Market Overview

The South Africa Catering (Food Solutions) Market is valued at about USD ~ billion. This sits within a broader foodservice profit sector that generated ZAR ~ billion in revenue, rising to ZAR ~ billion in the most recent reporting period, reflecting steady growth in out-of-home eating. Expansion is underpinned by a national economy of around USD 400.26 billion GDP and per-capita income above USD 6,250, supporting institutional and workplace catering demand despite muted overall growth.

The market is concentrated around Gauteng, Western Cape and KwaZulu-Natal, anchored by Johannesburg, Pretoria, Cape Town and Durban. Gauteng alone contributes roughly a third of national GDP and is described as the leading financial and manufacturing hub of the country, making it a natural core for corporate, industrial and mining catering contracts. Cape Town’s metro population is approaching 5 million and has grown by nearly 30% since the previous decade, driven by tourism, migration and services-sector expansion, reinforcing demand for hospitality, inflight and event catering.

Market Segmentation

By Service Model

South Africa Catering (Food Solutions) Market is segmented by service model into on-site catering and transport catering. On-site catering holds the dominant share as large mines, industrial plants, government complexes, hospitals and corporate campuses still prefer fully operated kitchens at the point of consumption. Mining alone contributes over 6% of national GDP and supports more than 460,000 direct jobs, translating into large, daily captive catering volumes at remote sites and labour camps. Combined with corporate and healthcare canteens in Gauteng and Western Cape, this keeps on-site kitchens at the core of meal production, while commissaries and tech-enabled formats grow as supporting models rather than primary ones.

By End-User Sector

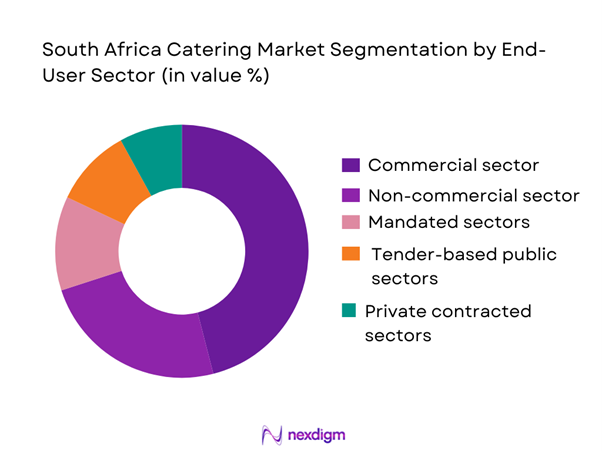

South Africa Catering (Food Solutions) Market is segmented by end-user sector into commercial, non-commercial, mandated, tender-based public and private contracted sectors. Commercial clients dominate, led by corporate offices, private hospitals, private education, mining houses and airlines purchasing catering directly or via facilities-management providers. The profit foodservice sector already generates around USD 35 billion in revenue, with quick service, full-service restaurants and workplace foodservice forming the largest channels. Within this, commercial catering customers typically seek higher menu spend, differentiated offerings and multi-site SLAs. Non-commercial and public feeding programmes are large in absolute meals, but budgets per meal are constrained, as seen in the over 9 million learners fed daily under the National School Nutrition Programme and R8.4 billion annual spending on school feeding schemes.

South Africa Inflight Catering Sub-Segment

South Africa’s inflight catering niche is anchored by hubs at OR Tambo International, Cape Town International and King Shaka International, served by global providers such as LSG Sky Chefs and Newrest, along with local airline-aligned kitchens. OR Tambo alone handled roughly 17.85 million passengers and more than 204,000 aircraft movements in the most recent reporting period, illustrating the scale of catering uplift operations. Long-haul routes into Europe, the Middle East and intra-African corridors drive demand for premium-class menus and complex dietary catering, while low-cost carriers and regional operators require high-volume, cost-optimised snack and light-meal solutions. Inflight catering is increasingly integrating with airport concessions, commissary kitchens and bonded warehousing to manage security-driven time windows and cold-chain integrity.

