Market Overview

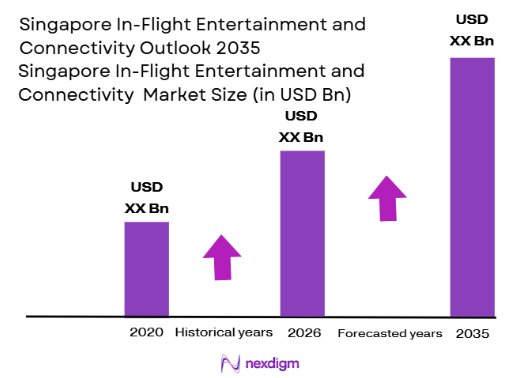

The Singapore In-Flight Entertainment and Connectivity (IFE&C) market is expected to see considerable growth driven by increasing passenger demand for seamless connectivity and entertainment options during flights. In 2025, the market size is estimated to be valued at USD ~ million. This growth is primarily driven by the rapid advancement of satellite communication technologies, a growing focus on passenger experience, and the rising demand for high-speed internet and immersive entertainment on-board. Additionally, the increasing number of international travelers, particularly with Singapore Airlines expanding its reach to over ~ destinations worldwide, contributes to the upward trajectory of the IFE&C market. Singapore, as a global aviation hub, is uniquely positioned to leverage its strategic location, technologically advanced airports, and its renowned airlines to drive further growth in the sector.

Singapore is a leader in the IFE&C market due to its robust aviation infrastructure, world-class airport facilities, and a strong emphasis on technological advancements within the aviation sector. Singapore Airlines, a globally recognized carrier, has been at the forefront of integrating cutting-edge IFE&C solutions, offering premium services across its fleet. The country’s position as a key aviation hub in Southeast Asia ensures its dominance, attracting international passengers who expect high-quality entertainment and connectivity during their flights. The strong government backing and progressive regulations around air transport further enhance Singapore’s role as a central player in this market, making it a global model for in-flight services.

Market Segmentation

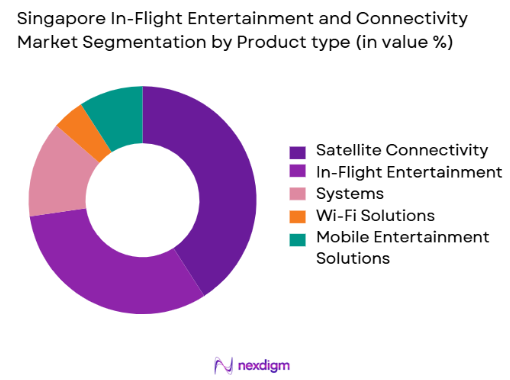

By Product Type

The Singapore IFE&C market is segmented by product type, including satellite connectivity, in-flight entertainment systems, Wi-Fi solutions, and mobile entertainment services. Among these, in-flight entertainment systems dominate the market, accounting for a significant share in 2024. This dominance is largely due to the established presence of systems like seat-back entertainment, which continue to be favored by airlines for long-haul flights. Airlines, such as Singapore Airlines, integrate state-of-the-art IFE systems to deliver a comprehensive experience that includes live TV, movies, music, games, and internet access. These systems are in high demand due to their role in increasing customer satisfaction and engagement during flights. With passengers increasingly desiring personalized and immersive experiences, the continual development and upgrade of IFE systems have secured the position of this segment as the market leader.

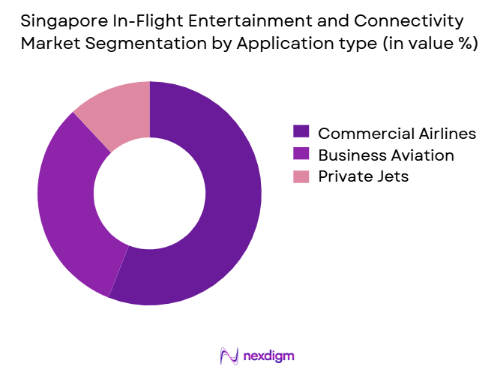

By Application

The market is segmented by application into commercial airlines, business aviation, and private jets. Commercial airlines lead the market share in 2024, largely due to the high number of passengers and extensive fleet sizes of major carriers like Singapore Airlines. The need for reliable, high-speed internet and entertainment systems on long-haul flights has prompted airlines to heavily invest in these solutions. As of 2023, commercial airlines in Singapore, including low-cost carriers like Scoot, are rapidly expanding their fleets with state-of-the-art IFE&C systems to meet the growing demand from passengers. In contrast, business aviation and private jets represent niche markets but still show steady growth as more affluent passengers seek personalized services and enhanced connectivity.

