Market Overview

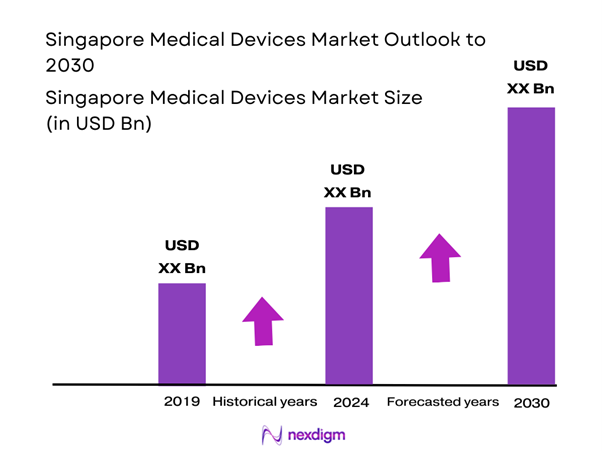

The Singapore Medical Devices Market is valued at USD 4.8 billion in 2024, demonstrating robust growth driven by technological advancements and an aging population. The increasing demand for advanced healthcare solutions and higher expenditures on healthcare services contribute significantly to this market expansion. Technological innovations, particularly in minimally invasive surgical equipment and diagnostic devices, continue to propel the market forward, making high-quality healthcare more accessible.

The key regions dominating the Singapore medical devices market include major urban centers such as Singapore City and Jurong, both known for their strong healthcare infrastructure. Singapore City is a hub for healthcare innovation and research, attracting significant investments from global medical device companies. Additionally, regulatory frameworks and support from the Health Sciences Authority (HSA) ensure that the market remains competitive while fostering innovation, further consolidating Singapore’s position as a leading medical devices market in Asia.

Healthcare expenditure in Singapore has seen a significant rise, reaching approximately USD 13.2 billion in 2022, according to the World Bank. This financial boost reflects the nation’s commitment to enhancing healthcare infrastructure, technology, and services, subsequently benefiting the medical devices market. Increased funding assures that new medical technologies and innovations are adopted to improve patient outcomes and care standards.

Market Segmentation

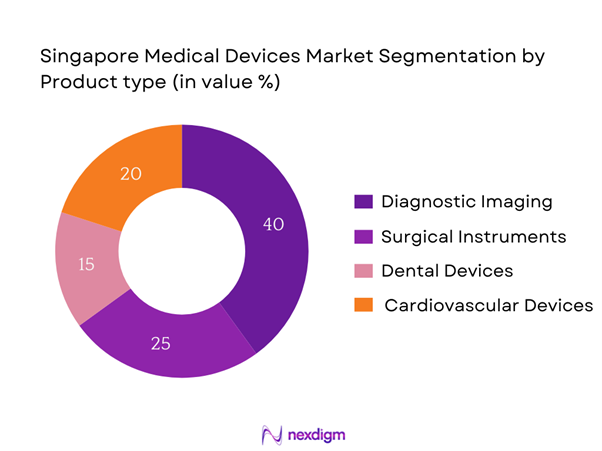

By Product Type

The Singapore medical devices market is segmented by product type into diagnostic imaging, surgical instruments, dental devices, and cardiovascular devices. Recently, diagnostic imaging has been a dominant segment in the market, owing to increasing demand for precise and early disease detection methods. Technologies such as MRI and CT scans are integral to healthcare practices, boosting the market share of this sub-segment. Leading companies in diagnostic imaging have made significant advancements in imaging technologies, focusing on portability, improved accuracy, and reduced radiation exposure, making them preferred choices in hospitals and clinics.

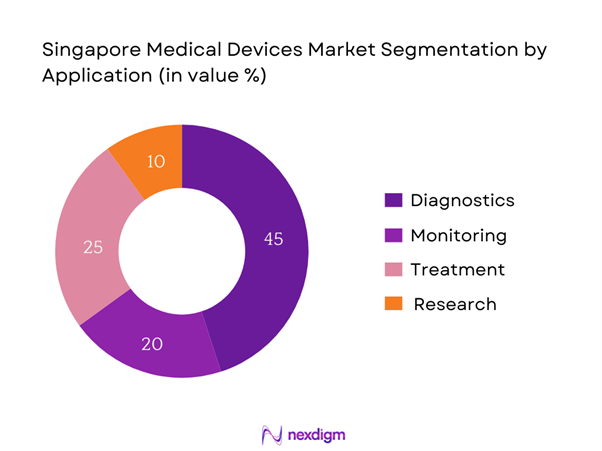

By Application

The market is segmented by application into diagnostics, monitoring, treatment, and research. Among these, diagnostics holds a dominant market share as healthcare providers increasingly prioritize early detection and disease prevention strategies. The rise in chronic diseases necessitates advanced diagnostic solutions, including lab tests and imaging, enabling timely medical intervention. Furthermore, innovations and advancements in point-of-care diagnostics have improved access to healthcare services, particularly in outpatient settings, further driving the growth of this segment.

