Market Overview

The Spain BNPL market is valued at USD 7.98 billion in 2024, stemming from a valuation of USD 7.00 billion in 2023, reflecting strong annual growth driven by surging consumer adoption of online shopping and demand for flexible payment options.

Major urban centers like Madrid and Barcelona dominate the BNPL market due to their high e‑commerce penetration, dense merchant ecosystems, and tech‑savvy consumer base. These cities also benefit from greater integration into EU digital payment frameworks and stronger fintech partnership networks.

Market Segmentation

By Payment Channel

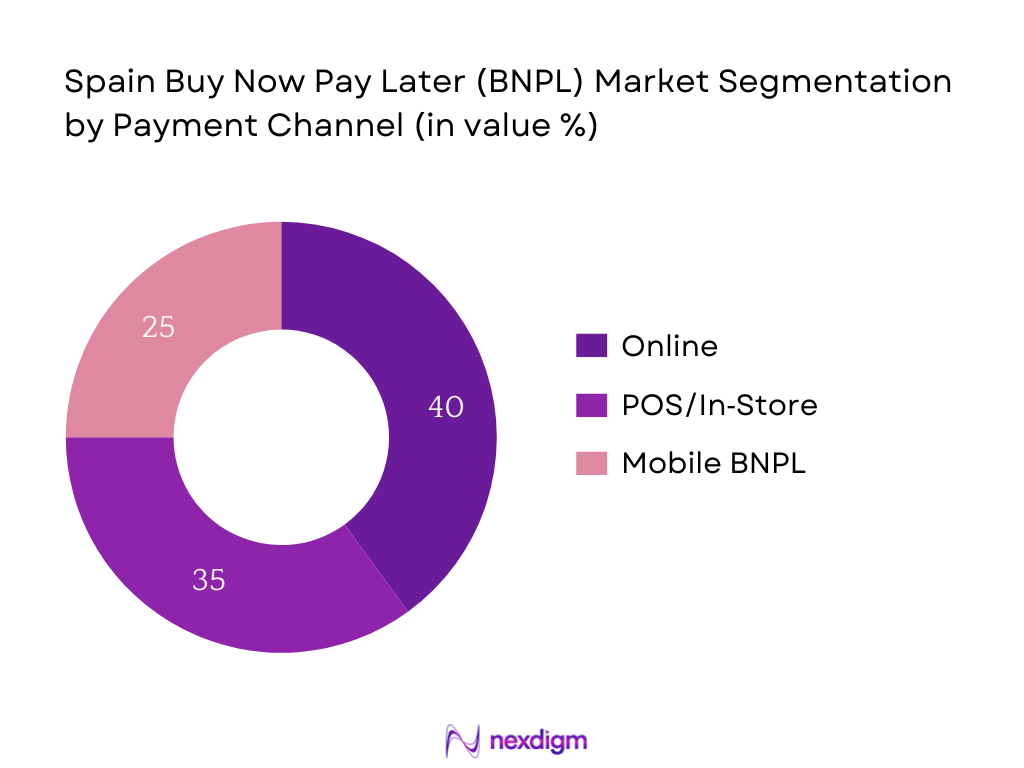

The Spain BNPL market is segmented by payment channel into Online, In‑Store, and Mobile. Online BNPL leads in market share, commanding roughly 40% of the 2024 market. This dominance stems from widespread e‑commerce usage post‑pandemic, with consumers increasingly preferring seamless financing options at checkout. Retailers have rapidly integrated BNPL APIs into checkout flows to reduce cart abandonment and drive conversion. The convenience of instant approval, absence of interest, and digital-first payment experience appeals especially to millennials and Gen Z. Furthermore, established BNPL providers like Klarna, Afterpay, and SeQura have strong alliances with major Spanish e‑tailers, reinforcing the online channel’s supremacy.

