Market Overview

The Singapore offshore helicopters market is valued at approximately USD ~billion in 2024, driven by the growing offshore energy sector and increased demand for transportation services to offshore oil and gas platforms, as well as renewable energy installations. The market is propelled by the need for safe, efficient transportation of personnel and equipment to remote offshore sites, alongside technological advancements in helicopter safety and performance. Moreover, the government’s focus on infrastructure development and regulatory improvements are also fostering market growth.

The dominance of Singapore in the offshore helicopters market can be attributed to its strategic location as a regional hub for oil and gas activities in Southeast Asia. The country’s robust maritime infrastructure, well-established aviation regulatory frameworks, and proximity to major offshore oil and gas reserves make it a preferred location for offshore helicopter operations. Furthermore, Singapore’s advanced port facilities and connectivity enhance its role in the offshore energy sector, further reinforcing its market leadership.

Market Segmentation

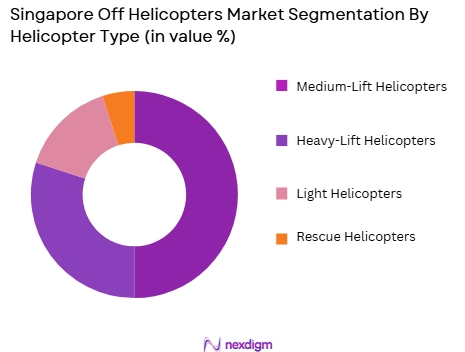

By Helicopter Type

The Singapore offshore helicopters market is segmented by helicopter type into medium-lift helicopters, heavy-lift helicopters, light helicopters, and rescue helicopters. In 2024, medium-lift helicopters dominate the market, as they are the most versatile for offshore operations. These helicopters can transport a wide range of personnel and cargo, making them highly suitable for various offshore applications, including oil and gas exploration and renewable energy installations. Medium-lift helicopters are also popular due to their fuel efficiency, affordability, and operational range, making them the go-to choice for offshore transport.

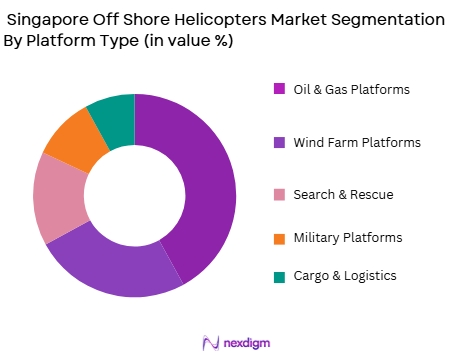

By Platform Type

The market is also segmented by platform type into oil & gas platforms, wind farm platforms, search & rescue operations, military platforms, and cargo and logistics platforms. Oil and gas platforms account for the largest market share in 2024, as they remain the primary offshore operation for helicopters. Offshore oil exploration, particularly in Southeast Asia, continues to drive the demand for helicopters to transport personnel and equipment to these platforms. Additionally, the expansion of offshore wind energy farms further fuels the demand for helicopter services in this segment.

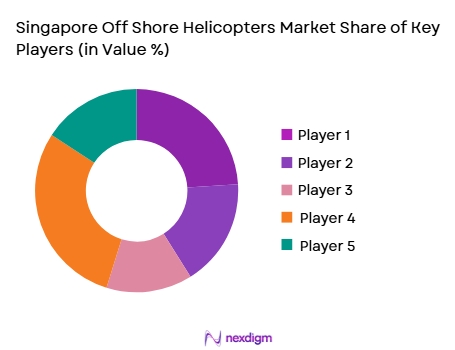

Competitive Landscape

The Singapore offshore helicopters market is highly competitive, with a few dominant players leading the industry. These companies offer a wide range of helicopter services for offshore operations, including personnel and cargo transport, emergency response, and specialized services for the oil and gas and renewable energy sectors. The consolidation of a few major players, such as Bristow Group and CHC Group, highlights their significant influence in the market. These companies have extensive fleets, strong service networks, and a proven track record in providing safe, reliable, and efficient offshore transportation.

| Company Name | Establishment Year | Headquarters | Helicopter Fleet Size | Service Coverage | Key Platforms | Market Share | Technology Use | Safety Record |

| Bristow Group | 1955 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| CHC Group | 1947 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| S-76 Helicopters | 1993 | Singapore | ~ | ~ | ~ | ~ | ~ | ~ |

| Airbus Helicopters | 1992 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo Helicopters | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore Offshore Helicopters Market Analysis

Growth Drivers

Increasing Demand for Offshore Oil and Gas Operations

The offshore oil and gas sector is a significant contributor to the demand for offshore helicopter services in Singapore. With the continuous need for transportation to offshore platforms, helicopters remain the most efficient means of reaching these locations. The rapid expansion of offshore drilling and exploration activities, particularly in Southeast Asia, has led to a higher demand for helicopter services to ensure safe and timely transportation of personnel and equipment. According to data from industry reports, Singapore’s oil and gas sector has seen substantial growth, further increasing the reliance on helicopters to support offshore projects.

Advancements in Helicopter Technology and Safety

Technological innovations in helicopter design, navigation systems, and safety protocols have been key growth drivers for the offshore helicopter market. Newer helicopters offer enhanced safety features, greater fuel efficiency, and the ability to operate in adverse weather conditions. These improvements ensure higher operational reliability and reduce risks associated with offshore transportation, leading to increased adoption in offshore operations. The development of long-range helicopters with improved fuel capacities has particularly bolstered the market’s growth, meeting the needs of offshore operations in distant, hard-to-reach locations.

