Market Overview

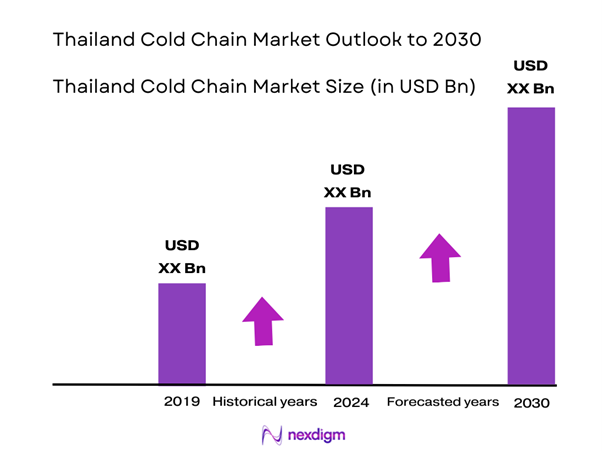

The Thailand Cold Chain Market is valued at USD 1.21 Billion in 2025 with an approximated compound annual growth rate (CAGR) of 8.03% from 2025-2030, based on a five-year historical analysis. The growth of the cold chain market is primarily driven by the increasing demand for perishable goods and the rising number of e-commerce platforms that require efficient temperature-controlled logistics.

Key cities such as Bangkok and Chiang Mai dominate the market due to their strategic logistics positioning and infrastructure. Bangkok, as the capital, serves as the primary hub for cold chain operations and distribution, benefiting from advanced transportation networks and significant consumer demand. Similarly, Chiang Mai, known for its agricultural activities, ensures a steady supply of fresh produce, thereby increasing the dependency on cold chain services in these regions.

The Thai government has committed to improving infrastructure and logistics capabilities, allocating approximately USD 2.3 billion in investments for transportation and logistics enhancements by 2025. Notable initiatives include the Eastern Economic Corridor (EEC), aimed at boosting investment in high-tech industries, including food processing and cold chain logistics. The government also introduced regulations to streamline operations within the cold chain sector, making it easier for businesses to comply with necessary standards, thereby supporting the market’s growth.

Market Segmentation

By Product Type

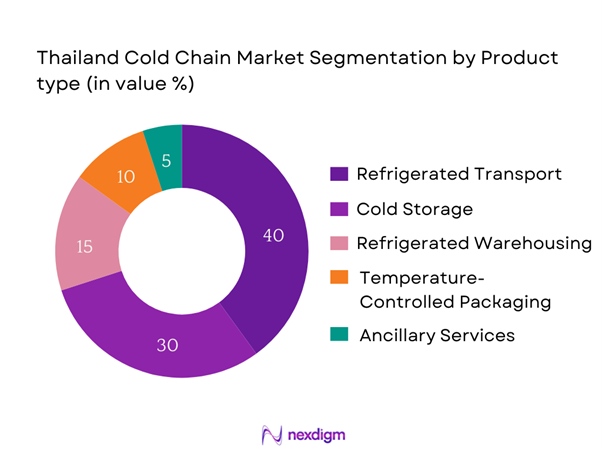

The Thailand Cold Chain Market is segmented by product type into Refrigerated Transport, Cold Storage, Refrigerated Warehousing, Temperature-Controlled Packaging, and Ancillary Services. Refrigerated Transport has a dominant market share within this segmentation due to the increasing demand for timely delivery of perishable goods. As the logistics sector evolves, companies are investing in state-of-the-art refrigerated vehicles to ensure the freshness of products during transit. Major brands and suppliers in this segment prioritize route optimization and real-time tracking, which enhances operational efficiency and customer satisfaction. This focus on improved service delivery further strengthens the position of refrigerated transport in the cold chain market.

By Application

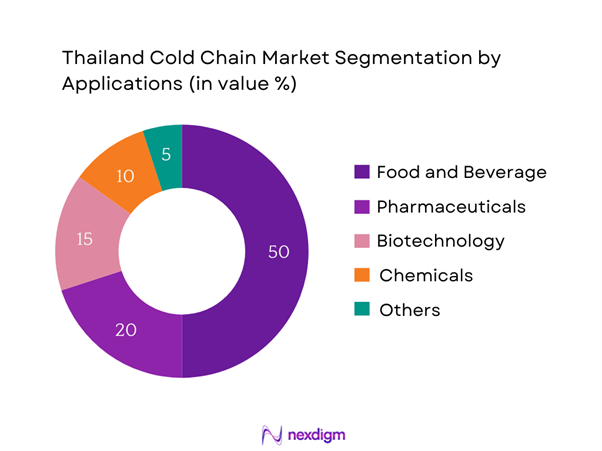

The Thailand Cold Chain Market is segmented by application into Food and Beverage, Pharmaceuticals, Biotechnology, Chemicals, and Other Applications. The Food and Beverage segment holds a significant market share as consumer demand for fresh produce, dairy, and frozen foods continues to rise. With the increased consumption of convenience foods and the growing trend of home delivery services, businesses are prioritizing robust supply chains to meet consumer expectations. This segment’s growth is driven by advancements in cold storage technologies and efficient logistics, facilitating the distribution of various perishable food items.

