Market Overview

The Singapore Light Sport Aircraft (LSA) market is estimated at USD ~ million in 2024. This growth is driven by Singapore’s increasing number of aviation enthusiasts and recreational pilots. With a growing affluent population and a focus on aviation infrastructure, Singapore is establishing itself as a hub for light sport aircraft. The presence of top-flight schools and the availability of affordable training programs also support the market’s growth. Government initiatives for aviation-related infrastructure and investments further stimulate demand for LSAs.

Singapore’s aviation sector is largely concentrated around its capital, Singapore City, which serves as the primary hub for aviation activities. The city-state’s strategic location between Southeast Asia, Europe, and the Middle East provides a perfect base for light sport aircraft operations. Additionally, Singapore’s high-income population, rapid urbanization, and its ambitions to be a regional aviation hub support the dominance of the market in this region. Government efforts to develop aviation infrastructure and create a favorable regulatory environment further strengthen Singapore’s dominance.

Market Segmentation

By Product Type

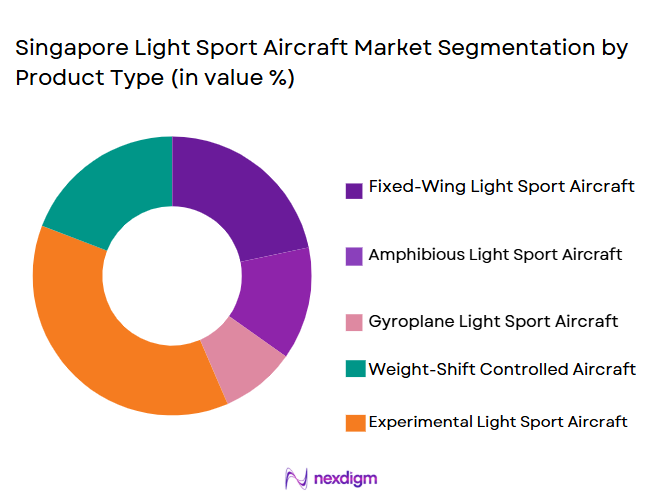

The market is segmented by product type into Ultralight Aircraft, 2-Seater Aircraft, and Electric Light Sport Aircraft.

Ultralight Aircraft dominate the market due to their affordability and ease of operation, making them a popular choice among recreational pilots in Singapore. These aircraft require less training and maintenance, making them ideal for individuals entering the aviation world. As the aviation industry in Singapore continues to grow, ultralight aircraft provide an accessible option for flying enthusiasts. Additionally, flight schools favor ultralight aircraft for training due to their lower costs, which further drives their market dominance.

By Platform Type

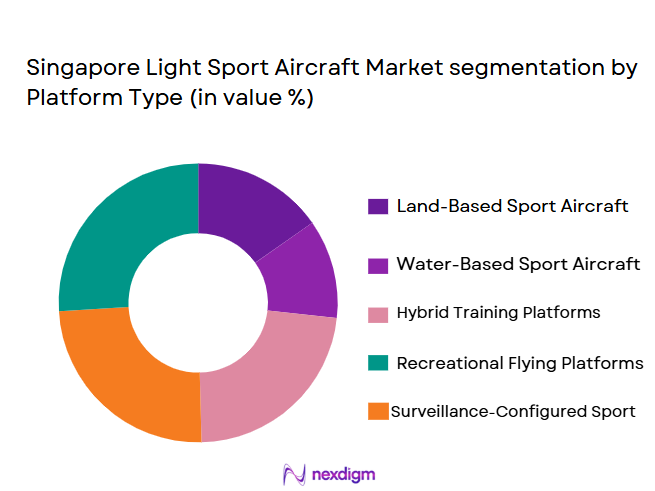

The Singapore Light Sport Aircraft market is segmented into Personal Aviation, Pilot Training, and Commercial Aviation.

Pilot Training holds the largest market share due to the increasing number of aviation training schools offering light sport aircraft as a training tool. The affordability and low operating costs of light sport aircraft make them an attractive choice for flight schools, enabling more people to enter the aviation sector. The growth of aviation training programs in Singapore, paired with government support for aviation education, boosts demand for LSAs in training applications.

Competitive Landscape

The Singapore LSA market is dominated by a mix of established international players and emerging local manufacturers. Global brands such as Pipistrel, Tecnam, and Flight Design lead the market due to their proven track record in aircraft manufacturing and safety standards. These companies have a strong presence in the Southeast Asian region, with Singapore serving as a key market. Additionally, local manufacturers are making inroads with customized LSAs designed for the specific needs of Singapore’s growing aviation community.

