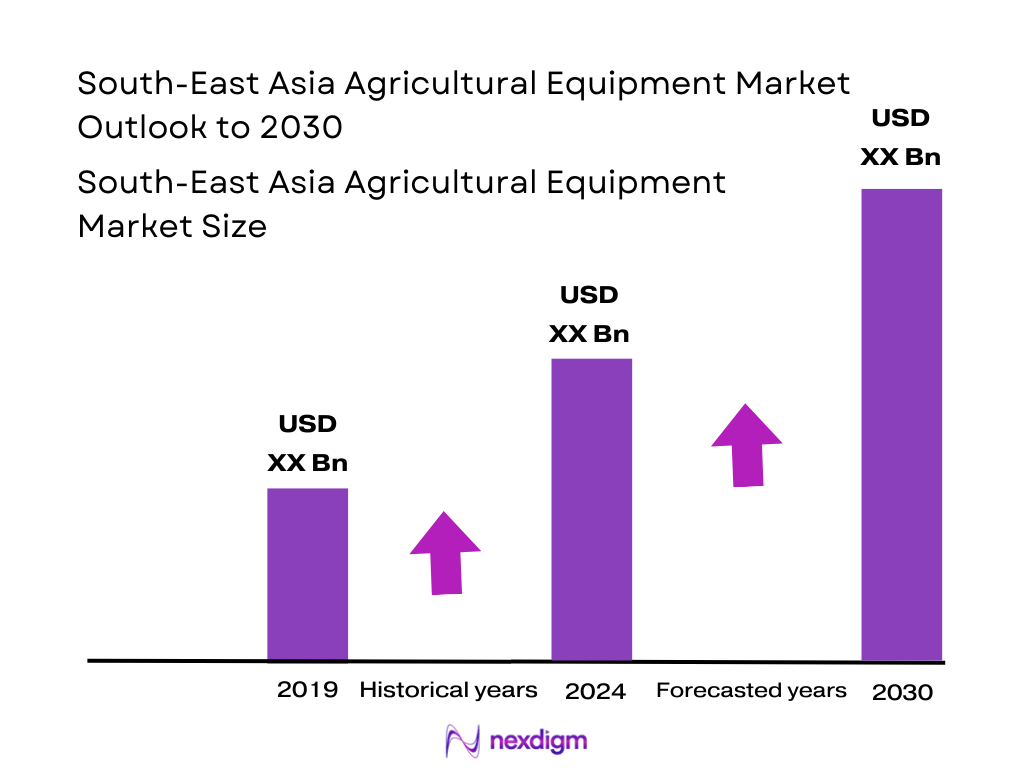

Market Overview

The Southeast Asia agricultural equipment market is valued at USD 6.3 billion, based on recent industry data reflecting the state of the market in 2024, supported by the widespread adoption of precision farming tools and governmental focus on mechanization. This size underscores strong farm-level equipment utilization, driven by farmers modernizing operations, increasing farm labor shortages, and strengthened rural financing mechanisms. Banks and public schemes have enabled equipment acquisition, further bolstering demand across major agricultural economies.

Indonesia and Vietnam lead the regional market due to large cultivable land areas, robust government subsidy schemes, and accelerating equipment demand. Indonesia benefits from expansive rice and plantation farming and proactive mechanization programs. Meanwhile, Vietnam has seen a sharp reduction in traditional animal- and human-powered farming, fostering high tractor adoption—especially for <12 HP machines—boosting equipment utilization and market dominance.

