Market Overview

The market for electric aircraft in Singapore is expected to reach a substantial value in 2024, driven by the growing demand for sustainable aviation solutions. The transition to electric aircraft is facilitated by advances in battery technology and increased governmental support for green aviation. The size of the market is projected to be over USD ~ million, backed by investments from both public and private sectors. Technological advancements in battery energy density and electric propulsion systems are leading the way in accelerating this transformation.

Singapore, a global aviation hub, is at the forefront of the electric aircraft market due to its strategic location and government policies supporting green aviation. The city-state has long been a leader in adopting new technologies, including the push for sustainable air travel. Proximity to major Asian aviation markets and its role as a logistics and trade center makes Singapore a key player in electric aviation. Regulatory frameworks and infrastructure development also play a significant role in driving the country’s dominance in the sector.

Market Segmentation

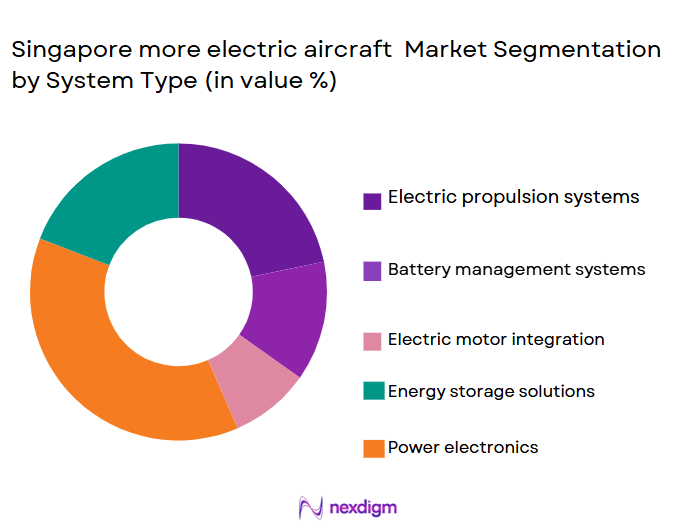

By System Type

The electric aircraft market in Singapore is segmented by product type into hybrid electric aircraft, full electric aircraft, parallel hybrid systems, series hybrid systems, and electric propulsion systems. Among these, hybrid electric aircraft have a dominant market share due to their ability to combine the efficiency of electric motors with the reliability of traditional jet engines. This hybrid solution addresses the challenges of range and energy storage while offering significant fuel savings and reduced emissions, making it an attractive choice for both commercial and cargo aviation.

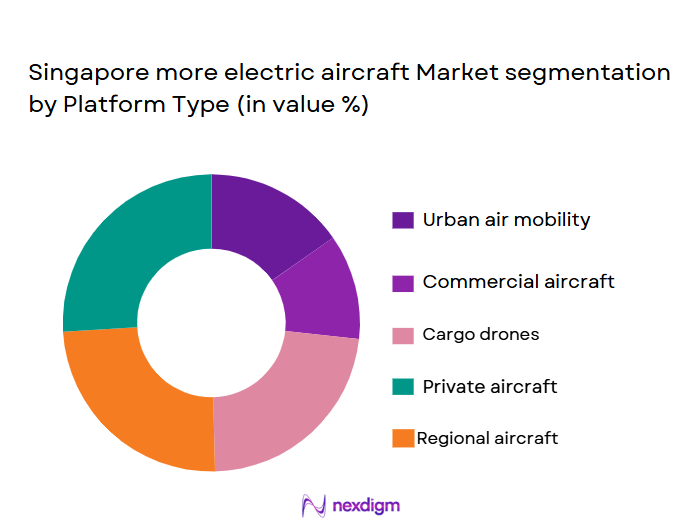

By Platform Type

The market is also segmented by platform type into regional aircraft, urban air mobility (UAM), commuter aircraft, cargo aircraft, and military aircraft. Urban air mobility (UAM) has emerged as the dominant segment due to growing interest in air taxis and short-distance travel in congested cities. With the support of Singapore’s advanced infrastructure and government backing, UAM is expected to revolutionize transportation by reducing ground traffic congestion and providing fast, environmentally friendly alternatives for urban mobility.