The Singapore market is competitive, with a few key international and local players offering a variety of aircraft suited for different uses. International manufacturers such as Pipistrel and Tecnam provide reliable aircraft options with strong safety records, while local manufacturers focus on providing cost-effective and customizable options for the growing flight school and personal aviation sectors.

| Company Name | Year of Establishment | Headquarters | Revenue in 2024 | Market Position | Key Products | Global Footprint |

| Pipistrel Aircraft | 1989 | Ajdovščina, Slovenia | ~ | ~ | ~ | ~ |

| Tecnam Aircraft | 1948 | Capua, Italy | ~ | ~ | ~ | ~ |

| Flight Design | 1994 | Germany | ~ | ~ | ~ | ~ |

| CubCrafters | 1980 | Yakima, USA | ~ | ~ | ~ | ~ |

| Aeropro Aircraft | 2000 | Slovakia | ~ | ~ | ~ | ~ |

Singapore Light Sport Aircraft Market Analysis

Growth Drivers

Increasing Demand for Affordable Aviation Solutions

The demand for affordable aviation solutions in Singapore has seen a steady increase, with aviation being perceived as an accessible and growing sector. Singapore’s high-income population, supported by a stable economy (GDP growth of ~% in 2024), has spurred interest in private aviation. Light Sport Aircraft (LSA) have become an attractive option for individuals seeking affordable air travel alternatives. The Singapore government has also been promoting aviation as a key sector for growth, providing support for aviation-related infrastructure and reducing regulatory barriers.

Growth of Aviation Training Schools and Hobbyist Pilots

The growth of aviation training schools and the increasing number of hobbyist pilots in Singapore are significant drivers of the Light Sport Aircraft market. Singapore’s aviation education sector has expanded, with over 40 flight schools in operation across the country. The Singapore Civil Aviation Authority (CAAS) reported an annual increase in the number of pilot licenses issued, driven by the demand for recreational flying and private aviation. Additionally, the affordability of LSAs makes them an ideal choice for flight training, fueling the growth in this segment.

Market Challenges

Regulatory Challenges and Safety Standards

Despite the growing popularity of Light Sport Aircraft, regulatory challenges remain a key obstacle in Singapore. The Singapore Civil Aviation Authority (CAAS) enforces stringent airworthiness standards and certifications, which adds complexity to aircraft production and operation. These regulations are aligned with international standards set by the International Civil Aviation Organization (ICAO), which ensures safety but may delay the approval process for new aircraft models. Additionally, meeting these safety standards involves costly and time-consuming procedures, which affects the affordability and speed of market entry for LSAs.

Limited Infrastructure and Accessibility

While Singapore boasts world-class airports, the infrastructure for light sport aircraft is underdeveloped. Smaller airstrips, adequate hangar space, and other aviation-related facilities are limited, which hinders the operational convenience of light sport aircraft owners and operators. According to the Singapore Economic Development Board, the infrastructure required to fully support private aviation and light aircraft operations is still being developed, creating a bottleneck for the industry’s growth. Furthermore, airspace congestion at Changi Airport limits accessibility for LSAs, affecting market expansion.

Opportunities

Expansion of Aerodromes and Aviation Facilities

The Singapore government is heavily investing in the expansion of aviation infrastructure, including new aerodromes and smaller private terminals to cater to the needs of light sport aircraft. The government’s focus on aviation as a key sector in its economic development plan has led to increased funding for airport expansion and new airstrips. Additionally, the increase in private aviation has spurred the development of dedicated flying zones for LSAs. These developments create ample opportunities for the growth of the LSA market in Singapore.

Growth of Light Aircraft Leasing and Financing Models

The light aircraft leasing and financing market in Singapore is experiencing rapid growth. With more individuals and businesses looking to access light sport aircraft without the upfront capital cost, leasing and financing models have become a popular alternative. Financial institutions in Singapore have developed specialized loan products for aircraft leasing, which has made private aviation more accessible. In 2024, the number of LSA leasing agreements in Singapore increased by ~%, and this growth is expected to continue as aviation infrastructure improves and the popularity of LSAs increases.

Future Outlook

Over the next five years, the Singapore Light Sport Aircraft market is expected to continue its growth trajectory. This growth is driven by an increasing demand for affordable and flexible aviation solutions, especially for recreational flying and pilot training. Government efforts to enhance aviation infrastructure, including the expansion of smaller aerodromes and private aviation terminals at Changi Airport, will further stimulate the market. Additionally, advancements in electric aircraft technology are expected to open up new opportunities for sustainable aviation solutions in Singapore.