Market Segmentation

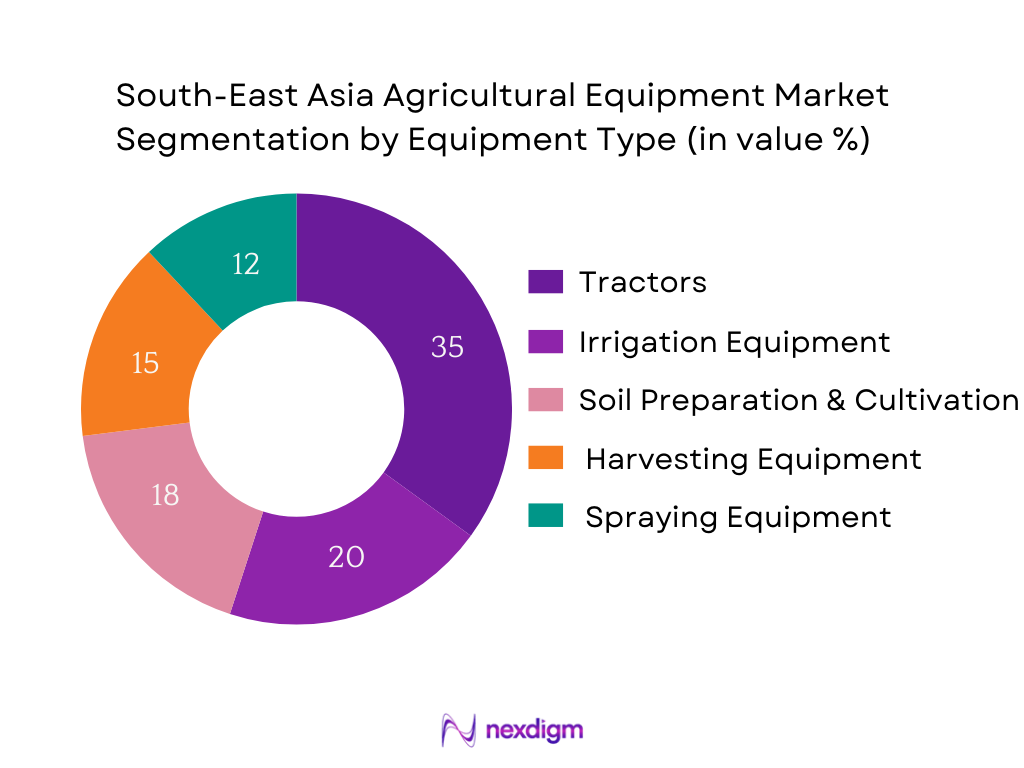

By Equipment Type

This segment includes Tractors, Harvesting Equipment, Irrigation Equipment, Soil Preparation & Cultivation Equipment, and Spraying Equipment. In 2024, Tractors dominate, holding the largest share. Their dominance stems from being versatile tools critical across farm operations. The scarcity of labor favors mechanization, and government subsidies lower acquisition costs, enhancing tractor adoption in smallholder-heavy markets.

