Market Overview

The Singapore turboprop engine market current size stands at around USD ~ million, supported by steady aircraft operations and fleet utilization levels. In 2024 and 2025, engine demand remained stable due to regional connectivity requirements and fleet replacement cycles. The market is influenced by aircraft utilization rates, maintenance activity, and regional connectivity needs. Engine procurement activity reflects steady operational demand rather than rapid expansion. Maintenance cycles and aftermarket services continue to represent a significant portion of engine-related activity. Fleet utilization trends remain consistent due to stable short-haul aviation demand across Southeast Asia.

Singapore serves as a regional aviation hub with strong connectivity to Southeast Asian markets and island economies. The presence of major MRO facilities supports turboprop engine maintenance and overhaul activity. Demand concentration is driven by regional airlines, cargo operators, and government aviation units. A mature aviation ecosystem supports engine lifecycle services, including repair, overhaul, and testing. Regulatory stability and aviation safety oversight further support sustained operations. Infrastructure readiness and skilled technical workforce availability strengthen market continuity.

Market Segmentation

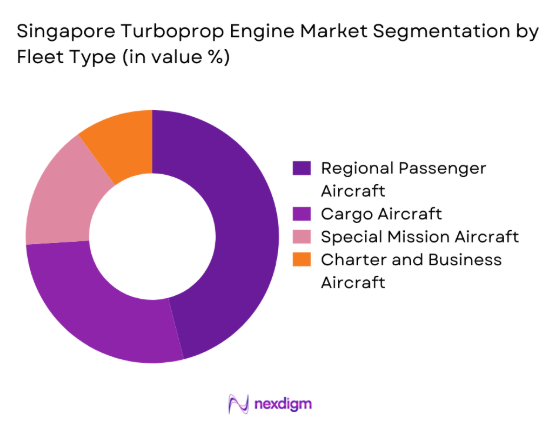

By Fleet Type

Regional passenger turboprop aircraft dominate the market due to their efficiency in short-haul routes and inter-island connectivity. Cargo-configured turboprop aircraft maintain strong relevance due to express logistics demand and time-sensitive deliveries. Special mission aircraft, including surveillance and training platforms, contribute steadily to engine utilization. Charter and business turboprop aircraft represent a smaller but stable segment supported by corporate mobility needs. Fleet modernization cycles influence engine demand patterns across all fleet categories. Operators prioritize reliability and fuel efficiency when selecting turboprop platforms.

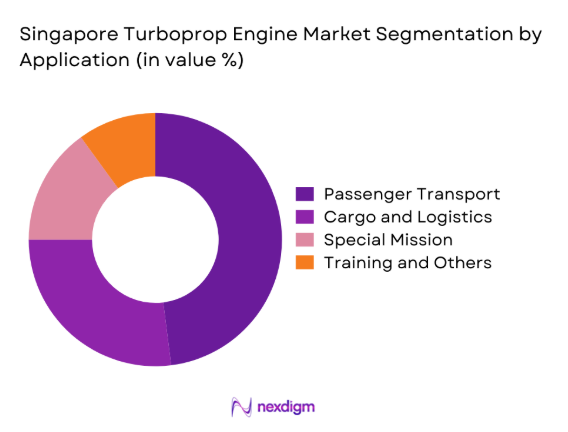

By Application

Passenger transportation remains the dominant application due to regional air travel needs and short-haul route density. Cargo and logistics applications continue to grow with increasing e-commerce and express freight volumes. Maritime surveillance and special mission usage support consistent engine utilization in government operations. Training aircraft applications contribute to steady engine demand from aviation academies and defense units. The balance between civilian and government usage supports long-term market stability. Application diversity helps reduce dependency on a single demand source.

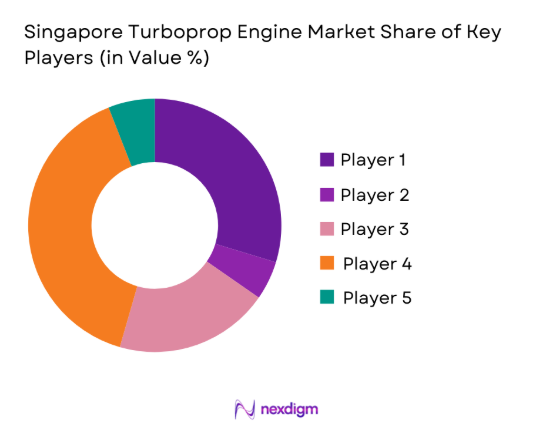

Competitive Landscape

The Singapore turboprop engine market is moderately consolidated, supported by global OEMs and regional maintenance providers. Market competition is driven by engine reliability, maintenance support capability, and long-term service agreements. Strong regulatory compliance and aftersales service networks influence buyer preferences. The presence of established aviation infrastructure enhances competitive stability. Strategic partnerships between operators and service providers shape market dynamics.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Pratt & Whitney Canada | 1928 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| GE Aerospace | 1917 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 1905 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore Turboprop Engine Market Analysis

