Market Overview

The Singapore Supersonic Jet market current size stands at around USD ~ million, reflecting early-stage commercial and defense-linked adoption activity. Demand is primarily driven by prototype development, testing programs, and preliminary procurement initiatives supported by aviation modernization strategies. During 2024 and 2025, platform evaluation programs expanded, supported by increased aerospace R&D spending and regional connectivity ambitions. The market remains limited in operational scale, yet demonstrates consistent growth signals driven by technological maturation and policy-backed aviation innovation initiatives.

Singapore’s dominance in the market is supported by its advanced aviation infrastructure, strong regulatory clarity, and established aerospace ecosystem. The presence of major maintenance, repair, and overhaul hubs strengthens readiness for supersonic operations. Demand concentration is centered around government-backed aviation programs, defense-linked testing initiatives, and premium commercial aviation stakeholders. The city-state’s strategic airspace management, innovation-friendly policies, and integration with regional aerospace supply chains further reinforce its leadership position within the Asia-Pacific supersonic aviation landscape.

Market Segmentation

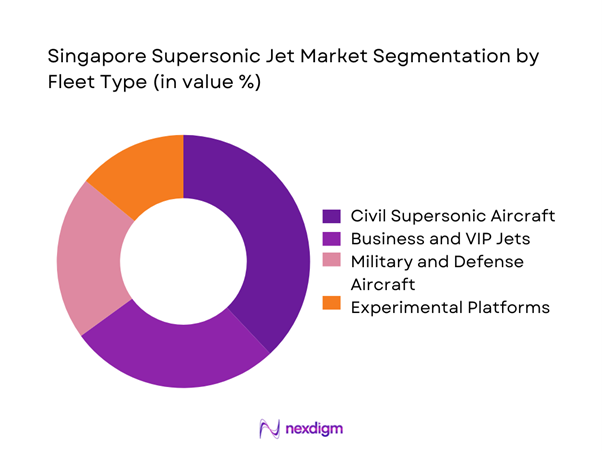

By Fleet Type

The market is primarily dominated by civil and experimental supersonic aircraft platforms due to ongoing testing programs and future commercial route planning. Business and VIP supersonic jets follow closely, supported by demand for time-sensitive executive travel and premium aviation services. Military and defense aircraft maintain steady relevance, particularly for surveillance, rapid response, and advanced testing roles. Experimental and prototype platforms account for a significant share, reflecting the market’s developmental stage and emphasis on performance validation, acoustic compliance, and sustainability testing within controlled airspace environments.

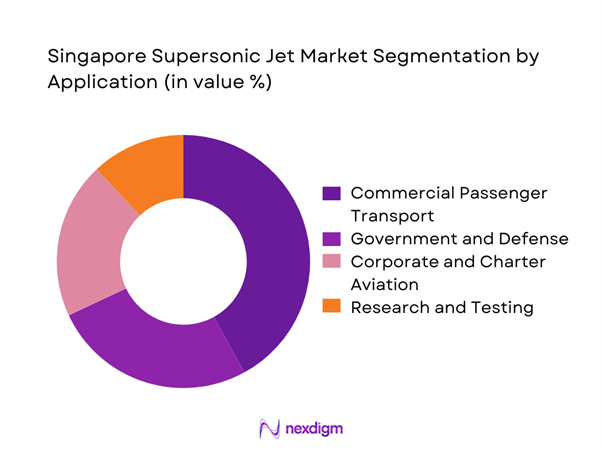

By Application

Commercial passenger transport represents the dominant application segment, driven by premium long-haul travel demand and reduced transit time objectives. Government and defense usage remains critical, focusing on reconnaissance, strategic mobility, and testing programs. Corporate and charter aviation follows as enterprises seek faster intercontinental connectivity. Research and experimental applications maintain relevance, supporting aerodynamic testing, propulsion optimization, and noise-reduction validation programs across controlled aviation corridors.

