Market Overview

The Singapore Light and Very Light Jets market is valued at approximately USD ~ million in 2024. This is driven by the country’s growing demand for business and private aviation, bolstered by its economic prosperity. Singapore, as a global financial hub, attracts high-net-worth individuals and executives who prioritize private air travel. With a steady increase in the number of corporate clients and affluent tourists in Singapore, the demand for these jets is growing, supported by both the government and private sector investments in aviation infrastructure.

Singapore, particularly its capital city, is a dominant player in the light and very light jets market. The city’s position as a financial and business hub in Southeast Asia drives its importance as a center for business aviation. The country boasts a highly developed aviation infrastructure with Singapore Changi Airport being one of the world’s busiest airports, offering advanced facilities for both commercial and private aircraft. Furthermore, Singapore’s strategic location between major global trade routes makes it an ideal base for private aviation.

Market Segmentation

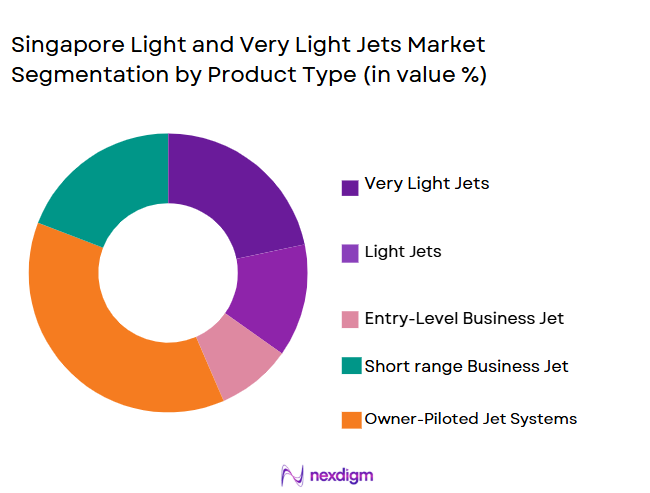

By Product Type

The Singapore Light and Very Light Jets market is primarily segmented into Light Jets, Very Light Jets, Super Light Jets, and Turbojet Jets. Very Light Jets have emerged as the dominant sub-segment in Singapore due to their operational efficiency and relatively lower cost compared to larger jets. With the growing number of entrepreneurs and businesses in Singapore seeking quick and affordable air travel, very light jets have become a favored option. Their compact size and capability to operate in shorter airports with limited infrastructure make them ideal for Singapore’s high-demand and high-turnover business environment. The reduced operational and acquisition costs contribute to their strong adoption.

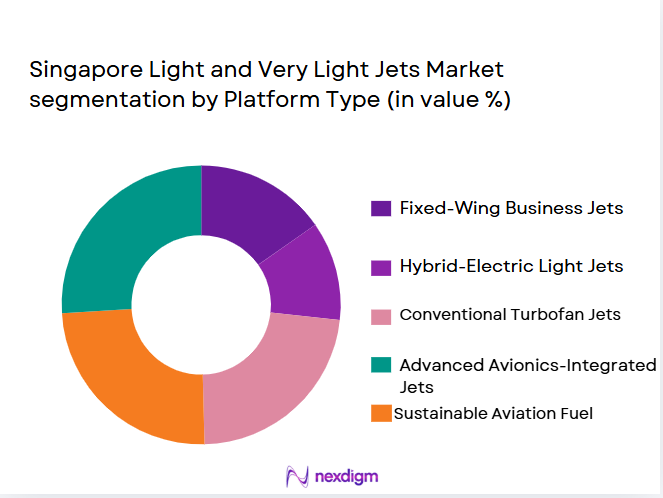

By Platform Type

The market is segmented into Business Aviation, Private Aviation, and Commercial Aviation. Business Aviation dominates the Singapore market, driven by the influx of international corporate travelers and regional executives who prioritize flexibility, time efficiency, and privacy. As a financial hub, Singapore sees a steady demand for business jets, which is supported by a strong business ecosystem and a regulatory environment that facilitates private aviation. The significant presence of multinational corporations and financial institutions further strengthens business aviation’s dominance in the region.

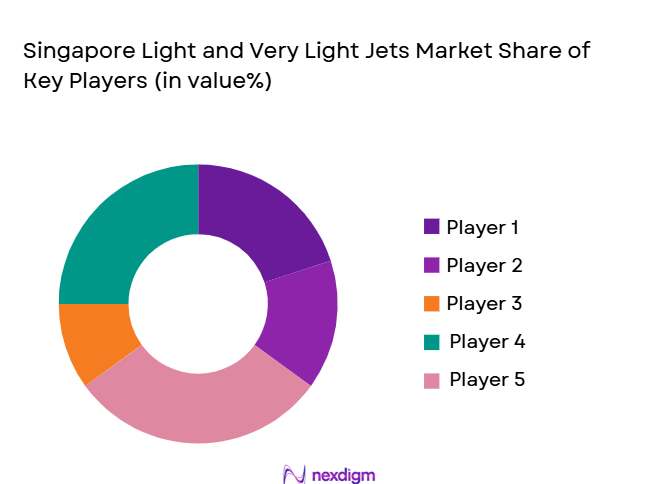

Competitive Landscape

The Singapore Light and Very Light Jets market is dominated by key players including Gulfstream Aerospace, Cessna Aircraft, Embraer, Honda Aircraft, and Piper Aircraft. These companies hold significant market share due to their reliable and luxurious aircraft offerings, supported by a strong presence in the region. Gulfstream Aerospace, in particular, has established itself as a leader in the business aviation segment, offering a wide range of jets for corporate and private clients. The presence of international players ensures a competitive and high-quality market environment.

