Market Overview

The Singapore Private Jet Charter Services market is valued at approximately USD ~billion, driven by rising disposable incomes among high-net-worth individuals and an increasing demand for luxury and convenience in air travel. The market is further bolstered by advancements in private aviation technologies, offering superior comfort and time efficiency. Additionally, government policies that encourage the development of the aviation infrastructure contribute to market growth, alongside robust international trade relations and business travel requirements that elevate the demand for private jet services.The market is dominated by major cities such as Singapore and Hong Kong, where affluent individuals and business executives have a high propensity to use private jet services. Singapore, with its strategic location as a business hub in Southeast Asia, offers a strong aviation infrastructure that supports the growing demand for private jets. The presence of established aviation companies, coupled with strong regulations ensuring safety and customer satisfaction, further solidifies its dominance in the market.

Market Segmentation

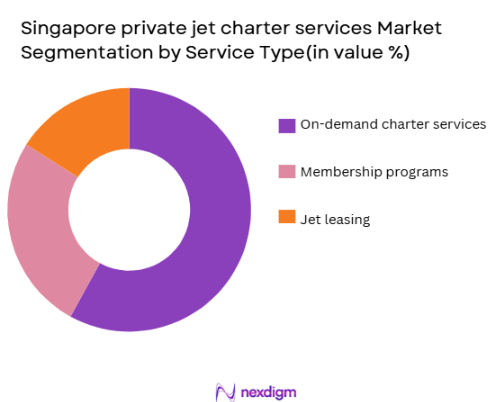

By Service Type:

The Singapore Private Jet Charter Services market is primarily segmented by service type into on-demand charter flights, membership programs, and jet leasing. Among these, on-demand charter services have a dominant market share due to their flexibility and convenience, allowing customers to book flights without long-term commitments. This model is particularly favored by business executives and leisure travelers who require personalized travel solutions without the constraints of ownership or membership. Furthermore, the increasing number of wealthy individuals in the region, along with high business travel volumes, further drives the preference for this segment.

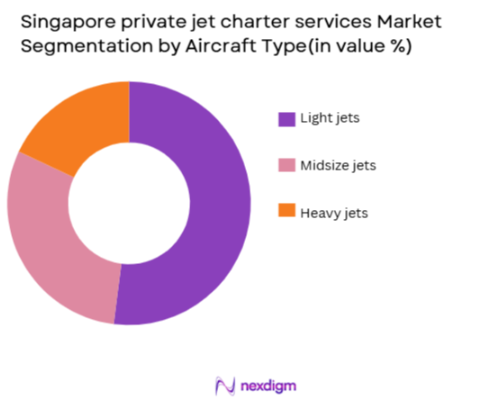

By Aircraft Type:

The market is also segmented by aircraft type, including light jets, midsize jets, and heavy jets. Light jets currently hold the dominant market share due to their cost-effectiveness and suitability for short to medium-range flights, catering to both business and leisure travelers. These aircraft are widely available, with prominent global brands operating fleets that are accessible to charter services. The flexibility of light jets to accommodate various travel needs while offering competitive pricing is a key factor in their market dominance.

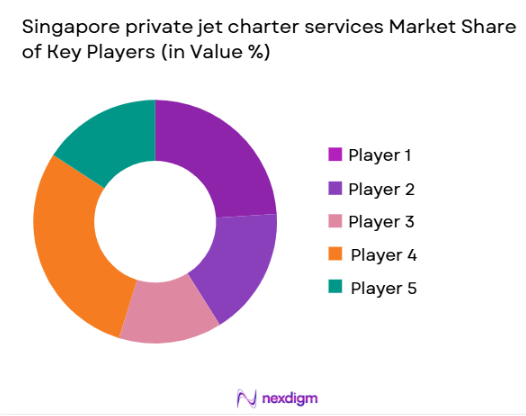

Competitive Landscape

The Singapore Private Jet Charter Services market is dominated by a few major players, including international brands such as Jet Aviation, VistaJet, and Air Charter Service. These companies maintain their dominance by offering a wide range of services, fleet options, and customer support. Their ability to maintain high-quality service standards, coupled with a well-established reputation, has solidified their positions in the competitive landscape. Additionally, local players like JetSetGo and Sky Jet have also found a foothold by catering to regional preferences and offering customized services.

