Market Overview

The Singapore Helicopter Simulator market is valued at USD ~ million in 2023 and is expected to reach USD ~ million by 2024. The market is primarily driven by the continuous expansion of the aviation sector in Singapore, particularly in military and commercial sectors. Furthermore, increasing demand for cost-effective, safe, and highly efficient training solutions also contributes to the growth of the market. The rapid advancements in helicopter simulation technologies, including full-motion and virtual reality-based systems, further catalyze the market’s development.

Singapore, being a global aviation hub, is home to key players in both military and civilian sectors, positioning the country as a dominant market in the region. The country’s strong aviation infrastructure, supported by international training academies and its strategic location in Southeast Asia, makes it a pivotal player in the Asia-Pacific helicopter simulator market. Additionally, Singapore’s high-tech military capabilities and continuous investment in defense training technology further enhance its dominance in the helicopter simulator market.

Market Segmentation

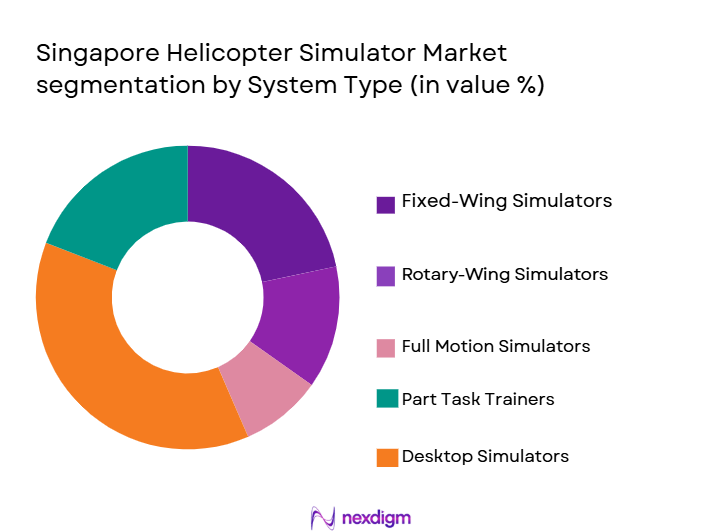

By System Type

The Singapore Helicopter Simulator market is segmented by system type into fixed-wing simulators, rotary-wing simulators, full-motion simulators, part-task trainers, and desktop simulators. The rotary-wing simulators have the dominant market share due to the high demand for specialized training solutions for helicopter pilots. These simulators are crucial for enhancing the skill sets of helicopter pilots, especially in the defense sector. The ability to replicate diverse flight scenarios, including emergency landings and bad weather conditions, positions rotary-wing simulators as an essential component for both military and civil aviation training. As helicopter operations are complex, these simulators provide an effective and cost-efficient way to train pilots without putting them in actual hazardous situations.

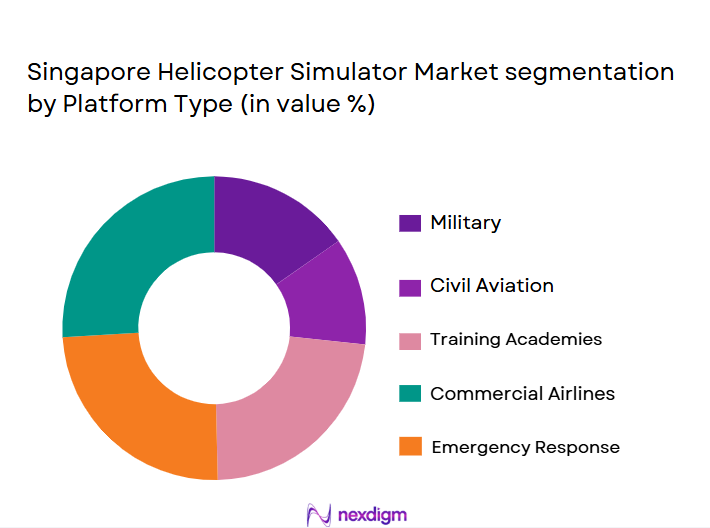

By Platform Type

In the Singapore Helicopter Simulator market, the platform type is divided into military, civil aviation, training academies, commercial airlines, and emergency response. The military platform type holds the largest market share, driven by the high demand for advanced training systems in defense. Singapore’s strong military presence and consistent investments in defense training technologies contribute to the dominance of military platforms in the helicopter simulator market. These simulators are increasingly employed to improve operational readiness, as they can replicate various combat scenarios and emergency conditions without risking personnel or equipment. The need for specialized training for military pilots, coupled with budget allocations from defense forces, ensures the continued growth of this segment.