Growth Drivers

Rising regional air connectivity and short-haul routes

Regional air connectivity expansion continues to support turboprop engine utilization across short-haul aviation corridors. Airlines increasingly deploy turboprop aircraft to serve secondary airports and regional routes efficiently. This operational model enhances aircraft utilization while maintaining lower fuel consumption profiles. Airport infrastructure improvements further enable frequent short-distance flight operations. The demand for reliable turboprop engines increases as route networks expand. Operators prioritize aircraft suited for high-frequency regional services. Fleet operators favor turboprops due to runway flexibility and operational economics. Regional tourism and intercity mobility stimulate consistent passenger traffic volumes. These dynamics collectively reinforce sustained engine demand across active fleets. The trend supports stable procurement and maintenance activity levels.

Growth of cargo and express logistics operations

Cargo and express logistics activity continues to expand across regional supply chains and island economies. Turboprop aircraft provide optimal payload efficiency for short-distance cargo movement. Logistics operators rely on turboprops for time-sensitive deliveries and feeder services. E-commerce growth sustains steady air cargo volumes throughout the region. Dedicated cargo operators increasingly favor turboprops for operational reliability. Fleet utilization rates remain high due to frequent scheduling requirements. Engine usage intensity rises with increased flight cycles. Maintenance demand grows proportionally with higher utilization levels. Logistics-driven demand supports long-term engine servicing contracts. This trend reinforces consistent aftermarket revenue streams.

Challenges

High acquisition and maintenance costs

High acquisition costs limit rapid fleet expansion among smaller regional operators. Maintenance expenses remain significant due to stringent safety and certification requirements. Engine overhaul cycles require specialized facilities and skilled labor. Cost sensitivity influences procurement timing and fleet renewal decisions. Operators often extend engine life cycles to manage expenditure. Spare part availability impacts maintenance planning efficiency. Currency fluctuations can affect component procurement costs. Budget constraints limit adoption of newer engine technologies. Financial planning complexity increases for smaller fleet operators. These factors collectively restrain aggressive market expansion.

Limited turboprop fleet expansion compared to jets

Jet aircraft adoption continues to outpace turboprop fleet expansion in some routes. Passenger preference for jets influences airline fleet planning strategies. Higher cruising speeds of jets reduce travel time on certain sectors. Airlines prioritize jet aircraft for premium and longer regional routes. This trend reduces turboprop deployment opportunities on selected corridors. Infrastructure upgrades increasingly favor jet-compatible operations. Fleet modernization strategies often prioritize jet acquisitions. Turboprop fleet growth remains moderate in comparison. Operational economics alone do not always offset performance perception. These dynamics constrain overall turboprop market growth.

Opportunities

Growth in regional cargo aviation

Regional cargo aviation continues expanding due to supply chain decentralization. Turboprop aircraft serve as cost-efficient platforms for short-haul cargo movement. Rising e-commerce penetration supports consistent demand for cargo flights. Logistics operators favor turboprops for flexible route planning. Increased freight volumes drive higher engine utilization rates. Cargo operators invest in fleet reliability and engine performance. Maintenance cycles become more frequent with higher flight activity. Engine service providers benefit from recurring service demand. Regional cargo hubs enhance turboprop relevance. This segment presents sustained growth potential.

Expansion of sustainable aviation initiatives

Sustainable aviation initiatives are influencing engine technology development and operations. Airlines seek fuel-efficient engines to meet emissions objectives. Turboprop engines inherently offer lower fuel consumption characteristics. Regulatory emphasis on environmental compliance supports turboprop utilization. Operators invest in engine upgrades to improve efficiency metrics. Sustainable aviation fuels further enhance turboprop attractiveness. Environmental reporting requirements influence fleet selection strategies. Manufacturers align engine designs with sustainability targets. Government support encourages adoption of efficient aircraft platforms. These initiatives create long-term growth opportunities.