| Company Name | Establishment Year | Headquarters | Fleet Size | Service Type | Pricing Strategy | Customer Satisfaction | Global Presence |

| Jet Aviation | 1967 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| VistaJet | 2004 | Malta | ~ | ~ | ~ | ~ | ~ |

| Air Charter Service | 1990 | UK | ~ | ~ | ~ | ~ | ~ |

| JetSetGo | 2013 | India | ~ | ~ | ~ | ~ | ~ |

| Sky Jet | 2010 | Singapore | ~ | ~ | ~ | ~ | ~ |

Singapore private jet charter services Market Analysis

Growth Drivers

Rising demand for personalized luxury travel

The increasing preference for exclusive travel experiences among affluent travelers is one of the key drivers in the Singapore Private Jet Charter Services market. The growth of luxury tourism and the demand for bespoke travel experiences in the Asia-Pacific region have significantly contributed to this trend. In Singapore, where high-net-worth individuals (HNWIs) account for a significant portion of the population, the demand for personalized, efficient, and flexible travel services is on the rise. By 2026, the number of HNWIs in the region is projected to increase, further boosting the demand for private jet services. In 2024, Singapore’s total number of HNWIs is estimated at 134,000 individuals, contributing to a demand surge for private aviation services. The strong infrastructure and connectivity of Singapore, combined with its global business hub status, make it an attractive destination for luxury travelers, further fueling this growth.

Increase in the number of high-net-worth individuals in the region

Singapore’s growing number of high-net-worth individuals (HNWIs) is directly contributing to the expansion of the private jet charter services market. The country’s robust economic growth, favorable taxation policies, and business-friendly environment continue to attract wealthy individuals from around the world. In 2024, Singapore is estimated to be home to 134,000 HNWIs, a figure that has grown steadily over recent years. The rising number of wealthy individuals, especially those seeking business efficiency and personalized luxury services, is leading to increased demand for private jet services, particularly for corporate travel and leisure trips. This demographic is increasingly opting for private jets as a preferred mode of transport, contributing significantly to the market growth in the region.

Market Challenges

High operational and maintenance costs for jet charter services

One of the significant challenges faced by private jet charter services in Singapore is the high operational and maintenance costs associated with running these services. The annual cost of operating a private jet, including crew salaries, fuel, maintenance, and insurance, can exceed USD ~million. With fuel prices fluctuating and strict safety regulations in place, maintaining these aircraft becomes a costly endeavor for service providers. Additionally, with rising environmental concerns, private jet operators are also facing pressure to incorporate eco-friendly technologies, further adding to the operational expenses. In 2024, operational costs are expected to remain high, presenting challenges for operators to maintain profitability while delivering premium services.

Regulatory hurdles and certification requirements for private jets

The regulatory framework surrounding private jet operations in Singapore is stringent, requiring operators to comply with various international and national aviation regulations. These include aircraft certification, operational approvals, and safety standards, all of which add layers of complexity and cost to the operations of private jet charter services. In 2024, private jet charter companies must adhere to the rigorous standards set by the Civil Aviation Authority of Singapore (CAAS), ensuring that their aircraft meet safety and environmental regulations. These regulatory hurdles, while essential for ensuring safety, can lead to delays and increased operational costs for service providers in the region.

Market Opportunities

Growth in demand for sustainable and eco-friendly private jet solutions

There is a growing market opportunity for private jet services that prioritize sustainability and eco-friendliness. Increasing environmental awareness, combined with pressure from regulatory bodies and environmentally-conscious consumers, has led to a demand for more sustainable aviation options. In 2024, private jet charter companies are actively seeking to reduce their carbon footprint by adopting alternative fuel sources, such as sustainable aviation fuel (SAF), which is expected to see increased adoption in the coming years. Additionally, hybrid and electric aircraft technologies are gaining traction, aligning with global trends towards sustainability in aviation. As sustainability becomes a key factor in consumer decisions, companies offering eco-friendly private jet options are positioned to capture a growing market segment.

Increasing adoption of hybrid models to reduce travel costs

The adoption of hybrid aircraft models presents a significant opportunity for the Singapore private jet charter market, as these models help reduce both operational costs and environmental impact. Hybrid-electric aircraft, which combine traditional jet engines with electric propulsion systems, are becoming increasingly viable, offering lower fuel consumption and reduced carbon emissions. In 2024, manufacturers are focusing on advancing hybrid technology to improve the efficiency and sustainability of private jets, which will become increasingly attractive to charter companies looking to reduce costs while enhancing their environmental credentials. As demand for cost-effective and eco-friendly travel increases, hybrid models are expected to become a key solution in the private jet market.