Competitive Landscape

The Singapore Helicopter Simulator market is dominated by several leading players, including both local and international companies. Key players such as CAE Inc., Thales Group, and FlightSafety International play a crucial role in driving innovation and providing advanced training solutions. The competition is primarily focused on the development of highly sophisticated simulation technologies that enhance the training experience, ensuring safety and efficiency for both military and civil aviation sectors. Companies in this market also focus on establishing long-term contracts with government agencies and private aviation firms to maintain a competitive edge.

| Company Name | Establishment Year | Headquarters | Revenue (USD) | Key Technologies | Key Clientele | Product Offerings |

| CAE Inc. | 1947 | Canada | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ |

| FlightSafety International | 1975 | USA | ~ | ~ | ~ | ~ |

| L3 Technologies | 1997 | USA | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | USA | ~ | ~ | ~ | ~ |

Singapore Aircraft Sensors Market Analysis

Growth Drivers

Demand for aircraft safety

The increasing demand for aircraft safety and performance optimization is driving the growth of the Singapore Aircraft Sensors market. With the rise in air travel, particularly in Asia-Pacific, the aviation sector is prioritizing advanced sensor systems to enhance aircraft operational efficiency, ensure passenger safety, and improve fuel management. Aircraft sensors play a crucial role in detecting system malfunctions, monitoring real-time data for predictive maintenance, and ensuring compliance with stringent safety regulations. As Singapore continues to position itself as a global aviation hub, the demand for cutting-edge sensor technologies in both civil and military aviation is rising significantly.

Sensor technologies

Technological advancements in sensor technologies, such as the integration of artificial intelligence (AI) and machine learning (ML), are fueling the growth of the aircraft sensors market in Singapore. AI and ML enhance sensor capabilities, allowing for smarter predictive analytics and real-time decision-making. The Singaporean aviation sector’s focus on embracing next-generation technologies, such as smart sensors for monitoring flight data and improving aircraft health management, is creating new opportunities for innovation. These advancements contribute to more efficient operations, reducing downtime, and improving cost-effectiveness in fleet management

Market Challenges

Singapore Aircraft Sensors

One of the significant challenges facing the Singapore Aircraft Sensors market is the high cost of advanced sensor systems. The installation of cutting-edge sensors, such as radar, LiDAR, and infrared systems, requires substantial investments, which can be prohibitive for smaller operators. Additionally, the integration of these sensors with existing aircraft systems demands significant infrastructure upgrades. The initial high costs, coupled with maintenance and calibration requirements, make it difficult for some smaller commercial operators and private aviation companies to adopt these technologies, limiting their widespread use across the market.

Growth of the aircraft

Regulatory hurdles also pose a challenge for the growth of the aircraft sensors market in Singapore. The aviation industry is heavily regulated, and the certification process for new sensor technologies can be lengthy and complex. The Civil Aviation Authority of Singapore (CAAS) and international bodies, such as the International Civil Aviation Organization (ICAO), enforce strict standards for safety and performance, which sensor manufacturers must meet before their products can be deployed. The rigorous testing and certification processes slow the pace at which new sensor technologies are adopted by operators, delaying potential market expansion.

Opportunities

Aircraft Sensors market

There is a growing opportunity in the Singapore Aircraft Sensors market driven by the increasing demand for predictive maintenance solutions. Sensors that monitor critical systems in real-time and generate data on component wear, fuel usage, and engine performance are becoming increasingly important. These sensors enable airlines and operators to perform timely maintenance, reducing downtime, improving safety, and lowering operational costs. As airlines, especially in Singapore, invest more in fleet management and operational efficiency, the adoption of predictive maintenance technologies is expected to expand, presenting significant growth prospects for the aircraft sensors market.

