Market Overview

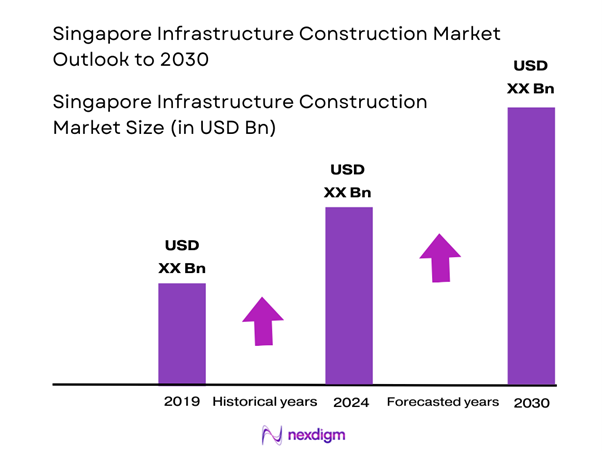

The Singapore Infrastructure Construction Market is valued at USD 4 billion, based on performance data leading up to the present. This substantial market size is primarily driven by increasing government investments in infrastructure development and the need for urban renewal projects, particularly in transportation and public facilities. These investments are reinforced by a robust economy and the commitment to becoming a smart city with sustainable practices.

Singapore consistently emerges as a dominant player in the infrastructure construction market due to its strategic geographical location, well-established economic framework, and a forward-looking government that prioritizes infrastructural growth. Key cities like Singapore City and Jurong East play a significant role, benefiting from high population density, significant foreign investment, and a strong emphasis on technological advancements which foster innovation in construction techniques.

The Singaporean government has significantly increased infrastructure investments, allocating SGD 93 billion for infrastructure projects as part of its national budget for 2024. These projects include key areas such as transport, urban development, and utilities, demonstrating a commitment to enhancing public service delivery and infrastructure robustness. The government’s continuous emphasis on building a comprehensive public transport network further reinforces these investments, with the Land Transport Authority planning to expand the MRT network to over 360 km, improving connectivity and accessibility within the region.

Market Segmentation

By Construction Type

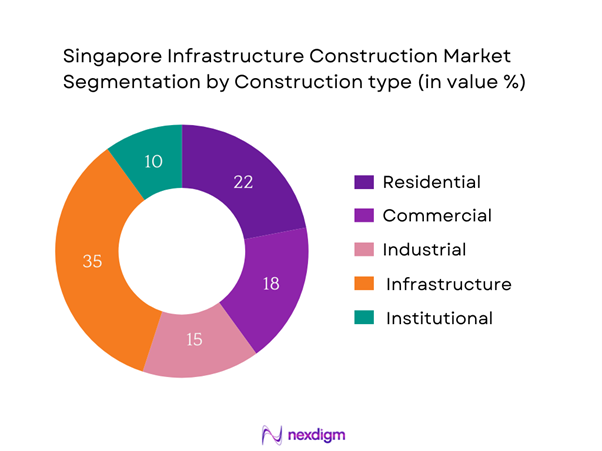

The Singapore Infrastructure Construction Market is segmented by construction type into residential, commercial, industrial, infrastructure, and institutional projects. Among these, infrastructure projects hold a dominant market share due to their critical role in sustaining the country’s economic activities and urban connectivity. With major developments like the Thomson-East Coast Line and the Cross Island Line, the focus remains on enhancing public transportation and improving accessibility. This segment thrives on the government’s initiatives aimed at elevating public infrastructure standards, thus bolstering demand and investment.

By Project Funding

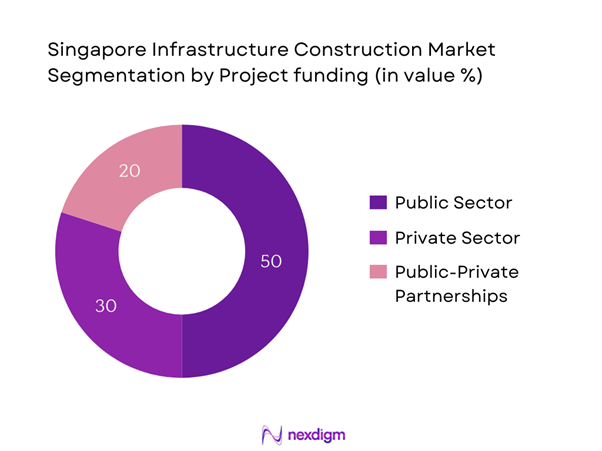

The market is also segmented by project funding into public sector, private sector, and public-private partnerships (PPPs). Currently, public sector funding dominates due to significant government-backed projects aimed at urban renewal and necessary infrastructural updates. Government agencies allocate substantial budgets for these developments, emphasizing modernization and sustainability, particularly in areas affecting public service delivery, such as roads, bridges, and public transport solutions. This focus ensures that public sector funding continues to maintain its leading position in the market.