By Purchase Category

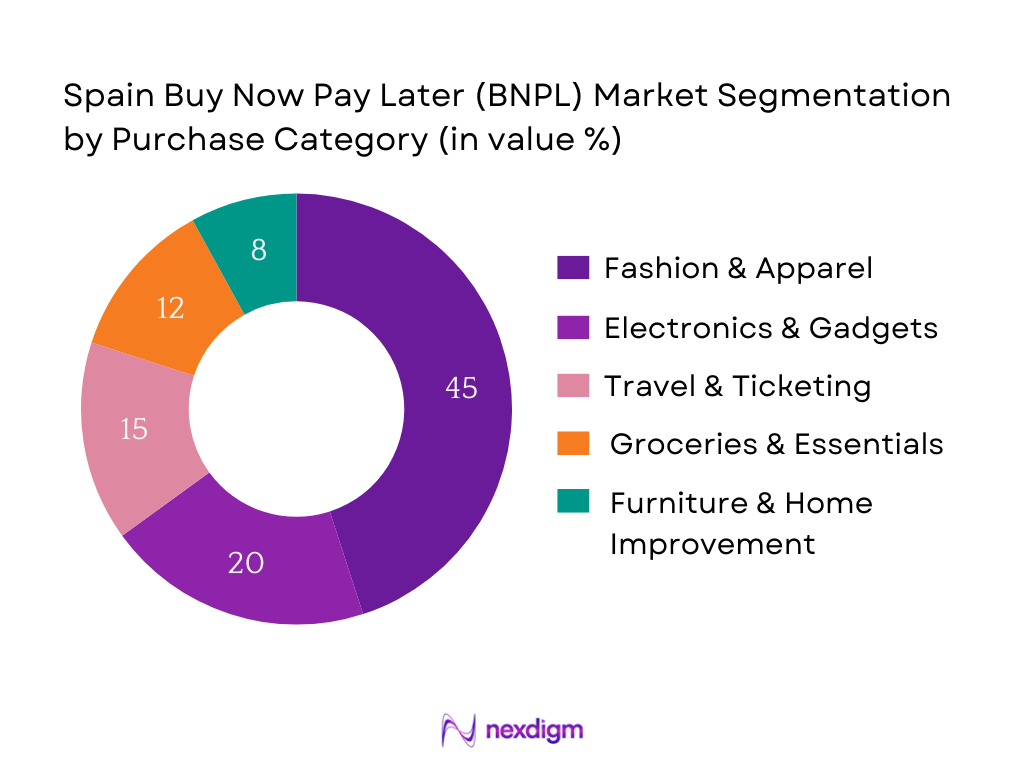

The Spain BNPL market is segmented by purchase category into Fashion & Apparel, Electronics & Gadgets, Travel & Ticketing, Groceries & Essentials, and Furniture & Home Improvement. Fashion & Apparel commands approximately 45% of the BNPL purchase mix in 2024. This leadership is due to fast‑fashion’s prevalence, frequent new collections, and high impulse buy rates—making flexible payment particularly appealing. Retail giants like Zara, Mango, and Desigual leverage BNPL to offer frictionless checkout and recurring purchases. The popularity of installment payments—such as pay‑in‑3—aligns well with fashion consumers’ behavior. Additionally, fashion brands heavily advertise BNPL during seasonal campaigns, reinforcing its dominance in this category.

Competitive Landscape

The Spain BNPL market features intense competition among both global fintechs and local players. Major players like Klarna, Afterpay, SeQura, Aplázame, and Scalapay dominate through strong merchant partnerships and consumer brand loyalty. This consolidation underscores their strategic influence across e‑commerce and physical retail channels.

| Company | Est. Year | Headquarters | Approval Model | Merchant Partnerships | Default Rate | Average Ticket Size | Credit Scoring Model | Mobile App Adoption |

| Klarna Spain | 2005 | Stockholm (Sweden) | – | – | – | – | – | – |

| Afterpay (EU wing) | 2015 | Sydney (Australia) | – | – | – | – | – | – |

| SeQura | 2017 | Madrid, Spain | – | – | – | – | – | – |

| Aplázame (WiZink) | 2012 | Madrid, Spain | – | – | – | – | – | – |

| Scalapay | 2019 | Milan, Italy | – | – | – | – | – | – |

Spain BNPL Market Analysis

Key Growth Drivers

Surge in Mobile-Based Retail Spending

Spain’s e‑commerce sector continues to expand robustly, with online retail revenues reaching €95.2 billion in 2024—an increase of €11 billion from the prior year—highlighting consumers’ growing reliance on digital channels. Mobile platforms contribute significantly: in early 2021, approximately 73 percent of e‑commerce sales originated via mobile devices. Payment infrastructure also reflects this trend: SEPA Instant Credit Transfers and Bizum—instant payment solutions—are now used by over 25 million customers across 38 banks, representing roughly 98 percent of the Spanish banking sector. These figures underscore how increasing mobile usage and instant payment technologies are critical enablers of BNPL adoption, allowing consumers to access flexible payment options seamlessly at checkout.