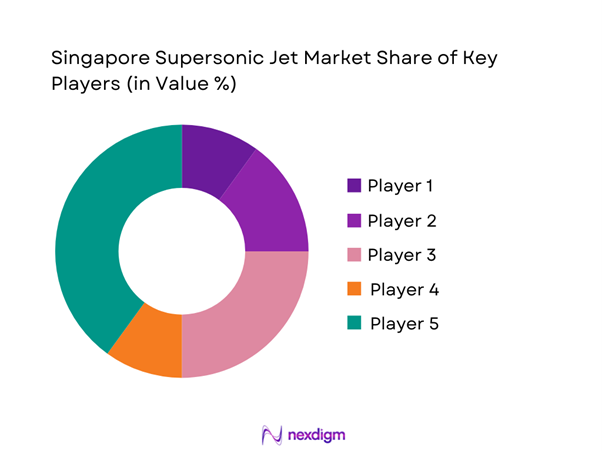

Competitive Landscape

The competitive landscape is moderately concentrated, characterized by aerospace manufacturers, propulsion system developers, and advanced aviation technology providers. Market participants focus on technological differentiation, regulatory alignment, and strategic collaborations with aviation authorities. Innovation intensity remains high, while commercialization timelines depend heavily on certification milestones and infrastructure readiness.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Boom Supersonic | 2014 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Dassault Aviation | 1929 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore Supersonic Jet Market Analysis

Growth Drivers

Rising demand for ultra-fast intercontinental travel

The growing need for reduced long-haul travel time continues to support supersonic jet adoption across premium aviation segments. Business leaders increasingly value time efficiency, encouraging investment in faster air mobility solutions. In 2024, demand for rapid intercontinental connectivity strengthened across Asia-Pacific routes. Singapore’s geographic positioning enhances its role as a strategic transit hub. High-income passenger segments demonstrate willingness to adopt premium flight alternatives. Aviation stakeholders prioritize speed advantages for competitive differentiation. Infrastructure readiness supports testing and gradual operational integration. Airlines continue exploring high-yield routes suitable for supersonic deployment. Government-backed aviation programs reinforce industry confidence. These factors collectively strengthen market momentum.

Strategic positioning of Singapore as an aviation hub

Singapore’s established aviation ecosystem supports early adoption of advanced aerospace technologies. The presence of integrated MRO facilities enhances operational readiness for next-generation aircraft. Strong regulatory frameworks enable controlled experimentation and certification pathways. Investment in aerospace research facilities strengthens technological capabilities. Regional connectivity positions Singapore as a launch platform for supersonic services. Airport infrastructure supports high-performance aircraft requirements. Policy consistency encourages long-term industry participation. International collaborations strengthen technical knowledge transfer. Demand concentration supports pilot deployment programs. These elements collectively drive sustained market development.

Challenges

Strict sonic boom and noise regulations

Regulatory constraints on sonic boom emissions limit operational flexibility for supersonic aircraft. Urban density increases sensitivity to noise compliance requirements. Aviation authorities enforce stringent environmental impact assessments. Certification timelines extend due to evolving acoustic standards. Operational route planning remains restricted over populated regions. Compliance costs increase development complexity. Manufacturers must invest heavily in noise-mitigation technologies. Regulatory harmonization remains limited across jurisdictions. These constraints delay widespread commercial deployment. Market expansion depends on regulatory adaptation.

High development and certification costs

Supersonic aircraft development involves complex engineering and prolonged testing cycles. Certification requirements increase financial exposure for manufacturers. Advanced materials and propulsion systems elevate production expenses. Limited economies of scale constrain cost efficiency. Testing infrastructure demands significant capital commitment. Certification delays affect commercialization timelines. Smaller developers face entry barriers due to capital intensity. Risk profiles remain elevated for early-stage programs. Financial sustainability becomes critical for long-term participation. These factors collectively restrict rapid market expansion.

Opportunities

Next-generation low-emission supersonic aircraft

Development of low-emission propulsion systems creates opportunities for sustainable supersonic travel. Environmental compliance drives innovation in engine efficiency and fuel usage. Sustainable aviation fuel integration enhances regulatory acceptance. Aircraft manufacturers focus on reducing carbon intensity. Governments support cleaner aviation initiatives through policy frameworks. Demand for environmentally responsible travel continues rising. Technology advancements improve operational viability. Collaboration accelerates innovation timelines. Market acceptance improves with sustainability alignment. These developments create long-term growth potential.

Public-private partnerships in aerospace R&D

Collaborative research initiatives accelerate technological validation and certification readiness. Government funding reduces financial burden on manufacturers. Shared infrastructure enhances testing efficiency. Partnerships support knowledge exchange between academia and industry. National aerospace programs strengthen innovation ecosystems. Risk-sharing models improve investment confidence. Collaborative frameworks enable faster regulatory alignment. Public sector support enhances commercialization prospects. Regional cooperation expands research capabilities. These partnerships significantly enhance market development opportunities.

