Market Overview

As of 2024, the Singapore logistics market is valued at USD ~ billion, with a growing CAGR of 5.4% from 2024 to 2030, driven by an increasing adoption of technology and the expansion of e-commerce in the region. The sector has experienced substantial growth due to rising consumer demand for quick and efficient delivery services, pushing logistics companies to innovate and enhance service offerings. As a global trading hub, Singapore’s advanced infrastructure and strategic location in Southeast Asia further bolster its logistics sector capabilities and attractiveness.

The market is dominated by major regional players in logistics and supply chain management, particularly in cities like Singapore, which is recognized for its robust transport infrastructure and logistics efficiency. Often regarded as a logistics hub, Singapore’s proximity to key Southeast Asian markets facilitates seamless trade, logistics operations, and supply chain connectivity, allowing companies to serve a broader regional consumer base effectively.

Market Segmentation

By Mode of Transport

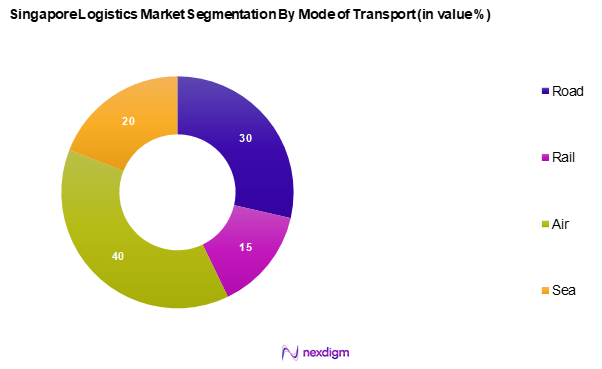

The Singapore logistics market is segmented into road, rail, air, and sea. Among these modes, air transport holds a dominant market share due to the increasing demand for rapid delivery services and the growing e-commerce sector, which necessitates swift logistics solutions. The air freight industry has thrived on the back of international trade, with logistics providers leveraging Singapore’s Changi Airport, one of the busiest cargo hubs in the world. Given the strategic importance of air transport in facilitating global business connections, it is expected to continue leading in the logistics modal split in the coming years.

By Service Type

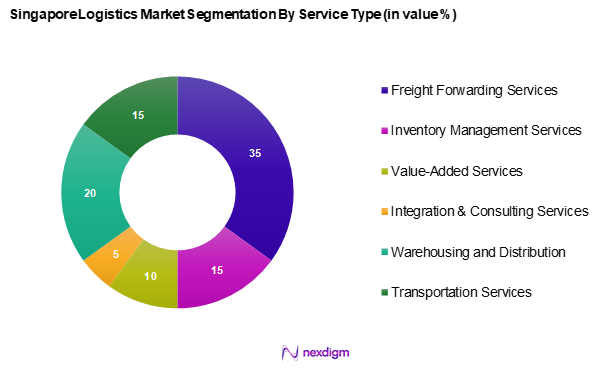

The Singapore logistics market is segmented into freight forwarding services, inventory management services, value-added services, integration & consulting services, warehousing and distribution services, and transportation services. Freight forwarding services dominate the market share, primarily due to increasing international trade volumes and the need for comprehensive logistics solutions. With the emergence of globalization, businesses often rely on freight forwarders to navigate complex international shipping regulations and optimize logistics operations, contributing significantly to their market leadership.

Competitive Landscape

The Singapore logistics market is characterized by several major players, including both local companies and international logistic firms. Key companies in this sector include DHL, Yusen Logistics, and Kuehne + Nagel, representing a blend of strategic global reach and localized service capabilities. This competitive landscape highlights the importance of network connections, technological innovation, and service quality in maintaining market presence and attractiveness to consumers.

| Company Name | Establishment Year | Headquarters | Revenue (USD Mn) | Employees | Service Offerings | Market

Share % |

| DHL | 1969 | Bonn, Germany | – | – | – | – |

| Kuehne + Nagel | 1890 | Switzerland | – | – | – | – |

| Yusen Logistics | 1955 | Tokyo, Japan | – | – | – | – |

| DB Schenker | 1872 | Essen, Germany | – | – | – | – |

| Agility Logistics | 1977 | Sulaibiya, Kuwait | – | – | – | – |

Singapore Logistics Market Analysis

Growth Drivers

Increasing E-commerce Penetration

The continued rise of e-commerce in Singapore has significantly boosted the logistics sector. With a growing portion of the population shifting toward online shopping, the demand for efficient and timely delivery services has intensified. The logistics industry plays a central role in meeting this demand, supporting last-mile delivery and fulfillment needs. Government initiatives to enhance digital infrastructure have further catalyzed this trend by enabling more robust and tech-enabled logistics operations. The growing share of e-commerce within the broader retail landscape reinforces logistics as a key enabler of consumer satisfaction and retail performance.

Technological Advancements

Technology is playing an increasingly pivotal role in transforming logistics operations across Singapore. Automation, artificial intelligence, and IoT applications are being widely adopted, driving improvements in inventory management, real-time tracking, and overall supply chain transparency. Public sector programs, such as smart logistics initiatives, are encouraging industry players to embrace digital tools, enhancing operational efficiency and service quality. These advancements not only streamline backend processes but also improve the end-user experience, making technology integration a major growth catalyst.

