Market Overview

The Singapore piston engine aircraft market is valued at USD ~ million, based on recent historical trends and developments within the aviation sector. The market’s growth is driven by increasing investments in aviation infrastructure and the rising demand for flight training and recreational flying. Singapore’s aviation sector has seen a surge in both private aviation and pilot training programs, with more flight schools and recreational pilots opting for cost-effective piston engine aircraft, particularly single-engine models, due to their lower operational costs compared to jet engines. The government’s Vision 2030 strategy has also played a crucial role in supporting aviation infrastructure development, further driving market expansion. Singapore is a prominent player in the APAC for piston engine aircraft due to its strategic geographical location and ongoing economic growth, which drives both private and commercial aviation demand. Doha, the capital, is the hub for aviation activities, including flight schools, air clubs, and private aviation operators. The country’s rapid urbanization, increasing wealth, and government initiatives, such as Singapore National Vision 2030, have positioned Singapore as the primary market for piston engine aircraft in the region. Investments in both general aviation and pilot training have contributed to the market’s growth in Qatar.

Market Segmentation

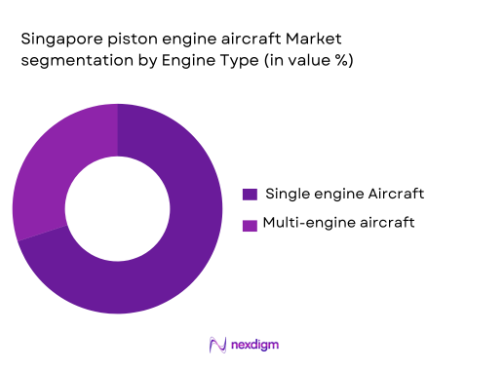

By Engine Type

The Singapore piston engine aircraft market is segmented by engine type into single-engine and multi-engine aircraft. Single-engine aircraft dominate the market, primarily due to their affordability, operational efficiency, and suitability for pilot training and recreational flying. These aircraft are widely used in flight schools, air clubs, and for personal aviation in Singapore. The cost-effectiveness and ease of maintenance make single-engine aircraft particularly attractive to new pilots and private owners looking for an economical aviation solution. Moreover, the growing popularity of flying as a recreational activity in Singapore has contributed to the continued dominance of this segment.

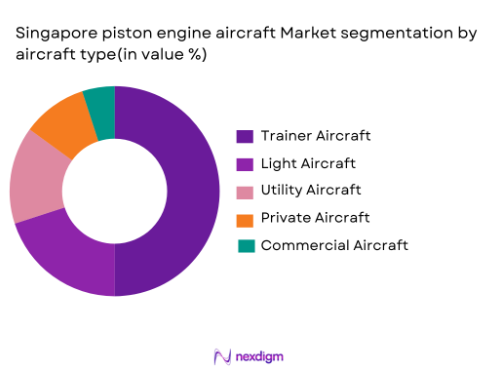

By Aircraft Type

The market is also segmented by aircraft type into light aircraft, trainer aircraft, utility aircraft, private aircraft, and commercial aircraft. Trainer aircraft dominate the market, driven by Singapore’s increasing demand for pilot training programs. The country’s expanding aviation sector, with a growing number of flight schools, has led to a high demand for piston engine aircraft used in flight training. These aircraft are ideal for beginner pilots due to their simplicity, reliability, and cost-effectiveness. The growing interest in aviation careers and the availability of affordable training solutions have further fueled the demand for trainer aircraft in Qatar.

Competitive Landscape

The Singapore piston engine aircraft market is competitive, with several key players leading the development and distribution of piston engine aircraft in the region. Companies like Textron Aviation, Piper Aircraft, Cessna Aircraft, and Diamond Aircraft dominate the market. These companies offer a wide range of piston engine aircraft that cater to the needs of flight schools, private aviation owners, and commercial entities. Their strong brand presence and commitment to quality, innovation, and customer service have contributed to their dominance in the Qatari market.

| Company Name | Establishment Year | Headquarters | Aircraft Models | Market Focus | Revenue (USD) | Global Presence |

| Textron Aviation | 1923 | Wichita, USA | – | – | – | – |

| Piper Aircraft | 1937 | Vero Beach, USA | – | – | – | – |

| Cessna Aircraft | 1927 | Wichita, USA | – | – | – | – |

| Diamond Aircraft | 1981 | Wiener Neustadt, Austria | – | – | – | – |

| Cirrus Aircraft | 1984 | Duluth, USA | – | – | – | – |

Singapore Piston Engine Aircraft Market Dynamics

Growth Drivers

Increasing Demand for Private and Commercial Aviation

Singapore’s private and commercial aviation sectors are experiencing significant growth, driven by the country’s economic diversification and expanding tourism. In 2023, passenger traffic at Hamad International Airport reached over 35 million, marking a significant rise from the previous years. The growth in both private and commercial aviation is further supported by Qatar’s growing status as a business hub and tourist destination. The country’s increasing demand for air travel is driving the need for more cost-effective aircraft options, including piston engine aircraft, which are commonly used in private aviation and for short-haul flights.

Rising Investments in the Aviation Infrastructure of Qatar

Singapore is making significant investments in aviation infrastructure as part of its broader economic diversification strategy under Vision 2030. In 2023, the country allocated USD 4.5 billion for expanding Hamad International Airport, increasing its capacity to handle over 50 million passengers annually. These infrastructure developments are key drivers of the Singapore piston engine aircraft market, as they support both commercial air traffic and private aviation needs. The expansion of regional airports and aviation hubs is expected to continue fueling demand for piston engine aircraft, particularly for training, private flights, and regional travel.

