Market Overview

The Taiwan Defense Market market current size stands at around USD ~ million, reflecting sustained procurement momentum across air, naval, land, cyber, and ISR domains driven by security imperatives and modernization programs. Spending concentration remains anchored in platform upgrades, networked command systems, and sustainment of active fleets, supported by multi-year acquisition planning and domestic industrial participation. The market structure integrates foreign procurement pathways with localized manufacturing, MRO, and subsystem integration, reinforcing resilience across program lifecycles and operational readiness outcomes.

Northern Taiwan anchors procurement coordination and systems integration due to proximity to command headquarters, logistics hubs, and major shipyards, while central regions concentrate aerospace manufacturing and avionics integration. Southern coastal zones host naval construction, fleet sustainment, and port-based testing ecosystems. Demand clusters around air bases, naval ports, and joint command facilities supported by testing ranges and hardened infrastructure. Ecosystem maturity is reinforced by policy alignment, industrial offsets, and supplier qualification regimes that streamline qualification, compliance, and lifecycle support.

Market Segmentation

By Domain

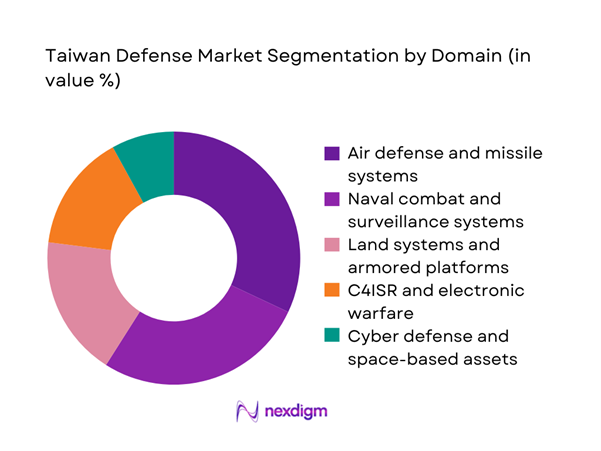

Air and missile defense, naval combat systems, and C4ISR dominate demand due to integrated deterrence doctrines, continuous fleet modernization, and network-centric operations. ISR fusion across sensors, command networks, and cyber defense elevates multi-domain interoperability, while land systems modernization focuses on survivability and mobility. Unmanned aerial and maritime platforms gain traction for persistent surveillance and distributed operations. The ecosystem favors modular architectures, rapid integration, and sustainment-centric procurement, supporting lifecycle upgrades and interoperability across joint commands. Policy emphasis on asymmetric capabilities sustains steady procurement across missiles, sensors, EW, and resilient communications.

By End User Branch

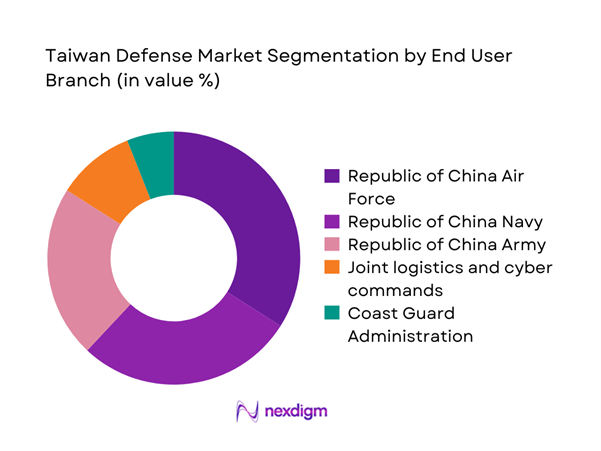

The Air Force drives platform upgrades and sensor-network integration to strengthen early warning and strike coordination. The Navy prioritizes surface combatants, undersea platforms, and coastal surveillance to enhance sea denial and maritime domain awareness. The Army advances mobility, counter-landing capabilities, and protected firepower for distributed defense. Joint commands accelerate cyber defense, data fusion, and resilient communications to enable cross-domain coordination. The Coast Guard strengthens surveillance and patrol assets to support maritime security and civil-military coordination, reinforcing layered deterrence and operational continuity across contested environments.

