Market Overview

The market for Singapore Zero Emission Aircraft is expected to reach USD ~ billion, driven by increased demand for sustainable aviation solutions and growing environmental regulations. The shift towards zero-emission aircraft is primarily driven by the government’s support for green technology, as well as the rising costs of fossil fuel-based air travel. This growth is supported by technological advancements in electric and hybrid propulsion systems, which continue to gain traction due to their potential for reducing carbon emissions. Strong investments in aviation R&D and collaborative efforts among industry players are also boosting the market’s expansion.

Singapore, as a global aviation hub, leads the market for zero-emission aircraft, fueled by its strategic location and commitment to sustainability. The country’s robust aviation infrastructure, combined with its proactive government policies promoting clean energy solutions, positions it as a key player in the market. Additionally, Singapore’s focus on green technologies and urban air mobility solutions further strengthens its dominance. Major global and regional players also view the country as a prime testing ground for sustainable aviation innovations.

Market Segmentation

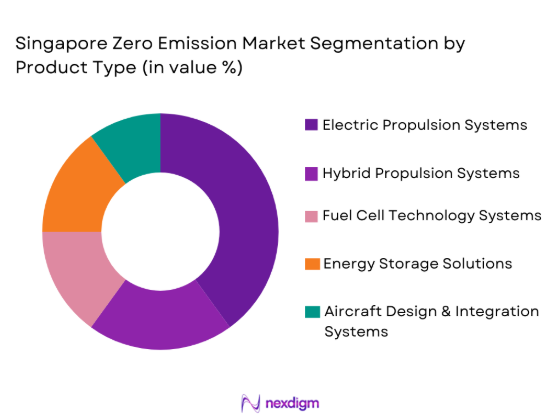

By Product Type

Singapore Zero Emission Aircraft market is segmented by product type into Electric Propulsion Systems, Hybrid Propulsion Systems, Fuel Cell Technology Systems, Energy Storage Solutions, and Aircraft Design & Integration Systems. Recently, Electric Propulsion Systems have a dominant market share due to factors such as demand patterns, brand presence, infrastructure availability, or consumer preference. The adoption of electric propulsion is driven by environmental concerns, government incentives, and technological advancements, with a shift toward reducing emissions in the aviation industry. Battery energy density improvements and the scalability of electric engines further support this trend.

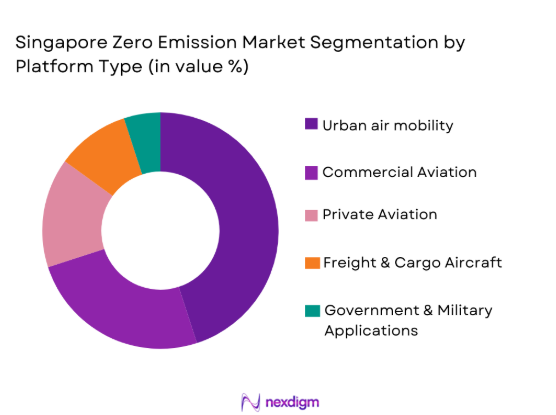

By Platform Type

Singapore Zero Emission Aircraft market is segmented by platform type into Urban Air Mobility, Commercial Aviation, Private Aviation, Freight & Cargo Aircraft, and Government & Military Applications. Recently, Urban Air Mobility has a dominant market share due to factors such as demand patterns, brand presence, infrastructure availability, or consumer preference. The push towards urban air mobility solutions is fueled by advancements in battery technologies, government support for green transportation, and the increasing need for efficient urban transportation networks. The reduction of emissions and the integration of drones and electric aircraft in urban spaces contribute to the platform’s growth.

Competitive Landscape

The competitive landscape in the Singapore Zero Emission Aircraft market is marked by increasing consolidation, with major players investing in technology advancements and strategic partnerships to capture the growing demand for sustainable aviation solutions. The presence of key aviation and technology companies is driving the adoption of zero-emission aircraft across commercial and government sectors. These firms are focusing on enhancing propulsion technologies, reducing costs, and expanding infrastructure for electric aircraft charging stations. Additionally, the market is influenced by government policies supporting clean technologies.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-Specific Parameter |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | London, UK | ~ | ~ | ~ | ~ | ~ |