Competitive Landscape

The Singapore Infrastructure Construction Market is highly competitive, characterized by several major players, including both local and international firms. Companies like Sembcorp Industries, Lendlease Group, and Bouygues Bâtiment International lead the market. The presence of these key companies indicates both localized expertise and global innovative practices, highlighting a blend in operational efficiency and advanced technological integration.

| Company | Establishment Year | Headquarters | Revenue | Key Projects | Market Focus |

| Sembcorp Industries | 1998 | Singapore | – | – | – |

| Bouygues Bâtiment International | 1952 | France | – | – | – |

| Lendlease Group | 2010 | Australia | – | – | – |

| GS Engineering & Construction | 1969 | South Korea | – | – | – |

| Dragages Singapore | 1991 | Singapore | – | – | – |

Singapore Infrastructure Construction Market Analysis

Growth Drivers

Population Growth and Urbanization

Singapore’s population is projected to grow to around 5.5 million by the end of 2024, according to the Singapore Department of Statistics. This ongoing growth contributes to increasing urban density and heightened demand for housing, transport, and public amenities. With more than 80% of the population living in high-rise buildings, urbanization is driving the need for adequate infrastructure to accommodate this density. Urban renewal initiatives, such as the transformation of underutilized spaces into parks and communal areas, are underway to improve living conditions amidst rapid urbanization.

Technological Advancements in Construction

Technological advancements are revolutionizing the infrastructure construction landscape in Singapore, enhancing efficiency and sustainability. The use of Building Information Modeling (BIM) technology has led to improved project coordination. As of 2024, around 75% of construction projects are expected to incorporate BIM, resulting in reduced project timelines and costs. Additionally, initiatives to adopt smart construction practices—integrating AI and IoT—are projected to streamline processes, enhance productivity, and foster innovative solutions to existing challenges. These technologies are crucial not only for immediate project completion but also for long-term sustainability goals.

Market Challenges

Labor Shortages

The infrastructure construction sector in Singapore is grappling with labor shortages, exacerbated by stricter foreign worker regulations. As of 2024, the construction workforce is estimated to consist of approximately 320,000 individuals, which represents a decrease of around 10% from previous years, primarily due to tightened immigration policies. This shortage impacts project timelines and overall productivity, making it increasingly challenging for construction firms to meet demand. The government is undertaking initiatives to boost local employment in this field, providing training and upskilling programs aimed at addressing these labor gaps.

Rising Material Costs

Rising material costs are a significant challenge confronting the infrastructure construction market. Data from the Building and Construction Authority (BCA) indicate that construction material prices increased by about 6% in 2023, primarily due to global supply chain disruptions and rising fuel prices. Key materials such as steel and concrete have seen sharp price increases, affecting project budgets and timelines. These fluctuations in raw material costs necessitate better planning and resource allocation among construction companies to mitigate their effects on ongoing and future projects.

Opportunities

Green and Sustainable Construction

The push for green and sustainable construction practices presents a wealth of opportunities within the Singapore infrastructure sector. The government has committed SGD 3 billion to support sustainable building initiatives, with policies encouraging the adoption of energy-efficient technologies. Currently, there are over 1,000 green buildings in Singapore, contributing significantly to reducing the overall carbon footprint. The rising consumer awareness of environmental issues further boosts the demand for eco-friendly materials and construction practices, shaping a more sustainable market landscape ready for future developments.

Smart City Developments

The Singapore government’s Smart Nation initiative aims to harness technology to improve urban living and infrastructure efficiency. Investments in smart technologies for transportation, waste management, and urban planning are estimated to reach SGD 12 billion by 2025. Initiatives such as the deployment of smart traffic systems and IoT-based monitoring for infrastructure maintenance underline the potential for growth in this sector. Approximately 70% of new developments are expected to integrate smart technologies, enhancing city livability and sustainability.