Competitive Landscape

The electric aircraft market in Singapore is characterized by rapid innovation and increasing consolidation among key players. Companies like Airbus and Rolls-Royce are leading the market with their technological advancements in hybrid-electric propulsion systems. Collaboration with governmental bodies and aviation regulators is critical for these companies to secure certification and regulatory approval. Major players are expanding their focus towards urban air mobility and full-electric aircraft, positioning themselves for future growth as demand for sustainable air travel increases globally.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Market Parameter |

| Airbus | 1970 | France | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | UK | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ | ~ |

| Vertical Aerospace | 2016 | UK | ~ | ~ | ~ | ~ | ~ |

| Joby Aviation | 2009 | USA | ~ | ~ | ~ | ~ | ~ |

Singapore more electric aircraft Market Analysis

Growth Drivers

Increasing Demand for Sustainable Aviation Solutions

The push for greener and more sustainable aviation solutions is one of the key drivers of the electric aircraft market in Singapore. Governments and industries worldwide are under pressure to reduce carbon emissions, and aviation, being a major contributor to global CO2 emissions, has become a focus for decarbonization efforts. Singapore, being a major aviation hub, has implemented various policies and investments to promote electric aircraft technology. The government’s commitment to sustainability, combined with technological advances in battery storage and propulsion systems, is fostering rapid growth in the market for electric aircraft. This shift towards green aviation is expected to reduce dependence on fossil fuels, lower operating costs, and provide a significant opportunity for the electric aircraft market to expand. Moreover, airlines and aviation companies are increasingly investing in eco-friendly aircraft to meet international emissions reduction targets and government mandates for greener fleets. Additionally, international collaborations between the private sector and governmental agencies are helping accelerate the development of electric aircraft technologies, which further boosts market growth.

Technological Advancements in Battery Energy Density and Propulsion Systems

Technological advancements, particularly in the development of high-energy-density batteries and electric propulsion systems, are another major growth driver. The improvement in battery technology is crucial to the viability of electric aircraft, as it directly impacts the range and efficiency of the aircraft. Innovations such as solid-state batteries, lightweight materials, and more efficient energy management systems are enabling electric aircraft to operate at lower costs and with greater operational reliability. In Singapore, investment in research and development of electric propulsion systems is pushing the market forward, as both commercial and cargo aviation sectors seek more energy-efficient alternatives to traditional aircraft engines. This technological evolution is also facilitating the development of hybrid-electric systems, which combine electric power with traditional jet engines to achieve greater range and payload capacity. As these technological barriers are overcome, the electric aircraft market will continue to grow, with significant advancements expected in the coming years. The integration of AI in flight management systems is also enhancing aircraft performance, further driving market growth.

Market Challenges

High Initial Investment and Development Costs

One of the most significant challenges facing the electric aircraft market is the high initial investment and development costs associated with the production of electric aircraft. Despite the growing demand for sustainable aviation solutions, the cost of manufacturing electric aircraft, including hybrid-electric systems, remains high. This is largely due to the cost of advanced materials, battery technology, and specialized components required to build electric aircraft. The long development timelines and the need for substantial investment in R&D have created a barrier to entry for new players in the market. Furthermore, electric aircraft manufacturers must adhere to stringent safety standards and regulatory requirements, which can increase development costs even further. As a result, many companies face difficulties in securing adequate funding to support the development and commercialization of electric aircraft. While these costs are expected to decrease as technology advances and economies of scale are realized, they remain a significant challenge for both established and new entrants in the market.

Regulatory Barriers and Certification Delays

The process of obtaining certification for electric aircraft is complex and time-consuming, posing a challenge for market expansion. Regulatory bodies such as the FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency) have established rigorous standards for the certification of aircraft, which include extensive testing of new technologies, including electric propulsion systems. These lengthy certification processes can delay the introduction of new electric aircraft models into the market, limiting the pace at which electric aircraft can be adopted. In addition to the technical testing requirements, regulatory authorities also need to evaluate the safety of charging infrastructure and air traffic control systems for electric aircraft, which adds further complexity to the process. As the electric aircraft industry grows, regulators will need to develop new certification pathways tailored to the unique challenges posed by electric propulsion, but this transition is expected to take time. Until regulatory barriers are addressed, the widespread deployment of electric aircraft will face significant delays, hindering the market’s full potential.

Opportunities

Emergence of Urban Air Mobility (UAM)

One of the most promising opportunities in the electric aircraft market is the rise of Urban Air Mobility (UAM). UAM includes the development of electric air taxis, drones, and other small aircraft designed to transport people and goods in urban environments. With the increasing demand for faster and more efficient transportation in crowded cities, UAM has the potential to revolutionize the way people travel in urban areas. Singapore, with its advanced infrastructure and focus on sustainable transport solutions, is well-positioned to become a leader in the UAM sector. The government’s support for electric aviation, along with the growth of electric propulsion systems, provides a solid foundation for the development and deployment of UAM solutions. This growing market presents a lucrative opportunity for companies in the electric aircraft space to invest in new technologies and services that cater to urban transportation. As the demand for air taxis and short-distance travel grows, the UAM market is expected to expand rapidly, driving the adoption of electric aircraft.