Competitive Landscape

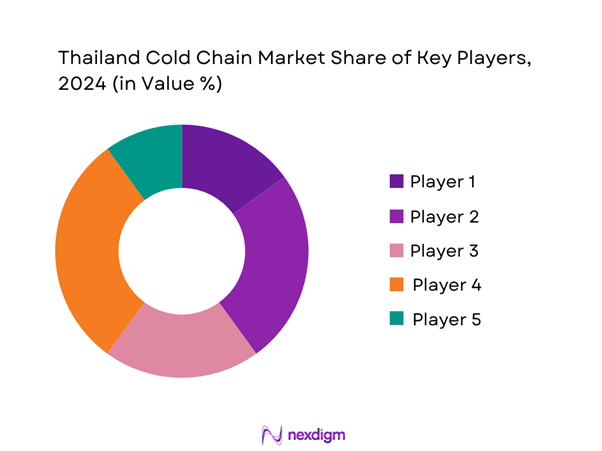

The Thailand Cold Chain Market is dominated by a few major players, including SCG Logistics, Kerry Logistics, and Thai Cold Chain Network. This consolidation highlights the significant influence of these key companies, which offer an extensive range of solutions and capabilities across the cold chain. Their strategic initiatives, such as investment in technology and expansions into pivotal regions, reinforce their dominance and set industry standards for efficiency and reliability.

| Company Name | Establishment Year | Headquarters | Market Share (%) | Key Service Offerings | Distribution Channels |

| SCG Logistics | 1995 | Bangkok | – | – | – |

| Kerry Logistics | 1981 | Bangkok | – | – | – |

| Thai Cold Chain Network | 2005 | Nonthaburi | – | – | – |

| DPDHL Supply Chain | 1969 | Bangkok | – | – | – |

| Siam Cold Storage | 2000 | Bangkok | – | – | – |

Thailand Cold Chain Market Analysis

Growth Drivers

Increasing Demand for Perishable Goods

Thailand’s growing middle class, which is projected to reach 20 million by end of 2025, drives the increasing demand for perishable food products. The country’s agricultural sector produces over 30 million tons of fruits and vegetables annually, highlighting the need for efficient cold chain systems to prevent spoilage. Additionally, the export value of fresh fruits and vegetables was approximately USD 1.36 billion in 2022, underscoring the rising international demand that relies heavily on effective cold logistics. This surge in demand necessitates the enhancement of cold chain capabilities to maintain product quality and reduce waste.

Rise in E-commerce and Online Grocery Services

Thailand’s e-commerce market has seen a dramatic rise, reaching USD 33 billion in 2022, with online grocery sales specifically growing by 29% from the previous year. This growth creates significant demand for efficient cold chain logistics as consumers increasingly expect fresh produce delivered to their doorsteps. The rapid adoption of online grocery platforms has necessitated the expansion of cold storage facilities and refrigerated transport solutions to ensure that perishable goods remain fresh throughout the supply chain.

Market Challenges

High Operational Costs

Operating cold chain logistics can be capital-intensive, with operational costs for refrigerated transport estimated at USD 0.35 per mile as of 2023. The increasing costs of energy, driven by Thailand’s rising electricity prices, which averaged USD 0.12 per kWh in 2022, have further affected the profitability of cold chain operators. Additionally, infrastructure investment bottlenecks compound these challenges by increasing the burden on existing cold chain systems, ultimately making operational efficiency more difficult to achieve.

Infrastructure Limitations

Despite recent investments, cold chain infrastructure in Thailand still faces significant challenges, particularly in rural areas where only 30% of produce is adequately stored and delivered using proper cold chain methods. This gap leads to high levels of food spoilage, with reports indicating that approximately 3.3 million tons of fruits and vegetables are wasted annually due to inadequate logistics. Insufficient cold storage facilities and limited access to refrigerated transport in remote areas complicate the supply chain, affecting food security and increasing losses.

Opportunities

Introduction of Sustainable Practices

Sustainability trends in Thailand are fueling investments in eco-friendly cold chain practices. The government and businesses are increasingly focused on reducing carbon footprints, with approximately 59% of companies having adopted some form of sustainability measure as of 2022. This shift is evident in the push for energy-efficient refrigerators and vehicles using renewable energy sources. Enhanced cold chain systems that minimize energy consumption will have a pivotal role in meeting consumer preferences for sustainable products and promoting the long-term health of the environment.

Technological Innovations

Technological advancements present significant growth opportunities for the Thailand Cold Chain Market. The adoption of IoT-based tracking systems is increasingly prevalent, with estimates indicating that the installation of smart sensors in cold storage facilities will reach 40% by end of 2025. These innovations not only enhance transparency and real-time monitoring capabilities but also enable businesses to respond quicker to threats in the supply chain. Investing in advanced technologies will likely optimize operations and lead to improved customer satisfaction by ensuring product integrity.

