Market Overview

The South Africa platinum mining market is characterized by a valuation of USD 15.9 billion in 2024, and expected to grow at a CAGR of 5.7% from 2024 to 2030. This market is significantly driven by robust demand from various industries, particularly automotive and electronics, which require platinum for applications ranging from catalytic converters to electronics components. Furthermore, the increasing adoption of fuel cells in the renewable energy sector highlights the market’s potential growth.

South Africa stands out as a dominant player in the platinum mining industry, primarily due to its substantial reserves located in regions like Limpopo and North West. The country is recognized for its rich geological formations, which host some of the world’s largest platinum deposits. This concentration of resources, coupled with established mining practices and infrastructure, solidifies South Africa’s position in the global market.

Market Segmentation

By Mining Method

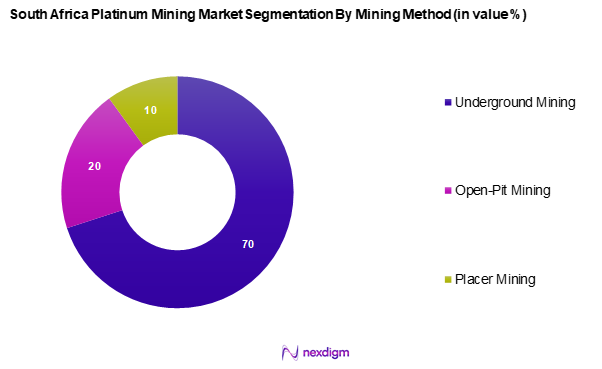

The South Africa platinum mining market is segmented into underground mining, open-pit mining, and placer mining. Underground mining has witnessed a dominant market share in this sector, primarily due to its ability to access deep-lying ore bodies efficiently. The method is well-suited for the geological conditions prevalent in South Africa, where high-grade deposits are typically located at significant depths. Furthermore, the prevailing focus on safety and efficiency in operations has led many companies to optimize their underground mining practices, thereby reinforcing its market position.

By Application

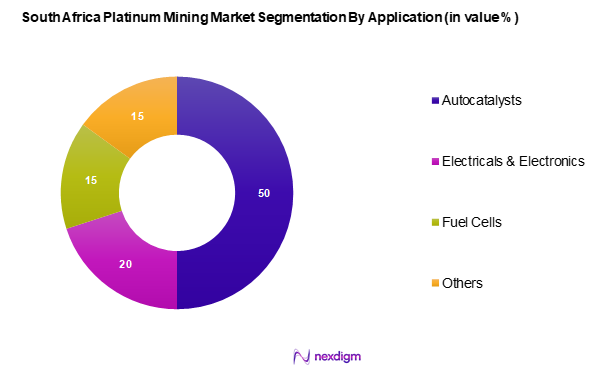

The South Africa platinum mining market is segmented into autocatalysts, electricals and electronics, fuel cells, and others. Autocatalysts dominate the South Africa platinum mining market, driven by the increasing global demand for fuel-efficient and low-emission vehicles. Platinum’s critical role in catalytic converters makes it indispensable for automotive manufacturers, who strive to meet stringent environmental regulations. The automotive sector’s growth, spurred by rising consumer preferences for sustainable vehicles, continually boosts the demand for platinum as a key resource in auto parts manufacturing.

Competitive Landscape

The South Africa platinum mining market is characterized by a few major players, including Anglo American Platinum, Impala Platinum Holdings, and Sibanye Stillwater. This consolidation reveals the significant influence these key companies have in shaping market dynamics and establishing standards for operational excellence.

| Company | Year Established | Headquarters | Production Capacity | Key Market Segment | Revenue (USD Billion) | Unique Value Proposition |

| Anglo American Platinum Limited | 1917 | Johannesburg, SA | – | – | – | – |

| Impala Platinum Holdings Limited | 1957 | Johannesburg, SA | – | – | – | – |

| Sibanye Stillwater | 2013 | Westonaria, SA | – | – | – | – |

| Lonmin Plc | 1909 | London, UK | – | – | – | – |

| Northam Platinum Ltd | 1977 | Cresta, SA | – | – | – | – |

South Africa Platinum Mining Market Analysis

Growth Drivers

Rising Automotive Production

The automotive sector in South Africa is experiencing steady expansion, supported by both domestic demand and export-oriented manufacturing. Favourable government policies and increased involvement from global automobile manufacturers are strengthening this trend. Platinum plays a crucial role in automotive applications, particularly in catalytic converters used for reducing vehicle emissions. As the automotive industry continues to grow and strives to meet stringent global environmental standards, the demand for platinum is expected to rise accordingly.

Growing Demand from the Renewable Energy Sector

South Africa is increasingly focusing on expanding its renewable energy capacity as part of its long-term sustainability goals. Platinum is a key material in hydrogen fuel cell technology, which is gaining momentum as a clean energy alternative across multiple industries. The push toward green energy solutions, both domestically and globally, positions South Africa’s platinum resources as vital to the development of future energy systems, particularly those involving hydrogen-based applications.

Market Challenges

Stringent Regulatory Requirements and Environmental Concerns

The regulatory environment surrounding the mining industry in South Africa is becoming more rigorous, especially with regard to environmental compliance. Mining companies are being compelled to adopt sustainable practices, which often require significant investment and operational adjustments. Failure to adhere to these regulations can lead to legal consequences and operational disruptions. These challenges are increasingly shaping the strategic priorities and cost structures of platinum mining operators.