Collaborations with International Defense Contractors

Another significant opportunity for the electric aircraft market lies in collaboration with international defense contractors to develop hybrid-electric and fully electric military aircraft. As defense agencies around the world seek to reduce fuel consumption and decrease the environmental impact of military operations, electric aircraft present a compelling solution. Singapore’s strategic location and its strong defense sector provide an ideal environment for military applications of electric aircraft. Collaborations between private electric aircraft manufacturers and defense contractors could lead to the development of innovative solutions for military aviation, including electric drones, surveillance aircraft, and cargo transport. These collaborations could also accelerate the advancement of electric aircraft technologies by sharing resources, knowledge, and expertise across the civil and military aviation sectors. As the global defense sector continues to focus on sustainability, this market segment is expected to grow, offering significant opportunities for electric aircraft manufacturers.

Future Outlook

The electric aircraft market is expected to experience rapid growth in the next five years, driven by advancements in battery technology, propulsion systems, and increasing regulatory support for green aviation. As infrastructure for electric aircraft charging and maintenance expands, the adoption of electric aircraft in both commercial and urban air mobility sectors will accelerate. With continued governmental support and technological breakthroughs, the electric aircraft market is poised to play a major role in reshaping the aviation industry, contributing to significant reductions in carbon emissions and the global transition to sustainable aviation.

Major Players

• Rolls-Royce

• Boeing

• Vertical Aerospace

• Joby Aviation

• Lilium

• Embraer

• Honeywell Aerospace

• NASA

• PWC (Pratt & Whitney Canada)

• Zunum Aero

• MagniX

• Heart Aerospace

• EHang

• Volocopter

Key Target Audience

• Government and regulatory bodies

• Aviation manufacturers

• Airlines

• Urban air mobility operators

• Aviation research and development companies

• Electric vehicle technology companies

• Infrastructure development firms

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key factors affecting the electric aircraft market, including technological advancements, regulatory frameworks, and consumer demand.

Step 2: Market Analysis and Construction

Market trends, growth patterns, and future projections are analyzed through primary and secondary research methods, which provide a comprehensive view of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Engagement with industry experts and stakeholders validates hypotheses, providing deeper insights into market dynamics and customer behavior.

Step 4: Research Synthesis and Final Output

The final report synthesizes the data collected, combining both qualitative and quantitative insights to present a well-rounded analysis of the market.

- Executive Summary

- Singapore more electric aircraft Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for sustainable aviation solutions

Government initiatives and green aviation policies

Technological advancements in battery energy density - Market Challenges

High initial investment costs in electric aircraft

Regulatory hurdles and certification delays

Limited charging infrastructure for electric aircraft - Market Opportunities

Emergence of urban air mobility and air taxis

Development of new lightweight materials for aircraft

Collaboration between private and public sectors for infrastructure - Trends

Adoption of hybrid-electric propulsion systems

Growth in electric aircraft prototypes and testing

Integration of artificial intelligence in flight systems

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Hybrid Electric Aircraft

Full Electric Aircraft

Parallel Hybrid Systems

Series Hybrid Systems

Electric Propulsion Systems - By Platform Type (In Value%)

Regional Aircraft

Urban Air Mobility (UAM)

Commuter Aircraft

Cargo Aircraft

Military Aircraft - By Fitment Type (In Value%)

Retrofit Systems

OEM Systems

Hybrid Aircraft Systems

Battery Integration Systems

Energy Storage Systems - By EndUser Segment (In Value%)

Commercial Aviation

Urban Air Mobility Operators

Military Aviation

Cargo Transportation

Private Aviation - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Third-party System Integrators

Government and Defense Contracts

Aerospace Component Suppliers

Leasing Companies

- Market Share Analysis

- Cross Comparison Parameters

(Technology Integration, Market Position, Geographic Reach, Product Portfolio, Manufacturing Capabilities) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus

Boeing

Rolls-Royce

Embraer

Vertical Aerospace

Joby Aviation

EHang

Lilium

Bell Textron

AeroMobil

Hydrogen Aviation

ZeroAvia

MagniX

Heart Aerospace

Ampaire

- Increased demand for green aviation by commercial airlines

- Urban mobility solutions gaining traction in metropolitan areas

- Military interest in reducing carbon footprint of aerial fleets

- Cargo operators exploring electric aircraft for short-haul deliveries

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035