Market Overview

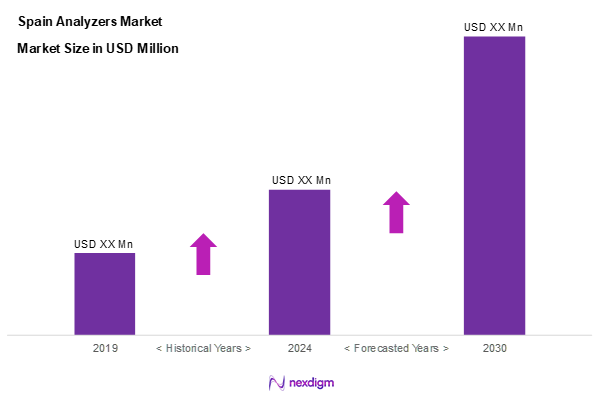

As of 2024, the Spain analyzers market is valued at USD 571.3 million, with a growing CAGR of 5.7% from 2024 to 2030. This robust growth is predominantly driven by the rising demand for laboratory and industrial analyzers due to stringent regulatory standards in healthcare and environmental sectors. Technological advancements and increased investment in R&D further propel market expansion, alongside the growing focus on quality control in various industries.

The major cities dominating the analyzers market in Spain include Madrid, Barcelona, and Valencia. Madrid serves as the political and economic centre, fostering a strong healthcare and industrial sector, while Barcelona is known for its expansive pharmaceutical industry. Valencia contributes significantly as a hub for agricultural and food-related analysis, ensuring the effective implementation of analyzers across multiple applications.

