Market Overview

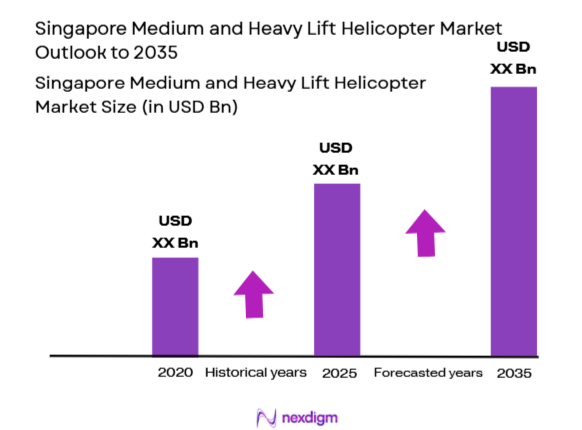

The Singapore medium and heavy lift helicopters market is valued at USD ~ billion in 2023. This market is primarily driven by increasing defense and military modernization efforts, the expansion of the oil and gas industry, and growing demand for helicopters in search and rescue operations. Additionally, the technological advancements in helicopter designs, including fuel efficiency and automated flight systems, have boosted market growth. The demand for helicopters is expected to increase further, with more focus on offshore and military applications.

The countries dominating the Singapore medium and heavy lift helicopters market include Singapore, Australia, and Malaysia. Singapore’s strategic location and strong defense budget have made it a leading player in the region, with a robust demand for both civil and military helicopters. Malaysia, with its growing offshore oil industry, and Australia, which has an expansive search and rescue and defense sector, also contribute significantly to the market. These countries’ strong aviation infrastructure and government support make them key players in the market.

Market Segmentation

By System Type

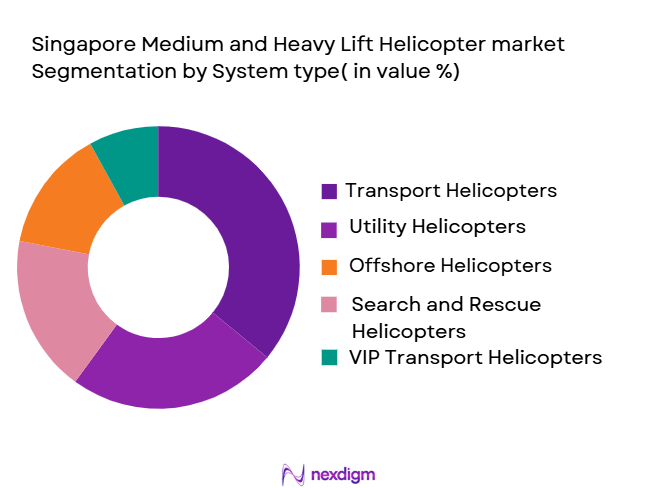

The Singapore medium and heavy lift helicopters market is segmented by system type into utility helicopters, transport helicopters, search and rescue helicopters, offshore helicopters, and VIP transport helicopters. Transport helicopters dominate the market due to their wide usage in both military and civil sectors. The increasing need for transporting personnel and equipment for offshore oil and gas operations, coupled with growing defense demands, has made this segment a key player in the market. The versatility of transport helicopters, especially those equipped for both cargo and personnel, ensures their continued dominance in the market.

By Platform Type

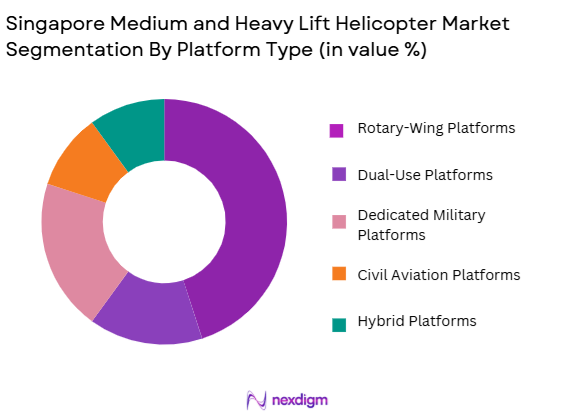

The market is segmented by platform type into rotary-wing platforms, dual-use platforms, dedicated military platforms, civil aviation platforms, and hybrid platforms. The rotary-wing platforms segment dominates the market. These platforms are essential for medium and heavy lift helicopters, offering flexibility and operational efficiency. The high demand from the military and offshore industries, which rely heavily on these platforms for versatile applications, contributes to the dominance of rotary-wing platforms in the market.

