Market Overview

The Singapore Utility Aircraft market current size stands at around USD ~ million, supported by an active fleet exceeding ~ units and annual utilization rates above ~ flight hours. Operational demand intensified with mission sorties rising ~ percent across surveillance, logistics, and maritime support roles. Fleet availability improved as serviceability levels crossed ~ percent through maintenance optimization. Platform replacement cycles shortened to ~ years, reflecting operational intensity. Government-backed procurement pipelines stabilized deliveries at ~ aircraft annually, while readiness benchmarks consistently exceeded ~ percent across core missions.

Singapore represents the sole regional focus, with demand concentrated around Changi aviation infrastructure, Seletar aerospace facilities, and integrated defense logistics hubs. The ecosystem benefits from advanced MRO capabilities, strong regulatory oversight, and coordinated civil-military airspace management. High mission density, compact geography, and maritime security priorities drive aircraft deployment intensity. Policy emphasis on rapid response and resilience strengthens fleet utilization. Mature aerospace services, skilled workforce availability, and streamlined procurement frameworks reinforce sustained operational demand across utility aircraft programs.

Market Segmentation

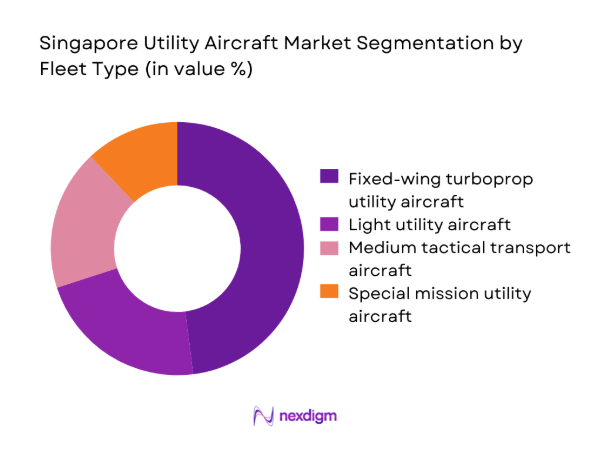

By Fleet Type

Fixed-wing turboprop utility aircraft dominate fleet composition due to balanced payload capacity, short takeoff capability, and efficient endurance profiles suited for Singapore’s compact geography. In active operations, these platforms account for the majority of mission assignments across logistics, patrol, and humanitarian roles. Light utility aircraft support liaison and training missions, while medium tactical aircraft remain limited but strategically critical. Fleet decisions emphasize versatility, interoperability, and rapid deployment readiness. Procurement strategies favor proven airframes with modular upgrade potential, ensuring adaptability to evolving mission requirements without expanding fleet complexity.

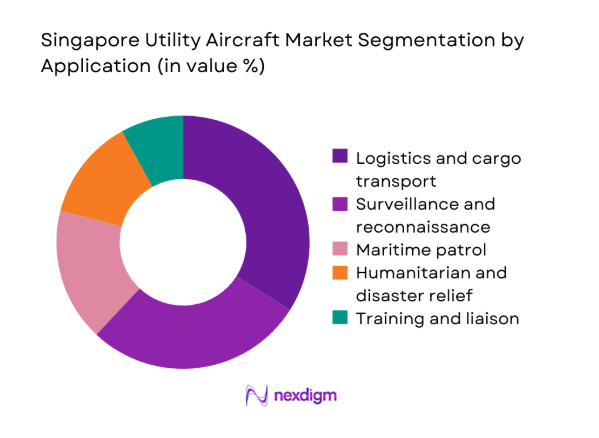

By Application

Logistics and cargo transport applications command the largest share, reflecting persistent requirements for rapid inter-base movement and supply chain resilience. Surveillance and reconnaissance missions closely follow, driven by maritime domain awareness priorities. Humanitarian assistance and disaster relief missions maintain steady utilization due to regional contingency planning. Training and liaison roles, while smaller, ensure pilot readiness and operational continuity. Application-driven procurement emphasizes mission flexibility, sensor integration capability, and sustained operational availability, aligning aircraft configurations with Singapore’s multi-role deployment doctrine.