Competitive Landscape

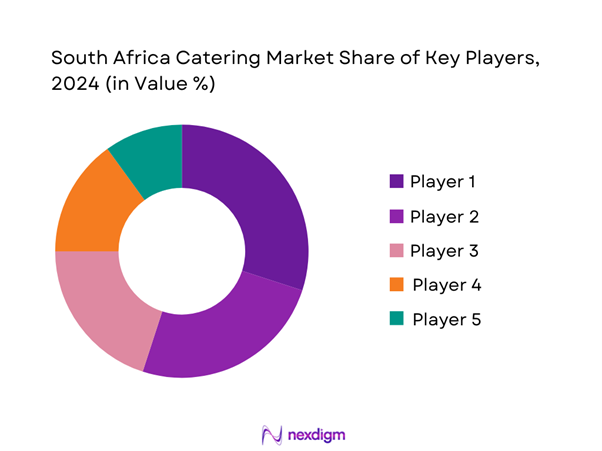

The South Africa Catering (Food Solutions) Market is relatively consolidated, with a handful of large, multi-service providers such as Tsebo Solutions Group, Bidfood/Bidvest catering brands, Compass Group Southern Africa, Servest Food Solutions and RoyalMnandi acting as anchor suppliers across mining, corporate, education, healthcare and government contracts. Around these sit strong regional players like Feedem and Capitol Caterers, and specialists in camp catering and inflight services. This concentration allows major groups to leverage national supply chains, central production units, menu-engineering expertise and B-BBEE-aligned ownership structures to secure long-term SLAs with blue-chip clients, while niche players compete on regional presence, flexibility and sector specialisation.

| Player | Establishment Year | Headquarters (SA) | Core Catering Focus in SA | Key End-User Sectors | Network Scale / Footprint* | Remote / Mining Camp Capability | Tech & Data Capabilities | ESG / B-BBEE Positioning |

| Tsebo Solutions Group | 1971 | Johannesburg | ~ | ~ | ~ | ~ | ~ | ~ |

| Bidfood / Bidvest Catering | 1989 (group) | Johannesburg | ~ | ~ | ~ | ~ | ~ | ~ |

| Compass Group Southern Africa | 1989 | Sandton | ~ | ~ | ~ | ~ | ~ | ~ |

| Servest Food Solutions | 1997 | Johannesburg | ~ | ~ | ~ | ~ | ~ | ~ |

| RoyalMnandi | 1990 | Johannesburg | ~ | ~ | ~ | ~ | ~ | ~ |

South Africa Catering Market Analysis

Growth Drivers

Mining Workforce Strength

South Africa’s formal mining sector employed 481,307 people in Q4 2023, underscoring its role as a major source of stable institutional catering demand, particularly in remote sites and labour camps where consistent meals are essential for workforce productivity and retention. The country remains a leading global producer of coal, platinum, gold and iron ore, keeping mining central to its industrial activity and creating sustained demand for large-volume onsite catering. Additionally, mining exports and associated services support worker populations spread across multiple provinces, ensuring ongoing contract catering opportunities in high-density operational zones.

Industrial Expansion

South Africa’s broader industrial base continues to contribute to institutional catering demand beyond mining. The country’s economy, measured at USD 426.38 billion in current price GDP, reflects industrial, manufacturing and services activity that employs millions and drives corporate and onsite catering needs. In Q4 2024, mining, personal services and utilities contributed to the 0.6% annual GDP expansion, indicating that even with structural constraints, industrial sectors are active and generating demand for catering meals on-site. Urban centres with dense manufacturing and logistics operations, such as Gauteng and the Western Cape, maintain high volumes of daily meals required by structured workforces, reinforcing contract catering revenue streams.

Market Challenges

Inflationary Food Costs

Food inflation remains a persistent challenge for South African catering operators, as staple food and beverage costs have shown volatility. In April 2024, the annual food inflation rate was reported at 4.7%, while headline CPI increased by 5.2%, reflecting sustained pressure on input costs that caterers must absorb or pass on. High food prices historically spiked to a peak of 14% in March 2023, indicating structural volatility in food supply pricing that directly impacts meal cost control and foodservice margins. Although food price pressures have moderated, the underlying cost base for raw ingredients, meat, dairy and cereals remains elevated, forcing operational adjustment in menu planning, supplier negotiations and contract pricing.