| ZeroAvia | 2017 | California, USA | ~ | ~ | ~ | ~ | ~ |

| Joby Aviation | 2009 | California, USA | ~ | ~ | ~ | ~ | ~ |

Singapore Zero Emission Aircraft Market Analysis

Growth Drivers

Government Support for Green Aviation

Government incentives and regulations are propelling the adoption of zero-emission aircraft in Singapore. Policies that promote clean energy technologies and emissions reduction targets in aviation support manufacturers and operators transitioning to sustainable aviation. Such policies are critical in creating demand for low-emission aircraft, offering financial support, subsidies, and facilitating research and development efforts in the sector. By establishing a regulatory framework that aligns with environmental objectives, Singapore’s government is directly fostering market growth for electric and hydrogen-powered aviation systems. Moreover, the government’s push for a sustainable aviation ecosystem is accelerating investments in infrastructure such as electric charging stations and hydrogen refueling facilities, enabling the growth of this market. The establishment of green aviation corridors is expected to further amplify the demand for zero-emission aircraft solutions.

Technological Advancements in Aircraft Propulsion

Technological breakthroughs in propulsion systems are a key growth driver for the zero-emission aircraft market in Singapore. Electric propulsion systems have become more viable as advancements in battery technology and energy storage solutions have improved aircraft efficiency and reduced costs. The emergence of hybrid and hydrogen-powered systems has further enhanced the sustainability of aviation, offering extended range and operational flexibility. As innovations in fuel cells, electric motors, and lightweight materials continue to evolve, the performance and affordability of zero-emission aircraft will continue to improve. Additionally, developments in digital technologies such as autonomous flight systems and advanced avionics are complementing propulsion advancements, driving the market forward. The increasing collaboration between government agencies, aerospace companies, and universities in this space is accelerating the development and deployment of these technologies.

Market Challenges

High Initial Investment Costs

One of the significant barriers to the widespread adoption of zero-emission aircraft in Singapore is the high upfront costs associated with manufacturing and purchasing these advanced technologies. Electric propulsion systems and hydrogen fuel cells still require substantial capital investments to develop, test, and integrate into existing infrastructure. Aircraft manufacturers must also invest heavily in research and development to ensure safety, reliability, and regulatory compliance, which further drives up the initial costs. For airlines and aircraft operators, these high costs can be a deterrent to adopting these sustainable technologies, especially when compared to the established fossil fuel-powered aircraft. Although the long-term savings from reduced fuel consumption and maintenance costs are considerable, the initial financial burden poses a significant challenge for operators in a highly competitive industry with tight margins.

Infrastructure and Charging Network Challenges

Another major challenge facing the market is the lack of infrastructure needed to support zero-emission aircraft. The availability of charging stations and hydrogen refueling facilities is limited, particularly in regions outside of major metropolitan areas. This lack of infrastructure poses a barrier to the widespread deployment of electric aircraft, especially for commercial operators who need to ensure that their fleets can operate seamlessly without relying on fossil fuels. Without widespread, easily accessible charging stations or refueling hubs, airlines may be hesitant to adopt zero-emission technologies, fearing operational disruptions and range limitations. Furthermore, the infrastructure development required to support the electrification of aviation will require significant investments and time, slowing the rate of market adoption. Government incentives and private sector collaboration will be crucial in overcoming this challenge.

Opportunities

Expansion in Urban Air Mobility Solutions

The demand for urban air mobility solutions presents a significant opportunity for the zero-emission aircraft market in Singapore. With the rise in urbanization and the need for more efficient transportation systems, there is a growing interest in deploying electric vertical takeoff and landing (eVTOL) aircraft for urban transport. These electric aircraft can provide efficient, sustainable alternatives to ground transportation, helping to reduce congestion and emissions in crowded cities. Singapore’s position as a regional hub for innovation and smart city technologies, coupled with its proactive stance on sustainability, makes it an ideal location for the implementation of urban air mobility solutions. The government’s support for urban air mobility research, including the development of eVTOL aircraft and the creation of aviation corridors, offers an attractive investment opportunity in the sector.

Collaborations with Technology Startups

Another opportunity lies in the increasing collaboration between established aerospace companies and technology startups working on zero-emission solutions. Startups in the electric and hydrogen aviation sectors are developing innovative technologies that have the potential to transform the aerospace industry. By partnering with these startups, established players can gain access to cutting-edge technologies and faster time-to-market for their products. Additionally, startups benefit from the resources, infrastructure, and market reach that large companies provide. These partnerships will foster technological innovation and accelerate the development of new, cost-effective solutions for zero-emission aircraft. Collaborative ventures between technology startups and government agencies will further streamline the regulatory approval process, allowing for quicker adoption of green aviation technologies in the market.

