Market Overview

The Singapore Helicopter Ice Protection Systems market is valued based on a comprehensive analysis of past and present market conditions. In 2023, the market achieved a size of USD ~ million, driven primarily by increasing helicopter operations in cold weather regions and the growing demand for safety systems in both commercial and military aviation. Technological advancements and regulatory requirements continue to be key drivers, with the increasing adoption of advanced anti-icing and de-icing systems in helicopters. These factors combined lead to steady market growth and the expansion of infrastructure, which supports further industry development.

Singapore, being a global aviation hub, dominates the helicopter ice protection systems market due to its strategic location in Southeast Asia and its significant aviation infrastructure. The demand for high-quality helicopter safety systems is bolstered by Singapore’s military operations and increasing commercial helicopter services, including air tourism and emergency medical services. Additionally, other countries in the region, such as Japan and South Korea, also contribute significantly to the market due to their cold climate conditions and strong aviation sectors, reinforcing the demand for advanced ice protection systems.

Market Segmentation

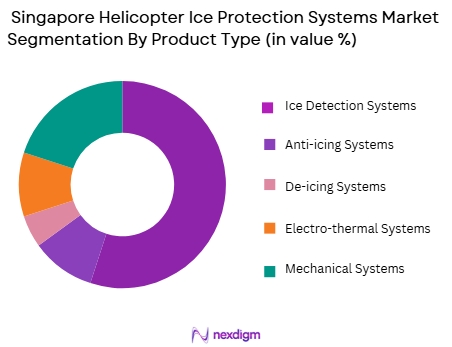

By Product Type

The Singapore Helicopter Ice Protection Systems market is segmented by product type into ice detection systems, anti-icing systems, de-icing systems, electro-thermal systems, and mechanical systems. Among these, anti-icing systems hold a dominant market share due to their critical role in preventing ice accumulation on helicopters during flight. Anti-icing systems are essential for maintaining safety, particularly in regions with unpredictable weather conditions. As commercial and military helicopters increasingly operate in colder climates, the need for reliable anti-icing systems has surged, contributing to the dominance of this segment.

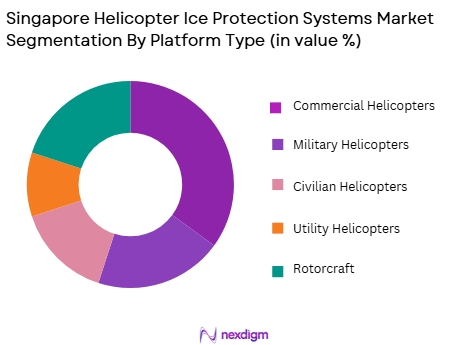

By Platform Type

The market is also segmented by platform type into commercial helicopters, military helicopters, civilian helicopters, utility helicopters, and rotorcraft. The commercial helicopter segment leads the market due to the high demand for helicopter services in tourism, medical evacuations, and private transportation. Commercial helicopters operating in colder regions require reliable ice protection systems to ensure safety, especially during high-altitude flights or in mountainous areas. This demand, coupled with advancements in helicopter technology, has solidified the dominance of the commercial helicopter segment in the market.

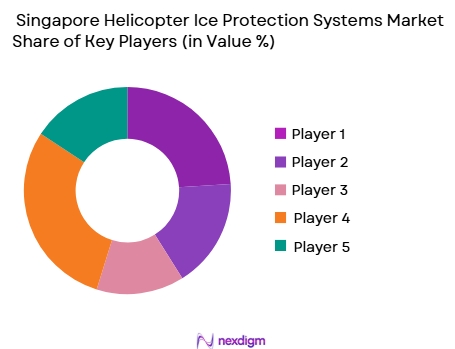

Competitive Landscape

The Singapore Helicopter Ice Protection Systems market is dominated by a few key players, including both local and global manufacturers that provide a range of products and services tailored to the aviation industry. This consolidation highlights the significant influence of these major companies, with their technological expertise and strong market presence.