Future Outlook

In the coming years, the Singapore Infrastructure Construction Market is expected to exhibit robust growth, driven by comprehensive government policies aimed at enhancing public infrastructure and investments in sustainable projects. The exploration of smart city initiatives, technological integration in construction, and eco-friendly practices will significantly impact market dynamics. As urbanization continues, the need for upgraded transport systems and public amenities will spur demand across various sectors, consolidating Singapore’s position as a leading player in infrastructure development.

Major Players

- Sembcorp Industries

- Bouygues Bâtiment International

- Lendlease Group

- GS Engineering & Construction

- Dragages Singapore

- China Communications Construction Company

- Jardine Matheson Holdings

- Woh Hup (Pte) Ltd

- Samsung C&T Corporation

- Shimizu Corporation

- HYPM Construction Pte Ltd

- OHL Group

- CPG Consultants

- Van Oord

- UEM Group

Key Target Audience

- Government and Regulatory Bodies (Building and Construction Authority, Urban Redevelopment Authority)

- Infrastructure Developers

- Construction Firms

- Real Estate Investment Trusts (REITs)

- Private Investors

- Investments and Venture Capitalist Firms

- Municipal Authorities

- Engineering and Design Consultancies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Singapore Infrastructure Construction Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including economic indicators, regulatory environments, and technological advancements.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Singapore Infrastructure Construction Market. This includes assessing construction output, project approvals, and the ratio of government-funded projects versus private initiatives. Moreover, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates, providing a solid foundation for future projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies active in the infrastructure sector. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple construction and engineering companies to acquire detailed insights into ongoing and upcoming projects, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from a bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Singapore Infrastructure Construction Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Overview

- Timeline of Major Infrastructure Projects

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Government Initiatives and Investments

Population Growth and Urbanization

Technological Advancements in Construction - Market Challenges

Labor Shortages

Rising Material Costs

Regulatory Compliance - Opportunities

Green and Sustainable Construction

Smart City Developments - Trends

Innovations in Construction Technologies

Increased Use of Modular Construction - Government Regulation

Construction Standards and Codes

Sustainability Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Construction Type (In Value %)

Residential

– Public Housing

– Private Condominiums

– Luxury Apartments

– Mixed-Use Residential Towers

Commercial

– Office Complexes

– Retail Malls

– Hotels and Resorts

– Data Centers

Industrial

– Manufacturing Plants

– Logistics Parks

– High-Tech Industrial Facilities

– Cleanroom & Semiconductor Facilities

Infrastructure

– Expressways & Tunnels

– Mass Rapid Transit (MRT) Infrastructure

– Drainage & Flood Mitigation Systems

– Urban Utilities

Institutional

– Government Schools and Polytechnics

– Universities and R&D Campuses

– Public Healthcare Infrastructure

– Civic Buildings and Emergency Services - By Project Funding (In Value %)

Public Sector

– Government Ministries and Statutory Boards

– Municipal Infrastructure Projects

Private Sector

– Developer-Led Residential & Commercial Projects

– Foreign Direct Investment (FDI) Projects

Public-Private Partnerships (PPP)

– Government-Funded MRT/Expressway Concessions

– Hospital and Education PPP Models

– Infrastructure Leasing Agreements - By Materials Used (In Value %)

Concrete

– Pre-stressed Concrete

– Ready-Mix Concrete

– Reinforced Concrete Structures

Steel

– Structural Steel Frames

– Steel Cladding and Panels

– Steel Bridges

Timber

– Engineered Wood

– Sustainable Hardwood for Interiors

– Temporary Formwork and Scaffolding

Prefabricated Materials

– Prefabricated Prefinished Volumetric Construction (PPVC)

– Modular Bathroom Units

– Precast Facade Systems - By Region (In Value %)

Central Region

Northern Region

Eastern Region

Western Region - By End-User Industry (In Value %)

Government

Private Developers

Non-Profit Organizations

- Market Share of Major Players on the Basis of Value/Volume

Market Share of Major Players by Construction Type Segment - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Construction Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Capacity, Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Major Projects

- Detailed Profiles of Major Companies

Sembcorp Industries

KHS Asia

Woh Hup (Pte) Ltd

China Communications Construction Company

Bouygues Bâtiment International

OHL Group

GS Engineering & Construction Corp

Lendlease Group

ST Engineering

Samsung C&T Corporation

Dragages Singapore

HYPM Construction Pte Ltd

Van Oord

Shimizu Corporation

CPG Consultants

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030