Market Overview

The Singapore turboprop aircraft market current size stands at around USD ~ million, supported by active fleet operations during 2024 and 2025. Aircraft utilization increased steadily due to regional connectivity demand, fleet modernization initiatives, and expanding cargo feeder services across nearby Southeast Asian routes. Operational activity remained stable, with consistent aircraft movements recorded across commercial, utility, and government missions. Fleet renewal cycles continued as operators prioritized efficiency and reliability improvements. Maintenance and overhaul activity also expanded, supported by local aerospace infrastructure and skilled technical availability. The market remained resilient despite global aviation volatility and evolving regulatory requirements.

Singapore remains the central operational hub for turboprop activities due to advanced airport infrastructure and strong aviation governance. Demand concentration is highest around regional passenger transport, cargo logistics, and special mission aviation. The presence of maintenance hubs, leasing firms, and training centers strengthens ecosystem maturity. Policy support for sustainable aviation and regional connectivity further reinforces demand. Proximity to Southeast Asian markets enhances aircraft deployment efficiency. A stable regulatory framework continues to encourage long-term fleet planning.

Market Segmentation

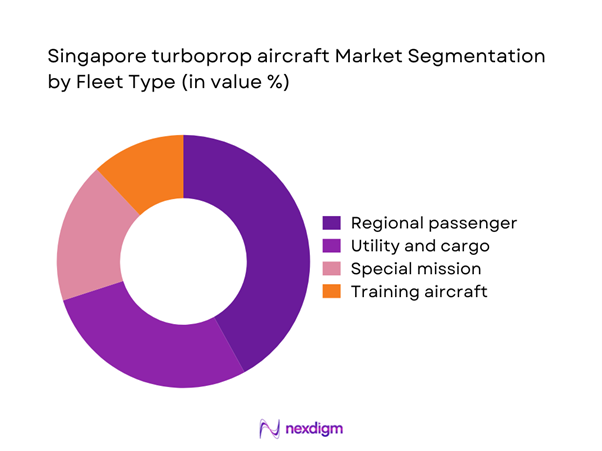

By Fleet Type

The regional passenger turboprop segment dominates due to high-frequency short-haul operations and strong inter-island connectivity demand. Airlines prioritize turboprops for cost-efficient operations, quick turnaround times, and flexible route deployment. Utility and cargo turboprops follow closely, driven by express logistics and e-commerce expansion. Special mission and training aircraft maintain stable demand from government and defense users. Fleet renewal cycles favor modern turboprop platforms offering improved fuel efficiency and avionics integration. Operators increasingly prefer multi-role aircraft supporting mixed mission profiles. This segmentation reflects operational diversity and sustained utilization across aviation sub-sectors.

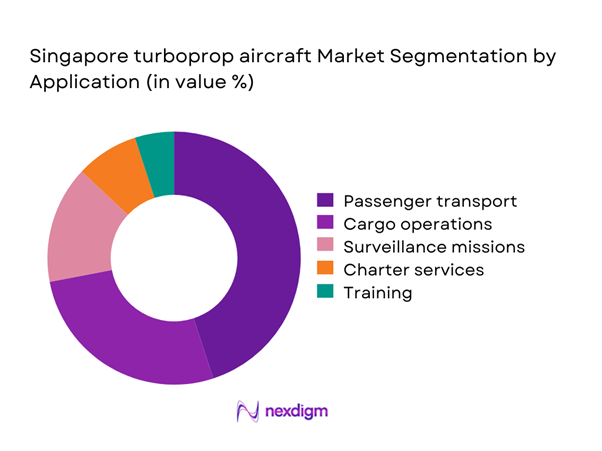

By Application

Passenger transport dominates application demand due to consistent regional travel requirements and network expansion. Cargo operations follow, supported by growing express freight and e-commerce logistics volumes. Maritime surveillance and special mission applications remain essential for border and coastal monitoring. Charter and business aviation maintain niche but stable usage. Training applications continue to support pilot development needs. Application diversity ensures balanced fleet utilization and risk mitigation across operators.

