for new engine technologies

Environmental regulations on emissions and fuel efficiency - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Turboshaft Engines

Turbofan Engines

Piston Engines

Hybrid Engines

Electric Engines - By Platform Type (In Value%)

Military Helicopters

Civilian Helicopters

Cargo Helicopters

Search and Rescue Helicopters

VIP and Executive Helicopters - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Refurbishment Fitment

Upgraded Fitment

Custom Fitment - By EndUser Segment (In Value%)

Military

Commercial Airlines

Private Sector

Search and Rescue Agencies

Government Agencies - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Through OEMs

Third-Party Distributors

Government Contracts

Aftermarket Suppliers

- Cross Comparison Parameters (Market Share, Competitive Pricing, Technological Innovation, Customer Service, Brand Reputation, Market Value, CAGR, Volume Demand, Fleet Size & Expansion, Utilization Metrics, Performance Benchmarks)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus Helicopters

GE Aviation

Rolls-Royce

Pratt & Whitney

Safran Helicopter Engines

Honeywell Aerospace

Turbomeca

Kaman Aerospace

MTU Aero Engines

L-3 Communications

Lockheed Martin

Sikorsky Aircraft

Airbus Group

Leonardo Helicopters

United Technologies Corporation

- Increasing demand from Singapore’s defense sector for advanced helicopter engines

- Expansion of commercial and tourism helicopter services in Singapore

- Singapore’s focus on emergency services and search-and-rescue capabilities

- Growth in private sector helicopter usage for executive and VIP transport

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035