Competitive Landscape

The market features a concentrated group of international primes alongside domestic integrators, with competition centered on platform breadth, integration depth, lifecycle support, and compliance readiness. Partnerships and co-development models shape access to advanced subsystems and sustainment capabilities, while local industrial participation strengthens qualification pipelines and long-term support.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Lockheed Martin | 1995 | Bethesda, Maryland | ~ | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2020 | Arlington, Virginia | ~ | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, Virginia | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ |

Taiwan Defense Market Analysis

Growth Drivers

Rising defense budget driven by cross-strait security risks

Rising defense budget driven by cross-strait security risks intensifies multi-domain modernization, prioritizing readiness and resilience. In 2024, joint exercises increased to 16 annual iterations, expanding live-fire drills across air, sea, and littoral zones. The armed forces fielded 48 new ISR nodes integrated with 12 command centers, improving detection-to-decision timelines. Airbase hardening programs expanded shelter capacity by 320 units, while runway rapid repair teams increased to 24 detachments. Cyber defense units added 900 trained personnel during 2025, strengthening network monitoring across 6 regional hubs. Maritime patrol days rose to 2,140, reinforcing persistent surveillance coverage nationwide.

Acceleration of indigenous defense industrialization policy

Acceleration of indigenous defense industrialization policy expands local integration capacity and lifecycle autonomy. During 2024, certified domestic suppliers increased to 186 entities across avionics, propulsion subsystems, and secure communications. Co-development programs supported 42 active technology transfer workstreams aligned to naval shipbuilding and missile integration. The workforce added 3,400 skilled engineers across composite materials, software-defined radios, and systems integration in 2025. Local MRO throughput rose by 28 facilities achieving qualification for depot-level maintenance. Test ranges expanded instrumentation coverage across 5 coastal corridors, reducing integration cycles for sensors and EW payloads while strengthening quality assurance and sustainment readiness nationwide.

Challenges

Technology transfer restrictions and export controls

Technology transfer restrictions and export controls constrain access to advanced subsystems, extending qualification timelines and integration risk. In 2024, 17 critical components required multi-agency licensing, adding 9 months to average program schedules. Secure cryptographic modules faced 14 approval checkpoints across allied compliance regimes, complicating interoperability certification. Export review backlogs affected 23 subsystem variants awaiting clearance for integration testing. Engineering change requests increased to 61 instances due to specification substitutions, elevating validation workloads across 8 accredited labs. These constraints amplify dependency on alternate architectures and local redesign, slowing fielding velocity for time-sensitive capabilities and raising sustainment complexity across deployed platforms.

Supply chain vulnerabilities for critical components

Supply chain vulnerabilities for critical components disrupt program tempo and readiness sustainment. In 2024, lead times for high-grade microelectronics stretched to 46 weeks, impacting 19 integration milestones across radar and EW systems. Single-source dependencies affected 27 propulsion and guidance items, creating exposure to production pauses. Quality escapes rose to 11 incidents requiring rework across depot maintenance lines. Inventory buffers increased to 120 days for 34 components, tying up logistics capacity. Transportation bottlenecks across 6 ports delayed acceptance testing cycles, compressing training windows and increasing re-certification workloads across 4 operational commands during readiness surges.

Opportunities

Indigenous submarine and naval shipbuilding programs

Indigenous submarine and naval shipbuilding programs create sustained integration, testing, and sustainment demand across domestic yards. In 2024, keel-laying milestones advanced across 3 hulls with 21 major subsystems entering harbor integration trials. Acoustic testing hours expanded to 4,800 across coastal ranges, accelerating signature management validation. Workforce certification added 1,200 technicians in hull fabrication and combat system integration by 2025. Supplier qualification onboarded 64 local vendors for power management, sensors, and secure networks. Dry dock utilization increased to 310 operational days annually, strengthening lifecycle support capacity and continuous improvement loops for maritime combat readiness nationwide.

Expansion of unmanned aerial and maritime systems

Expansion of unmanned aerial and maritime systems enables persistent ISR and distributed operations at lower risk profiles. In 2024, 72 UAV units entered service across 9 squadrons, extending endurance coverage across 18 maritime corridors. Autonomous surface craft completed 1,260 patrol hours, integrating 14 sensor payloads with shore command nodes. Training pipelines certified 380 operators in 2025, while maintenance crews added 220 specialists for composite airframes and propulsion modules. Secure data links expanded to 26 relay sites, improving mesh resilience across contested littorals and enabling rapid tasking for reconnaissance, targeting support, and maritime domain awareness operations.

Future Outlook

The outlook reflects sustained modernization across air, naval, land, cyber, and ISR capabilities through the mid-2030s. Program sequencing will prioritize resilience, interoperability, and lifecycle sustainment, with deeper localization and co-development. Multi-domain integration and unmanned systems adoption will accelerate. Regulatory coordination and supply chain resilience will shape delivery cadence, while training pipelines and depot capacity expansion support readiness and continuous upgrades.

Major Players

- Lockheed Martin

- Raytheon Technologies

- Northrop Grumman

- Boeing Defense, Space & Security

- General Dynamics

- BAE Systems

- L3Harris Technologies

- Thales Group

- Saab AB

- Leonardo

- Hanwha Aerospace

- Mitsubishi Heavy Industries

- Naval Group

- Taiwan Aerospace & Defense Technology Co.