Competitive Landscape

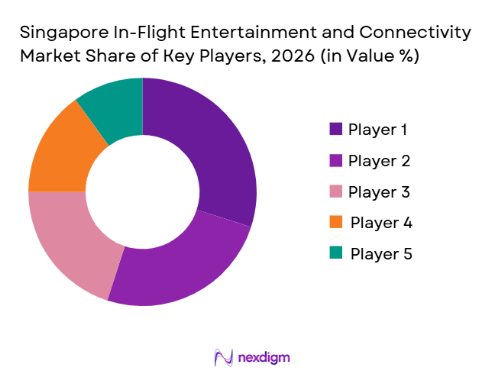

The Singapore In-Flight Entertainment and Connectivity market is dominated by a mix of established global players and regional companies that offer innovative solutions in entertainment and connectivity. Companies such as Singapore Airlines, Inmarsat, Panasonic Avionics, and Thales Group have a significant influence on the market. These key players have not only invested heavily in cutting-edge IFE&C technologies but also have the expertise and infrastructure to deploy them on a large scale. In particular, Singapore Airlines has been a major driver of innovation, implementing IFE systems across its fleet, ensuring high-speed internet access, and providing personalized content to passengers. The competition in this market is expected to intensify with advancements in 5G technology and more personalized in-flight services.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Revenue (2024) | Technology Focus | Partnerships |

| Singapore Airlines | 1947 | Singapore | ~ | ~ | ~ | ~ |

| Inmarsat | 1979 | London, UK | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ |

| Gogo Inc. | 1991 | Broomfield, USA | ~ | ~ | ~ | ~ |

| Panasonic Avionics | 1979 | California, USA | ~ | ~ | ~ | ~ |

Singapore In-Flight Entertainment and Connectivity Market Analysis

Growth Drivers

Increasing Demand for Seamless Connectivity

The increasing demand for seamless connectivity during air travel is one of the primary growth drivers for the Singapore IFE&C market. According to the World Bank, Singapore’s internet penetration rate reached ~% in 2024, which is indicative of the high expectations for reliable internet access among its population. Additionally, in 2025, the number of internet users globally reached over ~billion, with a ~% increase in the Middle East and Southeast Asia. This increase in demand for seamless, high-speed internet access is fueling the aviation industry’s need to provide uninterrupted in-flight connectivity.

Expansion of Airline Networks and In-Flight Service Offerings

The expansion of airline networks and in-flight service offerings continues to drive the Singapore IFE&C market. As of 2024, Singapore Airlines operates over ~ international destinations, with increasing demand for premium services. The International Air Transport Association (IATA) reports that the Middle East’s aviation industry will grow by 8% in the coming years, further enhancing the need for advanced IFE&C solutions. Singapore’s aviation infrastructure is among the best in the world, with Changi Airport ranking as the best airport globally in 2024, which is positively influencing the demand for next-generation in-flight services.

Market Challenges

High Infrastructure and Maintenance Costs

A major challenge in the Singapore IFE&C market is the high infrastructure and maintenance costs associated with providing seamless connectivity and entertainment systems on aircraft. According to the International Civil Aviation Organization (ICAO), the installation and maintenance of satellite communication systems, which are essential for in-flight connectivity, can cost upwards of USD ~ million per aircraft per year. These costs are a significant barrier to smaller airlines and are especially burdensome for international carriers like Singapore Airlines, which operates a large fleet of aircraft that requires continuous technological upgrades to stay competitive.

Regulatory Hurdles and Airspace Limitations

Regulatory hurdles and airspace limitations are another challenge for the Singapore IFE&C market. According to the International Telecommunications Union (ITU), satellite communication frequency allocation is regulated internationally, and each country must comply with its airspace regulations. For instance, Singapore’s airspace is heavily regulated, and the country faces competition for satellite bandwidth with neighboring regions. Moreover, political tensions in Southeast Asia occasionally result in restricted airspace access, which can limit the availability of in-flight connectivity. These regulatory issues create operational difficulties for airlines looking to provide seamless service across the region.

Opportunities

Rise of 5G Connectivity and its Integration in Aircraft

The rise of 5G connectivity presents significant opportunities for the Singapore IFE&C market. As of 2024, Singapore’s 5G network coverage reached approximately ~% of the population, with the government planning to expand this to nearly ~% by 2025. This fast and reliable 5G infrastructure is expected to revolutionize in-flight connectivity by enabling faster data transfer speeds and reduced latency. Singapore Airlines is already working on integrating 5G technology into its fleet, ensuring that passengers will have access to ultra-fast internet speeds. As 5G networks become more widespread, airlines will have the opportunity to offer passengers an even more enhanced in-flight experience.

Increased Investment in Sustainable Aviation Practices

Increased investment in sustainable aviation practices offers a significant growth opportunity for the IFE&C market. The Singapore government is committed to reducing its carbon emissions, and as part of the global aviation industry’s efforts to reduce its carbon footprint, the Civil Aviation Authority of Singapore (CAAS) has prioritized environmental sustainability. Singapore Airlines has made significant strides by committing to reduce its carbon emissions by ~% by 2030. This investment in sustainable practices includes the adoption of energy-efficient in-flight entertainment systems and satellite communication solutions. This trend toward sustainability will likely drive future demand for green IFE&C solutions, providing opportunities for market players.