Future Outlook

The Singapore turboprop engine market is expected to maintain steady development through the forecast period. Continued regional connectivity and cargo activity will sustain engine utilization levels. Technological improvements and sustainability initiatives will support fleet modernization. Regulatory stability and strong maintenance infrastructure will reinforce long-term market resilience.

Major Players

- Pratt & Whitney Canada

- GE Aerospace

- Rolls-Royce

- Safran Aircraft Engines

- Honeywell Aerospace

- MTU Aero Engines

- RTX Corporation

- StandardAero

- ST Engineering Aerospace

- Daher

- Textron Aviation

- ATR

- Leonardo

- Magellan Aerospace

- Safran Nacelles

Key Target Audience

- Commercial airline operators

- Cargo and logistics companies

- Aircraft leasing companies

- Aviation maintenance providers

- Defense and government aviation agencies

- Airport authorities and operators

- Investments and venture capital firms

- Civil Aviation Authority of Singapore

Research Methodology

Step 1: Identification of Key Variables

Market scope was defined based on turboprop engine usage, fleet composition, and operational deployment patterns. Key performance indicators were identified through industry benchmarks and regulatory frameworks. Data points were selected to reflect operational and maintenance activity levels.

Step 2: Market Analysis and Construction

Market structure was developed using fleet activity, application usage, and service demand patterns. Segmentation logic was aligned with aircraft type, application, and operational roles. Analytical models were built to ensure consistency across segments.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with aviation professionals and maintenance specialists. Industry feedback was used to verify operational assumptions and demand drivers. Adjustments were made to reflect realistic market behavior.

Step 4: Research Synthesis and Final Output

All data points were consolidated and cross-verified for internal consistency. Qualitative insights were integrated with quantitative trends. Final outputs were structured to support strategic decision-making.

- Executive Summary

- Research Methodology (Market Definitions and civil turboprop propulsion scope mapping, Aircraft and fleet segmentation logic for Singapore aviation market, Bottom-up engine shipment and installed base estimation methodology, Revenue attribution across OEM, MRO and aftermarket streams)

- Definition and scope

- Market evolution

- Aircraft deployment and usage patterns

- Aviation ecosystem structure

- Supply chain and MRO network

- Regulatory and certification environment

- Growth Drivers

Rising regional air connectivity and short-haul routes

Growth of cargo and express logistics operations

Fleet modernization by regional carriers

Increasing demand for fuel-efficient propulsion

Expansion of MRO capabilities in Singapore

Government support for aviation hub development - Challenges

High acquisition and maintenance costs

Limited turboprop fleet expansion compared to jets

Stringent certification and regulatory requirements

Dependence on global OEM supply chains

Skilled workforce availability constraints

Competition from advanced turbofan aircraft - Opportunities

Growth in regional cargo aviation

Expansion of sustainable aviation initiatives

Engine retrofit and upgrade demand

Aftermarket and MRO service expansion

Adoption of digital engine health monitoring

Regional defense and surveillance programs - Trends

Shift toward fuel-efficient turboprop platforms

Increasing adoption of FADEC systems

Growth in predictive maintenance solutions

Rising use of turboprops in short-haul logistics

OEM-MRO strategic partnerships

Focus on lifecycle cost optimization - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Regional passenger aircraft

Cargo and logistics aircraft

Special mission and surveillance aircraft

Charter and business aviation aircraft - By Application (in Value %)

Passenger transport

Cargo and logistics

Maritime patrol and ISR

Training and special missions - By Technology Architecture (in Value %)

Single-spool turboprop engines

Free turbine turboprop engines

FADEC-enabled turboprop engines - By End-Use Industry (in Value %)

Commercial aviation

Defense and government aviation

Charter and business aviation

Aviation training institutes - By Connectivity Type (in Value %)

Conventional engine systems

Digitally monitored engines

Connected and predictive maintenance-enabled engines

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (engine thrust class, fuel efficiency, maintenance cycle cost, installed base, aftermarket support, technology maturity, regional presence, certification portfolio)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

GE Aerospace

Rolls-Royce

Safran Aircraft Engines

Honeywell Aerospace

MTU Aero Engines

RTX Corporation

StandardAero

ST Engineering Aerospace

Daher

Textron Aviation

ATR

Leonardo

Magellan Aerospace

Safran Nacelles

Demand and utilization drivers

Procurement and tender dynamics

Buying criteria and vendor selection

Budget allocation and financing preferences

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035