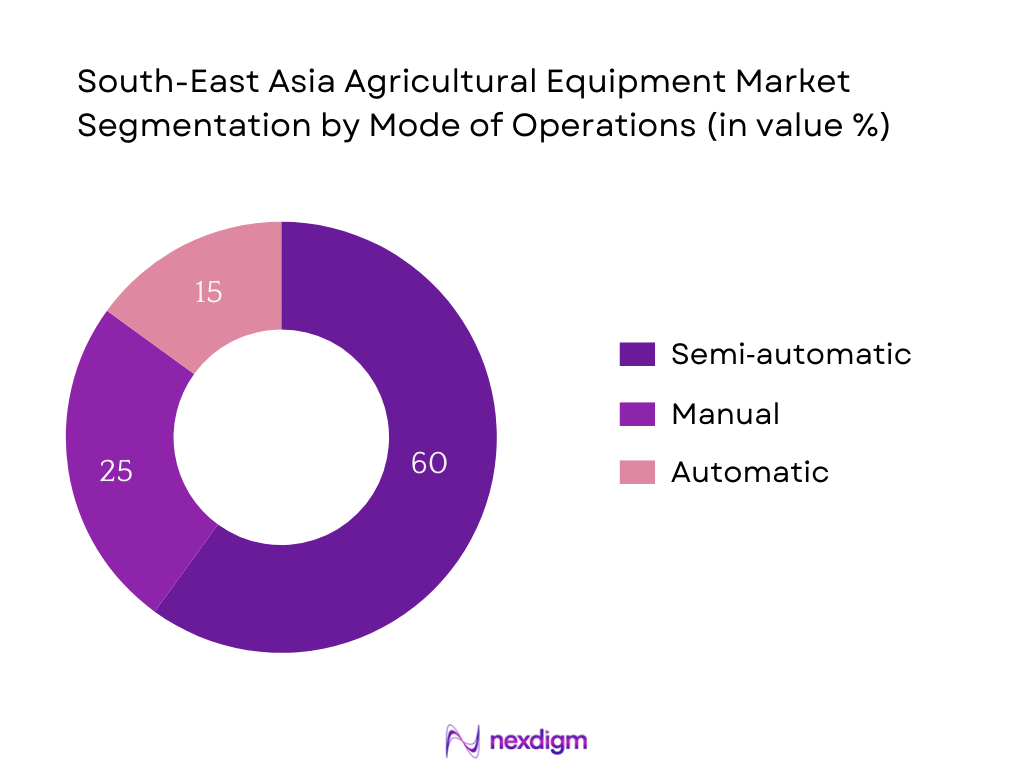

By Mode of Operation

This segment comprises Manual, Semi-automatic, and Automatic equipment. Semi-automatic equipment leads the segment with the highest share in 2024. This prevalence stems from its affordability relative to fully automatic technologies, making it accessible to small- and medium-sized farmers. It balances cost efficiency with operational ease, fitting the region’s mechanization stage.

Competitive Landscape

The Southeast Asia agricultural equipment market is concentrated among a few global and regional OEMs, creating a competitive environment where reliability, product support, and cost determine market positioning. Key players like John Deere, AGCO, CNH Industrial, Kubota, Mahindra Tractors, and JCB continue to dominate by leveraging superior R&D, strong after-sales services, and extensive distribution networks.

| Company Name | Establishment Year | Headquarters | Product Range | Distribution Network | Tech Integration | After‑sales Services | Localization Capability |

| John Deere | – | USA | – | – | – | – | – |

| CNH Industrial | – | UK/Netherlands | – | – | – | – | – |

| AGCO Corporation | – | USA | – | – | – | – | – |

| Kubota Corporation | – | Japan | – | – | – | – | – |

| Mahindra Tractors | – | India | – | – | – | – | – |

South-East Asia Agricultural Equipment Market Analysis

Growth Drivers

Mechanization Rate

In Southeast Asia, public investments in mechanization remain significant. For example, the World Bank funded USD 5.37 billion in agriculture, forestry, and fisheries projects across developing countries in fiscal year 2024, enhancing rural infrastructure and enabling machinery adoption by farmers. Moreover, “agricultural irrigated land” as a share of total agricultural land continues to increase—signaling expanding irrigated infrastructure that supports equipment use and mechanized operations. These investments and land-use improvements directly elevate mechanization by making equipment more viable and cost-effective in farm operations.

Rural Financing Penetration

In the Philippines, the Department of Agriculture’s annual public agricultural expenditure averaged around USD 1 billion per year during 2020–2023, facilitating access to equipment financing and subsidies for smallholder farmers. This budget allocation reflects a tangible extension of rural credit and support mechanisms, enabling farmers to acquire essential machinery. Such government-directed financial flows serve as a proxy for strengthened rural financing infrastructure, underpinning market uptake of agricultural equipment across Southeast Asia.

Opportunities

Smart Irrigation Solutions

Projects like the World Bank’s Climate-Smart Agriculture and Water Management initiative report improved irrigation or drainage services covering a measured area of hectares as of May 2024, underlining expansion of irrigated infrastructure. While precise area figures were reported as zero in the document, the inclusion of this metric in a comprehensive results framework indicates active development of irrigation infrastructure. This measurable investment in irrigation services signals growing readiness for adoption of smart irrigation technologies, supported by underlying policy and infrastructure development.

Future Outlook

Over the next few years, the Southeast Asia agricultural equipment market is poised for robust expansion, supported by rapid technological adoption, rising mechanization, and expanding government support. Digital transformation in agriculture—via GPS systems, automation, and IoT sensors—is accelerating, while sustainable farming practices encourage demand for modern, efficient, and eco‑friendly equipment. These dynamics collectively forecast a dynamic market trajectory.

Major Players

- John Deere

- AGCO Corporation

- CNH Industrial

- Kubota Corporation

- Mahindra & Mahindra (Mahindra Tractors)

- JCB

- CLAAS KGaA mbH

- Iseki & Co., Ltd.

- Amazonen‑Werke H. Dreyer SE & Co. KG

- Agromaster

- APV – Technische Produkte GmbH

- SDF S.p.A.

- Valmont Industries, Inc.

- Deere & Company (John Deere’s formal name)

- Yanmar Co., Ltd.