| Company | Year Established | Headquarters | Product Range | Technological Innovation | Market Focus | Global Presence |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1930 | USA | ~ | ~ | ~ | ~ |

| B/E Aerospace | 1987 | USA | ~ | ~ | ~ | ~ |

| Sikorsky Aircraft | 1923 | USA | ~ | ~ | ~ | ~ |

| Airbus Helicopters | 1992 | France | ~ | ~ | ~ | ~ |

Singapore Helicopter Ice Protection Systems Market Analysis

Growth Drivers

Increasing Aircraft Fleet in Singapore

The growth of Singapore’s aircraft fleet is a key driver for the Helicopter Ice Protection Systems market. As of 2024, Singapore has a growing aviation infrastructure, with the Civil Aviation Authority of Singapore (CAAS) reporting over ~ helicopters registered in the country. The increase in both military and commercial helicopter usage drives demand for reliable ice protection systems. Additionally, Singapore’s strategic location as a regional hub for air travel boosts aircraft operations, creating a need for advanced safety systems. The increasing frequency of international and domestic flights necessitates enhanced ice protection to ensure safety and efficiency.

Rising Focus on Aviation Safety

Singapore’s commitment to aviation safety is reflected in its investments in modernizing airport infrastructure and helicopter fleets, which directly impacts the demand for advanced ice protection systems. The Ministry of Transport’s initiatives, such as increasing surveillance and weather monitoring systems at airports, have led to improvements in operational safety. In addition, the Singaporean government is enhancing public-private partnerships to implement new technologies, including ice protection systems, to maintain high standards of safety in the aviation sector. These efforts are expected to stimulate further market growth.

Market Challenges

High Initial Cost of Installation

One of the key challenges facing the helicopter ice protection systems market in Singapore is the high initial installation cost of these advanced systems. While the market for helicopter safety equipment is growing, the cost of installing ice protection systems is still a significant barrier, especially for small to medium-sized fleet operators. The price of these systems can be upwards of USD ~ per unit, which is a considerable financial burden for some operators. As of 2024, this high cost limits adoption in some segments of the aviation market.

Technical Complexity and Maintenance Challenges

The complexity of installing and maintaining helicopter ice protection systems poses a significant challenge. Singapore’s climate, with its occasional cold weather and humid conditions, demands that these systems be robust and adaptable. The advanced technology embedded in these systems requires highly specialized maintenance and skilled technicians, which increases operating costs. Currently, there is a lack of sufficient skilled labor, creating an additional challenge for fleet operators. Maintenance for such systems can cost around SGD ~ annually for every helicopter, significantly impacting operational budgets.

Opportunities

Increasing Air Traffic in Singapore

The continuous rise in air traffic in Singapore presents significant opportunities for the helicopter ice protection systems market. Singapore Changi Airport, one of the busiest hubs in the Asia-Pacific region, is experiencing a consistent increase in the number of helicopter flights. In 2024, Changi Airport recorded over ~ helicopter arrivals and departures, indicating strong demand for safety systems, including ice protection. The continued growth of air traffic in and out of Singapore will likely lead to expanded use of ice protection systems to ensure safety during operations in cold and adverse weather conditions.

Technological Advancements in Ice Protection Systems

The rapid technological advancements in helicopter ice protection systems present lucrative opportunities for market growth. Innovations in thermal and anti-icing technologies, such as the use of advanced composites and anti-icing coatings, are being integrated into modern systems. As of 2024, there is an increasing demand for more efficient, lightweight, and energy-efficient ice protection systems that reduce operational costs. These innovations create opportunities for manufacturers to develop next-generation products to meet the growing needs of the aviation sector in Singapore and beyond.

Future Outlook

Over the next decade, the Singapore Helicopter Ice Protection Systems market is expected to show significant growth, driven by continuous government support, technological advancements, and increasing demand for helicopters operating in cold regions. With growing commercial helicopter services in Southeast Asia and increasing military investments, the demand for efficient and reliable ice protection systems is expected to rise. These systems will continue to evolve with innovations like electro-thermal technology and AI-based ice detection systems, ensuring the future market remains robust.