Future Outlook

The future of the Singapore Zero Emission Aircraft market looks promising, with expected growth driven by advancements in propulsion technologies, growing demand for sustainable aviation solutions, and increasing government support. Over the next five years, the market will experience substantial development in electric and hydrogen-powered aircraft, driven by ongoing R&D and regulatory support. Technological advancements will lead to more efficient and cost-effective solutions, making zero-emission aircraft a more viable option for commercial operators. Additionally, the expansion of urban air mobility and the development of infrastructure for electric aircraft charging and hydrogen refueling will support the market’s growth trajectory.

Major Players

- Boeing

- Airbus

- Rolls-Royce

- ZeroAvia

- Joby Aviation

- Lilium

- Heart Aerospace

- Ampaire

- Eviation Aircraft

- Vertical Aerospace

- MagniX

- Harbour Air

- AeroTEC

- Pipistrel

- Elbit Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft manufacturers

- Airlines and commercial operators

- Urban air mobility service providers

- Battery and energy storage solution providers

- Hydrogen fuel suppliers

- Aircraft parts and components suppliers

Research Methodology

Step 1: Identification of Key Variables

The key variables driving market growth are identified, including demand for green aviation technologies, regulatory frameworks, and technological advancements in propulsion systems and infrastructure.

Step 2: Market Analysis and Construction

A detailed analysis of the market dynamics, including segmentation by product type, platform type, and technology, is conducted, followed by the construction of an accurate market model.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts, academic researchers, and regulatory bodies are carried out to validate hypotheses about market trends and growth projections.

Step 4: Research Synthesis and Final Output

The findings from expert consultations, market data, and industry reports are synthesized into a comprehensive market report that provides actionable insights and recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Government Incentives for Sustainable Aviation

Advancements in Electric Propulsion Technologies

Public Demand for Eco-friendly Air Travel

International Regulations on Aircraft Emissions

Technological Innovations in Battery Efficiency - Market Challenges

High Initial Investment Costs for Zero Emission Aircraft

Limited Charging Infrastructure for Electric Aircraft

Technological Maturity of Propulsion Systems

Regulatory Approval Processes for New Aircraft Technologies

Competition from Traditional Aircraft Manufacturers - Market Opportunities

Expansion of Urban Air Mobility Solutions

Collaborations with Technology Startups for Innovation

Global Push Toward Carbon Neutrality in Aviation - Trends

Increased Investment in Electric Aircraft Development

Partnerships Between Aviation and Clean Energy Sectors

Emerging Hybrid Power Systems for Aircraft

Technological Focus on Sustainable Aircraft Materials

Surge in Air Mobility Solutions in Urban Areas - Government Regulations & Defense Policy

Aviation Emissions Reduction Targets

Carbon Offset Programs for Aviation

Government Grants for Zero Emission Aircraft Development - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electric Propulsion Systems

Fuel Cell Technology Systems

Hybrid Systems

Energy Storage Solutions

Aircraft Design & Integration Systems - By Platform Type (In Value%)

Urban Air Mobility

Commercial Aviation

Private Aviation

Freight & Cargo Aircraft

Government & Military Applications - By Fitment Type (In Value%)

OEM Solutions

Retrofit Solutions

Modular Solutions

Customized Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Commercial Airlines

Private Aircraft Operators

Cargo Airlines

Government & Military Organizations

Urban Air Mobility Service Providers - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Leasing & Financing Options

Online Bidding Platforms - By Material / Technology (in Value%)

Carbon Fiber Composites

Lithium-ion Batteries

Solid-state Batteries

Fuel Cells

Advanced Lightweight Materials

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Boeing

Airbus

Rolls-Royce

ZeroAvia

Joby Aviation

Lilium

Heart Aerospace

Ampaire

Eviation Aircraft

Vertical Aerospace

MagniX

Harbour Air

AeroTEC

Pipistrel

Elbit Systems

- Commercial Airlines Exploring Zero Emission Solutions

- Private Aircraft Operators Adopting Green Technologies

- Government Entities Promoting Clean Aviation Solutions

- Urban Air Mobility Providers Seeking Sustainable Aircraft

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035