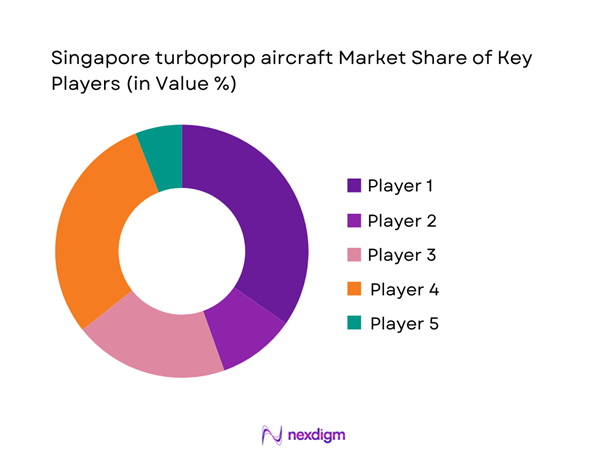

Competitive Landscape

The Singapore turboprop aircraft market features a consolidated competitive environment with established manufacturers and strong aftermarket providers. Competition centers on aircraft performance, lifecycle support, and regional service capability. Players emphasize fleet reliability, operational efficiency, and regulatory compliance. Strategic partnerships with operators and maintenance providers enhance market positioning. Continuous product upgrades and service differentiation remain key competitive factors.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| ATR | 1981 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| De Havilland Canada | 1928 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Pilatus Aircraft | 1939 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Textron Aviation | 2014 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore turboprop aircraft Market Analysis

Growth Drivers

Rising demand for regional air connectivity

Regional connectivity demand increased due to expanding short-haul routes linking secondary cities and emerging regional destinations. Airlines optimized fleet deployment to serve high-frequency sectors with lower operational complexity and turnaround requirements. Passenger movement between regional hubs supported consistent turboprop utilization throughout operational cycles. Government support for regional aviation strengthened network expansion initiatives. Improved airport infrastructure enabled greater aircraft movement efficiency. Increased tourism flows further stimulated short-distance travel demand. Airlines favored turboprops for cost-effective scheduling flexibility. Fleet utilization rates remained stable across 2024 and 2025. Operational reliability enhanced airline confidence in turboprop platforms. This demand trend continued supporting steady fleet expansion decisions.

Cost efficiency of turboprops for short-haul routes

Turboprop aircraft offered superior fuel efficiency compared to jet aircraft on short-haul routes. Lower operating costs supported airline profitability under fluctuating fuel price environments. Maintenance intervals aligned well with high-cycle regional operations. Operators achieved reduced seat-mile costs through optimized aircraft utilization. Fleet commonality further improved cost management strategies. Crew training efficiencies contributed to operational savings. High dispatch reliability minimized revenue losses from delays. Aircraft residual value stability encouraged procurement confidence. Short runway capability expanded route accessibility. These cost advantages sustained operator preference across the market.

Challenges

Limited airport slot availability

Airport slot constraints restricted operational flexibility for turboprop operators across major hubs. High traffic density reduced opportunities for schedule expansion. Infrastructure saturation affected peak-hour aircraft movement planning. Slot allocation policies favored larger aircraft categories in certain terminals. Operators faced challenges aligning schedules with passenger demand patterns. Congestion increased turnaround times and operational inefficiencies. Expansion plans required coordination with aviation authorities. Slot limitations constrained fleet growth potential. Regional airports faced similar capacity pressures. These factors collectively limited rapid operational scaling.

Competition from regional jets

Regional jets increasingly competed on short-haul routes traditionally served by turboprops. Improved fuel efficiency reduced cost differentials between aircraft types. Passenger preference for jet aircraft influenced airline deployment strategies. Jet aircraft offered higher cruise speeds and extended range capabilities. Airlines evaluated fleet modernization toward mixed aircraft portfolios. Competitive route economics pressured turboprop load factors. Marketing perceptions favored jet operations in premium segments. Network optimization reduced turboprop route allocations. Lease availability of jets further intensified competition. This trend challenged turboprop market share sustainability.

Opportunities

Expansion of regional connectivity programs

Government-backed regional connectivity programs encouraged new route development across underserved locations. Subsidized routes improved commercial viability for turboprop operators. Infrastructure upgrades enhanced airport accessibility. Policy alignment supported regional aviation growth objectives. Airlines leveraged incentives to expand network coverage. Increased passenger accessibility stimulated demand growth. Turboprops aligned well with short-runway operations. Regional connectivity strengthened economic integration. Fleet deployment flexibility improved route experimentation. These programs created sustained growth opportunities.