The growing demand for aviation training and the increasing number of flying enthusiasts in the region are expected to continue to propel the market forward.

Major Players

- Pipistrel Aircraft

- Tecnam Aircraft

- Flight Design

- CubCrafters

- Aeropro Aircraft

- Sling Aircraft

- Skycraft Aircraft

- Diamond Aircraft Industries

- BRM Aero

- EVEKTOR Aircraft

- Jabiru Aircraft

- Comco Ikarus

- Hirth Engines

- Aerospool Aircraft

- Skyranger Aircraft

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Private Aviation Companies

- Flying Schools and Aviation Academies

- Aircraft Leasing Companies

- Flight Training Providers

- Aerospace Component Manufacturers

- Airports and Aviation Infrastructure Developers

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying the key drivers, barriers, and trends influencing the Light Sport Aircraft market in Singapore. This is achieved through extensive desk research and interviews with aviation professionals, manufacturers, and regulatory bodies to understand the dynamics of the market.

Step 2: Market Analysis and Construction

In this phase, data from reliable industry sources, including governmental bodies, aviation authorities, and market experts, are compiled and analyzed. The historical data is reviewed to determine the market size, growth patterns, and key market segments.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding the market’s growth drivers and challenges are validated through expert consultations, including structured interviews with aircraft manufacturers, aviation regulators, and private aircraft owners. These consultations provide real-world insights and help refine the data for accuracy.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all findings into a comprehensive report, presenting an in-depth analysis of the Singapore Light Sport Aircraft market, complete with market forecasts, key trends, competitive analysis, and recommendations for stakeholders.

- Executive Summary

- Singapore Light Sport Aircraft Market Research Methodology

Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growing interest in recreational and sport aviation activities

Rising demand for cost-effective pilot training platforms

Supportive regulatory environment for general aviation development - Market Challenges

Limited airspace availability and operational restrictions

High ownership and hangarage costs

Dependence on imported aircraft and spare parts - Market Opportunities

Adoption of electric and low-emission light sport aircraft

Expansion of flight training and aviation academies

Potential use in surveillance and coastal monitoring roles - Trends

Increasing penetration of electric and hybrid propulsion systems

Wider use of digital avionics and glass cockpits

Preference for amphibious and multi-role light sport aircraft

- By Market Value 2024–2029

- By Installed Units 2024–2029

- By Average System Price 2024–2029

- By System Complexity Tier 2024–2029

- By System Type (In Value%)

Fixed-Wing Light Sport Aircraft

Amphibious Light Sport Aircraft

Electric Light Sport Aircraft

Gyroplane Light Sport Aircraft

Experimental Light Sport Aircraft - By Platform Type (In Value%)

Land-Based General Aviation Platforms

Water-Operated Amphibious Platforms

Training-Oriented Sport Platforms

Recreational Leisure Flying Platforms

Surveillance and Observation Platforms - By Fitment Type (In Value%)

Factory-Built Aircraft

Kit-Built and Assembled Aircraft

Avionics-Upgrade Retrofits

Fleet Replacement Aircraft

Mission-Specific Configured Aircraft - By EndUser Segment (In Value%)

Private Recreational Pilots

Flying Clubs and Aero Associations

Flight Training Organizations

Aviation Tourism Operators

Government and Public Agencies - By Procurement Channel (In Value%)

Direct OEM Procurement

Authorized Dealers and Distributors

Flying Club Bulk Purchases

Leasing and Rental Providers

Pre-Owned Aircraft Market

- Market Share Analysis

- Cross Comparison Parameters

(Aircraft Acquisition Cost, Operating Cost per Hour, Range, Payload Capacity, Avionics Configuration) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Tecnam

Pipistrel Aircraft

Flight Design

Icon Aircraft

CubCrafters

Evektor-Aerotechnik

Vans Aircraft

AutoGyro

Aeroprakt

TL Ultralight

BRM Aero

Jabiru Aircraft

Zenith Aircraft

Skyleader

Aeromarine LSA

- Recreational pilots focus on affordability, safety, and ease of operation

- Flying clubs prioritize durability and low lifecycle costs

- Training organizations emphasize reliability and regulatory compliance

- Government users seek flexible platforms for monitoring and patrol

- Forecast Market Value 2030–2035

- Forecast Installed Units 2030–2035

- Price Forecast by System Tier 2030–2035

- Future Demand by Platform 2030–2035