Market Segmentation

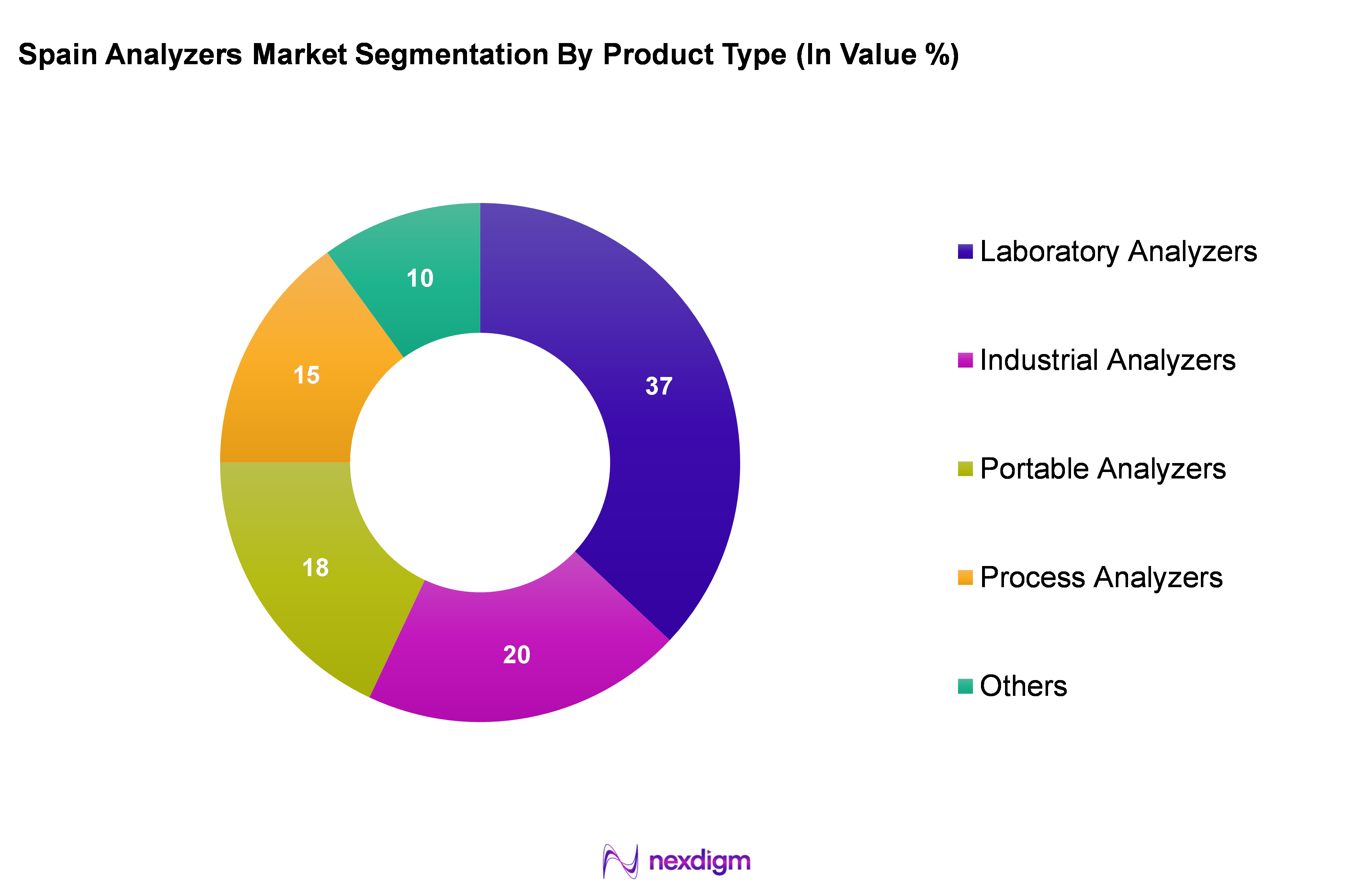

By Product Type

The Spain analyzers market is segmented into laboratory analyzers, industrial analyzers, portable analyzers, process analyzers, and others. Laboratory analyzers have a prominent share in the market due to the increasing number of diagnostics tests and research initiatives in healthcare. The demand for precision and reliability in laboratory settings drives manufacturers to innovate continuously, maintaining a competitive edge. Reputable brands are investing significantly in research and collaborations to further enhance their product offerings, solidifying their position in this sub-segment.