Supply Chain Volatility

South Africa’s economic and logistical environment introduces volatility into food supply chains critical to catering operations. National GDP growth has been modest, with 0.6% expansion in 2024 compared with the prior year, indicating slow industrial momentum that can affect transport, food logistics and procurement reliability. Moreover, constraints such as irregular electricity provision (load-shedding) and infrastructure challenges in freight and distribution create fragmentation in supply continuity, particularly for remote and large-scale kitchens. While mining and personal services showed some expansion, secondary sectors like manufacturing contracted, revealing weaknesses in the movement of goods used by caterers. These factors, combined with fluctuating food price inputs, make supply chain management a critical operational hurdle for contract catering providers.

Opportunities

Tech-Enabled Catering

Digitally enhanced catering operations present a strategic opportunity in the South Africa market, where traditional onsite kitchens are complemented by tech systems that optimise ordering, inventory and customer experience. South Africa has a broadband penetration that supports mobile and cloud-based technologies for workforce and institutional clients, enabling digital ordering, cashless payment systems and kitchen workflow software. With consumer and corporate sectors increasingly tech-savvy, implementing digital systems reduces food waste, improves forecasting and enhances compliance tracking across multi-site contracts. These solutions also support adherence to food safety standards and nutrition profiling, aligning with institutional procurement requirements. Emerging tech adoption provides scalable platforms that can reduce manual processes, improve operational margins and elevate service differentiation in a competitive catering landscape where volume and precision matter.

AI Menu Engineering

Artificial intelligence (AI) and data analytics tools are becoming integral to optimizing foodservice operations, particularly for complex contract catering environments in South Africa. AI-driven menu engineering allows caterers to harness consumption patterns, nutritional requirements and cost structures to design menus that balance quality with efficiency. Using digital data from client usage, inventory levels and seasonality, AI systems can recommend meal compositions that support health standards while optimizing supplier orders and reducing waste. Integration of AI into meal planning systems also supports adherence to sector-specific dietary needs such as Halal, therapeutic diets in healthcare settings and culturally tailored offerings in education. With institutional clients demanding increasingly sophisticated reporting and compliance capabilities, AI enhances operational intelligence, enabling caterers to tailor offerings based on real-time consumption data and predictive forecasts.

Future Outlook

Over the next six years, the South Africa Catering (Food Solutions) Market is expected to track steady, GDP-linked growth, supported by resilient institutional feeding, gradual recovery in corporate office occupancy, continued mining-sector employment and growth in school and social feeding schemes. World Bank data shows GDP at roughly USD 400.26 billion with modest positive growth and stable inflation, providing a platform for incremental catering spend.

Major Players

- Tsebo Solutions Group

- Bidfood / Bidvest Catering Services

- Compass Group Southern Africa

- Servest Food Solutions

- Feedem Group

- RoyalMnandi

- Capitol Caterers

- Fedics (Bidvest Group)

- ATS Catering (Mining & Industrial)

- Minopex Camp Catering

- African Food Catering Services (AFCS)

- Britehouse Food Solutions

- Golden Air Catering / ACSA-aligned inflight caterers

- LSG Sky Chefs South Africa

- Newrest Inflight South Africa

Key Target Audience

- Integrated facilities management companies (multi-service FM and soft-services providers bundling catering with cleaning, security and technical services)

- Mining, energy and industrial operators (companies running mines, smelters, processing plants and labour camps across South Africa)

- Healthcare groups and hospital networks (public-private hospital groups, day-care centres and long-term care operators)

- Education departments and tertiary institutions (Department of Basic Education; provincial education departments; universities and TVET college operators responsible for campus foodservice)

- Airlines and aviation ecosystem players (South African-based and foreign carriers, ground-handling companies and airport concessionaires)

- Hospitality, tourism and MICE venue operators (hotel chains, convention centres, event venues and stadium operators)

- Investments and venture capitalist firms (private equity, infrastructure funds and impact investors targeting foodservice, logistics, ESG and social-feeding platforms)

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the full ecosystem of the South Africa Catering (Food Solutions) Market, including contract caterers, inflight service providers, facility-management firms, food distributors, central commissaries and public-sector feeding programmes. Extensive desk research, leveraging World Bank, IMF, and official South African statistics, is used to identify fundamental variables such as meals served, contract types, menu price bands, cost structures, employment intensity and capital intensity across segments.

