Market Overview

As of 2024, the South Korea car rental and leasing market is valued at USD ~ million, with a growing CAGR of 1.4% from 2024 to 2030. This substantial market size is largely driven by the increasing urbanization trends, changing consumer preferences towards mobility solutions, and the rise in tourism, where travelers prefer rental services for city exploration. The post-COVID recovery in tourism has considerably boosted the demand for short-term rentals, further expanding the market.

In South Korea, cities like Seoul, Busan, and Incheon dominate the car rental market due to their high population density, urbanization rates, and traffic dynamics. These cities feature extensive public transport systems that complement rental services, offering convenience to both locals and tourists. Additionally, prominent business hubs in these cities attract corporate clients seeking rental solutions for their employees, enhancing their market appeal.

Market Segmentation

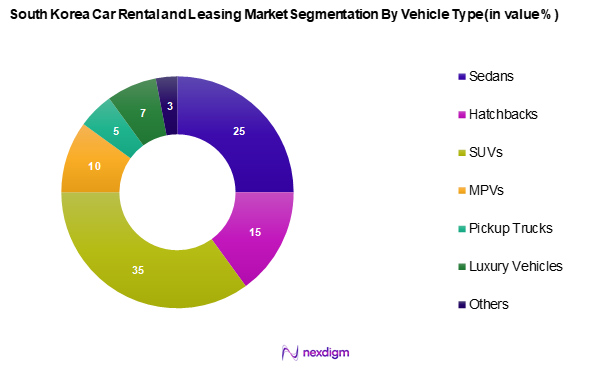

By Vehicle Type

The South Korea car rental market is segmented into sedans, hatchbacks, SUVs, MPVs, pickup trucks, luxury vehicles, and others. Among these, the SUV segment is currently dominating the market share due to consumer preference for spaciousness and versatility. South Koreans increasingly favor SUVs for both personal and business travel, appreciating their larger cargo space and robust performance. The rise of adventure tourism and outdoor activities has also fueled the demand for SUVs, making them a preferred choice among renters.

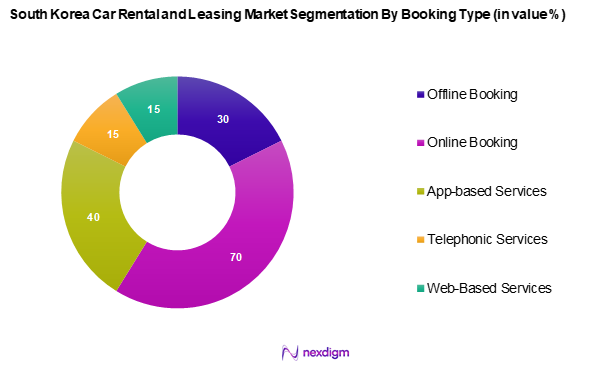

By Booking Type

The South Korea car rental market is segmented into offline booking and online booking, which includes app-based, telephonic, and web-based services. Online booking is witnessing a dominant market share as it offers convenience and accessibility to consumers. The proliferation of smartphone usage and digital platforms like dedicated rental apps has made online booking the preferred choice for many users. The ease of comparing prices and instant booking confirmations has also contributed significantly to the growth of this segment.

Competitive Landscape

The South Korea car rental market is dominated by several key players, reflecting a competitive landscape that includes local enterprises and international companies. This consolidation underscores the significance of these companies in influencing market trends and shaping consumer preferences. Major players facilitating growth within the sector include AJ Networks, Avis Budget Group, and Enterprise Holdings.

| Company | Establishment Year | Headquarters | Market Focus | Fleet Size | Revenue (2024 est.) | Distribution Channels |

| AJ Networks Co., Ltd. | 2000 | Seoul, South Korea | – | – | – | – |

| Avis Budget Group, Inc. | 1946 | New Jersey, USA | – | – | – | – |

| Enterprise Holdings, Inc. | 1947 | St. Louis, USA | – | – | – | – |

| SK Networks Co. Ltd. | 1953 | Seoul, South Korea | – | – | – | – |

| Lotte Corporation | 1966 | Seoul, South Korea | – | – | – | – |

South Korea Car Rental and Leasing Market Analysis

Growth Drivers

Increasing Urbanization

As of 2024, urbanization in South Korea is at approximately 82.1%, reflecting a continuous trend of migration towards metropolitan areas. This rapid urban growth is critical as a significant percentage of the population resides in cities like Seoul and Busan, leading to increased demand for flexible transportation solutions. Urban lifestyle changes require more adaptable mobility options, and rental services have become an ideal choice for both locals and visitors. The influx of people into urban areas has caused a bustling rental market to evolve, with extensive transport networks making car rentals a convenient option.

Rise in Tourism

Tourism in South Korea has shown remarkable growth, with over 3.1 million international tourists recorded in 2022. The Budget Travelers Insight report predicts that tourist arrivals will continue to rise in 2024, reflecting South Korea’s burgeoning appeal as a travel destination. Major events, festivals, and cultural offerings attract global tourists who prefer renting vehicles for ease of travel across cities. With government initiatives aimed at promoting diverse tourism experiences, the demand for car rentals among tourists is soaring, further supporting this growth trajectory.

Market Challenges

Regulatory Constraints

Regulatory challenges remain a significant concern in the South Korean car rental market. As of 2024, local governments have imposed varied regulations affecting rental services, from licensing requirements to insurance mandates. For instance, the Ministry of Land, Infrastructure and Transport has specified rules governing vehicle emissions, requiring compliance from operators to reduce air pollution. Adhering to these regulations can be difficult for smaller operators, potentially leading to increased operational costs and limiting market entry for new competitors, thus impacting the overall market landscape.