Competitive Landscape

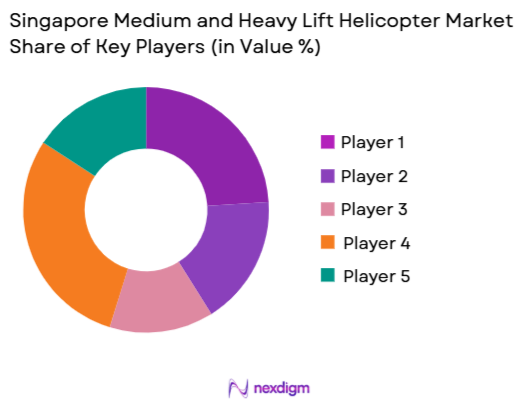

The Singapore medium and heavy lift helicopters market is dominated by a few major players, including both local and international companies. These players include Airbus Helicopters, Boeing, Sikorsky Aircraft, Leonardo, and Bell Helicopter. Their dominance stems from their advanced helicopter designs, strong brand presence, and established customer relationships across various sectors, including defense, civil aviation, and offshore industries.

| Company | Establishment Year | Headquarters | Product Offerings | Key Market Segments | Global Presence | Strategic Partnerships |

| Airbus Helicopters | 1992 | France | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ |

| Sikorsky Aircraft | 1923 | USA | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ |

| Bell Helicopter | 1935 | USA | ~ | ~ | ~ | ~ |

Singapore Medium and Heavy Lift Helicopter Market Analysis

Growth Drivers

Urbanization

Singapore’s urbanization continues to drive the demand for medium and heavy lift helicopters, particularly in sectors such as search and rescue, offshore oil and gas, and defense. With the country’s urban population expected to exceed ~million in 2024, the demand for rapid transport solutions and emergency services is increasing. The government’s investment in infrastructural development, including urban search and rescue, supports this trend, as helicopters offer timely solutions for transportation in congested urban areas. The high density and infrastructure expansion further emphasize the need for medium and heavy lift helicopters to serve critical sectors efficiently.

Industrialization

The industrial sector’s continued growth in Singapore has been a key growth driver for the medium and heavy lift helicopter market, especially in the offshore oil and gas industry. As of 2024, Singapore’s industrial production is expected to grow at a steady pace, with major sectors such as oil extraction, shipbuilding, and aerospace driving this expansion. These industries require reliable air transport solutions to move equipment, personnel, and goods to and from offshore platforms, fueling the demand for medium and heavy lift helicopters. With an industrial production value of USD ~billion in 2023, the demand for logistics and infrastructure support is expected to rise, promoting the use of helicopters for these services.

Restraints

High Initial Costs

Despite the growing demand, the high initial cost of acquiring medium and heavy lift helicopters remains a key restraint for the market. The upfront cost of purchasing a new helicopter can reach millions of dollars, making it a significant financial investment for governments and private enterprises. In 2024, the price of a medium-lift helicopter can range from USD ~ million to USD ~million, while heavy-lift models can exceed USD ~million, depending on the specifications and equipment. The financial burden of these investments, particularly for small to medium-sized operators, limits the accessibility of these helicopters, making it a challenge for market growth.

Technical Challenges

The technical challenges associated with medium and heavy lift helicopters, including their maintenance, repair, and operational efficiency, pose a significant restraint on the market. The helicopters require high levels of technical expertise and specialized training for their operation and maintenance. As of 2024, helicopter operators in Singapore face challenges in maintaining a skilled workforce capable of servicing advanced helicopter systems. Technical issues such as component wear and tear, fuel efficiency, and the cost of spare parts also add to the operational burden, making it more difficult for operators to remain competitive. These factors limit the rapid expansion of the market.

Opportunities

Technological Advancements

Technological advancements in medium and heavy lift helicopters offer significant opportunities for market growth in 2024. New innovations in engine efficiency, lightweight materials, and automation are pushing the boundaries of what these helicopters can achieve. Helicopters with hybrid-electric propulsion systems, for example, offer the potential for reduced operational costs and better fuel efficiency, addressing the growing environmental concerns in the aviation sector. These advancements present substantial opportunities for operators to upgrade their fleets with more advanced and cost-effective models. The continuous progress in autonomous flight systems also offers a glimpse into the future of helicopter operations, where increased automation could enhance operational efficiency and reduce human errors.

International Collaborations

International collaborations are a key opportunity for the growth of Singapore’s medium and heavy lift helicopter market. By engaging in joint ventures and partnerships with global aerospace manufacturers, local companies can access advanced helicopter technologies and increase their presence in international markets. For example, the ongoing collaboration between Singapore’s aerospace industry and major helicopter manufacturers like Boeing and Airbus enhances technological exchange and offers opportunities for growth in both military and civil helicopter segments. These collaborations help reduce R&D costs, promote innovation, and increase the competitiveness of Singaporean operators in the global aviation market.

