Market Overview

As of 2024, the South Korea auto finance market is valued at USD ~ billion, with a growing CAGR of 10.3% from 2024 to 2030, reflecting a robust growth trajectory influenced by the rising demand for vehicle ownership and favourable credit conditions. Factors such as low-interest rates and tailored financing options have significantly stimulated consumer purchases, encouraging both individual users and businesses to invest in new vehicles. This vibrant market is supported by a strong banking infrastructure and the presence of specialized financing firms dedicated to automotive needs.

In terms of geographical dominance, major cities such as Seoul, Busan, and Incheon are pivotal in the auto finance market due to their dense populations and economic activities. Seoul, as the capital and the largest city, drives a substantial portion of transactions with a vibrant automotive market and a well-developed financial ecosystem. Busan and Incheon, being major urban centers, also contribute to the overall market, fueled by industrial activity and urbanization.

Market Segmentation

By Vehicle Type

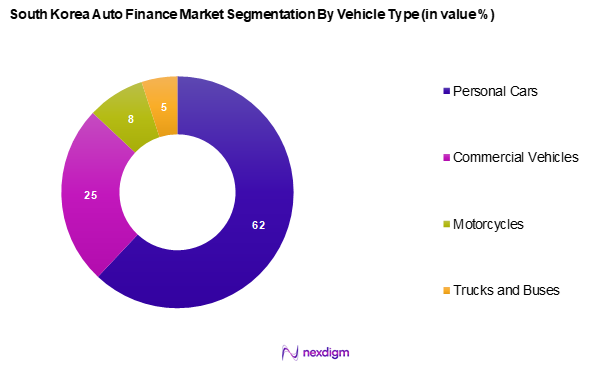

The South Korea auto finance market is segmented into personal cars, commercial vehicles, motorcycles, and trucks and buses. Personal cars dominate this segment, accounting for a significant majority of financing, driven by consumer preference for individual mobility and increased disposable income. The growing urban population and trends towards suburban living propel the demand for personal cars, leading to an increased uptake of auto finance options tailored for these vehicles.

By Financing Type

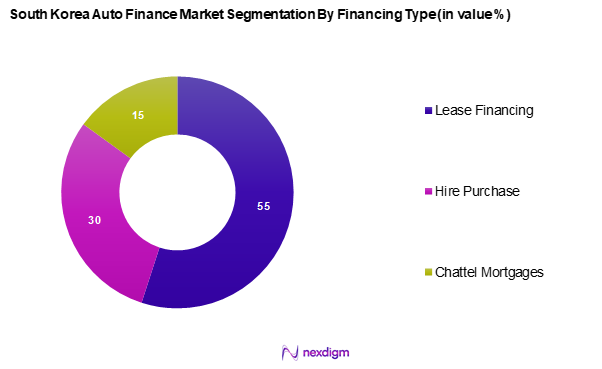

The South Korea auto finance market is segmented into lease financing, hire purchase, and chattel mortgages. Lease financing has emerged as the leading choice among consumers and businesses due to its flexibility and lower upfront payment requirements. As consumers increasingly opt for newer vehicles with the latest technology, leasing provides a cost-effective way to access these options without the burdens of ownership, thus solidifying its dominance in the market.

Competitive Landscape

The South Korea auto finance market is dominated by key players such as KakaoBank Corp., Hyundai Capital, and Woori Bank, among others. These companies hold substantial market positions through their integrated services and strong customer relationships. Their ability to offer competitive interest rates and diverse financing products underscores this segment’s consolidation.

| Company | Establishment Year | Headquarters | Market Focus | Digital Services | Customer Base | Annual Revenue (USD Mn) |

| KakaoBank Corp. | 2016 | Seoul, South Korea | – | – | – | – |

| Hyundai Capital | 1993 | Seoul, South Korea | – | – | – | – |

| Woori Bank | 1899 | Seoul, South Korea | – | – | – | – |

| SHINHAN Bank | 1982 | Seoul, South Korea | – | – | – | – |

| Toyota Financial Services | 1982 | Nagoya, Japan | – | – | – | – |

South Korea Auto Finance Market Analysis

Growth Drivers

Dominance of Passenger Vehicle Sales

The dominance of passenger vehicle sales in South Korea has become a significant growth driver for the auto finance market. In 2023, passenger vehicle sales reached approximately 1.5 million units, showcasing a 3% increase compared to the previous year due to an expansion in urban infrastructure and consumer preference for personal mobility. With a strong automotive industry supported by local manufacturers, the appetite for financing options tailored to individual consumers has surged. Furthermore, the growing trend of dual-income households enhances disposable income levels, resulting in higher demand for auto loans. This backdrop contributes to the heating up of the auto finance sector in South Korea.

Rapid Digitalization in Banking Services

The swift digital transformation of South Korea’s banking sector has emerged as a key enabler of growth in the auto finance market. Financial institutions are increasingly leveraging mobile apps and online platforms to streamline loan approvals, payment schedules, and customer service. This shift toward digital channels has made auto financing more accessible and user-friendly, especially for tech-savvy consumers. The growing use of digital wallets and mobile payment solutions also contributes to this trend, making financial transactions smoother and more integrated into consumers’ digital lifestyles.

