Market Overview

Spain’s agrivoltaics market is still emerging, and open-access sources rarely publish a Spain-only revenue figure; most commercial trackers disclose Europe-level agrivoltaics revenue instead. Using the latest disclosed benchmark, the Europe agrivoltaic market is valued at USD ~ million and is projected to expand rapidly. Spain’s demand-side pull is reinforced by solar scale-up: grid-connected solar PV installed capacity increased, strengthening developer appetite to de-risk land access via dual-use models.

Dominant Spanish regions for agrivoltaics deployment are shaped by utility-scale PV maturity + high-value agriculture. The strongest concentration of viable sites sits across Andalucía, Castilla-La Mancha, Extremadura, Aragón, Murcia, and Cataluña, where irradiance, land parcels, and agro-output (vineyards, olives, stone fruit, horticulture, grazing) align with grid buildout and developer origination. Policy execution is also becoming clearer: Spain has earmarked EUR ~ million for agrivoltaics incentives under national programming, supporting pilot-to-portfolio conversion where agriculture remains the “primary use.”

Market Segmentation

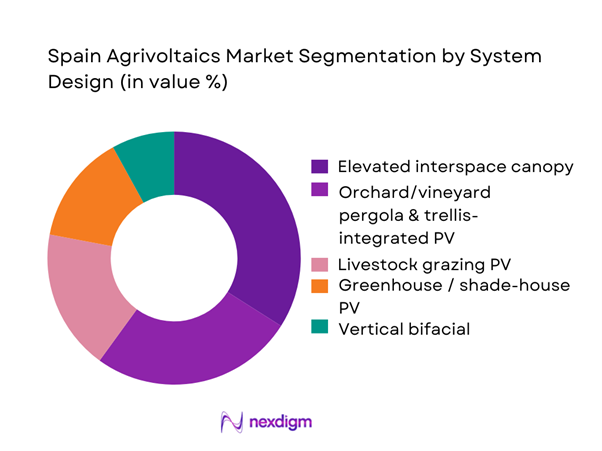

By System Design

Elevated interspace canopy leads because it best fits Spain’s permitting reality: projects can demonstrate continued agricultural operations (machinery access, crop plans, labor schedules) while also meeting energy yield targets. It is also the most “bankable” engineering template for developers and EPCs—standard racking, known O&M routines, and predictable performance. In Spain, where utility-scale PV pipelines are already deep, this design is the easiest to replicate across provinces and crop types, and it adapts well to irrigation layouts and farm-road logistics.

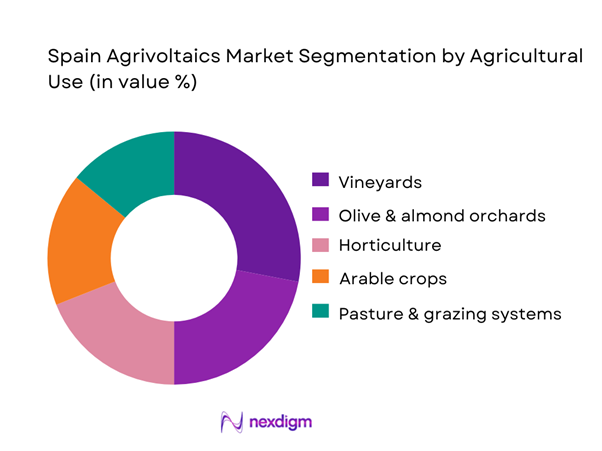

By Agricultural Use

Vineyards dominate because Spain has dense viticulture clusters that gain direct agronomic value from partial shading (heat-stress buffering, hail/UV mitigation, reduced evapotranspiration pressure in hot spells). Vineyard economics also tolerate added infrastructure if it stabilizes yield and quality. In parallel, vineyard plots often have clearer parcel boundaries and farm management sophistication, making it easier to implement measurable “agriculture-first” KPIs demanded by regulators and lenders. The segment also benefits from strong cooperative networks that can aggregate land and standardize operating protocols across multiple sites.