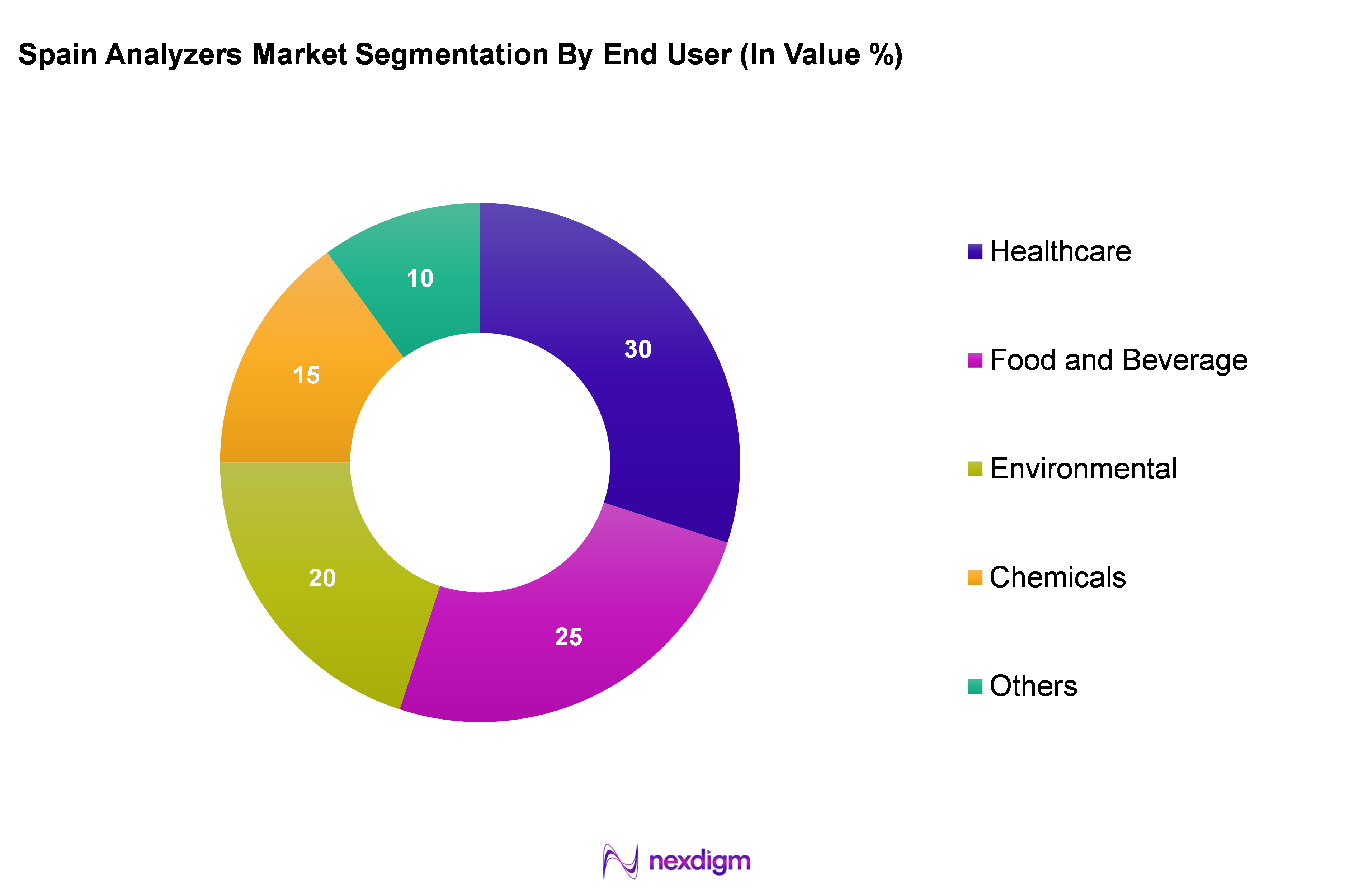

By End User

The Spain analyzers market is segmented into healthcare, food and beverage, environmental, chemicals, and others. The healthcare sector represents the largest end user segment due to the continuous demand for diagnostic testing and monitoring solutions in clinical laboratories and hospitals. The increasing prevalence of diseases and focus on preventive healthcare contribute to this dominance. Additionally, advancements in healthcare technology and the growing adoption of automated systems enhance the efficiency and accuracy of diagnostic procedures.

Competitive Landscape

The Spain analyzers market is characterized by strong competition among a few major players, including Thermo Fisher Scientific, Agilent Technologies, and Siemens Healthineers. These companies are at the forefront of technological advancement, incorporating innovative solutions and broad product portfolios to maintain a competitive edge. Their strong presence and extensive distribution networks facilitate market penetration and customer reach across various sectors.

| Company | Establishment Year | Headquarters | Market Presence | Product Range | Distribution Channels | R&D Investment |

| Thermo Fisher Scientific | 1956 | Waltham, Massachusetts | – | – | – | – |

| Agilent Technologies | 1999 | Santa Clara, California | – | – | – | – |

| Siemens Healthineers | 1847 | Erlangen, Germany | – | – | – | – |

| PerkinElmer | 1937 | Waltham, Massachusetts | – | – | – | – |

| Beckman Coulter | 1935 | Brea, California | – | – | – | – |

Spain Analyzers Market Analysis

Growth Drivers

Increasing Demand for Quality Control

The growing emphasis on quality control across various industries in Spain is driving the demand for advanced analysers. Sectors such as healthcare, food safety, and pharmaceuticals are prioritizing precision and compliance with stringent quality standards. The pharmaceutical industry, in particular, is witnessing a heightened focus on drug safety and efficacy, prompting companies to adopt cutting-edge analytical tools. Regulatory bodies are reinforcing quality control protocols, leading to greater investments in high-precision analysers to ensure compliance.

Regulatory Compliance Requirements

Stringent regulatory frameworks are shaping the landscape for analyzers in Spain. Healthcare and laboratory facilities are increasingly required to upgrade their diagnostic equipment to align with evolving European regulations. Compliance with global quality standards, such as those governing clinical trials and laboratory accreditation, is driving the adoption of advanced analytical solutions. Organizations are investing in state-of-the-art analyzers to meet these requirements, ensuring improved accuracy and reliability in diagnostics.

Market Challenges

High Initial Investment

The cost of acquiring advanced analytical equipment remains a key challenge for many healthcare and laboratory facilities in Spain. The need for continuous upgrades to meet evolving standards places a financial strain on smaller institutions, limiting their access to high-quality diagnostic tools. Budget constraints often delay the adoption of sophisticated analyzers, affecting overall testing capabilities and operational efficiency.

Competition from Low-Cost Alternatives

The presence of budget-friendly alternatives in the analysers market is intensifying competition for premium brands. Many laboratories and healthcare facilities are opting for cost-effective solutions to manage expenses, even if it means compromising on reliability and precision. This shift creates pressure on established manufacturers to balance affordability with quality, prompting them to innovate and enhance value offerings to maintain market competitiveness.