High Credit Card Avoidance Among Young Adults

While nationwide credit card penetration among individuals aged 15+ stood at about 56.6 percent in 2021, younger demographics tend to rely more on alternative payment methods and have lower credit card usage. Notably, Spain has approximately 86.5 million payment cards with cash functionality projected for 2024, yet younger users often exclude credit cards due to fee sensitivity or credit aversion. Meanwhile, mobile-driven payment methods like Bizum are embraced across age groups—accounting for widespread coverage and ease of use. This combination of moderate credit card usage and strong mobile payment adoption among younger cohorts drives BNPL preference as a non‑credit, flexible alternative, especially for under‑banked segments.

Key Market Challenges

Absence of Centralized Credit Scoring for Thin‑file Users

Spain lacks a unified national credit-scoring system for individuals with limited credit activity (“thin-file users”). While 98 percent of adults hold bank accounts, non-performing loan (NPL) levels remain a concern—Spanish NPLs were reported at €1.13 billion at end-2023. Without centralized scoring, BNPL providers must rely on fragmented data sources, making it harder to assess risk accurately. Consequently, underwriting thin-file customers becomes a challenge, limiting BNPL expansions into underserved segments and potentially increasing credit risk in the absence of robust credit histories.

Delinquency Rates in Unregulated Providers

The Spanish mortgage delinquency rate rose to 2.6 percent by end‑2023, up from the previous year. Although this relates to mortgages, it signals broader consumer credit strain. Without regulation, some BNPL providers may expose consumers to rising delinquency levels without proper safeguards. Furthermore, industry observations suggest BNPL delinquency issues—like loan stacking and overextension—are salient concerns. These market dynamics highlight the risk that unregulated providers could suffer higher default rates, undermining consumer trust and systemic stability.

Opportunities

BNPL Expansion into Public Sector & Utility Payments

Spain’s population in 2024 stood at approximately 48.8 million—up from 48.35 million the previous year. The extensive base of digitally connected consumers creates an opportunity for BNPL to move beyond retail into public sector and utility transactions (e.g., taxes, energy). With Bizum’s 25 million users and 60,000 merchants already integrated, scaling BNPL in these domains offers convenience and financial flexibility to citizens. Real-time payment rails and broad banking penetration pave the way for responsible installment solutions in essential services, tapping into everyday, non‑discretionary spend.

Healthcare and Education Financing via BNPL

Spain has a rapidly aging population—20 percent aged 65+, with the oldest cohort representing one-third of that segment. These demographic dynamics are likely to increase demand for healthcare and long-term care funding solutions. Simultaneously, education expenses—including private and supplementary services—present financing needs. Current consumer spending patterns, such as private health insurance expenditure of $11.36 billion in 2022 covering nearly 12 million people, demonstrate willingness to finance essential services. Offering BNPL options in these verticals could address rising out-of-pocket costs and demographic shifts, providing a growth channel for BNPL providers.

Future Outlook

Over the coming years, the Spain BNPL market is expected to continue robust growth, driven by deeper penetration into mobile and in‑store channels, more embedded finance in neobanks, and regulatory clarity under EU frameworks. Increasing consumer comfort with digital payments and BNPL models will further fuel expansion.

Major Players

- Klarna Spain

- Afterpay (via EU operations)

- SeQura

- Aplázame

- Scalapay

- PayPal Pay Later (Spain)

- Clearpay

- Alma

- Zinia (Santander)

- Bolsillo

- Finanbest BNPL

- Universia

- Plazo

- ID Finance

- Uplift

Key Target Audience

- Retail & E‑commerce Executives

- Digital Payment Decision‑Makers in Retail Chains

- Fintech & BNPL Strategy Heads

- Investments and Venture Capital Firms

- Government and Regulatory Bodies (e.g., CNMV, Bank of Spain)

- Digital Transformation Leaders in Banking

- Technology Providers for Point‑of‑Sale Systems

- Large Merchant Acquisition Teams

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the BNPL ecosystem in Spain—covering consumers, merchants, fintechs, traditional banks, and regulators. This was based on a rigorous review of secondary sources (industry reports, regulatory publications, statistical institutes) to establish the core variables driving market dynamics.