Step 2: Market Analysis and Construction

In this phase, Nexdigm compiles and analyses historical and current data on foodservice revenues, catering revenues, mining employment, air-passenger volumes and government feeding budgets. This includes triangulating revenue pools from the foodservice profit sector with dedicated catering services estimates, and splitting them by service model and end-user sector. Bottom-up modelling uses indicators such as average daily meals per worker, learners served, patient census and passenger uplifts, while top-down checks rely on macroeconomic data (GDP, inflation, population and employment) to validate overall revenue envelopes.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary hypotheses on segment shares, growth drivers, pricing structures and contract models are validated through structured interviews with senior executives at leading caterers, facilities-management companies, mining houses, hospital groups, airlines and procurement authorities. These discussions are conducted via computer-assisted telephone and online interviews, focusing on operational metrics (meal volumes, staffing ratios, menu cost engineering), commercial metrics (SLAs, tender win rates, contract durations) and investment priorities (kitchen automation, energy efficiency, waste management). Feedback from these experts is used to adjust assumptions and refine segment-level revenue and growth estimates.

Step 4: Research Synthesis and Final Output

The final step integrates quantitative models and qualitative insights into a coherent narrative on the South Africa Catering (Food Solutions) Market. Cross-checks are carried out against multiple independent sources for foodservice revenue, catering market size and macro indicators to ensure consistency. Detailed segment-wise sizing, competitive benchmarking, inflight sub-market analysis and future-scenario modelling are then synthesised into the final report, along with strategic recommendations for operators, investors and policymakers. All figures are subjected to range checks and sensitivity analyses to highlight upside and downside scenarios under differing assumptions on GDP growth, employment, public-feeding budgets and travel demand.

- Executive Summary

- Research Methodology (Market Definitions & Scope, Catering Value Pools, Institutional Procurement Frameworks, Market Sizing Logic for Foodservice Solutions, Multi-Stakeholder Research Approach, Informal Sector Inclusion Framework, Primary–Secondary Triangulation, Pricing & Menu Engineering Considerations, Limitations & Assumptions, Sensitivity Checks)

- Definition and Scope

- Evolution of the Institutional & Contract Catering Sector

- Role Within South Africa’s Foodservice & Non-Commercial Catering Ecosystem

- Business Cycle: Tendering → Mobilization → Menu Engineering → On-Site Operations → SLA Compliance → Renewal

- Supply Chain & Value Chain Analysis (Farm → Processor → Distributor → Caterer → Institutional Client)

- Growth Drivers (Mining Workforce Strength, Industrial Expansion, Workplace Return Rates, Healthcare & Education Institutionalisation, Food Safety Modernisation)

- Market Challenges (Inflationary Food Costs, Supply Chain Volatility, Labour Regulations, SLA Penalties, Infrastructure & Load Shedding)

- Opportunities (Tech-Enabled Catering, AI Menu Engineering, Halal Market Expansion, ESG & Sustainable Procurement, Outsourcing Model Shift)

- Trends (Central Commissary Growth, Per-Meal Pricing Innovation, Cashless Canteens, Health-Focused Meals, Waste-Reduction Systems)

- Government & Regulatory Framework (Food Safety Act Standards, HACCP Enforcements, Labour & Employment Compliance, Mining & Industrial Catering Guidelines)

- SWOT Analysis

- Stake Ecosystem (Caterers, Distributors, OEM Kitchen Equipment, Meal-Tech Providers, Facility Management Firms, Tender Bodies)

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume (Meals Served, Meal Equivalents, Consumption Units), 2019-2024

- By Cost Structure (Food Cost, Labour Cost, Overheads, Technology-Enabled Cost Centres), 2019-2024

- By Service Model (in Value %)

– On-Site Catering

Mining & Industrial Sites

Corporate Canteens & Business Parks

Healthcare & Hospital Foodservice

Government, Defence & Correctional Facilities

Education & Campus Dining

Hospitality & Events Contract Catering

– Transport Catering

Rail Catering (Passenger Rail, Long-Distance Services)

Bus & Coach Travel Catering

Maritime/Offshore Catering (Ports, Cargo Crews)

Airline Catering Uplifts (Domestic & Regional Turnarounds) - By End-User Sector (in Value %)

– Commercial Sector

Corporate Enterprises & Business Parks

Airlines & Aviation Operators (Inflight Catering)