Future Outlook

The Singapore supersonic jet market is expected to progress steadily through the forecast period as regulatory clarity improves and technological validation advances. Continued investments in sustainable aviation, infrastructure readiness, and aerospace innovation will shape long-term growth. Strategic collaborations and phased commercialization are likely to define the market’s trajectory toward broader adoption.

Major Players

- Boom Supersonic

- Lockheed Martin

- Northrop Grumman

- Dassault Aviation

- Boeing

- Airbus

- GE Aerospace

- Rolls-Royce

- Honeywell Aerospace

- Safran

- RTX Corporation

- Mitsubishi Heavy Industries

- Singapore Technologies Aerospace

- Spike Aerospace

- Aerion Supersonic

Key Target Audience

- Commercial airline operators

- Business jet operators

- Defense and aerospace procurement agencies

- Civil aviation authorities of Singapore

- Ministry of Transport Singapore

- Aerospace manufacturing companies

- Airport infrastructure developers

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Market boundaries, technology scope, application areas, and regulatory parameters were defined to establish analytical relevance and consistency.

Step 2: Market Analysis and Construction

Data was structured through evaluation of aircraft programs, infrastructure readiness, policy frameworks, and operational deployment trends.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through engagement with aviation professionals, regulatory experts, and aerospace engineering specialists.

Step 4: Research Synthesis and Final Output

Findings were consolidated using triangulation methods to ensure accuracy, coherence, and strategic relevance.

- Executive Summary

- Research Methodology (Market Definitions and supersonic aviation scope framing, platform segmentation and aircraft classification logic, bottom-up fleet and order book based market sizing, revenue modeling by aircraft program and service lifecycle, primary interviews with OEMs airports and aviation regulators, triangulation using flight activity data certification pipelines and investment flows, assumptions on regulatory timelines and sonic boom compliance)

- Definition and Scope

- Market evolution

- Usage and operational deployment models

- Ecosystem structure

- Supply chain and MRO framework

- Regulatory and airspace governance environment

- Growth Drivers

Rising demand for ultra-fast intercontinental travel

Strategic positioning of Singapore as an aviation hub

Advancements in low-boom supersonic technologies

Increasing defense modernization spending

Growing interest from premium business travel segment

Supportive aerospace innovation ecosystem - Challenges

Strict sonic boom and noise regulations

High development and certification costs

Limited infrastructure readiness

Fuel efficiency and sustainability concerns

High acquisition and operating costs

Regulatory uncertainty for overland supersonic flight - Opportunities

Next-generation low-emission supersonic aircraft

Public-private partnerships in aerospace R&D

Expansion of premium point-to-point travel

Defense and surveillance aircraft modernization

Integration of sustainable aviation fuels

Regional leadership in supersonic testing corridors - Trends

Shift toward low-boom supersonic designs

Increased use of composite materials

Digital flight testing and simulation adoption

OEM collaborations with governments

Emphasis on sustainable propulsion technologies

Rising investment in supersonic business jets - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Civil supersonic aircraft

Business and VIP supersonic jets

Military and defense supersonic platforms

Test and experimental aircraft - By Application (in Value %)

Commercial passenger transport

Government and defense operations

Corporate and charter aviation

Research and test flight operations - By Technology Architecture (in Value %)

Low-boom aerodynamic designs

Advanced composite airframes

Sustainable aviation fuel compatible engines

Hybrid propulsion and noise-mitigation systems - By End-Use Industry (in Value %)

Commercial aviation

Defense and homeland security

Private aviation and charter services

Aerospace research institutions - By Connectivity Type (in Value %)

Satellite-based connectivity

Air-to-ground communication systems

Hybrid connectivity architectures - By Region (in Value %)

Singapore domestic operations

Intra-Asia Pacific routes

Intercontinental long-haul routes

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology maturity, fleet size, certification progress, geographic presence, pricing strategy, partnerships, R&D intensity, aftersales capability)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Boom Supersonic

Lockheed Martin

Northrop Grumman

Spike Aerospace

Aerion Supersonic

Dassault Aviation

Boeing

Airbus

GE Aerospace

Rolls-Royce

Honeywell Aerospace

Safran

RTX Corporation

Singapore Technologies Aerospace

Mitsubishi Heavy Industries

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035