Key Target Audience

- Large-scale Agricultural Equipment Manufacturers (OEMs)

- Farm Cooperatives & Large Farming Enterprises

- Agricultural Equipment Distributors and Dealers

- Equipment Leasing and Rental Firms

- Agribusiness Investment Funds

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Precision Agri-Tech Solution Providers

Research Methodology

Step 1: Secondary Data Collection

We consolidated data from reputable industry reports for quantifying market size, segmentation, and regional distribution. Government publications and equipment trade bodies supplemented landscape understanding.

Step 2: Market Sizing and Forecast Modeling

Historical units and value data (2023–2024) were modeled using bottom‑up and market trend insights to estimate annual volumes and value flows. Forecasts were derived using CAGR projections from credible sources and extrapolated across segments and countries.

Step 3: Expert Validation

Hypotheses and segmentation assumptions were refined via consultations with industry experts—including OEM representatives, agritech consultants, and country‑level agricultural officials—to confirm regional demand patterns and adoption barriers.

Step 4: Competitive Intelligence and Final Synthesis

Competitor profiling, technology trend mapping, and distribution network analyses were integrated. The final report was validated through triangulation of data points, ensuring fidelity in value, volume, and forecast projections for Southeast Asia agricultural equipment.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Equipment Lifecycle and Replacement Trends

- Farm Mechanization Index by Country

- Agriculture-to-GDP Ratio and Workforce Dependency

- Supply Chain and Value Chain Mapping

- Seasonal Demand Trends and Crop Cycle Impact

- Growth Drivers (Mechanization Rate, Rural Financing Penetration, Farmer Productivity Gap, Precision Agriculture Adoption)

- Market Challenges (Smallholder Land Fragmentation, High Import Dependency, Spare Part Availability, Regional Subsidy Gaps)

- Emerging Opportunities (Electric Farm Equipment, Smart Irrigation Solutions, AI-Based Precision Tools, Equipment-as-a-Service)

- Key Trends (Telematics in Farm Equipment, Drip & Micro-Irrigation, Pay-per-Use Platforms)

- Government Regulations (Farm Mechanization Schemes, Equipment Import Tariffs, Agricultural Subsidy Allocation)

- SWOT Analysis

- Stakeholder Ecosystem (Farmers, OEMs, Cooperatives, Agro-Tech Startups, Financial Institutions)

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Equipment Price, 2019-2024

- By Equipment Type (In Value %)

Tractors

Combine Harvesters

Ploughing and Tilling Equipment

Sowing and Planting Equipment

Irrigation Equipment - By Power Rating (In Value %)

<20 HP

21–40 HP

41–70 HP

Above 70 HP - By Application (In Value %)

Paddy Cultivation

Sugarcane Farming

Horticulture & Plantation

Multi-Crop/Generic Use

Agro-Forestry - By Distribution Channel (In Value %)

Authorized Dealers

Company-Owned Sales Points

Online Marketplaces

Equipment Leasing and Rental Platforms - By Country (In Value %)

Indonesia

Vietnam

Thailand

Philippines

Malaysia

Myanmar

Cambodia

- Market Share by Value and Volume

Market Share by Equipment Type - Cross Comparison Parameters (Company Overview, Product Portfolio (Tractors, Harvesters, Implements, etc.), Manufacturing Capacity in SEA, Localized Customization Capabilities, Dealer and Service Network Density, Technology Integration (Telematics, GPS, IoT), Spare Parts Distribution, Equipment Leasing or Subscription Models)

- SWOT Analysis of Major Players

- Equipment Pricing Benchmarking Across Power Ratings

- Detailed Company Profiles

Kubota Corporation

Mahindra & Mahindra

CNH Industrial (New Holland & Case IH)

Yanmar Co., Ltd.

John Deere (Deere & Company)

TAFE – Tractors and Farm Equipment Ltd.

CLAAS KGaA mbH

Iseki & Co., Ltd.

Sonalika International

SAME Deutz-Fahr Group

Massey Ferguson (AGCO Corp)

Escorts Kubota Limited

LS Mtron

Zoomlion Heavy Industry

Shandong Wuzheng Group

- Farmer Segmentation and Income Groups

- Adoption Readiness by Farm Size

- Equipment Utilization Rates by Crop Type

- Impact of Credit Access and Leasing Models

- Regional Customization Demand

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Equipment Price, 2025-2030