Major Players

- Honeywell Aerospace

- Collins Aerospace

- B/E Aerospace

- Sikorsky Aircraft

- Airbus Helicopters

- Bell Helicopter

- Russian Helicopters

- Safran Helicopter Engines

- Turbomeca

- GKN Aerospace

- Denso Corporation

- Eaton Corporation

- Avidyne Corporation

- UTC Aerospace Systems

- L3 Technologies

Key Target Audience

- Aviation manufacturers and suppliers

- Military and defense contractors

- Helicopter operators

- Helicopter maintenance and service providers

- Regulatory bodies

- Aircraft safety engineers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The first step involves constructing a detailed ecosystem map that identifies the critical variables impacting the market. This includes key stakeholders like helicopter manufacturers, operators, service providers, and regulatory bodies. We leverage secondary data from industry reports and proprietary databases to comprehensively map the dynamics of the Singapore Helicopter Ice Protection Systems market.

Step 2: Market Analysis and Construction

In this phase, we compile historical and current market data. The analysis covers market trends, growth drivers, and challenges while assessing market penetration and service quality. We perform a comparative analysis of leading product segments and evaluate their revenue generation potential to forecast future market developments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed in earlier phases are validated through expert consultations. These are conducted through direct interviews with industry specialists and practitioners, who provide in-depth insights into operational challenges, technology adoption, and market opportunities.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing data collected from various sources to provide a validated, comprehensive analysis. This includes feedback from manufacturers and service providers to corroborate the statistics and projections derived from previous steps, ensuring a thorough market forecast.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Helicopter Fleet Size

Technological Advancements in Ice Protection Systems

Expansion of Helicopter Operations in Cold Regions

- Market Challenges

High Initial Cost of Ice Protection Systems

Maintenance and Operational Costs of Advanced Systems

Regulatory and Compliance Challenges - Market Opportunities

Emerging Markets in Cold Regions

Development of More Efficient and Cost-Effective Systems

Increasing Demand for Helicopter Safety Features - Trends

Rising Adoption of Composite Materials

Advancements in Automated Ice Detection Systems

Integration of AI and IoT in Helicopter Ice Protection - Government regulations

ICAO (International Civil Aviation Organization) Certification Guidelines

FAA (Federal Aviation Administration) Standards

EASA (European Union Aviation Safety Agency) Guidelines - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Ice Detection Systems

Anti-icing Systems

De-icing Systems

Electro-thermal Systems

Mechanical Systems - By Platform Type (In Value%)

Commercial Helicopters

Military Helicopters

Civilian Helicopters

Utility Helicopters

Rotorcraft - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket Retrofit

Line-fitment

Aftermarket Replacement

End-of-life Refurbishment - By EndUser Segment (In Value%)

Commercial Airlines

Military & Defense

Rescue Operations

Private Helicopter Operators

Utility Service Providers - By Procurement Channel (In Value%)

Direct Purchases

Online Retailers

Distributors & Dealers

OEM Partnerships

Government Contracts

- Cross Comparison Parameters (Market Share, Product Type, Technology Adoption, Regional Presence, Pricing Strategy, Regulatory Compliance, Installation & Maintenance Support, After‑Sales Service, Certification Standards, Warranty Terms, Supplier Reliability, Customization Capability, System Weight & Power Efficiency, Total Cost of Ownership)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Honeywell Aerospace

B/E Aerospace

UTC Aerospace Systems

L3 Technologies

Collins Aerospace

Denso Corporation

Eaton Corporation

GKN Aerospace

Avidyne Corporation

Sikorsky Aircraft Corporation

Airbus Helicopters

Bell Helicopter

Russian Helicopters

Safran Helicopter Engines

Turbomeca

- Increasing Demand from Commercial Airlines

- Government Defense Contracts for Ice Protection

- Growing Need for Helicopter-based Rescue Missions

- Private Operators Investing in Safety Systems

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035