Market Challenges

High Maintenance and Operational Costs for Piston Engine Aircraft

While piston engine aircraft are more affordable compared to jet engines, they still come with significant maintenance and operational costs. The average annual maintenance cost for a piston engine aircraft in Singapore is estimated at around USD ~ with additional expenses for fuel, parts, and inspections. The harsh environmental conditions in Singapore, such as high temperatures and sandy environments, contribute to additional wear and tear, further increasing maintenance costs. These operational costs can deter potential buyers and limit the expansion of piston engine aircraft fleets in both private and training sectors.

Competition from Jet Engine Aircraft in Commercial Aviation

The Singapore aviation sector is heavily dominated by jet engine aircraft, particularly for commercial aviation. Singapore Airways, for example, operates a large fleet of long-range jet aircraft, which are preferred for their speed and efficiency over long distances. As Singapore continues to develop as a global aviation hub, the demand for high-speed, long-range travel remains strong, posing a challenge for the piston engine aircraft segment. While piston engines are suitable for small, regional flights, jet aircraft continue to dominate in the commercial aviation market due to their performance advantages.

Market Opportunities

Growing Demand for Light Aircraft for Training and Leisure Flying

There is a growing interest in light aircraft in Singapore, especially for flight training and recreational flying. As of 2024, over 20 flight schools operate in Singapore, with more being established due to the increasing demand for pilot training. Light piston engine aircraft, such as the Cessna 172, are commonly used in these schools due to their affordability and ease of operation. The government’s push for more aviation education and the rise of aviation as a leisure activity are significant opportunities for growth in this segment. Additionally, Singapore’s growing number of private pilots and aviation enthusiasts further supports the demand for light piston engine aircraft.

Expansion of Singapore’s Aviation Infrastructure under Qatar National Vision 2030

The Singapore government’s Vision 2030 includes significant investments in the development of aviation infrastructure, which presents substantial growth opportunities for piston engine aircraft. In 2023, the government allocated USD ~ billion for the construction of new aviation hubs and upgrades to existing airports. These infrastructure projects are aimed at increasing the country’s connectivity and supporting the growing demand for private and regional aviation. As the aviation infrastructure expands, the demand for piston engine aircraft, especially for training, regional travel, and private use, is expected to rise, making it a key market opportunity.

Future Outlook

Over the next decade, the Singapore piston engine aircraft market is expected to experience significant growth driven by expanding aviation infrastructure, the increasing number of flight schools, and a growing number of private pilots. The government’s Vision 2030 initiative, which promotes the development of the aviation sector, will continue to fuel demand for piston engine aircraft, especially for training purposes. Additionally, the rising popularity of recreational flying and private aviation will contribute to the growth of this market, positioning Qatar as a key player in the APAC for piston engine aircraft.

Major Players

- Textron Aviation

- Piper Aircraft

- Cessna Aircraft

- Diamond Aircraft

- Cirrus Aircraft

- Mooney International Corporation

- Beechcraft

- Embraer

- Honda Aircraft Company

- Socata Aircraft

- Pipistrel

- Robinson Helicopter Company

- Bristell Aircraft

- Jabiru Aircraft

- Vulcan Aircraft

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aviation Manufacturers

- Flight Schools

- Aviation Training Institutions

- Private Aircraft Owners and Pilots

- Military and Defense Organizations

- Technology Integrators for Defense Systems

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the critical variables that impact the Singapore piston engine aircraft market. This includes understanding the demand drivers, challenges, and opportunities within the market. The data is gathered through secondary research and expert consultations to ensure comprehensive market analysis.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled and analyzed to understand the market dynamics. This includes reviewing the number of flight schools, private aviation trends, and the demand for training aircraft. The collected data is assessed for market penetration and to project future trends in the aviation sector.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, including aviation manufacturers, flight school operators, and regulatory bodies. These consultations provide real-time insights that help refine the market data and ensure its accuracy.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the data from various sources to create a comprehensive market report. The data is cross-verified and complemented with expert insights to ensure the reliability and validity of the market projections.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for private and commercial aviation

Rising investments in the aviation infrastructure of Singapore

Government initiatives to promote aviation tourism and recreational flying - Market Challenges

High maintenance and operational costs for piston engine aircraft

Competition from jet engine aircraft in commercial aviation - Market Opportunities

Growing demand for light aircraft for training and leisure flying

Expansion of Singapore’s aviation infrastructure under Qatar National Vision 2030 - Trends

Increased adoption of electric propulsion systems in small aircraft

Rising popularity of private aviation in the APAC

Advancements in fuel efficiency and hybrid engine technologies

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By Engine Type (In Value%)

Single-engine Aircraft

Multi-engine Aircraft

Turbocharged Aircraft

Diesel Engine Aircraft

Electric Engine Aircraft - By Aircraft Type (In Value%)

Light Aircraft

Trainer Aircraft

Utility Aircraft

Private Aircraft

Commercial Aircraft - By End User Segment (In Value%)

Military

Commercial Aviation

Private Aviation

Flight Schools

Government Agencies - By Procurement Channel (In Value%)

Direct Procurement

Leasing

Government Contracts

Private Sector Procurement

Online Procurement

- Market Share Analysis

- Cross Comparison Parameters (Price, Engine Efficiency, Maintenance Costs, Operational Range, Certification Status)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Detailed Company Profiles

Textron Aviation

Piper Aircraft

Cessna Aircraft

Diamond Aircraft

Cirrus Aircraft

Beechcraft

Rotax Aircraft Engines

Lycoming Engines

Continental Motors

Jabiru Aircraft

Mooney International Corporation

L3 Technologies

Pratt & Whitney Canada

Honda Aircraft Company

Piaggio Aerospace

- Increased interest in private aviation among high-net-worth individuals

- Demand for flight training aircraft from aviation schools

- Government and military demand for utility aircraft

- Commercial airlines looking for cost-effective regional aircraft

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035