Opportunities

Growing Healthcare Sector

The expanding healthcare sector in Spain presents a significant opportunity for the analysers market. An aging population and increasing health awareness are driving demand for enhanced diagnostic services and medical technologies. Rising investments in healthcare infrastructure are fostering the adoption of advanced analyzers, creating a favourable market environment for manufacturers to introduce innovative solutions tailored to emerging needs.

Expansion of Research and Development Activities

Spain is experiencing notable growth in research and development, particularly in biotechnology and pharmaceuticals. Increased investment in innovation is fuelling advancements in analytical technologies, with collaborations between academic institutions and industry players driving the development of next-generation analysers. This trend is opening new avenues for companies to expand their product portfolios and tap into evolving market demands.

Future Outlook

Over the next five years, the Spain analyzers market is expected to demonstrate substantial growth driven by the increasing automation in laboratories, rising healthcare expenditure, and heightened awareness regarding quality control across diverse industries. As regulatory frameworks evolve and technological advancements continue, stakeholders are poised to benefit from the expanding capabilities of analyzers. The push towards environmentally friendly practices and sustainability will also enrich market dynamics and stimulate growth opportunities.

Major Players

- Thermo Fisher Scientific

- Agilent Technologies

- Siemens Healthineers

- PerkinElmer

- Beckman Coulter

- Horiba

- Emerson Electric

- Merck Group

- Waters Corporation

- Mettler Toledo

- Fujifilm

- Abbott Laboratories

- Roche Diagnostics

- Malvern Panalytical

- Hitachi High-Technologies

Key Target Audience

- Manufacturers of Analyzers

- Distributors and Suppliers

- Pharmaceutical Companies

- Healthcare Providers

- Food & Beverage Companies

- Environmental Agencies (such as the Spanish Ministry of Ecological Transition)

- Research and Development Institutions

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The research begins with constructing a comprehensive ecosystem map outlining all major stakeholders within the Spain analyzers market. This process utilizes extensive desk research, integrating secondary and proprietary databases to gather comprehensive industry-level information. The objective is to identify and define the critical variables that significantly influence market dynamics, including economic indicators and technological trends.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data related to the Spain analyzers market. We assess market penetration and evaluate the dynamics between various marketplaces and service providers to ascertain their revenue generation capabilities. Additionally, an examination of qualitative factors, such as customer preferences and service quality statistics, ensures reliability in the revenue estimates formulated.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations using computer-assisted telephone interviews (CATIs) with industry experts from a range of companies in the analyzers field. This extensive collection of expert insights provides vital operational and financial perspectives directly from industry practitioners, thereby refining and corroborating the market data collected in earlier phases.

Step 4: Research Synthesis and Final Output

The final phase includes direct engagement with multiple manufacturers of analyzers to obtain granular insights into product segments, sales performance, consumer behavior, and other relevant factors. This interaction complements the statistics derived from both qualitative and quantitative research approaches, ensuring a comprehensive, accurate, and validated analysis of the Spain analyzers market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Key Trends and Insights

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Demand for Quality Control

Regulatory Compliance Requirements - Market Challenges

High Initial Investment

Competition from Low-Cost Alternatives - Opportunities

Growing Healthcare Sector

Expansion of Research and Development Activities - Trends

Shift Towards Automation

Rise of Smart Technologies - Government Regulations

Health and Safety Standards

Environmental Regulations - SWOT Analysis

- Stakeholders Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Laboratory Analyzers

Industrial Analyzers

Portable Analyzers

Process Analyzers - By End User (In Value %)

Healthcare

Food and Beverage

Environmental

Chemicals

Others - By Technology (In Value %)

Optical

Electrochemical

Others - By Region (In Value %)

Catalonia

Madrid

Andalusia

Valencia

Basque Country - By Distribution Channel (In Value %)

Direct Sales

Online Sales

Distributors

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Market Share, Revenue, Distribution Channels, Technological Capabilities)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Thermo Fisher Scientific

Agilent Technologies

PerkinElmer

Siemens Healthineers

Abbott Laboratories

Roche Diagnostics

Danaher Corporation

Horiba

Beckman Coulter

Emerson Electric

Waters Corporation

Merck Group

Mettler Toledo

Fujifilm

Sartorius

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030