Future Outlook

Over the next five years, the Thailand Cold Chain Market is expected to experience significant growth driven by ongoing investments from both private and public sectors, advancements in cold chain technology, and the increasing expanse of e-commerce platforms that demand efficient cold logistics. The growing awareness of food safety standards and increasing consumer demand for quality perishable goods further bolster this market’s expansion.

Major Players

- SCG Logistics

- Kerry Logistics

- Thai Cold Chain Network

- DPDHL Supply Chain

- Siam Cold Storage

- Thai Airways Cargo

- CP Group

- K. Cold Chain Solutions

- GENTING

- Golden Shipping

- R.E. Logistics

- Lantana Cold

- Charoen Pokphand Foods

- V. Cold Chain Logistics

- Dovis Logistic

Key Target Audience

- Food and Beverage Manufacturing Companies

- Pharmaceutical and Biotechnology Firms

- E-commerce Companies

- Distribution and Logistics Service Providers

- Retail Chains and Supermarkets

- Cold Chain Equipment Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Department of Fisheries, Ministry of Public Health)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map that includes all major stakeholders within the Thailand Cold Chain Market. This step relies on extensive desk research, where a combination of secondary and proprietary databases is utilized to gather industry-level information. The primary goal is to identify and define the critical variables that influence market dynamics, including technology trends and government regulations.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Thailand Cold Chain Market. This analysis involves evaluating market penetration rates, the relationship between service providers and marketplaces, and resultant revenue generation. Additionally, we conduct an evaluation of service quality statistics to ensure the reliability and accuracy of our revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through computer-assisted telephone interviews (CATIs) with industry experts from a diverse spectrum of companies. These consultations provide valuable operational and financial insights directly from practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase of the research methodology involves direct engagement with multiple cold chain service providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This engagement serves to verify and complement the statistics derived from the bottom-up approach, culminating in a comprehensive, accurate, and validated analysis of the Thailand Cold Chain Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Overview and Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for Perishable Goods

Rise in E-commerce and Online Grocery Services - Market Challenges

High Operational Costs

Infrastructure Limitations - Opportunities

Introduction of Sustainable Practices

Technological Innovations - Trends

Growing Demand for Real-Time Monitoring

Shift Towards Automation - Government Regulation

Compliance with Health and Safety Standards

Regulatory Framework for Cold Chain Operations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Refrigerated Transport

– Refrigerated Trucks

– Reefer Containers

– Two-Wheel Refrigerated Delivery Vehicles

Cold Storage

– Blast Freezers

– Chilled Warehouses

– Deep-Freezing Storage Facilities

Refrigerated Warehousing

– Multi-Temperature Zones

– Racked Cold Storage Units

– Automated Cold Warehousing Systems

Temperature-Controlled Packaging

– Gel Packs & Ice Packs

– Phase Change Materials (PCMs)

– Vacuum Insulated Panels (VIP)

Ancillary Services

– Pre-Cooling Units

– Quality Inspection & Certification

– Repackaging and Labeling Services - By Application (In Value %)

Food and Beverage

– Perishable Fruits & Vegetables

– Dairy Products

– Meat, Poultry, and Seafood

– Frozen Processed Foods

Pharmaceuticals

– Vaccines and Biologics

– Insulin & Hormonal Drugs

– Blood and Plasma Products

Biotechnology

– Gene Therapy & DNA Samples

– Cell Cultures and Microorganisms

Chemicals

– Temperature-Sensitive Industrial Chemicals

– Flammable/Reactive Compounds Requiring Cold Storage

Other Applications

– Cosmetics & Skincare Products

– Floral Products - By Technology (In Value %)

IoT and Smart Sensors

– Remote Monitoring Systems

– RFID & NFC Temperature Tags

– Data Loggers with Cloud Access

GPS Tracking

– Route Optimization Tools

– Real-Time Location and Temperature Integration

Thermal Packaging Solutions

– Insulated Shipping Boxes

– Smart Thermal Pallet Covers

– Active & Passive Packaging Systems - By Distribution Channel (In Value %)

Direct Sales

– B2B Contracts with Retail Chains

– Direct Deals with F&B & Pharma Companies

Online Platforms

– B2B E-commerce Cold Chain Logistics Platforms

– Online Aggregators for Perishable Freight Booking

Distributors and Retailers

– Third-Party Cold Chain Logistics Providers

– FMCG/Pharma Distributors with Cold Chain Capability - By Region (In Value %)

Central Region

Northern Region

Southern Region

Eastern Region

Western Region

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share Analysis by Type of Cold Chain Service, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Revenues by Service Type, Number of Facilities, Technologies Utilized, Client Segments, Service Range, Temperature Range Coverage, Geographic Reach, Compliance & Certifications, Sustainability Practices, Unique Value Proposition)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Service Tiers

- Detailed Profiles of Major Companies

SCG Logistics

Thai Cold Chain Network

CP Group

Kerry Logistics

DPDHL Supply Chain

Siam Cold Storage

GENTING

Charoen Pokphand Foods

T.K. Cold Chain Solutions

A.R.E. Logistics

Thai Airways Cargo

Golden Shipping

Sena Development

BKK Logistics

Lantana Cold Storage

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory Compliance Needs

- User Needs and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030