Competitive Landscape

The competitive landscape is characterized by a limited number of globally established aircraft manufacturers supported by strong local maintenance and integration partners. Platform selection emphasizes reliability, lifecycle support depth, and regulatory alignment rather than pricing competition.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Airbus Defence and Space | 1970 | Europe | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| Embraer | 1969 | Brazil | ~ | ~ | ~ | ~ | ~ | ~ |

| Textron Aviation | 1927 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Pilatus Aircraft | 1939 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore Utility Aircraft Market Analysis

Growth Drivers

Rising defense and homeland security readiness requirements

Singapore’s defense posture intensified as operational readiness benchmarks increased across airlift, surveillance, and response missions. Utility aircraft deployments expanded as planners prioritized rapid force mobility and persistent situational awareness. Increased joint operations elevated demand for reliable multi-role aircraft platforms. Training hours rose consistently, reinforcing fleet utilization intensity. Homeland security missions expanded scope, requiring flexible aircraft configurations. Inter-agency coordination improved mission planning efficiency significantly. Aircraft availability targets tightened, influencing procurement acceleration decisions. Readiness audits emphasized redundancy and resilience capabilities. Operational doctrines increasingly favored air-based rapid response. These dynamics collectively reinforced sustained demand growth.

Strategic need for rapid logistics and island-state mobility

Singapore’s geographic constraints necessitate air mobility for logistics continuity across dispersed facilities and maritime zones. Utility aircraft provide critical time-sensitive transport capabilities supporting defense and civil operations. High mission tempo requires platforms capable of frequent short-range sorties. Mobility planning integrates aircraft into broader resilience frameworks. Infrastructure density enables quick turnaround and deployment cycles. Operational planners prioritize aircraft versatility over specialization. Logistics doctrines increasingly emphasize speed and reliability. Aircraft selection reflects compatibility with compact airspace operations. Mobility requirements remain structurally embedded within national planning. This strategic imperative sustains consistent fleet relevance.

Challenges

High acquisition and lifecycle costs

Utility aircraft programs face financial pressure from sophisticated avionics and compliance-driven design requirements. Lifecycle management demands sustained investment in maintenance and upgrades. Operating environments accelerate component wear rates. Budgetary scrutiny influences procurement pacing decisions. Long service lives require periodic modernization cycles. Spare parts logistics add operational complexity. Training costs remain significant for specialized platforms. Certification compliance introduces additional program overhead. Cost containment strategies face practical limitations. These factors collectively constrain rapid fleet expansion.

Limited domestic manufacturing base

Singapore relies heavily on imported airframes and critical components. Limited local manufacturing restricts supply chain autonomy. Dependency increases exposure to external production schedules. Customization timelines extend due to offshore integration. Technology transfer opportunities remain selective. Local industry focuses primarily on MRO activities. Manufacturing scale constraints limit bargaining leverage. Strategic sourcing requires diversified supplier engagement. Industrial policy balances capability development with practicality. Structural dependence remains a persistent constraint.

Opportunities

Fleet replacement and modernization programs

Aging aircraft platforms create structured replacement opportunities aligned with readiness objectives. Modernization programs emphasize avionics upgrades and mission system integration. Replacement cycles enable efficiency improvements without fleet expansion. Newer platforms offer improved reliability and maintainability. Procurement planning aligns with phased retirement schedules. Modernization enhances interoperability across agencies. Upgrade programs extend asset life effectively. Capability refresh cycles attract vendor engagement. Technology insertion improves mission performance consistency. These programs represent sustained opportunity pathways.

Integration of ISR and mission system upgrades

Operational doctrines increasingly prioritize intelligence and situational awareness capabilities. Utility aircraft provide adaptable platforms for ISR payload integration. Sensor upgrades enhance maritime and border surveillance effectiveness. Mission system modularity supports evolving threat responses. Integration programs leverage existing airframes efficiently. Data link enhancements improve inter-agency coordination. ISR capability expansion aligns with national security priorities. Upgrade initiatives reduce reliance on specialized aircraft. Technology maturity supports scalable deployment. This integration trend creates high-value opportunity streams.

Future Outlook

The Singapore Utility Aircraft Market Outlook 2035 indicates stable demand supported by defense readiness priorities and mobility requirements. Fleet modernization initiatives will remain central through the forecast period. Emphasis on multi-role platforms and mission system upgrades will shape procurement strategies. Local MRO capabilities will continue strengthening operational resilience. Policy alignment and infrastructure maturity will sustain long-term market stability.