Step 2: Market Analysis and Construction

We compiled historical data on market transaction volumes, gross processed value, user growth, and average ticket size from trusted databases and public filings. E‑commerce adoption metrics and payment behavior statistics were also analyzed to triangulate market size accurately.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through tele‑and‑video interviews with industry stakeholders—including BNPL executives, merchant CIOs, and regulatory experts—to refine assumptions around approval rates, default trends, and merchant conversion uplift.

Step 4: Research Synthesis and Final Output

We engaged directly with select BNPL providers and merchant partners to obtain granular insights on integration models, user demographics, and technology adoption—complementing the bottom‑up model and ensuring validity of the market sizing and forecasts.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Evolution of BNPL in Spain (Fintech Penetration, Open Banking Regulations)

- Timeline of Key Market Events (Launches, M&As, Regulatory Updates)

- Business Model Structures in Spain (0% Interest Model, Interest-bearing Loans, White-Label Platforms)

- Supply Chain and Value Chain Mapping (Merchants, BNPL Providers, Credit Bureaus, Acquirers, Regulators)

- Key Growth Drivers

Surge in Mobile-Based Retail Spending

High Credit Card Avoidance Among Young Adults

API-Led Merchant Integrations via PSD2

Trust in Spanish FinTechs Due to CNMV Oversight - Key Market Challenges

Absence of Centralized Credit Scoring for Thin-file Users

Delinquency Rates in Unregulated Providers

Rising Regulatory Burden under EU BSR Framework

Merchant Pushback Due to Margin Compression - Opportunities

BNPL Expansion into Public Sector & Utility Payments

Healthcare and Education Financing via BNPL

White-labeled BNPL Solutions for Spanish Banks

Loyalty & Cashback Integration at Checkout - Trends

BNPL Integration into Neobanks and Super Apps

Green BNPL for Sustainable Product Financing

Rise of Subscription BNPL Models

AI-based Risk Modelling in Real-Time Approval - Government Regulations

Spanish CNMV Guidelines

European Buy Now Pay Later Regulation (BSR)

Data Privacy and Consumer Consent Under GDPR - SWOT Analysis

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis

- Competition Ecosystem (FinTech, Retail, Bank-led Models)

- By Gross Processed Value (GPV), 2019-2024

- By Number of BNPL Transactions, 2019-2024

- By Number of Active Users, 2019-2024

- By Average Ticket Size, 2091-2024

- By Purchase Category (In Value %)

Fashion & Apparel

Electronics & Gadgets

Travel & Ticketing

Groceries & Daily Essentials

Furniture & Home Improvement - By Consumer Age Group (In Value %)

18–24

25–34

35–44

45+ - By Merchant Type (In Value %)

Online-Only Retailers

Omni-channel Retailers

Physical Retail Stores - By Payment Tenure Option (In Value %)

Pay-in-3

Pay-in-4

Pay-in-30 (Deferred Payment)

Extended EMI Options (3–12 months) - By Customer Credit Profile (In Value %)

Prime

Near Prime

Thin-file / No Credit History

- Market Share of Major Players (By GPV, Users, Merchant Base)

- Cross Comparison Parameters (Integration APIs & SDKs, Approval Time (Instant / Soft Inquiry Time), Default Rate / Delinquency Ratio, Ticket Size Bandwidth Coverage, Merchant Discount Rate (MDR), Number of Spanish Merchant Partners, Real-time Fraud Detection Capabilities, BNPL Usage as % of Total E-Commerce Sales)

- SWOT Analysis of Key Players

- Pricing Analysis (Late Fees, MDR, Consumer Fees, Subscription Pricing)

- Detailed Company Profiles

Klarna Spain

Aplazame (WiZink)

Sequra

Scalapay

PayPal “Pay Later”

Afterpay

Zip Co

Alma

Zinia (by Santander)

Finanbest

Clearpay

Plazo

Universia

ID Finance

Moneyman

- Payment Behavior (On-time Payment Rate, Early Repayment Rate)

- Consumer Needs Assessment (Credit Availability, Flexibility, No Fee Demand)

- Average Monthly BNPL Usage Per Age Group

- Trust Metrics and Provider Switching Triggers

- Pain Point Mapping Across Checkout and Repayment Journey

- By Gross Processed Value, 2025-2030

- By Number of Transactions, 2025-2030

- By Number of Users, 2025-2030

- By Ticket Size, 2025-2030