Competitive Landscape

The Singapore medical devices market is characterized by significant competition, with several global players leading the industry. Major companies include Philips Healthcare, GE Healthcare, Siemens Healthineers, Medtronic, and Boston Scientific. These companies leverage strong R&D capabilities and innovative technologies to maintain market leadership.

| Company | Year Established | Headquarters | Market Presence | Key Products | Strategic Focus | Recent Developments |

| Philips Healthcare | 1891 | Netherlands | – | – | – | – |

| GE Healthcare | 1892 | USA | – | – | – | – |

| Siemens Healthineers | 1847 | Germany | – | – | – | – |

| Medtronic | 1949 | Ireland | – | – | – | – |

| Boston Scientific | 1979 | USA | – | – | – | – |

Singapore Medical Devices Market Analysis

Growth Drivers

Increasing Aging Population

The increasing aging population significantly drives the growth of the Singapore Medical Devices Market. In 2022, about 15.4% of Singapore’s total population was aged 65 and over, which is projected to rise to 21.9% by 2030, according to the Population Division of the United Nations. This demographic shift necessitates enhanced healthcare services and technologies tailored for elderly care, including advanced diagnostic tools and home care medical devices. The growing number of seniors furthermore increases the demand for mobility aids, monitoring devices, and health management solutions that cater specifically to age-related health issues.

Rising Prevalence of Chronic Diseases

The prevalence of chronic diseases in Singapore is a major growth driver for the medical devices sector. As of 2023, approximately 35% of Singaporeans aged 60 and above were reported to have chronic conditions such as hypertension, diabetes, and heart disease, according to the Ministry of Health Singapore. This increase—in tandem with an aging population—further underscores the demand for advanced medical technologies and devices focused on monitoring and managing chronic illnesses effectively. Higher investments in chronic disease management programs and continuous health monitoring devices will be crucial in addressing this public health challenge, emphasizing the need for ongoing innovations in the healthcare sector.

Market Challenges

Regulatory Hurdles

One of the prominent challenges in the Singapore Medical Devices Market is navigating the complex regulatory framework governing medical device licensing and approval. The Health Sciences Authority (HSA) maintains stringent regulations that require comprehensive documentation and substantial evidence for device safety and efficacy. This regulatory environment can extend the product development pipeline, dissuading some companies from entering the market or launching new products. Companies must invest considerable resources into compliance processes, which can delay the availability of innovative devices. While this ensures the high standards of medical products, it also poses a barrier to timely market entry.

Reimbursement Issues

Reimbursement challenges present another significant obstacle in the Singapore Medical Devices market landscape. Many innovative medical devices struggle to secure coverage under the national insurance framework, limiting their affordability and accessibility. In 2023, only 30% of new medical devices were included in the list of reimbursable items, according to reports from the Ministry of Health Singapore. This lack of reimbursement can adversely affect sales and market penetration of advanced medical technologies, as healthcare providers may be hesitant to invest in devices that do not offer financial incentives—thereby hindering the proliferation of cutting-edge solutions within the healthcare system.

Opportunities

Technological Advancements

Technological advancements present a significant opportunity for growth within the Singapore Medical Devices Market. Innovations in areas such as telemedicine, AI diagnostics, and wearable health technology are rapidly evolving. As of 2023, 45% of hospitals in Singapore integrated telemedicine services into their offerings, significantly enhancing patient access to healthcare. The current push for digital health solutions presents opportunities for companies to develop and market advanced devices and platforms that improve the efficiency of healthcare delivery, and address the challenges posed by an aging population and increasing chronic diseases. Capitalizing on these trends will be vital for industry players looking to expand their presence.

Rising Demand for Home Healthcare Devices

There is an increasing demand for home healthcare devices driven by the shift toward patient-centric care models. In 2022, the home healthcare market was valued at USD 612 million, reflecting patients’ preference for receiving care at home. The aging population, coupled with the rising frequency of chronic disease management, contributes to this demand. Technologies such as remote monitoring devices and home health assessments are gaining traction. This trend allows stakeholders to innovate and deliver products that empower patients to self-manage their health conditions, providing a significant opportunity to capture market share in the home healthcare segment.

Future Outlook

Over the next five years, the Singapore medical devices market is projected to experience significant growth, fueled by ongoing advancements in medical technology, increasing healthcare expenditure, and heightened consumer demand for innovative medical solutions. The market is expected to expand due to rising investments in healthcare infrastructure and regulatory support for the development of new devices, enhancing the country’s reputation as a leading medical technology hub in Asia.