Market Challenges

High Operational Costs and Maintenance

One of the major challenges faced by the offshore helicopter market is the high operational costs associated with maintaining and operating these aircraft. Helicopter operations require regular maintenance, which can be expensive due to the specialized nature of the aircraft and the harsh operating conditions. Furthermore, the cost of spare parts, fuel, and pilot training adds to the overall expenses. These high costs may limit the financial viability of small-scale operators and pose a challenge to the market’s growth in a competitive environment.

Regulatory Constraints and Airspace Management

Offshore helicopter operations are subject to stringent regulatory requirements that ensure the safety of passengers and crew. These regulations are often complex and can vary between countries, making it challenging for operators to navigate compliance requirements. Additionally, the management of airspace for offshore helicopter operations is becoming increasingly congested due to rising traffic. Operators must comply with multiple air traffic control regulations and ensure efficient coordination in high-traffic regions, which can hinder operational flexibility and lead to delays in some instances.

Opportunities

Expanding Demand for Helicopters in Renewable Energy Projects

As Singapore and other countries in the region increasingly focus on renewable energy sources, there is a growing opportunity for offshore helicopters in the wind energy sector. The development of offshore wind farms has led to a rising demand for helicopters to transport personnel and equipment to and from these sites. Offshore helicopters are ideal for servicing remote wind turbine locations, particularly in the South China Sea region, offering a new avenue of growth for operators in the offshore aviation industry.

Technological Integration for Improved Operational Efficiency

The integration of advanced technologies such as AI, data analytics, and remote diagnostics presents a significant opportunity for offshore helicopter operators. These technologies can enhance flight planning, improve operational efficiency, and reduce maintenance costs by predicting mechanical failures before they occur. Furthermore, the use of drones for inspection and maintenance tasks on offshore platforms can complement helicopter operations, providing more cost-effective and streamlined solutions to service offshore facilities.

Future Outlook

Over the next 5-10 years, the Singapore offshore helicopters market is expected to experience steady growth, driven by increasing demand for offshore energy exploration, especially in the oil, gas, and renewable energy sectors. Technological innovations, including the development of more fuel-efficient helicopters and advancements in safety systems, will further boost market growth. Additionally, the rise in offshore wind farm development and the growing need for emergency response operations will continue to support the expansion of the offshore helicopter market in Singapore.

Major Players

- Bristow Group

- CHC Group

- S-76 Helicopters

- Airbus Helicopters

- Leonardo Helicopters

- Bell Helicopter

- Sikorsky Aircraft Corporation

- PTDI

- NH Industries

- Russian Helicopters

- AgustaWestland

- Aerospatiale

- Turbomeca

- Mitsubishi Heavy Industries

- Kawasaki Heavy Industries

Key Target Audience

- Offshore oil and gas operators

- Wind energy companies

- Military and defense agencies

- Government regulators

- Aviation service providers

- Helicopter leasing firms

- Emergency and rescue organizations

- Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying all key variables influencing the offshore helicopters market. A thorough review of offshore oil and gas and wind energy projects is conducted through secondary research, utilizing databases, industry reports, and other credible sources to define these variables.

Step 2: Market Analysis and Construction

In this phase, historical data from offshore helicopter operators is gathered and analyzed. We evaluate factors such as fleet sizes, market penetration, and demand from key sectors like oil and gas, military, and renewable energy. This data is used to build a detailed market model.

Step 3: Hypothesis Validation and Expert Consultation

Experts in the offshore aviation industry, including helicopter operators, energy sector professionals, and aviation regulators, are consulted to validate market assumptions. Interviews and surveys are conducted to refine our market models and ensure accuracy.

Step 4: Research Synthesis and Final Output

The final phase includes synthesizing the gathered data and insights from consultations into a comprehensive report. All findings are validated through discussions with industry stakeholders to ensure the final output accurately reflects the market dynamics of the offshore helicopter sector.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast

Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in offshore oil & gas production

Expansion of offshore wind farms

Rising demand for emergency and rescue services - Market Challenges

High operational and maintenance costs

Stringent regulatory requirements

Limited availability of skilled personnel - Market Opportunities

Technological advancements in helicopter design

Increasing investments in renewable energy projects

Expansion of military and paramilitary operations - Trends

Automation and digitalization in helicopter operations

Integration of AI in flight safety and navigation systems

Growth of hybrid and electric propulsion systems - Government regulations

Civil Aviation Authority of Singapore (CAAS) regulations

International Maritime Organization (IMO) standards

Offshore Helicopter Transport Safety standards - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Medium Helicopters

Heavy Lift Helicopters

Light Helicopters

Rescue Helicopters

VIP/Executive Helicopters - By Platform Type (In Value%)

Oil & Gas Platforms

Wind Farm Platforms

Search & Rescue Operations

Military Platforms

Cargo and Logistics Platforms - By Fitment Type (In Value%)

New Fitments

Retrofits

Upgrades

Custom Modifications

Equipment Standardization - By EndUser Segment (In Value%)

Oil & Gas Companies

Wind Energy Companies

Government & Military Agencies

Private Operators

Rescue and Emergency Services - By Procurement Channel (In Value%)

Direct Sales

Authorized Dealers

Leasing

Brokered Sales

Service Contracts

- Cross Comparison Parameters (Market Share, Technology Adoption, Regulatory Compliance, Service Offerings, Customer Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Sikorsky Aircraft Corporation

Airbus Helicopters

Leonardo Helicopters

Bell Helicopter

AgustaWestland

China Southern Airlines

Selex ES

Bristow Group

PHI Inc.

CHC Group

Babcock International

S-76 Helicopters

H225 Super Puma

SAAB AB

McDonnell Douglas

- Increasing demand from the oil and gas sector for efficient transport

- Government-driven projects boosting military demand

- Rising need for offshore wind energy-related transportation

- Expanding role of helicopters in emergency and rescue operations

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035