Market Challenges

Regulatory Compliance

The logistics sector in Singapore operates under a highly regulated environment. New and evolving compliance requirements related to safety, emissions, and environmental standards present ongoing challenges for logistics firms. Meeting these standards demands continuous investment in training, systems, and processes, which can place a strain on operational resources. These regulatory pressures not only complicate daily operations but also create barriers for smaller players or new entrants, affecting the competitive dynamics within the market.

High Operational Costs

Rising operational costs remain a significant hurdle for logistics providers in Singapore. Increases in fuel prices and labor expenses, coupled with policy changes such as wage regulations, are placing upward pressure on cost structures. At the same time, talent shortages in the logistics workforce are adding further complexity, making it difficult for companies to operate efficiently at scale. These cost-related pressures can erode profit margins and make it harder for firms to compete both locally and in regional markets.

Opportunities

Expansion into Emerging Markets

Singapore’s strategic location continues to serve as a gateway to emerging economies in Southeast Asia, presenting logistics firms with lucrative expansion opportunities. As neighboring countries experience rapid economic development, demand for cross-border logistics and trade facilitation is increasing. Singapore-based logistics companies are leveraging this momentum to establish strong regional linkages, supported by government-backed trade partnerships and infrastructure enhancements. This regional expansion not only diversifies revenue streams but also strengthens Singapore’s position as a logistics hub in Asia.

Adoption of Sustainable Practices

Sustainability is becoming a prominent focus area for the logistics industry in Singapore. Many logistics firms are actively implementing green practices to reduce their environmental footprint, including the use of electric vehicles and energy-efficient warehousing. The government’s commitment to sustainability, reflected in its policy and funding support, is accelerating the transition toward cleaner logistics operations. Embracing sustainable practices offers companies a dual advantage—aligning with regulatory and social expectations while improving brand value and long-term competitiveness.

Future Outlook

Over the next five years, the Singapore logistics market is projected to experience significant growth driven by expanding e-commerce adoption, technological advancements in logistics processes, and increased investments in infrastructure. The focus on sustainability practices and the integration of digital solutions will further enhance operational efficiency, positioning Singapore as a global leader in logistics and supply chain management.

Major Players

- DHL

- Kuehne + Nagel

- Yusen Logistics

- DB Schenker

- Agility Logistics

- SingPost Logistics

- XPO Logistics

- Nippon Express

- Ryder Supply Chain Solutions

- Hitachi Transport System

- CEVA Logistics

- UPS Supply Chain Solutions

- Expeditors International

- SEKO Logistics

- Others

Key Target Audience

- Logistics Companies

- Retail and E-commerce Businesses

- Transport and Freight Forwarding Services

- Manufacturers and Suppliers

- Government and Regulatory Bodies (e.g., Ministry of Transport, Singapore Economic Development Board)

- Investments and Venture Capitalist Firms

- International Trade Organizations

- Supply Chain Management Firms

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables that compose the Singapore logistics market ecosystem. This includes constructing a comprehensive map of major stakeholders and collecting data on market dynamics. Various secondary and proprietary research databases are utilized to gather robust information that defines the parameters affecting the logistics landscape in Singapore.

Step 2: Market Analysis and Construction

In this phase, historical market data specific to the Singapore logistics sector is compiled and analyzed. The focus is on understanding market penetration rates, ratios of service providers, and relevant revenue generation statistics. This analysis provides the foundation to estimate future market growth accurately, giving insight into supply-demand dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses are validated through consultations with industry experts via computer-assisted telephone interviews (CATIs). Engaging a diverse range of stakeholders across logistics companies provides critical insights that refine and confirm the data gathered, ensuring a realistic perspective on market expectations.

Step 4: Research Synthesis and Final Output

The final phase engages with logistics providers to gather insights on product offerings, operational effectiveness, and consumption trends. This continues the verification process initiated in earlier steps, blending bottom-up and top-down approaches to deliver a comprehensive analysis of market trends and forecasts for the Singapore logistics market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing E-commerce Penetration

Technological Advancements - Market Challenges

Regulatory Compliance

High Operational Costs - Opportunities

Expansion of Emerging Markets

Adoption of Sustainable Practices - Trends

Rise of Smart Warehousing

Growth of Eco-Friendly Logistics Solutions - Government Regulation

Trade Policies

Environmental Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Mode of Transport, (In Value %)

Road

Rail

Air

Sea - By Service Type, (In Value %)

Freight Forwarding Services

Inventory Management Services

Value-Added Services

Integration & Consulting Services

Warehousing and Distribution Services

Transportation Services - By End-User Vertical, (In Value %)

Manufacturing

Consumer Goods

Retail

Food and Beverages

IT Hardware

Chemicals

Construction

Automotive

Telecom

Others - By Model, (In Value %)

1PL

2PL

3PL

4PL - By Category, (In Value %)

Conventional Logistics

E-Commerce Logistics - By Customer Type, (In Value %)

B2B

B2C

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Mode of Transport Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenue Analysis, Service Offerings, Technology Adoption)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

DHL

SingPost Logistics

Yusen Logistics

Kuehne + Nagel

DB Schenker

CEVA Logistics

Nippon Express

Agility Logistics

Ryder Supply Chain Solutions

Hitachi Transport System

XPO Logistics

Expeditors International

UPS Supply Chain Solutions

SEKO Logistics

Others

- Market Demand and Utilization Patterns

- Purchasing Power Analysis

- Regulatory and Compliance Requirements

- Needs and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Mode of Transport, 2025-2030