Unpredictable Market Dynamics

The platinum market is highly sensitive to global economic trends and sector-specific shifts, such as those in the automotive and jewelry industries. These external influences contribute to pricing volatility, making revenue forecasting and long-term planning more complex for mining companies. This uncertainty can impact investment flows and deter expansion initiatives, especially when market signals are inconsistent or unclear.

Opportunities

Advancements in Mining Technologies

Emerging technologies are reshaping the mining landscape, offering pathways to enhanced efficiency and sustainability. Automation, real-time monitoring, and advanced data analytics are being progressively integrated into platinum mining operations. These technologies contribute to better resource management, safer working environments, and reduced environmental footprints. As adoption increases, such innovations are expected to unlock new levels of productivity and drive more sustainable growth in the sector.

Future Outlook

Over the next several years, the South Africa platinum mining market is expected to demonstrate substantial growth. This expansion is anticipated to be driven by increasing demand from the automotive and renewable energy sectors, technological advancements in mining processes, and sustained investments in exploration and expansion activities. Additionally, global trends towards sustainable energy solutions and regulations will further bolster the market’s potential.

Major Players

- Anglo American Platinum Limited

- Impala Platinum Holdings Limited

- Sibanye Stillwater

- Lonmin Plc

- Northam Platinum Ltd

- Rustenburg Platinum Mines

- Sedibelo Platinum Mines Ltd

- Platinum Group Metals Ltd

- Eastern Platinum Ltd

- Wesiswe Platinum Ltd

- African Rainbow Minerals

- Royal Bafokeng Platinum

- Merafe Resources

- Tharisa PLC

- Zimbabwe Platinum Mines

Key Target Audience

- Mining companies

- Government and regulatory bodies (Department of Mineral Resources)

- Environmental agencies

- Investments and venture capitalist firms

- Suppliers and distributors in the mining supply chain

- Automotive manufacturers

- Renewable energy companies

- Industry analysts and market researchers

Research Methodology

Step 1: Identification of Key Variables

The research process begins by identifying and mapping out the key variables that influence the South Africa platinum mining market. This step includes gathering data from reputable industry reports and statistical databases to ensure a comprehensive understanding of market dynamics. Key variables such as production volumes, market trends, and regulatory factors are defined to establish a clear framework for analysis.

Step 2: Market Analysis and Construction

In this phase, historical data related to the platinum mining industry in South Africa is compiled and assessed. This analysis includes examining past production levels, market behavior, and the overall economic impact on the sector. The objective is to construct a well-rounded picture of the market which supports revenue generation forecasts and growth patterns.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends, challenges, and growth opportunities are developed and validated through consultations with industry experts. These insights gathered through direct interviews and surveys provide a valuable perspective on operational practices, competitive strategies, and the underlying financial structures of key market players.

Step 4: Research Synthesis and Final Output

The culmination of the research process involves synthesizing the gathered data and insights into a coherent final output. Extensive consultations with various stakeholders, including mining companies, government authorities, and industry experts, confirm the accuracy and validity of the data. This comprehensive approach ensures that the analysis reflects current market conditions and anticipates future trends in the South Africa platinum mining market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Key Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Automotive Production

Demand from Renewable Energy Sector - Market Challenges

Regulatory Compliance and Environmental Concerns

Market Volatility - Opportunities

Technological Innovations in Mining - Trends

Increased Recycling of Platinum - Government Regulation

Mining Health and Safety Regulations

Environmental Policies - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value (2019-2024)

- By Volume (2019-2024)

- By Average Price (2019-2024)

- By Mining Method

Underground Mining

– Bord and Pillar Mining

– Hybrid Mining

– Breast Stoping

Placer Mining

– Surface Sand Mining

– Sluicing Techniques

Open-Pit Mining

– Strip Mining

– Quarrying

– Bench Mining - By Ore Grade

High-Grade Ores

Medium-Grade Ores

Low-Grade Ores - By Deposit Type

Primary Deposits

Secondary Deposits

Alluvial Deposits - By Application

Autocatalysts

– Passenger Vehicle Emission Control

– Commercial Vehicle Emission Control

Electricals and Electronics

– Hard Disks

– Thermocouples

– Connectors & Contacts

Fuel Cells

– Proton Exchange Membrane Fuel Cells (PEMFC)

– Solid Oxide Fuel Cells (SOFC)

Glass, Ceramics, and Pigments

– High-Temperature Glass Manufacturing

– Glass Fiber Production

Jewelry

– Rings, Necklaces, and Accessories

– Investment Jewelry (e.g., Bars, Coins)

Medical

– Pacemakers

– Dental Implants

– Surgical Equipment

Chemical Industry

– Catalytic Converters

– Refining and Petrochemical Processes - By End-User Sector

Energy Sector

– Hydrogen Fuel Production

– Renewable Energy Storage

Automotive Sector

– ICE Vehicles (emissions control)

– Hybrid and Hydrogen Vehicles

Electronics Sector

– Circuit Boards

– Sensors

– Displays - By Company Size

Major Firms

SMEs - By Region

Limpopo

North West

Mpumalanga

- Market Share of Major Players on the Basis of Value/Volume

Market Share of Major Players by Type of Mining Method Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Mining Method, Number of Mines, Production Capacity, Unique Value Proposition, Market Penetration Strategies)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players in KSA

- Detailed Profiles of Major Companies

Anglo American Platinum Limited (AMPLATS)

Impala Platinum Holdings Limited

Sibanye-Stillwater

Lonmin Plc

Sedibelo Platinum Mines Ltd (Platinum Limited)

African Rainbow Minerals

Platinum Group Metals Ltd

Eastern Platinum Ltd

Northam Platinum Ltd

Wesiswe Platinum Ltd

Rustenburg Platinum Mines (formerly an Anglo American subsidiary)

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030