Future Outlook

Over the next 5 years, the Singapore medium and heavy lift helicopters market is expected to see significant growth driven by continued investment in defense modernization, offshore oil and gas exploration, and technological innovations in the helicopter industry. The demand for advanced, multi-role helicopters is projected to rise as more countries in the Asia-Pacific region focus on upgrading their air defense capabilities and offshore transport operations. Additionally, ongoing developments in autonomous flight systems and more fuel-efficient engines will shape the future growth trajectory of the market.

Major Players in the Market

- Airbus Helicopters

- Boeing

- Sikorsky Aircraft

- Leonardo

- Bell Helicopter

- Enstrom Helicopter Corporation

- Kaman Aerospace

- Russian Helicopters

- Lockheed Martin

- Guimbal Helicopteres

- Korean Aerospace Industries

- HAL (Hindustan Aeronautics Limited)

- Mitsubishi Heavy Industries

- China Aviation Industry Corporation

- Guizhou Aircraft Industry

Key Target Audience

- Military and Defense Organizations

- Oil and Gas Industry Stakeholders

- Emergency Medical Services Providers

- Government Aviation Agencies

- Investment and Venture Capitalist Firms

- Helicopter OEMs

- Offshore Operators

- Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves defining all key market variables that directly impact the Singapore medium and heavy lift helicopters market. This will include identifying crucial economic drivers such as defense spending, offshore demand, and advancements in aviation technologies. Research methods will include a blend of secondary research and expert consultations to create a comprehensive understanding of the market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data regarding the medium and heavy lift helicopter market will be analyzed. This involves examining past sales data, market penetration, and growth patterns within the region. A comprehensive analysis of market activities, including the impact of major government policies, will provide insights into the future market trajectory.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations will be conducted with industry leaders, including key stakeholders in defense, aviation, and offshore sectors. Interviews with helicopter manufacturers, government regulators, and operators will provide real-world insights into the evolving market and technology trends. This validation step ensures the accuracy and relevance of the findings.

Step 4: Research Synthesis and Final Output

The final output will be synthesized from the collected data, expert opinions, and market analysis. Detailed forecasts will be made based on market trends, technological developments, and customer demands. Insights will be cross-verified with primary sources, such as aviation authorities and helicopter manufacturers, to ensure comprehensive and credible results.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Offshore Transport

Rising Need for Search and Rescue Operations

Growing Military Expenditures - Market Challenges

High Operational Costs

Regulatory Compliance Complexities

Limited Availability of Skilled Pilots - Trends

Emerging Hybrid Power Systems

Digitalization of Maintenance and Operations

Development of Autonomous Flight Capabilities

- Market Opportunities

Advancements in Fuel Efficiency and Technology

Increased Military and Civil Aviation Integration

Growing Investments in Infrastructure Development - Government regulations

Stringent Noise and Emission Standards

Evolving Airworthiness Certification Requirements

Helicopter Safety Regulations - SWOT analysis

Strengthening Military Capabilities in Asia-Pacific

Emerging Trends in Helicopter Automation

Challenges in Meeting Fuel Efficiency Standards - Porters 5 forces

Moderate Threat of New Entrants

High Bargaining Power of Suppliers

Low Bargaining Power of Buyers

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Utility Helicopters

Transport Helicopters

Search & Rescue Helicopters

Offshore Helicopters

VIP Transport Helicopters - By Platform Type (In Value%)

Rotary-Wing Platforms

Dual-Use Platforms

Dedicated Military Platforms

Civil Aviation Platforms

Hybrid Platforms - By Fitment Type (In Value%)

Custom Fitment

Standard Fitment

Modified Fitment

OEM Fitment

Aftermarket Fitment - By EndUser Segment (In Value%)

Government / Military

Oil & Gas Industry

Emergency Medical Services

Search & Rescue Operations

VIP & Corporate Transport - By Procurement Channel (In Value%)

Direct Procurement

Government Tender

Third-Party Resellers

OEM Dealers

Leasing Companies

- Market Share Analysis

- CrossComparison Parameters(Market Value, Installed Units, System Complexity, Procurement Channel, Platform Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Singapore Technologies Aerospace

Boeing

Airbus Helicopters

Leonardo

Sikorsky Aircraft

Bell Helicopter

Enstrom Helicopter Corporation

Kaman Aerospace

Russian Helicopters

Lockheed Martin

Guimbal Helicopteres

Korean Aerospace Industries

HAL

China Aviation Industry Corporation

Guizhou Aircraft Industry

Mitsubishi Heavy Industries

- High Demand from Oil and Gas Sector for Heavy Lift Solutions

- Military Focus on Versatile Helicopters for Combat and Logistics

- Growing Civil Aviation Market for VIP Transport

- Increased Use of Helicopters in Disaster Relief and EMS

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035