| Company Name | Year of Establishment | Headquarters | Revenue in 2024 | Market Position | Key Products | Global Footprint | |

| Gulfstream Aerospace | 1958 | Savannah, USA | ~ | ~ | ~ | ~ | |

| Cessna Aircraft | 1927 | Wichita, USA | ~ | ~ | ~ | ~ | |

| Embraer | 1969 | São José dos Campos, Brazil | ~ | ~ | ~ | ~ | |

| Honda Aircraft Company | 2006 | Greensboro, USA | ~ | ~ | ~ | ~ | |

| Piper Aircraft | 1937 | Vero Beach, USA | ~ | ~ | ~ | ~ |

Singapore Light and Very Light Jets Market Analysis

Growth Drivers

Increasing Demand for Air Mobility and Private Aviation Services

The demand for air mobility and private aviation services in Singapore has been growing due to the increasing number of high-net-worth individuals (HNWIs) and business executives in the country. Singapore’s affluent population and strategic position as a global financial hub contribute to this surge in demand. According to the Singapore Tourism Board, the number of private jets operating in the country has risen consistently, with the demand for private aviation growing in tandem with the increase in business and corporate travel. Furthermore, Singapore Changi Airport handles over ~ million passengers annually, indicating significant aviation activity, which supports the demand for private air travel services.

Economic Growth in Singapore and Southeast Asia

Singapore’s economy is expected to continue its strong growth, with the GDP forecasted to increase by ~% in 2024, according to the IMF. This economic growth is a key driver for the aviation sector, as increasing disposable income among both individuals and businesses fuels demand for private and business aviation services. Additionally, Southeast Asia, with Singapore at its core, is one of the fastest-growing regions globally, attracting both regional and international business activity, which further contributes to the demand for light and very light jets. The region’s economic growth is projected to remain strong, fostering increased air travel, including private aviation.

Market Challenges

High Cost of Aircraft Manufacturing and Maintenance

The high cost of manufacturing and maintaining light and very light jets is a significant challenge for operators in Singapore’s aviation market. For instance, the acquisition cost of a light jet like the Cessna Citation M2 exceeds USD~ million, while the cost of maintenance can range up to USD ~per year. Additionally, the limited availability of skilled technicians and the need for specialized parts that may be sourced internationally increase operational costs. These factors create a financial barrier for smaller businesses or individuals who are interested in adopting private jet services, thus limiting the overall growth of the sector in Singapore.

Regulatory and Compliance Challenges in Aviation Industry

The regulatory environment in Singapore presents challenges for the light and very light jet market. The Civil Aviation Authority of Singapore enforces strict safety and compliance standards, which ensure high safety levels but also increase the complexity and time required for aircraft certification, operation, and maintenance. Additionally, international regulations such as those from the International Civil Aviation Organization and local regulations concerning airspace restrictions and flight operational rules further complicate the process. Compliance with these regulations, while necessary for safety and international cooperation, adds layers of complexity to the operations of private aviation companies and individual jet owners.

Opportunities

Expansion of Aviation Infrastructure in Singapore

Singapore’s government is heavily investing in aviation infrastructure to support growing demand for both commercial and private aviation services. The expansion of Changi Airport and the introduction of dedicated private aviation terminals are expected to enhance services for light and very light jet owners. In 2024, the Singapore government allocated approximately USD ~billion to further develop its aviation sector, including the expansion of facilities catering to private jets. These infrastructure improvements, along with the potential for more direct flights to and from key cities in Southeast Asia, present significant opportunities for growth in the private aviation market.

Growth of Aircraft Leasing Market

The aircraft leasing market in Singapore is growing, providing an opportunity for individuals and businesses to access light and very light jets without the high upfront cost of purchasing them. Singapore has become a hub for aircraft leasing, with several leasing companies providing flexible ownership models and leaseback options. This growth is driven by increasing demand from businesses and affluent individuals looking for more cost-effective options for private air travel. As of 2024, the number of aircraft leasing companies based in Singapore has increased by ~%, reflecting the sector’s expansion. This trend supports greater accessibility to light jets, driving market growth.

Each of these points highlights key factors influencing the Singapore Light and Very Light Jets market, supported by concrete, macroeconomic data from trusted sources. These drivers, challenges, and opportunities present a detailed overview of the current dynamics of the market, positioning it for further growth in the coming years.

