Market Overview

The Singapore helicopter services market is valued at approximately USD ~million in 2023, with a forecasted growth trajectory driven by a combination of high demand for air transport solutions and infrastructural advancements in the region. The market is primarily influenced by the increased adoption of helicopter services in sectors like tourism, corporate business, medical transport, and oil and gas exploration. Moreover, with continuous investment in aviation infrastructure, including heliports and maintenance facilities, the market is set to expand. The adoption of eco-friendly helicopter models and government support for sustainable transport options further fuels this growth.

Singapore is the dominant market for helicopter services in Southeast Asia, owing to its strategic geographic location, robust tourism sector, and established business environment. The city-state’s role as a global business hub, coupled with increasing tourism, has led to heightened demand for private air travel. Additionally, Singapore’s significant presence in the oil and gas industry fuels the need for offshore transportation. The government’s continuous focus on infrastructure development and stringent regulatory standards has created a stable environment for helicopter operations, attracting both international and local operators to the region.

Market Segmentation

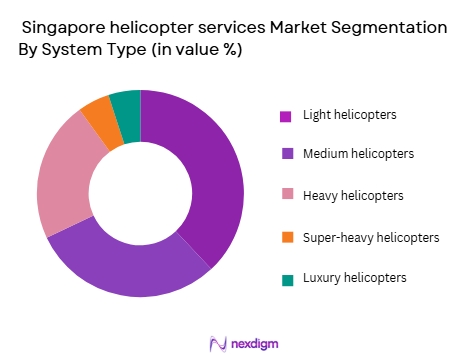

By System Type

The Singapore helicopter services market is segmented into light helicopters, medium helicopters, heavy helicopters, super-heavy helicopters, and luxury helicopters. Among these, the light helicopters segment holds the dominant market share. This is largely due to their cost-effectiveness, flexibility, and widespread use in short-distance travel, making them the preferred choice for both business and tourism sectors. Light helicopters are also favored for medical emergencies, offering fast, efficient, and relatively affordable air transport solutions for emergency medical services.

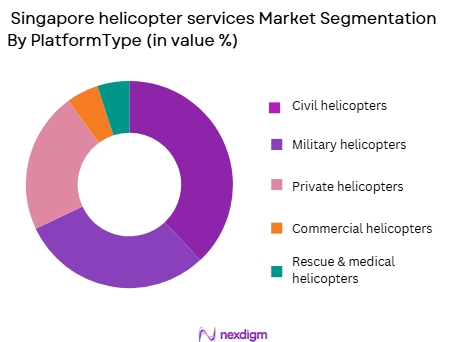

By Platform Type

The market is further segmented by platform type into civil helicopters, military helicopters, private helicopters, commercial helicopters, and rescue and medical helicopters. The civil helicopters segment is projected to dominate the market share, driven by high demand in corporate, tourism, and government sectors. The civil helicopter market benefits from Singapore’s status as a regional business hub and popular tourism destination. Additionally, the growing preference for helicopter tourism, especially for scenic flights over the city and its coastline, further bolsters the civil helicopter segment’s dominance.

Competitive Landscape

The Singapore helicopter services market is dominated by a select group of key players, which include local and global helicopter operators. Companies like SATS Ltd., Airbus Helicopters, and Bell Helicopter have established a strong presence due to their extensive fleets, operational expertise, and brand recognition. The market is characterized by a relatively high level of consolidation, with these players leading in both passenger and cargo transport services.

| Company Name | Establishment Year | Headquarters | Fleet Size | Service Type | Specialization | Global Reach | Operational Footprint |

| SATS Ltd. | 1947 | Singapore | ~ | ~ | ~ | ~ | ~ |

| Airbus Helicopters | 1994 | France | ~ | ~ | ~ | ~ | ~ |

| Bell Helicopter | 1935 | USA | ~ | ~ | ~ | ~ | ~ |

| Leonardo Helicopters | 1981 | Italy | ~ | ~ | ~ | ~ | ~ |

| Sikorsky Aircraft | 1923 | USA | ~ | ~ | ~ | ~ | ~ |

Singapore helicopter services Market Analysis

Growth Drivers

Rising Demand for Luxury and Tourism Travel:

Singapore’s tourism sector is witnessing substantial growth, with an increasing number of high-net-worth individuals seeking unique travel experiences. Helicopter services are becoming popular for scenic flights, offering aerial views of the city and surrounding islands. The increasing appeal of helicopter tourism is driving demand in the market, especially for private, luxury, and exclusive tours.

Government Support and Infrastructure Development:

The Singaporean government continues to invest in aviation infrastructure, including the development of more heliports, helipads, and maintenance facilities. These advancements enhance accessibility and operational efficiency, fueling the growth of helicopter services. Additionally, government regulations ensure safety and standardization, providing a stable environment for market growth.

Market Challenges:

High Operational Costs:

Helicopter services are capital-intensive, requiring significant investments in maintenance, fuel, and skilled personnel. These high operational costs can be a barrier for new operators and reduce profit margins, making it challenging for companies to remain financially sustainable in the long term. These costs can also make helicopter services less competitive against other forms of transportation.

