Market Overview

As of 2024, the Singapore warehousing market is valued at USD ~ billion, with a growing CAGR of 10.4% from 2024 to 2030, showing robust growth driven by the persistent expansion of e-commerce, which necessitates efficient logistics and inventory management solutions. Notably, the rise in technological advancements, such as automated warehousing systems, further fuels market growth. This landscape is complemented by a steady demand for diverse warehousing solutions, shaping a dynamic and competitive environment.

Singapore, as a logistics hub in Southeast Asia, dominates the warehousing market due to its strategic geographic location, excellent infrastructure, and pro-business policies that attract multinational corporations. The city-state’s connectivity to regional markets and its status as a global trading center enable companies to benefit from efficient supply chain operations, making it an attractive location for warehousing activities.

Market Segmentation

By Component

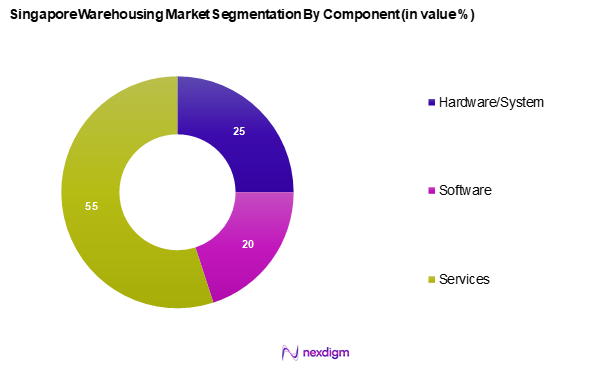

The Singapore warehousing market is segmented into hardware/system, software, and services. The services segments holds a dominant market share, attributing its leadership to the increasing demand for logistics support and enhanced supply chain management solutions. Companies are increasingly outsourcing warehousing services to third-party logistics providers (3PLs) to focus on their core business activities. Moreover, the rising complexities of global supply chains demand specialized warehousing services, solidifying this segment’s position as the leading driver of market growth.

By Function

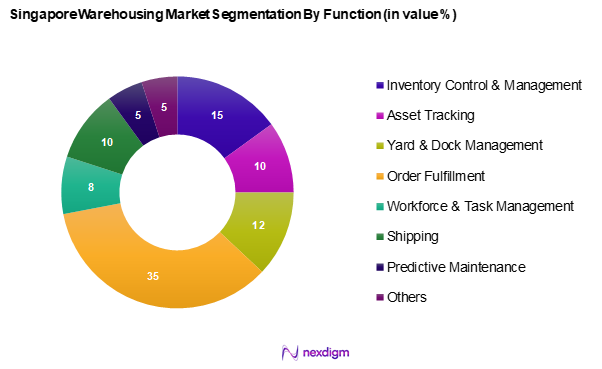

The Singapore warehousing market is segmented into inventory control and management, asset tracking, yard & dock management, order fulfilment, workforce & task management, shipping, predictive maintenance, and others. Order fulfilment leads this segment, supported by the booming e-commerce sector that necessitates efficient order processing and shipment handling. With the surge in online shopping, companies have invested heavily in advanced order fulfilment strategies to ensure rapid delivery times and improved customer satisfaction, thereby reinforcing the order fulfilment sub-segment’s dominant market position.

Competitive Landscape

The Singapore warehousing market is highly competitive, dominated by several major players including Stashworks, iHub Solutions Pte Ltd, and Yusen Logistics Co., Ltd. These companies leverage technology and strategic partnerships to enhance their service offerings and operational capabilities.

| Company | Establishment Year | Headquarters | Market Share (%) | Services Offered | Technological Focus | Geographic Reach |

| Stashworks | 2018 | Singapore | – | – | – | – |

| iHub Solutions Pte Ltd | 1985 | Singapore | – | – | – | – |

| Yusen Logistics Co., Ltd | 1955 | Tokyo, Japan | – | – | – | – |

| Whitebox Retail Logistics | 2007 | Singapore | – | – | – | – |

| GKE Warehousing & Logistics | 2001 | Singapore | – | – | – | – |

Singapore Warehousing Market Analysis

Growth Drivers

Rise in E-commerce Activities

The rapid expansion of e-commerce has significantly influenced the Singapore warehousing market. The increasing adoption of online shopping has led to a surge in demand for warehousing space, as retailers seek to accommodate growing inventory requirements. The need for faster delivery and enhanced customer service has further fuelled investments in advanced logistics and storage solutions. As businesses continue to expand their online presence, the warehousing sector is expected to evolve, integrating more efficient storage and distribution models to support the growing demand.

Technological Advancements

Technological advancements are transforming warehousing operations in Singapore. Investments in automation, robotics, and digital solutions have enhanced operational efficiency and inventory management. The adoption of warehouse management systems (WMS) has streamlined processes, improving productivity and reducing costs. With the integration of smart technologies such as artificial intelligence and the Internet of Things, logistics operators are better equipped to meet market demands, driving innovation and competitiveness in the industry.