Competitive Landscape

Spain’s agrivoltaics landscape is led by a mix of integrated utilities, IPP/developer platforms, and solar specialists expanding into agriculture-compatible designs. The market remains relatively consolidated at the top of the funnel because success depends on land origination, grid access, permitting execution, and the ability to operationalize agriculture as a primary activity (documentation, farming partners, audit trails), not just build PV.

| Company | Est. year | HQ | Spain agrivoltaics approach | Land strategy | Grid / interconnection strength | Offtake pathway | Delivery model | Agri-coactivity governance |

| Iberdrola | 1901 | Bilbao, Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| Acciona Energía | 1997 | Madrid, Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| Endesa (Enel) | 1944 | Madrid, Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| Naturgy | 1843 | Barcelona, Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| Solaria | 2002 | Madrid, Spain | ~ | ~ | ~ | ~ | ~ | ~ |

Spain Agrivoltaics Market Analysis

Growth Drivers

Grid-scale PV momentum

Spain’s agrivoltaics pipeline is being pulled forward by the sheer momentum of utility-scale solar PV already embedded in the national generation mix, which accelerates developer learning curves (permitting, EPC standardization, grid compliance) that can be reused for dual-use designs. Solar PV output reached ~ GWh—its highest annual production on record—showing that operational PV fleets are now large enough to justify systematic “co-activity” retrofits and agronomic add-ons rather than one-off pilots. At the macro level, Spain’s economy (GDP USD ~ million; GDP per capita USD ~) supports capital formation and bank-led project finance capacity that tends to spill into renewables and land-linked infrastructure. This scale effect matters for agrivoltaics because it shortens the time to standardize mounting heights, row spacing, tracker logic, and O&M routines compatible with machinery access and crop calendars—especially in regions already saturated with PV EPC capability and substation familiarity. The more PV is deployed and dispatched, the more grid operators and DSOs/TSOs refine curtailment rules and forecasting practices; agrivoltaics benefits by “inheriting” a maturing operational playbook while differentiating itself on land acceptance and farm economics.

Land-use conflict mitigation

Agrivoltaics in Spain is increasingly positioned as a land governance tool to reduce conflict between energy rollout and food production, especially where productive land is politically sensitive and where “single-use” PV faces stronger scrutiny. The land context is not abstract: Spain’s irrigated agriculture footprint is ~ hectares (and ~ hectares the prior year), demonstrating how much of the country’s high-value cropping depends on managed water and intensification—exactly the landscapes where social and regulatory resistance can rise if PV is perceived to displace production. In parallel, Spain’s macro baseline (GDP USD ~ million; GDP per capita USD ~) supports both the energy transition and a politically salient agrifood economy, making “dual-use validation” a pragmatic permitting argument rather than a CSR narrative. In market terms, agrivoltaics reframes the siting conversation: instead of competing with agriculture, projects are structured to preserve ongoing cultivation, formalize monitoring, and protect farm operations (access corridors, turning radii, seasonal work windows). This reduces opposition risk by converting a land-use trade-off into a land-use efficiency proposition with measurable agricultural continuity requirements tied to project eligibility in certain jurisdictions.

Challenges

Prime farmland scrutiny

Agrivoltaics in Spain faces elevated scrutiny when proposed on prime or irrigated agricultural land, because regulators and communities must balance decarbonization goals against food-system outputs and rural livelihoods. The scale of irrigated agriculture—~ hectares (following ~ hectares)—signals that a meaningful share of high-intensity production is directly exposed to land-use decisions. In practice, scrutiny tightens around irrigation districts, specialty cropping areas, and landscapes with established agrifood value chains, where even perceived displacement triggers opposition. This is not merely a narrative issue: water-stressed years have recently coincided with changes in irrigated area (e.g., the shift from ~ hectares to ~ hectares), reinforcing political sensitivity about maintaining production capacity under drought pressure. Spain’s macro context adds weight: GDP USD ~ million implies a large, diversified economy, but the agrifood sector remains socially and regionally vital—so land conversion debates are high-stakes at provincial and municipal levels. For developers, this scrutiny translates into real friction: stricter environmental assessment expectations, higher documentation loads for agronomic continuity, and more intensive stakeholder management.