Seasonal Demand Variations

The market experiences noticeable seasonal shifts, with demand peaking during specific months aligned with tourism and holidays, and tapering off during off-peak seasons. These fluctuations present challenges in managing fleet availability, pricing, and operational efficiency.

Opportunities

Expansion of Digital Platforms

The ongoing digital transformation presents significant opportunities for the South Korean car rental market. In 2023, digital bookings accounted for approximately 70% of all reservations, with increasing smartphone penetration reaching 97% among the urban population. As consumers prioritize convenience and efficiency, the demand for user-friendly apps and online platforms to book rentals is surging. Companies that innovate their digital interfaces and leverage data analytics to enhance customer experience can tap into this growing trend, expanding their market presence and catering to a tech-savvy clientele that prioritizes quick access and seamless transactions.

Introduction of Flexible Leasing Options

Changing consumer preferences, especially among younger generations and urban professionals, are driving interest in subscription-based and short-term leasing models. These options offer the convenience of access without the burdens of ownership, catering to a growing population seeking adaptable transportation solutions. Flexible leasing not only appeals to domestic users but also to expatriates and business travelers. Companies that incorporate environmentally conscious vehicle options and transparent pricing structures into these models can tap into both economic and sustainability trends, unlocking long-term growth potential.

Future Outlook

Over the next few years, the South Korea car rental and leasing market is expected to continue its growth trajectory driven by several factors. These include increasing digitalization in booking services, the expansion of flexible rental options, and the growing trend towards car subscriptions instead of traditional ownership. Urban mobility solutions will likely evolve further, accommodating the changing needs of consumers, particularly in metropolitan areas.

Major Players

- AJ Networks Co., Ltd.

- Avis Budget Group, Inc.

- Booking Holdings Inc.

- Enterprise Holdings, Inc.

- Hertz

- Lotte Corporation

- SK Networks Co. Ltd.

- Uber Technologies Inc.

- Vacaciones eDreams S.L.U.

- Sixt

- GOGOOUT CO., LTD

- Hi Rent

- SK Rent-a-Car

- Euro Rental Car

- Others

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Land, Infrastructure and Transport)

- Corporate Fleets and Business Enterprises

- Travel Agencies and Tour Operators

- Automotive Manufacturers and Distributors

- Logistics and Transportation Companies

- Tourism Boards and Associations

- Car Rental Service Providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the South Korea car rental and leasing market. This step utilizes a combination of secondary and proprietary databases to gather comprehensive industry-level information. The objective is to identify and define the critical variables that influence market dynamics and segment classification.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the South Korea car rental and leasing market is compiled and analyzed. This includes evaluating market penetration rates, the balance between service providers, and resultant revenue generation. A scrutiny of service quality statistics is conducted to ensure the reliability and accuracy of revenue estimates, facilitating comprehensive insights.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through expert consultations conducted via Computer-Assisted Telephone Interviews (CATIs) with industry leaders and stakeholders. Gathering insights directly from key operators provides valuable operational and financial perspectives essential for refining and corroborating the data.

Step 4: Research Synthesis and Final Output

The final phase entails engaging with various car rental companies for detailed insights into their product offerings, market strategies, and consumer preferences. This interaction is crucial for corroborating the collected data and ensuring a comprehensive and validated analysis of the South Korea car rental and leasing market, resulting in an accurate synthesized report.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Urbanization

Rise in Tourism - Market Challenges

Regulatory Constraints

Seasonal Demand Variations - Opportunities

Expansion of Digital Platforms

Introduction of Flexible Leasing Options - Trends

Growth of Car Subscription Services

Emphasis on Green Fleet Options - Government Regulation

Vehicle Emission Standards

Safety Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Daily Rental Rate, 2019-2024

- By Vehicle Type, (In Value %)

Sedans

Hatchback

SUVs

MPVs

Pickup Trucks

Luxury Vehicles

Others - By Rental Duration, (In Value %)

1 Year

2 Year

3 Year

4 Years & Above - By End-user Type, (In Value %)

Individual Consumers

Corporate Clients

Oil and Gas

Government militaries & ministries

Construction

Logistics and Transportation

Others - By Fuel Type, (In Value %)

Petrol

Diesel

Electric

CNG - By Booking Type, (In Value %)

Offline Booking

Online Booking - By Services Type, (In Value %)

Airport Transfers

Interstate Services

Intrastate Services - By Rental Type, (In Value %)

Business Rental

Chauffeur Drive

Self-Driving

Special Events - By Market Structure, (In Value %)

Organized

Unorganized

- Market Share of Major Players by Value/Volume, 2024

Market Share of Major Players by Type of Vehicle Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Revenue, Distribution Channels, Number of Locations, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

AJ Networks Co., Ltd.

Avis Budget Group, Inc.

Booking Holdings Inc.

Enterprise Holdings, Inc.

Hertz

Lotte Corporation

SK Networks Co. Ltd.

Uber Technologies Inc.,

Vacaciones eDreams S.L.U.

Sixt

GOGOOUT CO., LTD

Hi Rent

SK Rent-a-Car.

Euro Rental Car

Others

- Market Demand and Utilization Rate

- Purchasing Power and Behavioural Insights

- Regulatory Compliance and Customer Preferences

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Daily Rental Rate, 2025-2030