Market Challenges

Regulatory Compliance and Lending Standards

Stricter lending regulations and compliance requirements have created hurdles for the auto finance market. As part of broader financial reforms, authorities are intensifying scrutiny over credit issuance to safeguard against excessive household debt. This regulatory tightening affects both the structure and speed of auto loan disbursements, making it more complex for financial institutions to issue loans efficiently. The evolving policy environment adds to the operational burden for lenders and can lead to delays in approvals and disbursements, ultimately impacting consumer experience.

Rising Interest Rates Impacting Loan Demand

Higher interest rates are exerting downward pressure on loan demand across the auto finance sector. As borrowing costs rise, consumers are becoming more cautious about taking on new financial commitments, particularly for big-ticket purchases like vehicles. This shift in consumer behaviour is prompting potential buyers to either delay or reconsider financing options, which in turn slows market momentum. The impact is especially pronounced among first-time buyers and younger demographics who are more sensitive to changes in monthly repayment obligations.

Opportunities

Emerging Electric Vehicle (EV) Market

The rapid expansion of the electric vehicle market presents a compelling opportunity for growth within the auto finance space. With strong government backing for eco-friendly mobility and a rising environmental consciousness among consumers, demand for EVs is on the rise. Financial institutions are actively responding by introducing dedicated loan products and leasing plans tailored to the EV segment. These specialized offerings not only promote green mobility but also position lenders to capitalize on an increasingly important and expanding market segment.

Innovative Financing Solutions

The evolution of non-traditional financing models is reshaping how South Korean consumers access vehicle ownership. Subscription-based models, car-sharing schemes, and peer-to-peer financing platforms are becoming increasingly popular, particularly among younger consumers who prioritize flexibility and convenience. These alternative methods offer a more adaptive approach to vehicle usage, diverging from conventional ownership and loan structures. As consumer preferences evolve, lenders that embrace innovative financing strategies stand to gain a competitive edge in a dynamic market.

Future Outlook

Over the next five years, the South Korea auto finance market is expected to demonstrate significant growth driven by ongoing urbanization, technological advancements in the automotive sector, and increasing consumer adoption of financing solutions. The trend towards electric vehicles and sustainable mobility methods will also create new opportunities for auto finance providers as they adapt their offerings to meet evolving consumer preferences and regulatory frameworks.

Major Players

- KakaoBank Corp.

- Hyundai Capital

- Woori Bank

- SHINHAN Bank

- Toyota Financial Services

- BMW Group Financial Services Korea

- Mobilize Financial Services

- Renault Finance

- RCI Financial Services

- Truist

- City Bank PLC

- Hana Capital

- Hyundai Capital Services, Inc.

- Others

- NBFCs

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (Financial Services Commission, Bank of Korea)

- Automotive manufacturers

- Commercial vehicle dealerships

- Individual consumers

- Business fleets

- Financial analysts and market strategists

- Auto finance service providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the South Korea auto finance market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the South Korea auto finance market. This includes assessing market penetration, the ratio of financing avenues to actual vehicle sales, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies in the auto finance sector. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple auto finance companies and automotive manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the South Korea auto finance market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Dominance of Passenger Vehicle Sales

Rapid Digitalization in Banking Services - Market Challenges

Regulatory Compliance and Lending Standards

Rising Interest Rates Impacting Loan Demand - Opportunities

Emerging Electric Vehicle (EV) Market

Innovative Financing Solutions - Trends

Growth of Online Auto Financing Platforms

Rising Popularity of Used Vehicle Financing - Government Regulation

Financial Services Commission (FSC)

Regulations on Interest Rates and Lending Practices - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Interest Rate, 2019-2024

- By Vehicle Type, (In Value %)

Personal Cars

Commercial Vehicles

Motorcycles

Trucks and Buses - By Financing Type, (In Value %)

Lease Financing

Hire Purchase

Chattel Mortgages - By Customer Type, (In Value %)

Individual Consumers

Businesses/Corporate Entities

Governmental Entities - By City, (In Value %)

Seoul

Busan

Incheon

Daegu

Gwangju

Others - By Duration of Finance, (In Value %)

Short-term (1-4 years)

Medium-term (5-7 years)

Long-term (8+ years) - By Loan Provider, (In Value %)

Banks

Captives

Credit Unions

NBFCs

Others - By Purpose, (In Value %)

Loan

Leasing - By Vehicle Age, (In Value %)

New Vehicles

Used Vehicles

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Vehicle Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenue by Vehicle Type, Number of Branches/Offices, Distribution Channels)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

KakaoBank Corp.

Hyundai Capital

Hana Capital

Woori Bank

SHINHAN Bank (Vietnam) Ltd

BMW Group Financial Services Korea

Hyundai Capital Services, Inc.

Mobilize Financial Services

Toyota Financial Services

Renault Finance

RCI Financial Services

Truist

City Bank PLC

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Interest Rate, 2025-2030