- China Shipbuilding Corporation

Key Target Audience

- Ministry of National Defense procurement departments

- Armed forces program management offices

- Systems integrators and prime contractors

- Tier-1 and Tier-2 defense suppliers

- Maintenance, repair, and overhaul providers

- Cybersecurity and C4ISR solution providers

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

Capability roadmaps, platform inventories, and sustainment dependencies were mapped across air, naval, land, cyber, and ISR domains. Program milestones, integration bottlenecks, and regulatory checkpoints were identified to frame demand drivers. Supplier qualification criteria and lifecycle support needs were defined to scope integration depth and readiness constraints.

Step 2: Market Analysis and Construction

Program pipelines, subsystem integration flows, and depot capacities were structured into a multi-domain framework. Interoperability requirements and open-architecture adoption were incorporated to reflect upgrade cycles. Localization pathways and co-development models were embedded to assess delivery cadence and sustainment resilience.

Step 3: Hypothesis Validation and Expert Consultation

Operational planners, systems engineers, and logistics managers validated assumptions on readiness, integration risk, and sustainment throughput. Scenario stress tests assessed supply chain shocks, regulatory delays, and training capacity constraints. Feedback refined interoperability priorities and lifecycle planning assumptions across domains.

Step 4: Research Synthesis and Final Output

Findings were synthesized into capability-driven narratives aligned to procurement cycles and sustainment needs. Cross-domain dependencies were consolidated to highlight bottlenecks and opportunity areas. Final outputs aligned modernization priorities with integration readiness, training pipelines, and lifecycle support requirements.

- Executive Summary

- Research Methodology (Market Definitions and platform scope mapping, Taiwan MoD procurement data triangulation, defense budget line-item tracking and offsets analysis, primary interviews with defense contractors and retired ROC Armed Forces officers, SIPRI and IISS defense datasets integration, supply chain and domestic industrial base validation, scenario modeling of cross-strait contingencies)

- Definition and Scope

- Market evolution

- Defense capability development pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory and export control environment

- Growth Drivers

Rising defense budget driven by cross-strait security risks

Acceleration of indigenous defense industrialization policy

Expansion of asymmetric warfare capabilities

Modernization of legacy platforms and systems

Increased reliance on ISR, cyber, and EW capabilities

Deepening security cooperation with partner nations - Challenges

Technology transfer restrictions and export controls

Supply chain vulnerabilities for critical components

Limited domestic production scale for advanced platforms

Geopolitical risks affecting procurement timelines

Budget execution constraints and project delays

Talent shortages in advanced defense engineering - Opportunities

Indigenous submarine and naval shipbuilding programs

Expansion of unmanned aerial and maritime systems

Upgrades to integrated air and missile defense networks

Cybersecurity and space situational awareness investments

Localization of MRO and sustainment services

Dual-use technology spillovers into defense programs - Trends

Shift toward asymmetric and distributed defense concepts

Rising adoption of AI-enabled ISR and command systems

Increased procurement of loitering munitions and UAVs

Modular platform upgrades and open-architecture systems

Greater focus on resilience and hardened infrastructure

Expansion of joint operations and network-centric warfare - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Domain (in Value %)

Air defense and missile systems

Naval combat and surveillance systems

Land systems and armored platforms

C4ISR and electronic warfare

Cyber defense and space-based assets - By Capability Area (in Value %)

Integrated air and missile defense

Anti-ship and sea denial

ISR and early warning

Cybersecurity and information operations

Unmanned and autonomous systems - By Platform Type (in Value %)

Fixed-wing aircraft and UAVs

Surface combatants and submarines

Ground vehicles and artillery

Radar, sensors, and EW platforms

Missile and precision-guided munitions - By Procurement Channel (in Value %)

Foreign Military Sales

Direct commercial sales

Domestic prime contractors

Public-private co-development programs

Maintenance, repair, and overhaul contracts - By End User Branch (in Value %)

Republic of China Air Force

Republic of China Navy

Republic of China Army

Joint logistics and cyber commands

Coast Guard Administration

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (platform breadth, localization capability, technology transfer depth, lifecycle support capacity, cybersecurity integration, delivery timelines, compliance with export controls, cost competitiveness)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Lockheed Martin

Raytheon Technologies

Northrop Grumman

Boeing Defense, Space & Security

General Dynamics

BAE Systems

L3Harris Technologies

Thales Group

Saab AB

Leonardo

Hanwha Aerospace

Mitsubishi Heavy Industries

Naval Group

Taiwan Aerospace & Defense Technology Co. (AIDC)

China Shipbuilding Corporation (CSBC)

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035