Major Players

- Philips Healthcare

- GE Healthcare

- Siemens Healthineers

- Medtronic

- Boston Scientific

- Johnson & Johnson

- Abbott Laboratories

- Striker Corporation

- Becton, Dickinson and Company

- Canon Medical Systems

- Olympus Corporation

- Terumo Corporation

- 3M Company

- Getinge AB

- Smith & Nephew

Key Target Audience

- Healthcare Providers

- Hospitals and Clinics

- Medical Device Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Health Sciences Authority, Ministry of Health)

- Distributors and Suppliers

- Insurance Companies

- Health Technology Assessment Agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase of research involves constructing an ecosystem map that includes all major stakeholders within the Singapore Medical Devices Market. This comprehensive approach relies heavily on desk research, utilizing a mixture of secondary and proprietary databases, to gather in-depth information regarding industry dynamics. The primary goal is to identify and define crucial variables that impact market behavior and trends.

Step 2: Market Analysis and Construction

This phase entails compiling and analyzing historical data relevant to the Singapore Medical Devices Market. We will assess important indicators such as market penetration rates, the ratio of various product types, and revenue streams generated by different market segments. Additionally, an evaluation of service quality statistics will be performed to ensure the accuracy of the revenue projections and market estimations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through a series of structured interviews with industry experts representing various segments within the medical devices ecosystem. These consultations, conducted via computer-assisted telephone interviews (CATIs), will offer valuable insights and enable the refinement of existing market data based on feedback from practitioners with hands-on experience in the field.

Step 4: Research Synthesis and Final Output

In the final stage, our research team will engage directly with multiple medical device manufacturers to gather detailed information on product segments, sales performance metrics, consumer preferences, and various other key factors influencing the market. These interactions will serve to validate and corroborate data obtained during earlier phases, ensuring a comprehensive and reliable analysis of the Singapore Medical Devices Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Aging Population

Rising Prevalence of Chronic Diseases

Increased Healthcare Expenditure - Market Challenges

Regulatory Hurdles

Reimbursement Issues - Opportunities

Technological Advancements

Rising Demand for Home Healthcare Devices - Trends

Integration of IoT in Medical Devices

Growth of Minimally Invasive Surgery - Government Regulation

Medical Device Licensing

Safety and Quality Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Class I Devices

– Bandages and Dressings

– Thermometers

– Tongue Depressors

– Manual Wheelchairs

Class II Devices

– Infusion Pumps

– Blood Pressure Monitors

– Hearing Aids

– Surgical Drapes

Class III Devices

– Implantable Pacemakers

– Heart Valves

– Neurostimulators

– Cochlear Implants

Imaging Equipment

– Magnetic Resonance Imaging (MRI)

– Computed Tomography (CT) Scanners

– Ultrasound Machines

– X-ray Machines

Surgical Instruments

– Scalpels and Forceps

– Laparoscopic Instruments

– Robotic Surgical Systems

– Endoscopic Devices - By Application (In Value %)

Diagnostic

– Blood Glucose Monitoring

– Imaging Systems

– Diagnostic Kits

– In Vitro Diagnostic Devices

Therapeutic

– Dialysis Machines

– Insulin Delivery Systems

– Pain Management Devices

– Respiratory Therapy Devices

Monitoring

– ECG Monitors

– Blood Pressure Monitors

– Vital Signs Monitors

– Wearable Devices

Surgical

– Anesthesia Equipment

– Electrosurgical Devices

– Robotic-Assisted Surgery Systems

– Sterilization Equipment

Rehabilitation

– Mobility Aids

– Physical Therapy Equipment

– Prosthetics and Orthotics

– Assistive Devices for Elderly - By End User (In Value %)

Hospitals

– Government Hospitals

– Private Multi-specialty Hospitals

– Specialty Centers (Cardiology, Oncology, etc.)

Clinics

– General Practice Clinics

– Specialty Clinics (ENT, Ortho, etc.)

– Day Surgery Centers

Home Healthcare

– Chronic Disease Monitoring Devices

– Remote Patient Monitoring

– Mobility & Assistive Equipment

Diagnostic Laboratories

– Pathology Labs

– Imaging Centers

– Genetic Testing Labs

Nursing Homes

– Long-Term Elderly Care Facilities

– Assisted Living Facilities

– Palliative Care Centers - By Distribution Channel (In Value %)

Direct Sales

Distributors

Online Retail - By Region (In Value %)

Central Region

Eastern Region

Western Region

Northern Region

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Product Type Segment, 2024 - Cross Comparison Parameters

(Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Product Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Market Penetration Strategy, Average Product Margins) - SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Philips Healthcare

Siemens Healthineers

Medtronic

Johnson & Johnson

Abbott Laboratories

GE Healthcare

Boston Scientific

Stryker Corporation

Becton, Dickinson and Company

Zimmer Biomet

Olympus Corporation

Terumo Corporation

3M Company

Getinge AB

Canon Medical Systems

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030