Major Players

- Airbus Defence and Space

- Leonardo

- Embraer

- Textron Aviation

- Pilatus Aircraft

- Lockheed Martin

- Boeing Defense

- Saab

- L3Harris Technologies

- Korean Aerospace Industries

- PT Dirgantara Indonesia

- RUAG Aviation

- Viking Air

- Daher

- ST Engineering Aerospace

Key Target Audience

- Ministry of Defence Singapore

- Republic of Singapore Air Force

- Home Team Science and Technology Agency

- Civil Aviation Authority of Singapore

- Maritime and Port Authority of Singapore

- Government-linked aviation operators

- Private aerospace service providers

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Operational fleet size, mission profiles, aircraft utilization patterns, and regulatory constraints were identified. Platform categories and application roles were mapped. Demand drivers were aligned with national security and logistics priorities.

Step 2: Market Analysis and Construction

Segment frameworks were constructed based on fleet type and application usage. Operational data points were synthesized to assess deployment intensity. Qualitative indicators guided structural analysis.

Step 3: Hypothesis Validation and Expert Consultation

Industry practitioners, operators, and technical specialists validated assumptions. Operational feasibility and procurement logic were reviewed. Feedback refined segmentation relevance.

Step 4: Research Synthesis and Final Output

Insights were consolidated into a coherent analytical structure. Cross-validation ensured internal consistency. Final outputs aligned with consulting-grade publication standards.

- Executive Summary

- Research Methodology (Market Definitions and mission-capable utility aircraft scope alignment, fleet taxonomy by civilian and defense utility roles, bottom-up fleet-based market sizing using procurement and replacement cycles, value attribution across OEM sales MRO and upgrades, primary validation with operators regulators and MRO executives in Singapore, triangulation using flight registry defense budgets and import data, assumptions on utilization intensity and regulatory constraints)

- Definition and Scope

- Market evolution

- Operational and mission profiles

- Ecosystem structure

- Supply chain and aftermarket dynamics

- Regulatory environment

- Growth Drivers

Rising defense and homeland security readiness requirements

Strategic need for rapid logistics and island-state mobility

Modernization of aging utility aircraft fleets

Growth in maritime surveillance and border security missions

Government focus on disaster response preparedness - Challenges

High acquisition and lifecycle costs

Limited domestic manufacturing base

Stringent airworthiness and certification requirements

Pilot and maintenance workforce constraints

Dependence on imported platforms and components - Opportunities

Fleet replacement and modernization programs

Integration of ISR and mission system upgrades

Expansion of MRO and retrofit services

Dual-use platforms for civil and defense missions

Regional deployment and leasing opportunities - Trends

Shift toward multi-mission configurable aircraft

Increasing adoption of advanced avionics and sensors

Lifecycle extension through upgrades and retrofits

Emphasis on fuel efficiency and lower operating costs

Greater reliance on local MRO capabilities - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Fixed-wing turboprop utility aircraft

Light utility and multi-mission aircraft

Medium tactical transport aircraft

Special mission configured utility aircraft - By Application (in Value %)

Logistics and cargo transport

Surveillance and reconnaissance

Maritime patrol and coastal security

Humanitarian assistance and disaster relief

Training and liaison missions - By Technology Architecture (in Value %)

Conventional turboprop platforms

STOL-optimized airframe designs

Multi-role modular mission systems

Enhanced avionics and glass cockpit platforms - By End-Use Industry (in Value %)

Defense and military forces

Government and homeland security agencies

Commercial aviation service providers

Emergency and disaster response organizations - By Connectivity Type (in Value %)

Line-of-sight communication systems

SATCOM-enabled platforms

Integrated ISR data link systems

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (fleet size, payload capacity, range performance, mission flexibility, acquisition cost, lifecycle cost, MRO support strength, delivery timelines) - SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Textron Aviation

Pilatus Aircraft

Daher

Viking Air

Leonardo

Airbus Defence and Space

Lockheed Martin

Embraer

PT Dirgantara Indonesia

RUAG Aviation

Saab

Boeing Defense

KAI

ST Engineering Aerospace

L3Harris Technologies

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035