Qualification ambiguity

A key Spanish challenge is that agrivoltaics often lacks uniform national “qualification” rules, pushing projects into a patchwork where acceptance thresholds and definitions vary by region and by permitting authority. This ambiguity shows up in practical eligibility criteria: for example, technical guidance in Catalonia states that agricultural activity must be maintained and that post-construction crop yield across the project area must remain at least ~ of total yield—an explicit numeric requirement that directly influences design (panel height, spacing, shading profile) and agronomic plan selection. Such thresholds create uncertainty for developers operating across Spain because what qualifies as “true agrivoltaics” can change depending on the jurisdiction, the crop type, and the interpretation of “primary use” of land. Market impact is immediate: lenders and insurers tend to require clarity on whether a project will be treated like standard PV or like a specialized dual-use asset with performance obligations. Spain’s macro baseline (GDP USD ~ million, GDP per capita USD ~) supports sophisticated financing, but financeability still depends on regulatory clarity and enforceability.

Opportunities

Standardized crop-specific templates

Spain’s strongest near-term opportunity is to standardize agrivoltaic design templates by crop system and region, using Spain’s highly concentrated permanent-crop landscapes to create repeatable “agronomy + PV” packages. The olive sector is an anchor example: official agriculture information describes national olive coverage of ~ hectares, with ~ hectares concentrated in Andalucía—exactly the type of scale and geographic clustering that supports template replication (fixed-tilt vs tracker, canopy height for machinery clearance, pruning and harvest windows, soil compaction rules, irrigation line routing). Standardization benefits lenders and permitting authorities because it replaces bespoke engineering with proven configurations and monitoring plans. The irrigation base also reinforces template economics: Spain’s irrigated area of ~ hectares indicates a large pool of intensive farms where water management, labor scheduling, and mechanization constraints are well-defined—ideal for codifying “do’s and don’ts” for agrivoltaic layouts. From a macro lens, Spain’s GDP (USD ~ million) supports industrial-scale EPC capability and equipment supply chains that can deliver standardized systems at volume, while GDP per capita (USD ~) signals purchasing power and institutional depth to fund measurement-driven pilots that mature into templates.

Retrofit conversion of existing PV assets

A major market opportunity in Spain is to retrofit existing PV assets—or reconfigure adjacent land operations—toward agrivoltaic co-activity, leveraging the country’s already-massive PV operational base. Spain’s solar PV fleet delivered ~ GWh of generation in a single year, demonstrating that the installed base is mature enough for secondary optimization strategies beyond pure capacity additions. In parallel, the system operator reported record-scale PV commissioning in the recent buildout cycle, which implies a large cohort of projects with established grid connection, land control, and O&M routines—assets that can be upgraded with agronomic features, grazing integration, or crop-compatible spacing adjustments where feasible. The retrofit logic is commercially attractive in Spain because it partially sidesteps the hardest constraint for new agrivoltaics: grid interconnection. Where connection is already secured, developers can focus on land acceptance, biodiversity management, and agricultural co-use as value upgrades rather than starting from zero. Macro conditions support this: Spain’s GDP (USD ~ million) signals the financing depth and asset management sophistication to pursue “brownfield optimization” strategies, while GDP per capita (USD ~) correlates with institutional investor interest in operational renewable assets.

Future Outlook

Over the next planning cycle, Spain’s agrivoltaics market should shift from pilot-heavy activity into repeatable deployment, driven by tighter land-use scrutiny for ground-mounted PV, the need to de-risk permitting via agriculture continuity, and incentive frameworks supporting dual-use. Spain also has material runway for dual-use simply because agricultural land is extensive—Spain is reported to have ~ million hectares dedicated to agriculture and livestock, with ~ million hectares for cultivation—creating a large theoretical siting canvas where “agriculture-first” compliance is demonstrable.

Major Players

- Iberdrola

- Acciona Energía

- Endesa

- Naturgy

- Solaria

- Repsol Renovables

- Statkraft

- TotalEnergies

- RWE Renewables

- EDF Renewables

- Engie

- Grenergy

- Lightsource bp

- BayWa r.e.

Key Target Audience

- Utility & IPP Strategy Teams

- Renewable Project Developers & Land Origination Heads

- Solar EPC & Civil Contractors

- Agribusiness Cooperatives & Producer Organizations

- Corporate PPA Buyers

- Insurance & Risk Underwriters

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

We build a Spain agrivoltaics ecosystem map covering utilities, IPPs, EPCs, racking suppliers, farmers/cooperatives, and permitting bodies. We define variables such as system design eligibility, “agriculture-first” compliance rules, grid access lead times, and land contracting norms using structured secondary research and policy scanning.