Electrification of aircraft

The rising trend toward the electrification of aircraft, particularly in the form of electric and hybrid-electric propulsion systems, is creating a new opportunity for the aircraft sensors market. Electric propulsion systems require highly specialized sensors for monitoring battery health, energy efficiency, and system performance. As the Singapore government continues to support sustainable aviation technologies, including electric aircraft, the demand for sensors tailored to these new technologies is expected to increase. This trend opens up new avenues for sensor manufacturers to innovate and develop products specifically suited for next-generation aircraft.

Future Outlook

Over the next decade, the Singapore Helicopter Simulator market is expected to experience substantial growth, driven by technological advancements in simulator systems, increasing demand for pilot training, and the continuous expansion of the defense sector. The market will likely see a shift towards more advanced, cost-efficient, and scalable simulation solutions that can replicate a wide range of real-world flight scenarios. Government initiatives aimed at enhancing defense capabilities and increasing aviation safety standards are expected to further support the growth trajectory of the market. Moreover, the integration of AI and VR technologies into helicopter simulators will open new opportunities for growth and innovation in training programs.

Major Players

- CAE Inc.

- Thales Group

- FlightSafety International

- L3 Technologies

- Rockwell Collins

- Moog Inc.

- Simsphere

- Virtual Reality Simulators

- Helicopter Flight Services

- Fuselage Solutions

- Indra Sistemas

- Rheinmetall AG

- Avionics Support Group

- Farnborough International

- Frasca International

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Helicopter Manufacturers

- Aviation Training Centers

- Commercial Airlines

- Military Forces

- Private Aviation Operators

- Government Defense Agencies

Research Methodology

Step 1: Identification of Key Variables

The first phase involves mapping all key stakeholders in the Singapore Helicopter Simulator market. This process relies on a blend of secondary research and proprietary data to define and categorize the critical variables affecting market dynamics, such as product types, technology adoption, and end-user needs.

Step 2: Market Analysis and Construction

In this phase, historical data on the Singapore Helicopter Simulator market is gathered, focusing on market penetration, revenue generation, and service quality. This analysis includes understanding the balance between simulators used for defense and civil aviation training, and their impact on overall market growth.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts will be consulted to validate market hypotheses developed during the analysis phase. These consultations, conducted via structured interviews and surveys, will provide firsthand insights from key stakeholders involved in the helicopter simulator market.

Step 4: Research Synthesis and Final Output

The final phase includes cross-verifying the findings with a selection of manufacturers, service providers, and end users. This ensures that all data points are accurate and reflective of the actual trends and demands in the Singapore Helicopter Simulator market.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for military training simulators in defense sectors

Increasing adoption of flight simulators in aviation academies

Technological advancements in realistic simulator capabilities - Market Challenges

High initial cost of advanced simulators

Regulatory hurdles for simulator certifications

Limited adoption in developing economies - Market Opportunities

Growing demand for pilot training amidst rising air traffic

Expansion of commercial aviation in the Asia Pacific region

Rising interest in mixed reality and virtual reality simulation technologies - Trends

Emerging use of Artificial Intelligence in helicopter training simulators

Shift towards cloud-based simulation solutions

Increased focus on remote and online training modules

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Fixed-Wing Simulators

Rotary-Wing Simulators

Full Motion Simulators

Part Task Trainers

Desktop Simulators - By Platform Type (In Value%)

Military

Civil Aviation

Training Academies

Commercial Airlines

Emergency Response - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Upgrades

Customization Services

Repairs & Maintenance - By EndUser Segment (In Value%)

Military Forces

Aviation Training Institutes

Commercial Pilots

Private Operators

Government Agencies - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Suppliers

Online Marketplaces

Government Contracts

Aviation Distributors

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, Product Innovation, Market Penetration, Technology Integration, R&D Investment, Operational Efficiency, Customer Retention, Regulatory Compliance, Product Portfolio Diversity Customer Satisfaction, Geographic Reach, Technological Capabilities) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

CAE Inc.

Thales Group

FlightSafety International

L3 Technologies

Rockwell Collins

Moog Inc.

Simsphere

Virtual Reality Simulators

Helicopter Flight Services

Fuselage Solutions

Indra Sistemas

Rheinmetall AG

Avionics Support Group

Farnborough International

Frasca International

Mechtronix Systems

- Growing need for military-grade training systems in defense forces

- Shift towards cost-effective training solutions for commercial airlines

- Increased investment in aviation training academies

- Demand for simulators as a means of improving safety and reducing accident rates

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035