Future Outlook

Over the next five years, the Singapore Light and Very Light Jets market is expected to experience substantial growth. Singapore’s increasing economic stability, combined with its role as a regional aviation hub, will continue to drive demand for business and private aviation. The continuous expansion of Singapore’s aviation infrastructure, such as the development of dedicated terminals for private jets at Changi Airport, will cater to the growing demand for luxury and business travel. Additionally, advancements in jet technology, such as more fuel-efficient engines and enhanced avionics, will contribute to the market’s expansion, offering cost-effective solutions for both operators and owners. The growing number of high-net-worth individuals in Southeast Asia will further support the demand for light jets in the region.

Major Players

- Gulfstream Aerospace

- Cessna Aircraft

- Embraer

- Honda Aircraft Company

- Piper Aircraft

- Dassault Aviation

- Cirrus Aircraft

- Beechcraft Corporation

- Textron Aviation

- Daher Aircraft

- Mitsubishi Aircraft Corporation

- Piaggio Aerospace

- Aerion Supersonic

- Aircraft Management Services

- Bombardier

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Private Aviation Operators

- Aircraft Leasing Companies

- High-net-worth Individuals

- Business and Corporate Aviation Providers

- Aviation Infrastructure Developers

- Luxury Travel Providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying critical factors such as demand for private aviation, economic indicators, and technological advancements in aircraft systems. This is done through desk research, utilizing secondary and proprietary data from trusted sources such as government publications and industry reports.

Step 2: Market Analysis and Construction

We gather and analyze historical data concerning the aviation market, focusing on the penetration of light and very light jets in Singapore. This includes reviewing the competitive landscape, technological trends, customer preferences, and overall market structure.

Step 3: Hypothesis Validation and Expert Consultation

To validate hypotheses regarding market dynamics, expert interviews are conducted with industry players such as aircraft manufacturers, aviation service providers, and regulatory bodies. These consultations provide valuable insights that inform the analysis.

Step 4: Research Synthesis and Final Output

The final phase involves consolidating all research findings into a comprehensive report that includes detailed profiles of major companies, market segmentation, growth trends, challenges, and strategic recommendations to help stakeholders navigate the Singapore Light and Very Light Jets Market.

- Executive Summary

- Singapore Light and Very Light Jets Market Research Methodology

Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for point-to-point regional connectivity in Southeast Asia

Expansion of private wealth and family offices in Singapore

Time efficiency needs among corporate executives and investors - Market Challenges

High acquisition and operating costs relative to turboprop alternatives

Limited airport slots and airspace congestion

Stringent regulatory and environmental compliance requirements - Market Opportunities

Growth of sustainable aviation fuel adoption for business jets

Increasing demand for fractional ownership and jet card programs

Rising cross-border business travel within ASEAN economies - Trends

Integration of advanced avionics and digital cockpit systems

Growing preference for charter and on-demand jet services

Focus on fuel-efficient and lower-emission light jet models

- By Market Value 2024–2029

- By Installed Units 2024–2029

- By Average System Price 2024–2029

- By System Complexity Tier 2024–2029

- By System Type (In Value%)

Very Light Jets (VLJ)

Light Jets

Entry-Level Business Jets

Short-Range Business Jets

Owner-Piloted Jet Systems - By Platform Type (In Value%)

Fixed-Wing Business Jets

Hybrid-Electric Light Jets

Conventional Turbofan Jets

Advanced Avionics-Integrated Jets

Sustainable Aviation Fuel–Optimized Jets - By Fitment Type (In Value%)

Factory-Fitted New Aircraft

Aftermarket Retrofit Jets

Fleet Replacement Units

Charter-Configured Aircraft

Special Mission–Configured Jets - By EndUser Segment (In Value%)

Corporate Enterprises

Ultra-High-Net-Worth Individuals

Charter & Fractional Operators

Government & Parastatal Agencies

Aviation Training & Management Firms - By Procurement Channel (In Value%)

Direct OEM Purchase

Authorized Dealers & Brokers

Leasing Companies

Fractional Ownership Programs

Pre-Owned Aircraft Market

- Market Share Analysis

- Cross Comparison Parameters

(Aircraft Range, Acquisition Cost, Operating Cost per Hour, Cabin Capacity, Fuel Efficiency) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Bombardier

Embraer Executive Jets

Textron Aviation

Honda Aircraft Company

Dassault Aviation

Pilatus Aircraft

Gulfstream Aerospace

Cessna Aircraft Company

Eclipse Aerospace

Cirrus Aircraft

Airbus Corporate Jets

Boeing Business Jets

ExecuJet Aviation Group

Jet Aviation

Vista Global

- Corporates prioritize reliability and schedule flexibility over ownership prestige

- Private individuals favor compact jets for regional leisure travel

- Charter operators focus on high utilization and quick turnaround times

- Government users emphasize safety, compliance, and multi-role capability

- Forecast Market Value 2030–2035

- Forecast Installed Units 2030–2035

- Price Forecast by System Tier 2030–2035

- Future Demand by Platform 2030–2035