Market Challenges

Environmental Regulations

Stringent environmental regulations present challenges for the Singapore warehousing market. Companies are required to comply with sustainability initiatives aimed at reducing carbon emissions and enhancing energy efficiency. The implementation of green policies has prompted warehousing operators to invest in eco-friendly infrastructure and sustainable practices. However, the associated costs of compliance and the transition to greener solutions require businesses to carefully balance sustainability efforts with operational efficiency.

Rising Operational Costs

The warehousing sector in Singapore faces increasing operational costs, particularly in labour, real estate, and logistics. The rising demand for skilled workers and higher living expenses have contributed to elevated labour costs. Additionally, the increasing value of industrial real estate has put pressure on rental rates for warehouse spaces. These escalating expenses challenge the profitability of logistics providers.

Opportunities

Investment in Green Warehousing

Sustainability initiatives are creating opportunities in the Singapore warehousing market, particularly through investments in green warehousing solutions. There is a growing emphasis on eco-friendly logistics, with companies increasingly adopting energy-efficient systems and sustainable practices. Green certifications and environmentally conscious infrastructure are becoming key factors in warehousing investment decisions. This shift aligns with global sustainability trends and enhances corporate reputation, positioning businesses favourably in an environmentally aware marketplace.

Digital Transformation in Logistics

The ongoing digital transformation of logistics is driving new opportunities for the warehousing sector. The adoption of digital platforms has improved visibility, operational efficiency, and customer satisfaction. More companies are leveraging technology for real-time tracking and inventory management, streamlining processes and enhancing decision-making capabilities. As digital solutions continue to gain traction, logistics providers are poised to benefit from increased automation and data-driven strategies, further optimizing warehouse operations and supply chain management.

Future Outlook

Over the next five years, the Singapore warehousing market is expected to witness significant growth driven by the acceleration of e-commerce activities, technological innovation in logistics, and rising consumer expectations for faster delivery solutions. Companies will increasingly invest in smart warehousing systems and sustainable practices to enhance operational efficiency and meet evolving market demands.

Major Players

- Stashworks

- iHub Solutions Pte Ltd

- Whitebox Retail Logistics

- GKE Warehousing & Logistics

- Yusen Logistics Co., Ltd

- Spaceship Singapore

- M&P International Freights Pte. Ltd.

- Singapore G Pte Ltd

- MES Logistics Hub

- AW Transport & Warehousing Pte Ltd

- Gilmon Transportation & Warehousing Pte Ltd

- AC2 Group

- Bertschi AG

- DAP Asia Pacific (S) Pte Ltd

- SSW Group

- WarehouseJoy Pte Ltd

- Sunbo Holding

Key Target Audience

- Corporations looking for logistics solutions

- E-commerce companies

- Retailers seeking outsourcing services

- Manufacturers needing efficient supply chain management

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Transport)

- Real Estate Developers focused on warehouse construction

- Technology providers specializing in warehousing solutions

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the Singapore warehousing market. This is underpinned by extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The key objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Singapore warehousing market. This includes assessing market penetration, the ratio of marketplaces to service providers, and resultant revenue generation. Furthermore, we evaluate service quality metrics to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from practitioners in the market, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with multiple warehousing solution providers to gain detailed insights into product segments, sales performance, consumer preferences, and other relevant factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Singapore warehousing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Data Sources, Consolidated Research Approach, Understanding Market Dynamics Through Expert Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rise in E-commerce Activities

Technological Advancements - Market Challenges

Environmental Regulations

Rising Operational Costs - Opportunities

Investment in Green Warehousing

Digital Transformation in Logistics - Trends

Shift to Sustainable Practices

Increased Adoption of Automation - Government Regulation

Compliance Standards

Incentives for Sustainable Operations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Component, (In Value %)

Hardware/System

Software

Services - By Function, (In Value %)

Inventory Control and Management

Asset Tracking

Yard & Dock Management

Order Fulfilment

Workforce & Task (Process) Management

Shipping

Predictive Maintenance

Others - By Type, (In Value %)

Insource Warehousing

Outsource Warehousing - By Size, (In Value %)

Small

Medium

Large - By Ownership, (In Value %)

Public Warehouses

Private Warehouses

Bonded Warehouses

Consolidated Warehouse - By Warehousing Storage Nature, (In Value %)

Ambient Warehousing (Around 80°F)

Air Conditioned (56°F and 75°F)

Refrigerated (33°F and 55°F)

Cold/Frozen (Of or Below 32°F)

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Component Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Revenue Analysis, Operational Efficiency, Technology Utilization, Geographic Reach, Client Base)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Stashworks

Spaceship Singapore

iHub Solutions Pte Ltd

Whitebox Retail Logistics Singapore

M&P International Freights Pte. Ltd.

Singapore G Pte Ltd

MES Logistics Hub

AW Transport & Warehousing Pte Ltd

GKE Warehousing & Logistics Pte Ltd

Gilmon Transportation & Warehousing Pte Ltd

YUSEN LOGISTICS CO., LTD

AC2 Group

Bertschi AG

DAP Asia Pacific (S) Pte Ltd.

SSW Group

WarehouseJoy Pte Ltd

Sunbo Holding

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030