Hospitality, MICE & Event Catering

Retail Foodservice Outlets in Business Facilities

Private Healthcare Facilities

– Non-Commercial Sector

Public Schools & Universities

Public Hospitals & Clinics

Correctional Services & Reform Facilities

Government Departments & Defence Establishments

Social Welfare Feeding Programs

– Mandated Sectors (High-Regulation, High-Compliance)

Mining & Industrial Workforce Catering

Labour Camp Catering (Construction, Energy, Mining)

Aviation Inflight Meal Operations

Healthcare Therapeutic & Dietetic Meals

– Tender-Based Sectors

State Schools & Tertiary Education Catering

Public Hospitals & Clinics Foodservice

Military & Defence Canteen Management

Correctional Facility Catering Contracts

Municipal Feeding Initiatives

– Private Contracted Sectors

Corporate Canteens with Long-Term SLAs

Private Hospitals

Outsourced Staff Dining to FM Companies

High-End Event & Hospitality Catering Contracts - By Cuisine & Dietary Format (in Value %)

Standard & Regional South African Cuisine

Health, Wellness & Nutrition-Based Meals

Compliance & Religious Dietary Formats

Lifestyle & Preference-Based Meals

International Cuisine Segments - By Distribution Channel (in Value %)

Direct Long-Term Contracts (SLA-Based)

Public Tendering & Government Procurement

Facility Management-Integrated Catering

Food Distributors & Wholesalers (B2B Supply)

Digital & Technology-Enabled Channels - By Region (in Value %)

Gauteng

Western Cape

Eastern Cape

Rest of South Africa

- Inflight Catering Market Definition & Scope (South Africa)

- Value Chain & Process Flow (Menu Planning → Batch Production → Blast Chilling → Assembly → Airside Logistics → Aircraft Loading)

- Key Demand Drivers (Passenger Traffic, International Routes, Airline Partnerships, Tourism & Business Travel)

- Operational Challenges (Airside Regulations, Cold-Chain Integrity, Tight Turnaround Times, Security Protocols)

- Airline Customer Segmentation

Full-Service Carriers

Low-Cost Carriers

Charter & Private Aviation

International Long-Haul Airlines

Regional Operators - Menu Architecture Segmentation

Hot Meals

Snack Boxes

Premium Class/Business Class Meals

Beverage Programs

Special Dietary Meals (Halal, Kosher, Gluten-Free, Vegan) - Regulatory & Compliance Environment (ACSA, HACCP, ISO, Halal Audits, Aviation Security Protocols)

- Inflight Catering Competitive Landscape (South Africa)

- Partnerships & SLA Structures With Airlines

- Technology Adoption (AI Forecasting, Automated Portioning, IoT Cold-Chain Monitoring)

- Market Share of Major Players (By Value/Volume)

- Sector-Wise Market Shares (Mining, Education, Healthcare, Corporate, Government, Inflight)

- Cross Comparison Parameters (Operational Scale, Menu Engineering Capability, Tender Win Ratio, Workforce Deployment Model, Supply Chain Resilience, ESG/PPE Compliance, Technology Adoption Score, Sector Diversification Index)

- SWOT Analysis of Key Competitors

- Price Architecture & Meal Band Analysis (Basic Meals, Premium Meals, Diet-Specific Meals)

- Detailed Profiles of Major Companies

Tsebo Solutions Group

Bidfood / Bidvest Catering Services

Servest Food Solutions

Feedem Group

Compass Group South Africa

RoyalMnandi

Capitol Caterers

Fedics (Bidvest Group)

ATS Catering (Mining & Industrial)

Eurest South Africa

Minopex Camp Catering

African Food Catering Services (AFCS)

Britehouse Food Solutions

Golden Air Catering / ACSA-aligned inflight caterers

LSG Sky Chefs South Africa / Newrest

- End-User Demand & Meal Consumption Behaviour

- Procurement Models, Tender Cycles & Budget Allocation Frameworks

- Regulatory & Compliance Requirements for Each Sector

- Needs, Expectations & Pain Points (Mining, Corporate, Education, Healthcare, Government)

- Decision-Making Process & Vendor Evaluation Criteria

- By Value, 2025-2030

- By Volume, 2025-2030

- By Cost Architecture, 2025-2030