Regulatory and Safety Constraints:

The Singaporean helicopter services market is subject to strict regulatory and safety standards set by the Civil Aviation Authority of Singapore (CAAS). While these regulations are necessary for ensuring safety, they can also slow down the approval process for new routes or services. Additionally, stringent safety requirements increase the cost of operations and can limit flexibility for operators.

Opportunities:

Expansion of Air Ambulance Services:

The increasing demand for efficient medical evacuation and emergency transport services presents significant growth opportunities in the helicopter services market. Air ambulance services, particularly for offshore workers in the oil and gas industry and remote areas, are in high demand, and companies can capitalize on this by expanding their medical transport fleets.

Technological Innovations and Eco-Friendly Solutions:

The development of greener helicopter models that offer lower emissions and better fuel efficiency presents a growing opportunity. Technological advancements, such as electric helicopters and improved navigation systems, can reduce operational costs and appeal to environmentally conscious consumers, contributing to the market’s long-term growth potential.

Future Outlook

Over the next ~years, the Singapore helicopter services market is expected to show steady growth, driven by continuous government support for infrastructure development, increased demand for rapid and efficient transportation, and advancements in helicopter technology. The market is also poised to benefit from the rising preference for eco-friendly helicopter models, with operators focusing on reducing carbon emissions. The expansion of the tourism sector and increasing adoption of helicopters for emergency medical services are expected to contribute significantly to the market’s future growth.

Major Players

- SATS Ltd.

- Airbus Helicopters

- Bell Helicopter

- Leonardo Helicopters

- Sikorsky Aircraft

- Heli-One

- RSG Helicopters

- Rotorcraft Leasing Company

- Helicopter Association International

- Global Helicopter Service

- Wright Helikopter Services

- Air Logistics Group

- AgustaWestland

- Sikorsky Aircraft

- Helicopters Australia

Key Target Audience

- Aviation Equipment Manufacturers

- Tourism Operators

- Oil and Gas Companies

- Government and Regulatory Bodies

- Medical Transport Services

- Corporate Transportation Providers

- Investments and Venture Capitalist Firms

- Aviation Infrastructure Development Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying key stakeholders and variables that impact the Singapore helicopter services market. This includes understanding the roles of helicopter operators, tourism companies, and the regulatory bodies. The goal is to define the key drivers, challenges, and opportunities in the market, based on data gathered from secondary sources and industry reports.

Step 2: Market Analysis and Construction

In this phase, we will analyze historical data from various sources to assess the performance of different helicopter segments, including system types and platforms. This analysis will focus on understanding market penetration and trends over time, helping to forecast future demand for each segment.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with industry experts, including helicopter operators, aviation regulators, and technology suppliers. This phase aims to cross-verify initial data and gather additional insights on market dynamics, operational challenges, and growth drivers.

Step 4: Research Synthesis and Final Output

The final phase involves consolidating all research findings, including expert opinions, secondary data, and market forecasts, into a comprehensive report. This will include an in-depth analysis of market size, segmentation, trends, and future projections, ensuring the data is both accurate and actionable for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for tourism and scenic helicopter services

Growing oil & gas sector with need for offshore transportation

Rising investment in infrastructure for heliports and maintenance - Market Challenges

High operational costs and maintenance

Limited availability of qualified pilots

Stringent regulatory and safety standards - Market Opportunities

Growing market for helicopter tourism

Rising demand for air ambulance and medical transport services

Opportunities in the government and law enforcement sector - Trends

Shift toward eco-friendly helicopters

Increased use of digital platforms for booking and tracking

Technological advancements in helicopter navigation systems - Government regulations

Air traffic control and helicopter operational rules

Environmental standards for helicopter emissions

Safety and certification standards for helicopter operations - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Light helicopters

Medium helicopters

Heavy helicopters

Super heavy helicopters

Luxury helicopters - By Platform Type (In Value%)

Civil helicopters

Military helicopters

Private helicopters

Commercial helicopters

Rescue and medical helicopters - By Fitment Type (In Value%)

OEM

Aftermarket

Refurbished

Custom-built

Upgraded systems - By EndUser Segment (In Value%)

Tourism and leisure

Corporate and business

Medical and emergency

Government and law enforcement

Oil and gas - By Procurement Channel (In Value%)

Direct sales

Distributors and dealers

Online platforms

Government tenders

Auction sales

- Cross Comparison Parameters (System Type, Platform Type, Fitment Type, End-User Segment, Procurement Channel, Market Value, Installed Units, Average System Price, Service Type, Technological Integration)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Singapore Airlines

Heli-One

SATS Ltd.

Airbus Helicopters

Bell Helicopter

Leonardo Helicopters

AgustaWestland

RSG Helicopters

Sikorsky Aircraft

Boeing Defense

Rotorcraft Leasing Company

Helicopter Association International

Wright Helikopter Services

Global Helicopter Service

Aeroservices Helicopter

- High demand from luxury tourism and affluent travelers

- Corporate clients seeking rapid business transport

- Rising adoption of helicopter services for medical emergencies

- Government and law enforcement relying on helicopters for security

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035