Future Outlook

Over the next decade, the Singapore Private Jet Charter Services market is expected to experience significant growth. Factors such as the expansion of the luxury travel sector, increasing demand for customized travel experiences, and technological advancements in aviation will propel the market forward. Moreover, the growing focus on eco-friendly aviation solutions and government initiatives supporting the aviation infrastructure in Southeast Asia are expected to drive new opportunities for market players. With increasing disposable income among the affluent class and ongoing improvements in aircraft technology, the demand for private jet services will remain strong.

15 Major Players

- Jet Aviation

- VistaJet

- Air Charter Service

- JetSetGo

- Sky Jet

- Gama Aviation

- NetJets

- XOJet

- Flexjet

- Wheels Up

- Air Partner

- Sentient Jet

- Executive Jet Management

- Luxaviation

- PrivateFly

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Private aviation service providers

- High-net-worth individuals and affluent travelers

- Corporate executives and businesses

- Aircraft manufacturers

- Aviation infrastructure developers

- Travel management companies

- Research Methodology

Step 1: Identification of Key Variables

In the initial phase, a comprehensive market analysis was performed, including identifying key variables that affect the growth of the Singapore Private Jet Charter Services market. This involved primary and secondary research, utilizing data from proprietary industry reports and surveys to map the critical factors driving the demand for private jet services.

Step 2: Market Analysis and Construction

Historical data on private aviation services in Singapore was reviewed, analyzing trends and patterns in demand and fleet usage. The analysis focused on service type segmentation, aircraft type preferences, and customer behavior, providing a clear understanding of market dynamics and the factors that influence service offerings.

Step 3: Hypothesis Validation and Expert Consultation

Key industry experts, including executives from major private aviation companies, were consulted to validate the hypotheses. Their insights helped refine the market data, ensuring accuracy in forecasting and an understanding of market challenges and opportunities from a practical, operational perspective.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the data collected to produce a comprehensive, validated market report. Insights into service offerings, competitive strategies, and customer preferences were combined to provide a well-rounded analysis of the Singapore Private Jet Charter Services market, ensuring it reflects current and future trends.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for personalized luxury travel

Increase in the number of high-net-worth individuals in the region

Expansion of corporate travel services and executive mobility - Market Challenges

High operational and maintenance costs for jet charter services

Regulatory hurdles and certification requirements for private jets

Limited availability of airport slots during peak travel seasons - Trends

Technological advancements in aircraft interiors and amenities

Integration of AI for route optimization and customer service

Shift towards fractional ownership models in jet charter services

- Market Opportunities

Growth in demand for sustainable and eco-friendly private jet solutions

Increasing adoption of hybrid models to reduce travel costs

Expansion of charter services to underserved markets in Asia - Government regulations

Regulation of airspace usage and private aviation licensing in Singapore

International agreements on aviation safety and private jet operations

Environmental regulations and carbon offset programs for private aviation - SWOT analysis

Strengths: High demand for luxury and convenience in travel

Weaknesses: High costs and limited access to private jet services

Opportunities: Expansion of market to new regions in Asia

Threats: Regulatory pressure and increasing environmental concerns - Porters 5 forces

Threat of new entrants: Moderate due to high capital investment

Bargaining power of suppliers: High due to limited aircraft manufacturers

Bargaining power of buyers: High due to multiple service options

Threat of substitute products: Low with limited alternatives to private jets

Industry rivalry: Moderate with growing competition among charter providers

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Light Jets

Midsize Jets

Heavy Jets

Long-range Jets

Turbojets - By Platform Type (In Value%)

On-demand Charters

Membership Programs

Leased Fleet Options

Charter Flights for Corporate Events

Private Flight Solutions for Individuals - By Fitment Type (In Value%)

Interior Upgrades

Avionics and Communications

Entertainment Systems

Luxury Comfort Features

Safety Features - By EndUser Segment (In Value%)

Business Executives

Tourists and High-net-worth Individuals

Government Officials

Aviation Enthusiasts

Corporate Clients - By Procurement Channel (In Value%)

Direct Charter Service Providers

Aviation Brokers

Online Platforms and Marketplaces

Membership-based Services

Corporate Travel Agents

- Market Share Analysis

- CrossComparison Parameters(Fleet size, Service coverage, Customer satisfaction, Pricing models, Regulatory compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

VistaJet

Jet Aviation

Air Charter Service

PrivateFly

Gama Aviation

Sentient Jet

Air Partner

Charter Jet One

Global Private Jets

Luxaviation

XOJet

JetSetGo

JetSmarter

FlyEliteJets

ZettaJet

- Demand from corporate clients for executive mobility

- Rising preference for private chartered flights among high-net-worth individuals

- Adoption of private jets by tourism industry for luxury travel

- Government usage for diplomatic and high-level meetings

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035