Step 2: Market Analysis and Construction

We compile historical project activity (announced, permitted, grid-secured, under construction) and map it against Spain’s solar buildout trajectory and interconnection signals. Grid-reported renewable growth and PV installed base are used as boundary conditions to size realistic agrivoltaics adoption capacity and delivery throughput.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses via CATIs with developers, EPC heads, land agents, cooperatives, and legal/permitting specialists. Interviews focus on contract structures, agronomic monitoring requirements, bankability screens, and the documentation needed to evidence primary agricultural activity in dual-use sites.

Step 4: Research Synthesis and Final Output

We triangulate findings with incentive design and public program signals (including earmarked agrivoltaics support), then finalize sizing, segmentation, and competitive benchmarking. Outputs are stress-tested via internal review for consistency across permitting, grid feasibility, and agriculture operating models.

- Executive Summary

- Research Methodology (Market definitions and agrivoltaics qualification logic, scope boundary between Agri-PV vs ground-mount PV, assumptions and exclusions, primary interview architecture with farmers cooperatives DSOs EPCs insurers, GIS siting and land-class screening approach, project pipeline build method, regulatory triangulation national–regional, agronomic performance benchmarking framework, energy-yield modeling approach, interconnection queue mapping method, data validation and limitations)

- Definition and Scope

- Market Genesis and Adoption Narrative

- Business Cycle and Project Maturity Curve

- Spain Energy–Agriculture Convergence Context

- Stakeholder Universe Snapshot

- Growth Drivers

Grid-scale PV momentum

Land-use conflict mitigation

Farm-income stabilization logic

Policy-linked pilot programs

Water-energy coupling - Challenges

Prime farmland scrutiny

Qualification ambiguity

Grid interconnection queues

Appeals and litigation exposure

Agronomic underperformance risk - Opportunities

Standardized crop-specific templates

Retrofit conversion of existing PV assets

Irrigation community partnerships

Storage-coupled flexibility models - Trends

High-clearance structures adoption

Vertical bifacial deployment

Sensor-driven agronomy integration

Hybridization with energy storage - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Installed Capacity, 2019-2024

- By Project Count, 2019-2024

- By Land Under Dual-Use, 2019-2024

- By Energy Output, 2019-2024

- By Storage Attachment, 2019-2024

- By Fleet Type (in Value %)

Elevated canopy systems

Single-axis tracker with agronomic spacing

Vertical bifacial systems

Greenhouse and protected cultivation PV

Orchard and vineyard adapted structures - By Application (in Value %)

Vineyards and trellised crops

Olive groves and orchards

Horticulture and specialty crops

Cereals and dryland rotations

Grazing and pasture - By Technology Architecture (in Value %)

Irrigated farmland integration

Rainfed farmland integration

Irrigation community linked designs

On-farm reservoirs and canal-side dual use

Desalination and lift-irrigation adjacency - By Connectivity Type (in Value %)

Micro on-farm systems

Small utility-connected projects

Mid-scale clustered portfolios

Large utility-scale dual-use parks

Hybrid PV plus storage parks - By End-Use Industry (in Value %)

Merchant exposure projects

Corporate PPA projects

Utility PPA projects

Self-consumption and collective self-consumption

Energy communities and cooperative-led models - By Region (in Value %)

Andalucía

Castilla-La Mancha

Extremadura

Aragón

Cataluña

- Market Share Mapping

Go-to-Market Archetypes - Cross Comparison Parameters (Agronomic co-activity model and crop-yield retention governance, structure typology and mechanization compatibility, CAP eligibility compliance pathway, land origination strength and tenure structures, permitting execution capability, grid access readiness, monitoring stack integration, O&M delivery model)

- SWOT of Major Players

- Partnership and Ecosystem Mapping

- Detailed Company Profiles

Iberdrola

Acciona Energía

Endesa

Naturgy

Repsol Renovables

Solaria

Grenergy Renovables

Solarpack

X-ELIO

Q ENERGY

Statkraft Spain

BayWa r.e. Spain

Lightsource bp Spain

TotalEnergies Renewables Spain

- Farmers and Landowners

- Agri-Cooperatives and Irrigation Communities

- Utilities IPPs and Developers

- Corporate Offtakers

- Municipalities and Energy Communities

- By Installed Capacity, 2025–2030

- By Project Count, 2025–2030

- By Land Under Dual-Use, 2025–2030

- By Energy Output, 2025–2030

- By Storage Attachment, 2025–2030