Growth in maritime patrol and ISR missions

Rising maritime security requirements increased demand for turboprop-based surveillance aircraft. Governments expanded aerial monitoring across coastal and territorial waters. Turboprops provided endurance and cost advantages for patrol missions. Sensor integration capabilities improved operational effectiveness. Defense modernization programs supported fleet procurement. Multi-mission adaptability enhanced aircraft utilization rates. Surveillance demand increased across border monitoring applications. Fleet upgrades focused on mission-specific configurations. Training requirements expanded alongside fleet growth. This segment offered long-term stability.

Future Outlook

The Singapore turboprop aircraft market is expected to maintain steady expansion through the forecast period. Fleet modernization, regional connectivity, and defense requirements will continue supporting demand. Advancements in avionics and efficiency technologies will further enhance adoption. Regulatory stability and strong maintenance infrastructure will remain key enablers. The market outlook remains positive with balanced commercial and government demand.

Major Players

- ATR

- De Havilland Canada

- Pilatus Aircraft

- Textron Aviation

- Leonardo

- Embraer

- Viking Air

- PT Dirgantara Indonesia

- Hindustan Aeronautics Limited

- RUAG Aerospace

- ST Engineering Aerospace

- Singapore Airlines Engineering Company

- CAE

- Airbus Defence and Space

- Gulfstream Aerospace

Key Target Audience

- Regional airline operators

- Cargo and logistics operators

- Aircraft leasing companies

- Defense and security agencies

- Aviation maintenance providers

- Airport authorities

- Investments and venture capital firms

- Civil Aviation Authority of Singapore

Research Methodology

Step 1: Identification of Key Variables

Market scope, fleet classification, operational usage, and regulatory frameworks were defined using industry-specific indicators and operational benchmarks.

Step 2: Market Analysis and Construction

Data from aircraft operations, fleet movements, and maintenance activity were analyzed to establish market structure and dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through industry expert discussions, operator interviews, and aviation technical consultations.

Step 4: Research Synthesis and Final Output

Findings were consolidated, validated across sources, and structured to ensure analytical consistency and market relevance.

- Executive Summary

- Research Methodology (Market Definitions and operational scope of turboprop aircraft in Singapore, fleet classification and segmentation logic for commercial and special mission aircraft, bottom-up fleet sizing and aircraft value estimation approach, revenue attribution across OEM sales and aftermarket services, primary validation through airline operators MROs and aviation regulators)

- Definition and scope

- Market evolution

- Usage and mission profile in regional and utility aviation

- Ecosystem structure across OEMs MROs and operators

- Supply chain and maintenance infrastructure

- Regulatory and certification environment

- Growth Drivers

Rising demand for regional air connectivity

Cost efficiency of turboprops for short-haul routes

Growth in regional cargo and logistics operations

Fleet modernization by regional carriers

Government and defense surveillance requirements - Challenges

Limited airport slot availability

Competition from regional jets

High maintenance and overhaul costs

Pilot and technician shortages

Volatility in aircraft leasing rates - Opportunities

Expansion of regional connectivity programs

Growth in maritime patrol and ISR missions

Adoption of next-generation fuel-efficient turboprops

Rising demand for cargo feeder aircraft

MRO and aftermarket service expansion - Trends

Shift toward fuel-efficient and low-emission aircraft

Increasing adoption of digital avionics

Growth of wet-lease and ACMI models

Rising importance of lifecycle service contracts

Integration of predictive maintenance technologies - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Regional passenger turboprop

Utility and cargo turboprop

Special mission and surveillance turboprop

Training and government turboprop - By Application (in Value %)

Regional passenger transport

Cargo and logistics

Maritime patrol and surveillance

Charter and business aviation

Training and special missions - By Technology Architecture (in Value %)

Conventional turboprop

Advanced avionics-enabled turboprop

Hybrid-ready turboprop platforms - By End-Use Industry (in Value %)

Commercial aviation

Government and defense

Charter and private operators

Aviation training organizations - By Connectivity Type (in Value %)

Standalone avionics systems

Satellite-enabled connectivity

Integrated flight management and monitoring systems - By Region (in Value %)

Singapore domestic operations

Regional Southeast Asia operations

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (fleet size, aircraft performance range, operating cost structure, delivery lead time, aftermarket support capability, technology maturity, regional presence, pricing strategy)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

ATR

De Havilland Canada

Pilatus Aircraft

Textron Aviation

Leonardo

Viking Air

Embraer

RUAG Aerospace

PT Dirgantara Indonesia

Hindustan Aeronautics Limited

Airbus Defence and Space

ST Engineering Aerospace

Singapore Airlines Engineering Company

CAE

Gulfstream Aerospace

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035