Future Outlook

Over the next several years, the Singapore In-Flight Entertainment and Connectivity market is expected to experience steady growth driven by the continued evolution of satellite communication technologies, the rollout of 5G networks, and increasing consumer expectations for seamless connectivity during air travel. With the region’s strong aviation infrastructure and the rise in both business and leisure travel, airlines in Singapore and Southeast Asia will continue to expand their IFE&C offerings. The government’s support for sustainable aviation practices will also contribute to this growth, with airlines investing in greener technologies while enhancing the passenger experience.

Major Players

- Singapore Airlines

- Inmarsat

- Thales Group

- Panasonic Avionics

- Viasat Inc.

- Honeywell Aerospace

- Collins Aerospace

- Global Eagle Entertainment

- Satcom Direct

- SITAONAIR

- L3 Technologies

- SES Networks

- Intelsat

- Gogo Inc.

- Intelsat

Key Target Audience

- Investments and Venture Capitalist Firms

- Airline Operators

- Aircraft Manufacturers

- Satellite Connectivity Providers

- Aviation Regulatory Bodies

- Government and Regulatory Bodies

- Airport Authorities

- Airline Equipment Suppliers

Research Methodology

Step 1: Identification of Key Variables

In this phase, we identified the key variables affecting the Singapore In-Flight Entertainment and Connectivity market. We analyzed current and historical data related to market trends, technological advancements, and airline investments, using a combination of secondary data from trusted industry reports and proprietary research to develop an ecosystem map of major stakeholders in the market.

Step 2: Market Analysis and Construction

We compiled and analyzed historical data related to IFE&C adoption trends, particularly in commercial aviation. This included an assessment of market penetration, growth drivers, the competitive landscape, and technological developments in connectivity. We also evaluated the demand for premium entertainment services on long-haul flights to gauge the potential for future market expansion.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses were validated through consultations with industry experts, including airline executives, in-flight entertainment system providers, and telecommunications experts. These interviews helped refine the data collected and provided critical insights into the operational and financial aspects of the IFE&C market in Singapore.

Step 4: Research Synthesis and Final Output

In the final phase, we synthesized the information gathered and validated it with multiple airline operators and technology providers. We conducted in-depth interviews with suppliers and partners to gain insights into their future strategies, which allowed us to refine our market model and generate accurate forecasts.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Major Players

- Business Cycle and Economic Influence on IFE&C

- Supply Chain and Value Chain Analysis

- Key Drivers of IFE&C Adoption

- Technological Advancements Shaping the IFE&C Market in Singapore

- Growth Drivers

Increasing Demand for Seamless Connectivity

Expansion of Airline Networks and In-Flight Service Offerings

Technological Advancements in Airborne Connectivity Solutions

Demand for Passenger-Centric, Personalized Entertainment

Growth in Southeast Asian Aviation Sector - Singapore In-Flight Entertainment and Connectivity Market Challenges

High Infrastructure and Maintenance Costs

Regulatory Hurdles and Airspace Limitations

Data Security and Privacy Concerns

Limited Coverage in Remote/Long-Haul Flights - Opportunities

Rise of 5G Connectivity and its Integration in Aircraft

Increased Investment in Sustainable Aviation Practices

Expansion of Smart Airports and Ground Services|

Growing Demand for Interactive, Immersive In-Flight Entertainment - Trends

Passenger Engagement and Interactive Content Trends

Adoption of Green and Sustainable IFE Systems

Convergence of IFE with Internet of Things (IoT) Technology

Shift Toward More Affordable and Accessible Connectivity Solutions

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By Product Type, (In Value %)

Satellite Connectivity

Wi-Fi Solutions

In-Flight Entertainment Systems

Real-Time Communication

Mobile Entertainment Solutions - By Application (In Value %)

Commercial Airlines

Business Aviation

Charter and Private Jets

Military and Defense

Airports and Ground Services - By Service Provider (In Value %)

Network Service Providers

Content and Software Providers

In-Flight Connectivity Hardware Providers

Airlines with Integrated Solutions

Third-party Integration Service Providers

- By Region (In Value %)

Southeast Asia

North Asia

South Asia

Europe

Middle East

- By Technology (In Value %)Satellite Communication

Air-to-Ground Communication

5G and Next-Gen Connectivity

Virtual and Augmented Reality for Entertainment

Hybrid Connectivity Solutions

- Market Share of Major Players

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenues, Revenues by Product Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plants, Capacity, Unique Value Offering)

- SWOT Analysis of Major Players

- Porter’s Five Forces

- Detailed Profiles

Singapore Airlines

SATS Ltd.

Thales Group

Gogo Inc.

Inmarsat

Viasat Inc.

Panasonic Avionics

Honeywell Aerospace

Collins Aerospace

Global Eagle Entertainment

Satcom Direct

SITAONAIR

L3 Technologies

SES Networks

Intelsat

- Market Demand and Utilization Across Key End Users

- Airlines’ Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements for IFE&C Adoption

- Passenger Needs, Desires, and Pain Points

- Decision-Making Process in Airline Adoption of IFE&C Solutions

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035